Key takeaways

- Semi-liquid funds are not as liquid as stocks or cash, but they do allow private equity investors to access partial liquidity within pre-agreed thresholds at regular intervals.

- Returns from semi-liquid funds may be slightly lower than closed-ended funds as a portion of assets have to be held in lower returning, more liquid assets to cover for redemption windows.

- Investors, however, gain immediate access to private markets, rather than over a few years as is the case in a closed-ended fund.

Semi-liquid funds — investment fund structures designed to offer liquidity in traditionally illiquid asset classes — are surging in popularity as private markets managers explore ways to offer investors more liquidity.¹

These fund assets have expanded to a record $350 billion on the back of rising private wealth demand, according to Preqin figures.²

Pantheon, JPMorgan Asset Management, Muzinich & Co, Allianz Global Investors and Schroders Capital are just some of the private markets managers to have launched semi-liquid funds — also known as evergreen funds — in recent months.

They’ve joined the likes of EQT, Harbourvest and Partners Group, who also offer semi-liquid products, according to Private Equity International reports.³

Gaining momentum

Semi-liquid funds are not new structures and have been used by private markets managers since the early 2000s.⁴

However, as private wealth emerged as an increasingly important source of capital, structures that provide individual investors with more flexible access to liquidity moved firmly into the spotlight.

The increased flexibility offered by semi-liquid products has also appealed to institutional investors⁵, especially following last year where exits and distributions have slowed.

How semi-liquid funds work

Semi-liquid funds will offer investors opportunities for subscription as well as redemptions at set intervals, either monthly or quarterly depending on the fund. These redemptions are usually capped at a five percent range of net asset value or NAV.⁶

Semi-liquid funds will also be structured to include liquidity sleeves, composed of cash and public stocks. These can be drawn on to provide liquidity when private investment exits don’t immediately match redemption calls.⁷

It is important to note, however, that even though these funds offer liquidity at set intervals, they are still relatively illiquid when compared to cash assets, for example.

Some managers therefore prefer to describe the funds as evergreen to emphasise the open-ended structure of the vehicles without a specific timeline and the limits on liquidity that the funds can provide.

Buyout semi-liquid funds are the most prominent, but other private markets strategies, such as secondaries, can also match up well with semi-liquid structures.

The benefits of investing in semi-liquid funds

One of the main benefits of semi-liquid funds is that they make it easier for private investors and small institutions to build exposure to private markets strategies.

Investors don’t have to lock up large amounts of their allocations in illiquid closed-ended funds that only start generating larger distributions after five years from launching.

Rather, investors who are in need of liquidity can make redemptions at regular intervals while building private markets portfolios with lower investment minimums than those required for closed-ended funds.⁸

Semi-liquid structures also give investors immediate exposure by accessing assets already in the fund. Their capital is deployed in full, subject to subscription queues.⁹

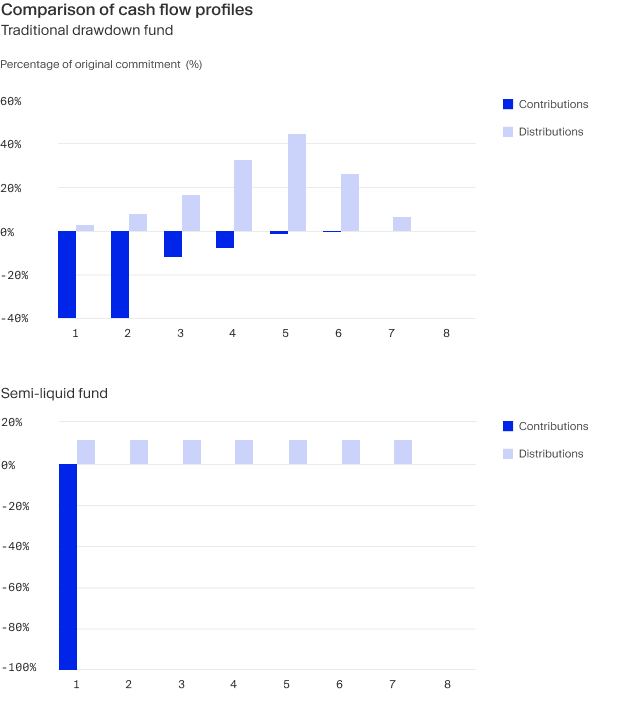

In closed-end private funds, by contrast, investors will make set commitments to a fund at the beginning of its life.This capital will not be put to work immediately, but rather called and invested over the three to five-year period. Investors can’t deploy uncalled capital elsewhere, as they have to ensure that they can meet all drawdowns by the manager as and when required (see graph below).¹⁰

The semi-liquid structure also gives investors more flexibility through regular distributions. Managers offer investors the option to take liquidity at the pre-agreed monthly or quarterly redemption windows and thresholds.

