Key takeaways:

- Evergreen funds are surging in popularity, unlocking features such as immediate PE portfolio exposure, partially redeemable capital and the potential for compounded returns.

- These funds can achieve a 3x multiple from a 11.6% net IRR. To achieve the same multiple, a closed-ended fund would need to generate a substantially higher IRR.¹

- However, evergreen (open-ended) funds are not without risk which may include potentially more complex and higher absolute fund fees and valuation lags.

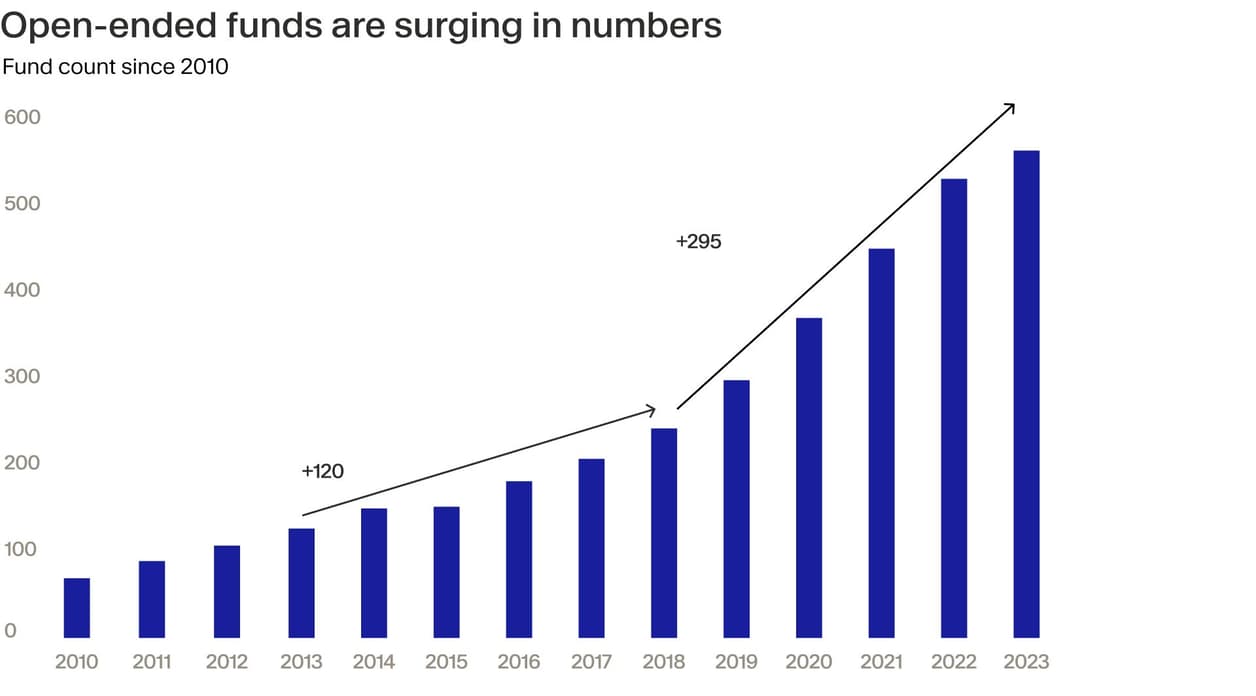

Evergreen semi-liquid private equity funds are becoming one of the industry’s hottest topics. Analysts note a surge in such fund launches and a substantial increase in assets under management, particularly among products designed for the growing private wealth segment.²

Preqin has estimated that these funds surpassed a record $350 billion in total net asset value (NAV) by the start of last year,³ while Pitchbook reports that since 2019 there is cumulative NAV of $400 billion across private market evergreen funds.⁴

