Key takeaways:

- Operational know-how and a laser-sharp focus on distributions will be the defining feature of best performing managers.

- Agile mid-market and specialist players may have a distinct advantage in targeting growth opportunities at attractive pricing that benefit from multiple exit routes.

- AI, the energy transition and essential services could provide attractive and durable return potential in a volatile and low-growth environment.

Private equity deals and exits showed clear signs of a sustained recovery in 2025. After a pause in the second quarter as industry players assessed the impact of the US tariff announcement, dealmaking resumed through the summer and into the final half of 2025.

The net result is that, by the end of the third quarter, global private equity deal value stood at $1.6 trillion for the year, up 23% on the same period a year earlier. With 2024 ending at $1.75 trillion, the momentum in 2025 suggests the industry will comfortably outpace last year’s figure.¹

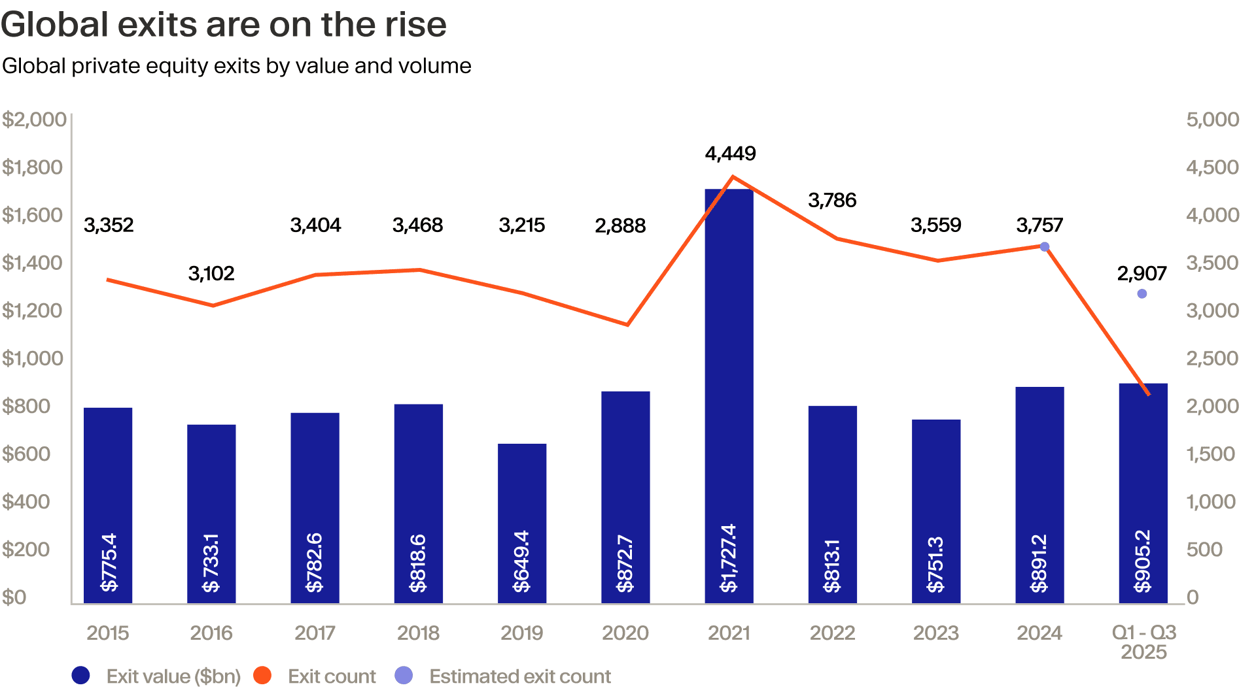

Exits are also starting to gather pace. Global PE realisation value had reached $905 billion by end-September, already ahead of full-year totals since 2022.² Meanwhile, fundraising is starting to reflect the slowdown of the past few years. As a lagging indicator, it tends to move with a delay — this year only 388 funds have raised $310 billion through Q3, compared with $585 billion across 905 funds in 2024.³

We see reasons for confidence over the next 12 months. Broader M&A is starting to rebound,⁴ while IPOs are on the rise as public markets prove welcoming to new issues: global listing values rose by 40% in the first nine months of 2025 compared with the same period last year.⁵ These are providing potential tailwinds for further private equity deal and exit activity.