This spreads distributions out over time, unlike traditional, closed-ended funds where distributions are at manager discretion and can be back-ended towards the end of a fund’s life when managers start to harvest portfolios.

Additionally, while some semi-liquids may provide distributions at set intervals, other semi-liquids reinvest distributions, potentially resulting in compounding gains for the investors.

Easier management

A semi-liquid fund is also relatively straightforward for investors to administer. Commitments are paid upfront, and investors don’t have to keep track of multiple capital calls and distribution notices.¹¹

Fee structures can also be attractive for investors, with some managers waiving traditional performance fees and charging only annual management fees, according to Schroders.¹²

Risks and restrictions

Semi-liquid funds offer investors a range of benefits and flexibility, but it is also important for investors to be aware of the limitations of the structure.

Although the vehicles do offer some liquidity, there are limits on this liquidity and it is usually not possible for investors to exit entire positions in one transaction, as they would be able to do with a stock portfolio.

Schroders analysis, for example, shows that for a semi-liquid fund with a quarterly redemption window, it can take investors between four and seven months in practice to get all their capital back. This offers significantly higher levels of liquidity than a closed-ended fund, but will still be relatively illiquid compared to other assets. Investors do have to manage liquidity expectations accordingly.¹³

Investors should also be aware of the potential difference between closed-ended private markets fund returns and semi-liquid fund returns. The portion of the funds kept in liquidity sleeves will not return at the same levels as private markets assets.¹⁴

The obligation to meet redemption requests in liquidity windows can potentially also introduce more volatility in semi-liquid fund valuations. In scenarios where redemption requests are higher than normal, managers may have to exit underlying assets — possibly at lower valuations — to meet liquidity demand.¹⁵

Despite these considerations, however, semi-liquid or evergreen funds can still be an useful addition to a portfolio, or a starting point for investors seeking immediate exposure to private markets for the first time.

Key differences

| Semi-liquid funds: | Closed-ended funds: |

|---|---|

|

|

¹ https://www.privatedebtinvestor.com/semi-liquid-fund-structures-push-requires-careful-marketing/ ² https://citywire.com/wealth-manager/news/semi-liquid-funds-reach-350bn-driven-by-private-wealth-demand/a2437082 ³ https://www.privatedebtinvestor.com/semi-liquid-fund-structures-push-requires-careful-marketing/ ⁴ https://bspeclub.com/the-rise-of-semi-liquid-funds-a-game-changer-in-modern-portfolio-management ⁵ https://www.privateequityinternational.com/why-semi-liquids-are-not-just-for-wealthy-individuals ⁶ https://www.privatedebtinvestor.com/semi-liquid-fund-structures-push-requires-careful-marketing/ ⁷ https://www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-insights/2023/semi-liquid-funds-key-features.html ⁸ https://www.ubs.com/content/dam/assets/asset-management-reimagined/global/insights/asset-class-perspectives/private-equity/docs/top-10-with-jochen-mende.pdf ⁹ https://www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-insights/2023/semi-liquid-funds-key-features.html ¹⁰ https://www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-insights/2023/semi-liquid-funds-key-features.html ¹¹ https://www.privateequityinternational.com/why-semi-liquids-are-not-just-for-wealthy-individuals ¹² https://www.schroders.com/en-au/au/individual/insights/semi-liquid-funds-is-the-cash-drag-really-such-a-drag/ ¹³ https://www.schroders.com/en-au/au/individual/insights/semi-liquid-funds-is-the-cash-drag-really-such-a-drag ¹⁴ https://bspeclub.com/the-rise-of-semi-liquid-funds-a-game-changer-in-modern-portfolio-management ¹⁵ https://www.privateequityinternational.com/why-semi-liquids-are-not-just-for-wealthy-individuals/