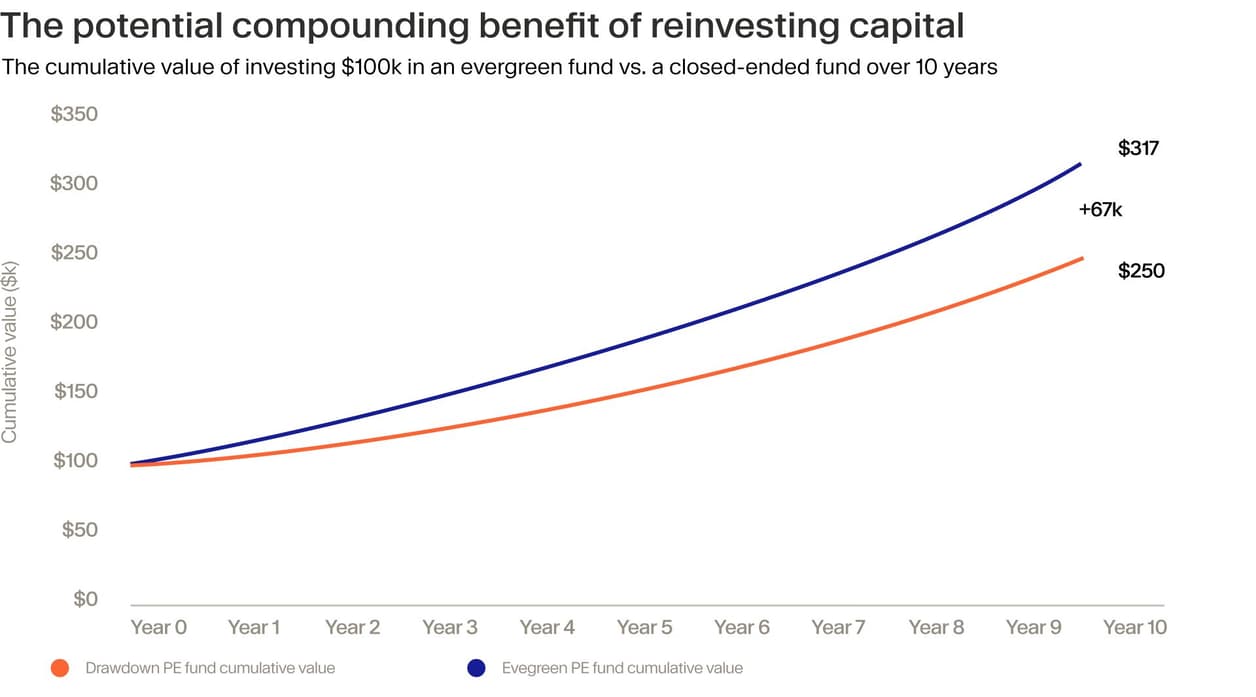

Open-ended vehicles are typically more flexible and may offer investors greater access to the asset class, with the potential advantage of amplified wealth growth through compounding.

Compounded returns

Before laying out how exactly this compounding works, first consider what happens when investing in a traditional, closed-ended PE fund, also known as a drawdown fund.

Limited partners (LPs) commit to the fund and the general partner (GP) draws down that capital for investment once it sources companies. The GP assists in developing value in those businesses, and later exits them. At this point, if the investment has been successful, investors receive a distribution. Some investors may then be faced with a decision about how best to reinvest that realised capital.

In an evergreen fund scenario, instead of investors receiving distributions and choosing how and where to reinvest, potentially losing time in market or footing new transaction costs, the fund itself aims to keep the capital productively invested on an ongoing basis.

While realised distributions are the ultimate goal of any investment into PE, typically the onus is on the investor to independently redeploy that capital. Open-ended funds aim to keep investors’ capital fully engaged indefinitely, allowing successful investments to potentially fuel further growth within the fund itself.

As the “evergreen” handle suggests, these funds have a far longer horizon since they have no predetermined end date or fundraising cycles. This perpetual nature potentially provides an indefinite runway for compounding to take effect.

Through compounding, these funds can achieve a 3x MOIC from a net IRR of 11.6% over a 10 year horizon, according to KKR’s estimates.⁵ To achieve the same 3x multiple, a closed-ended fund would need to generate an IRR of 18.4%.*

The true power of compounding may unfold over time. J.P. Morgan’s modelling projects that, over a 30-year period, there is a dramatic and ever-widening gap in wealth creation between an evergreen fund that continually reinvests proceeds and a traditional PE fund that distributes them.⁶ For long-term investors, this demonstrates how the compounding engine within evergreen funds can become a significant driver of portfolio outperformance if they remain allocated and the underlying portfolio companies perform well .

Immediate exposure and partial liquidity

Several inherent features of evergreen funds enable compounding to occur. Unlike traditional funds, where committed capital sits idle waiting to be called, their open-ended counterparts generally invest new subscriptions at the current NAV into an existing portfolio.