A healthier cycle ahead?

That said, there are plenty of risks on the road ahead. Geopolitical tensions continue to simmer, while the spectre of inflation continues to haunt many major economies, potentially leading to slower than anticipated interest rate cuts.

We are also monitoring industry-specific risks, including the debt maturity wall for PE deals completed in the peak 2021 and 2022 years, when interest rates were lower than today. Even so, sponsors have been actively refinancing some of the debt due from 2026 onwards, and many are extending loans to push repayments further out.⁶

Private equity also needs a broad-based and sustained recovery in exits to fully restart the flywheel and eventually, improve fundraising conditions. Should financing, M&A and public markets continue to be favourable, the industry looks set to enter a healthy cycle characterised by balance and discipline over the coming period.

As the industry resets in a more conducive dealmaking market, here's what we expect to take shape through 2026.

Value creation capabilities will define the PE winners

As the industry enters a healthier but more demanding cycle, competitive advantage will come from capabilities, with external conditions offering less consistency.

Indeed, elevated interest rates and lower exit multiples are limiting the returns managers can generate from financial engineering and multiple expansion. Firms are therefore doubling down on factors they can control by improving portfolio company operations to drive growth, increase profitability and create transformative change.

Operational improvements have always been part of PE’s value creation toolkit, but we’ve seen a major shift in return attribution in recent years. A recent Gain.pro study found that 71% of the value created in 2024 exits came from revenue growth — an increase from 64% in 2023, and far higher than any of the previous five years. By contrast, in 2019 nearly half of value creation stemmed from multiple expansion.⁷

Private equity seems to be returning to the basics of hands-on involvement in portfolio companies to support growth and change, but with deeper knowledge and expertise than before. Firms specialising in sectors, niches or market segments are creating operational improvement playbooks to generate repeatable outcomes, including by deploying advanced data analytics and generative AI (genAI) in portfolio companies. Nearly three-quarters (70%) of PE respondents to a KPMG survey said they were increasing investment in AI and genAI in their portfolio companies in the next 18 months.⁸

There’s strong evidence that private equity’s focus on improving companies will keep growing. In a recent Simon Kucher survey,⁹ one-third of industrial deal teams said business improvements were the main driver of an investment’s equity story - far ahead of buy-and-builds, multiple expansion and financial engineering. And this trend is strengthening: 78% expect company improvements to become even more important in 2026.

Yet many firms are still in the early stages of building out operational improvement teams. Just 18% of the 500 private equity leaders KPMG surveyed were operating partners, and two-thirds of them were stretched across five or more portfolio companies.¹⁰ Operational expertise headcount will have to increase threefold if firms are to capture today’s value creation opportunities. In our view, this capability gap will be the critical differentiator that will separate top performers from the rest of the field.

Manager selection will be more important than ever

With value creation now largely determining performance, choosing the right managers becomes even more critical.

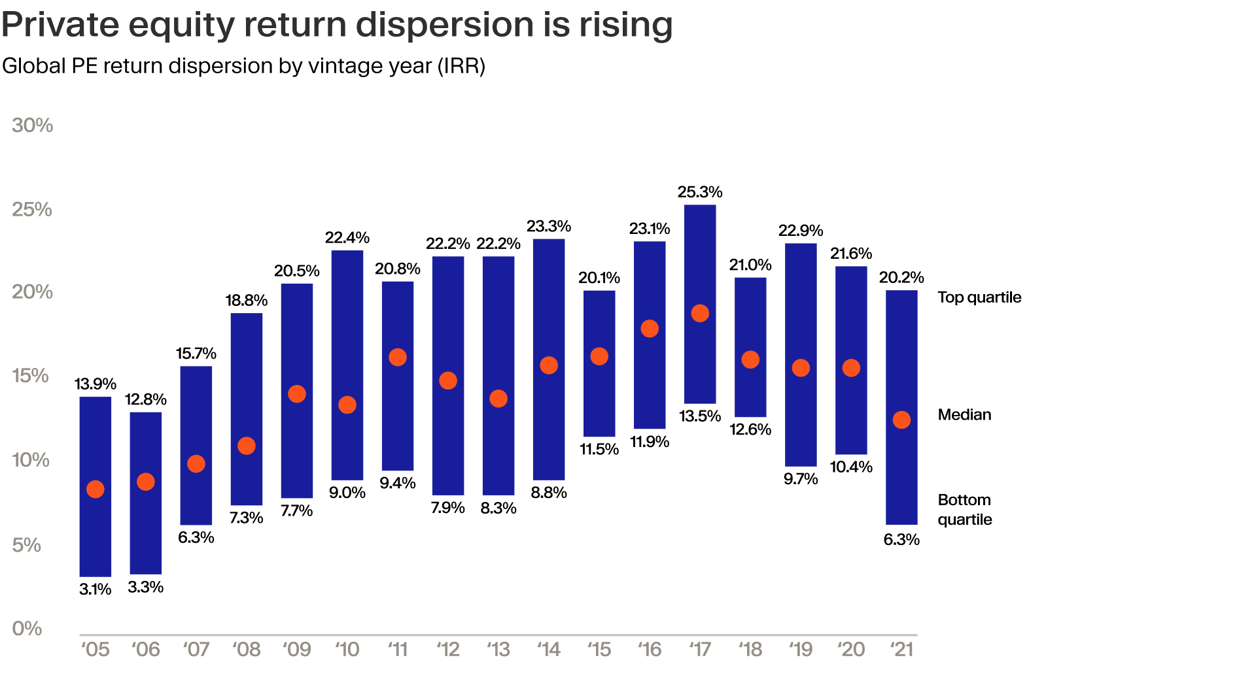

A high return dispersion in private equity is nothing new: between 2015 and 2025 the top performing buyout managers provided significant outperformance versus other asset classes, with a 20.7% IRR; median private equity funds, at around 12%, did not.¹¹

But the gap between the best and the rest is expected to widen as outperformance concentrates among firms with the skills and discipline to build value in a more volatile environment with higher interest rates and technology-driven disruption. There are already signs of this: at nearly 14 percentage points, the spread between buyout returns for the 2021 vintage year is the highest since 2014.¹² And the importance of manager selection is only increasing.

Adding value is only part of the story; managers must also realise it. Those emphasising distributions to paid-in capital (DPI) will lead the pack on performance. Part of this involves more work on readying portfolio companies for exit¹³ and developing systematic approaches to realisations. Using exit committees, they regularly assess DPI potential from both individual asset and whole fund perspectives.

Examples include Verdane and EQT, with the latter achieving gross exits worth €19 billion in the year to September 2025,¹⁴ while Hg is focusing on DPI by inverting the usual approach of selling strong companies early, leaving weaker assets in the portfolio. “We wanted to reverse that by acknowledging that some investments won’t be so good,” Hg chairman Nic Humphries told us recently in our Deal Talk podcast. “You should sell them early to drive DPI and cash, keeping better investments for later.”

Mid-market and specialist funds will come to the fore

With growth and exits hard to realise, private equity’s mid-market stands out. Unlike their larger counterparts, mid-market and specialist funds can be more agile, take advantage of domain expertise and move the needle when it comes to operational improvements.