This practice means capital is put to work immediately, shortening the time to active participation in the fund’s investments and the commencement of compounding. Furthermore, when underlying investments within the portfolio are sold, the strategy aims to reinvest the proceeds back into the fund rather than being fully distributed, aiming to maintain a fully invested position.

Many evergreen funds also provide exposure to a diversified portfolio of private companies, potentially spanning various sectors, strategies and vintage years, which can be an efficient way to achieve immediate diversification within private markets.

While not offering daily liquidity like mutual funds, evergreen funds do provide investors with opportunities to request periodic redemptions typically capped at a percentage of the fund's NAV, often around 5%.⁷ This semi-liquid feature offers a degree of flexibility not found in traditional PE funds, which typically lock up capital for 10 years or more. Read more on the benefits and risks of evergreen semi-liquid funds.

Crucial caveats

It is important that investors approach open-ended PE funds with a clear understanding of their idiosyncrasies and potential drawbacks.

Arguably the most critical factor for success is the manager's ability to source consistent, high-quality deal flow. The entire compounding advantage hinges on this. For the fund to deliver as intended, capital from realised investments must be redeployed swiftly and effectively into new portfolio companies that ultimately perform well. Selecting the right fund managed by a reputable GP with a demonstrable track record is therefore paramount — although it should be noted that GP selection does not guarantee performance.

Valuation considerations are also pertinent. NAV calculations in PE are made periodically and time lags mean these appraisals may not reflect the full extent of recent market volatility. The constant flow of subscriptions and redemptions in open-ended funds can make them prone to some NAV mispricing.⁸

The term "semi-liquid" itself underscores a critical point that bears repeating: these funds are not fully liquid like cash or publicly traded stocks. Redemptions are subject to notice periods of up to 90 days, predetermined windows, usually quarterly or monthly, as well as the foregoing fund-level caps.⁹

In stressed market conditions, fund managers may also have the right to temporarily suspend redemptions using “gates”,¹⁰ meaning these investments are best suited for capital that can be committed long-term. To provide this periodic liquidity, a portion of the fund is held in a “liquidity sleeve” of cash or public securities, which can also slightly temper overall returns.¹¹

Selection matters

These evergreen products represent a major evolution in how an incoming class of individual investors can start engaging with private equity. By offering mechanisms for continuous capital deployment and the powerful potential of compounding through profit reinvestment, they offer much more than just an entry point.

However, investors must recognise that these funds, while potentially offering enhanced flexibility over traditional private equity, are still not fully liquid and can pose a higher fee drag depending on their performance.

An evergreen fund is ultimately only as good as the assets it holds. The potential for improved compounding is rendered moot if the underlying investments fail to perform.

As with all PE investment, true value creation comes from the manager's ability to source, select and manage high-quality companies. Outperformance, therefore, is not a byproduct of the fund structure itself, but of the manager's skill in executing a successful investment strategy. With this in mind, the focus for all investors must be rigorous manager selection.

¹ https://www.kkr.com/insights/evergreen-vehicle-private-equity ² https://www.privateequityinternational.com/inside-the-semi-liquid-fund-boom/ ³ https://www.preqin.com/insights/research/blogs/evergreen-capital-funds-hit-record-high-at-350bn-on-private-wealth-demand ⁴ https://files.pitchbook.com/website/files/pdf/Q3_2024_PitchBook_Analyst_Note_The_Evergreen_Evolution.pdf ⁵ https://www.kkr.com/insights/evergreen-vehicle-private-equity ⁶ https://am.jpmorgan.com/us/en/asset-management/institutional/insights/portfolio-insights/alternatives/assessing-the-benefits-of-open-end-alternative-investments/ ⁷ https://www.moonfare.com/blog/semi-liquid-funds-private-equity ⁸ https://files.pitchbook.com/website/files/pdf/Q3_2024_PitchBook_Analyst_Note_The_Evergreen_Evolution.pdf ⁹ https://www.privateequityinternational.com/investors-need-to-dig-into-liquidity-fee-and-client-composition-risks-around-semi-liquids/ ¹⁰ https://archbridge.com/insights/evergreen-funds-a-new-paradigm-or-a-complement-to-drawdown-structures/ ¹¹ https://www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-insights/2023/semi-liquid-funds-key-features.html