Mid-market firms target growth opportunities at attractive pricing: entry valuations tend to be lower than for larger companies, with an average of 10.5x in 2024, against 13.1x in large and mega-cap deals.¹⁵

Most specialist funds sit firmly within the mid-market and so benefit from these advantages. Yet their expertise confers additional edge when identifying companies in their target market, pursuing a repeatable value creation playbook and understanding where exit opportunities lie. This filters through to returns: top quartile US sector specialist funds with 2006-2020 vintages achieved a 24.5% IRR as of mid-2024, versus 21.7% for generalist funds, according to Burgiss data.¹⁶

Exits are set to stage a comeback

As we noted earlier, global exit value by the end of Q3 2025 had already outpaced full-year totals for 2024, 2023 and 2022,¹⁷ worldwide M&A is trending upwards¹⁸ and IPOs are finding favour.¹⁹

Should this continue, much-needed liquidity can start flowing to investors through 2026. Private equity firms are certainly optimistic: 61% expected exits to increase in a Q3 2025 EY survey, up from 44% three months earlier and the highest level for two years.²⁰

However, the recovery is not yet in full swing. Activity is uneven: while European value rose by more than 80% quarter-on-quarter,²¹ US private equity exit value fell in Q3 from the previous two strong quarters²² yet still remain on course to improve. New listing activity will likely resume after the government shutdown is over²³ as firms take advantage of a more positive market sentiment.²⁴

More broadly, we expect exit activity to rise more meaningfully as 2026 progresses, but buyer quality thresholds remain high and current processes are skewed towards resilient companies with strong growth fundamentals.

Meanwhile, managers are holding onto other assets because they had not yet reached target growth or because there’s a gap between target valuation and what buyers were prepared to pay.²⁵ We therefore expect more continuation vehicle realisations as GPs create their own exits while continuing to hold on to some of their most prized assets.²⁶

Holding periods will extend

Even with friendlier exit markets, private equity will still be dealing with indigestion for a while. With so much capital deployed in 2021 and 2022 and the slow pace of exits since, holding periods have risen above historical averages. Pre-pandemic, the median time from acquisition to exit in the US was 5.2 years; in 2025, it was six years.²⁷

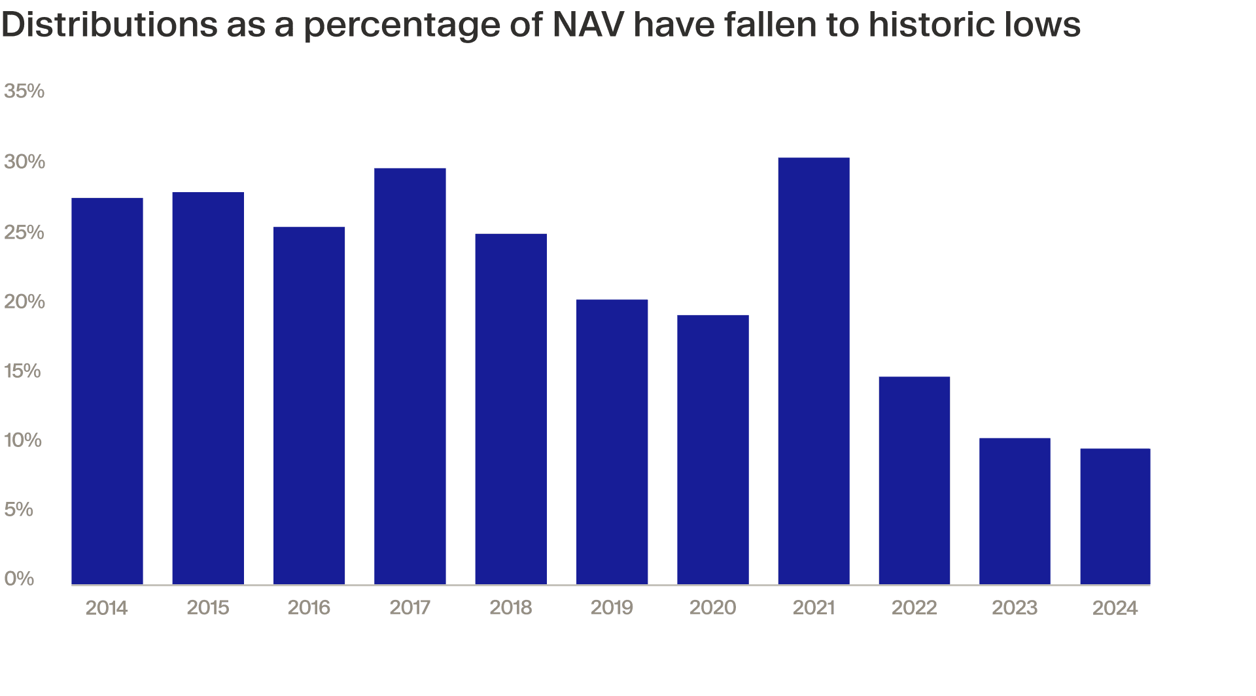

Meanwhile, the number of portfolio companies continues to climb. There are currently 30,000 assets in the global portfolio, including 35% held for more than six years.²⁸ This is taking a toll on distributions. Between 2014 and 2017, distributions as a percentage of net asset value (NAV) averaged 29%; in 2024, the figure was just 11%.²⁹

With over $3 trillion of unrealised value sitting in global buyout portfolios,³⁰ it will take several years to work through the backlog. As a result, we’d expect holding periods to remain elevated even with improved exit markets. The three to five-year average holding period is firmly in the past; five to six years is the new baseline. Some assets may even be held for longer through continuation vehicles or, given the pressure from LPs who are waiting for distributions, potentially sold at less-than-ideal prices.³¹

The challenging exit market is the biggest factor for these extensions, but they are also structural, reflecting the global portfolio’s larger and more complex companies in a maturing asset class.

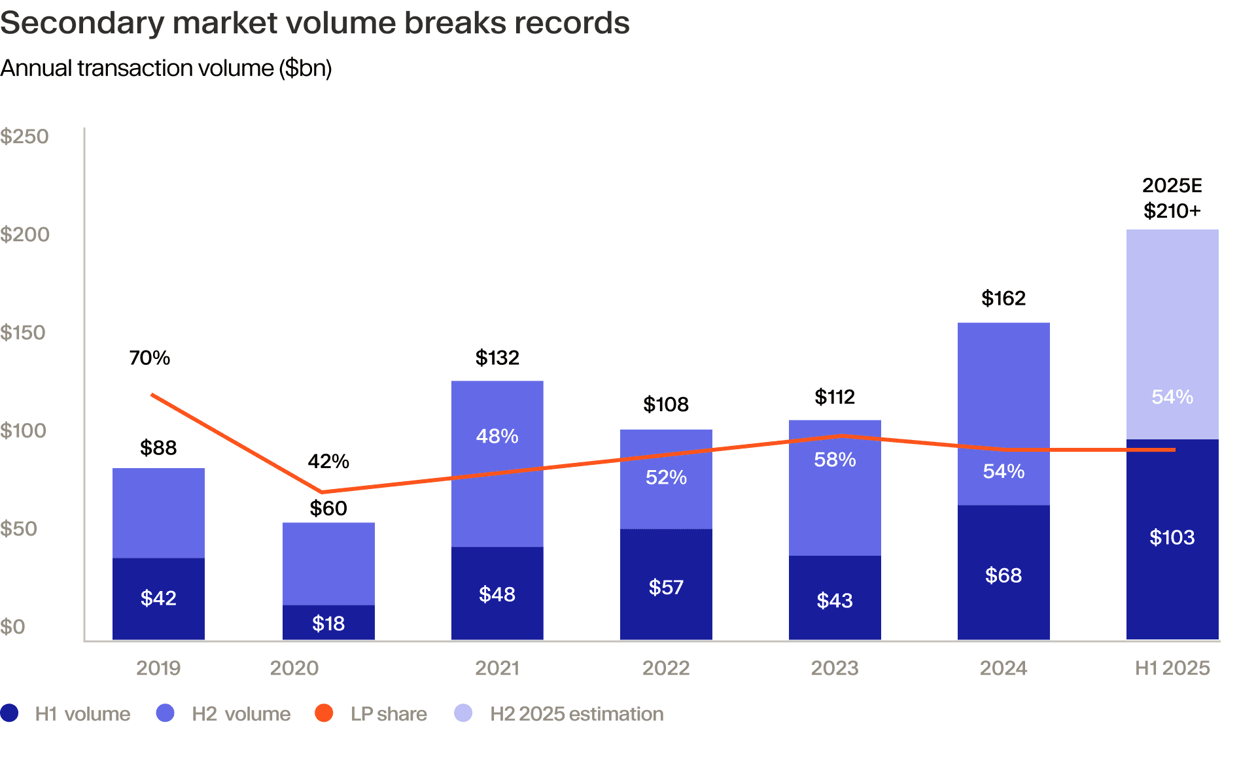

Secondaries are expected to continue their meteoric rise

With so much stuck capital, the secondary market will continue to be on a roll. Longer holding periods will drive more LPs and GPs to sell portfolios and release capital from assets as they seek liquidity. Yet there are also structural factors behind the secondary market’s rapid growth.

This year looks set to break records for secondary market transactions. Estimates suggest a volume of at least $210 billion off the back of a record strong $103 billion first half.³² And there are several reasons to believe that the 2026 volume could surpass this.

Key among these is that both LPs and GPs are now using the secondary market for reasons beyond liquidity. LPs are taking a more active approach to portfolio management to fine-tune their exposures: in the first half of 2025, nearly 50% of LP-led sales were motivated by opportunistic liquidity needs and portfolio rebalancing, 25% by administrative clean-up, and 23% by reducing non-core managers and strategies.

And managers are continuing to use GP-led deals to extend ownership of their prized assets while offering LPs the option of liquidity. By Q3 2025, US and European private equity firms had already completed 105 continuation fund deals, a sizeable increase on the 87 sealed in the first three quarters of 2024.³³

At the same time, the secondary market has extended beyond buyouts and venture capital, with rising activity in infrastructure, private credit and real estate.³⁴ This adds up to attractive opportunities for investors in secondary funds, which is why this segment has been spared the fundraising woes of the broader market. By the end of 2025, there will be an estimated $315 billion of dry powder targeted at secondaries, up 28% year-on-year.³⁵

Despite secondary volume’s stellar growth, just 1-2% of global private markets NAV trades in any given year,³⁶ suggesting significant room for further growth. Indeed, recent estimates of a $300 billion annual volume by 2030 may be on the conservative side.³⁷

Fundraising will become even more polarised

Widening return dispersion and more selective LPs (given ongoing liquidity constraints) will amplify the existing trend of a bifurcating fundraising market. Fundraising value was lower by Q3 2025 than the same period in 2024, and it remains tough to raise capital. Private equity funds closed in 2024³⁸ took an average of nearly 22 months to raise, up from just 14 months back in 2014.³⁹

Yet this is not the complete picture. The market is increasingly divided into “haves” and “have-nots”. Established managers with strong track records and ability to deliver DPI receive a warm welcome from investors. For example, Ardian raised a record $30 billion for its ninth secondaries fund, buyout shop Thoma Bravo closed Fund XVI at $24.3 billion and Veritas Capital amassed $14.4 billion, targeting technology companies.⁴⁰ Meanwhile, firms lacking these attributes are left out in the cold.

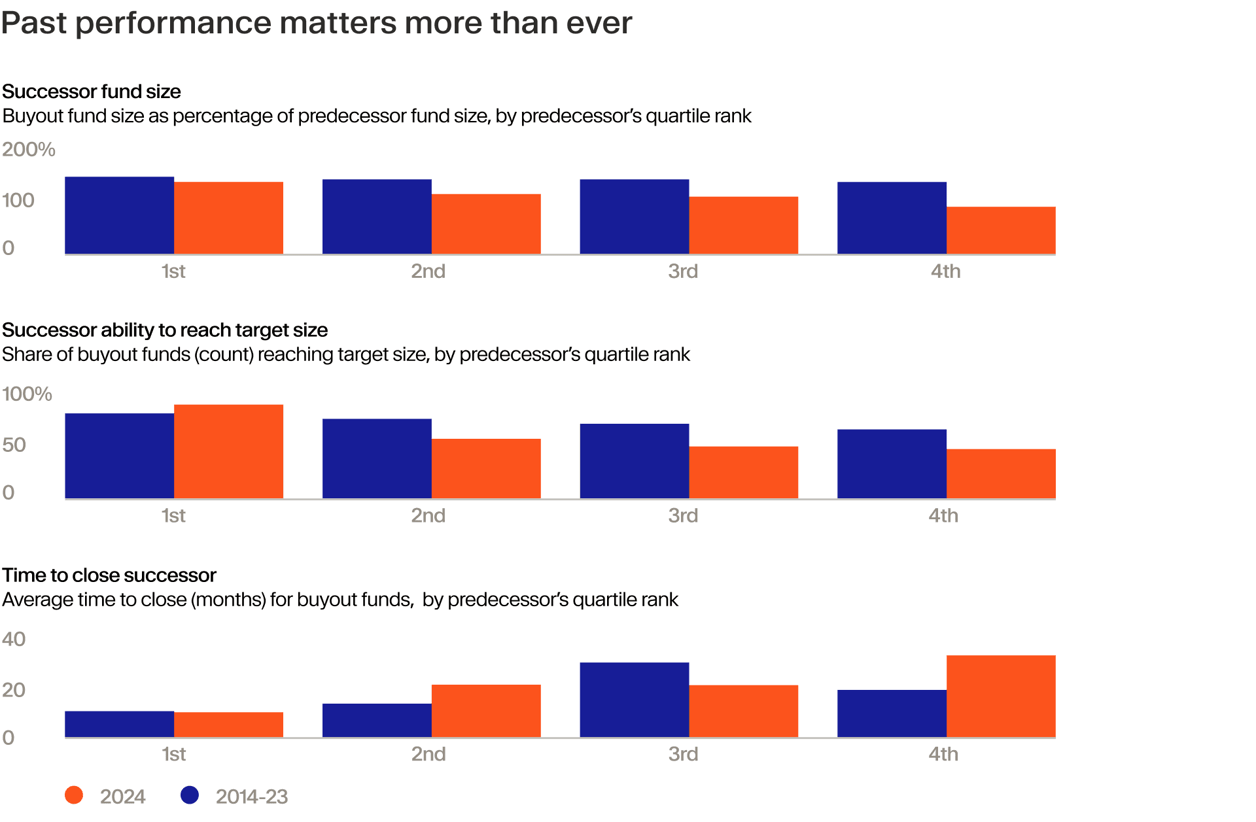

Performance matters to increasingly discerning LPs and re-ups today are far from guaranteed. In 2024, top quartile managers were far more likely to reach their target size than the rest, while time spent fundraising increased markedly for third and fourth quartile funds compared with the 2014 to 2023 average, but remained steady for top quartile funds.⁴¹

However, one trend seems to be reversing. Previously, investors were flocking to the mega-funds, but in 2024, they switched to more mid-market players. Funds seeking $1 billion to $5 billion were the only category that bucked a declining fundraising trend in 2024.⁴²

We anticipate this will continue as investors increasingly favour funds with clear differentiation and varied ways of delivering DPI. This is especially apparent in Europe, where mid-market funds accounted for two-thirds of capital raised up until Q3 2025, setting them on course for a record year.⁴³ With reports of a big fundraising push among some of Europe’s biggest players in 2026 (rumoured to total more than €110 billion),⁴⁴ the distinction between the “haves” and “have-nots” will likely become clearer still.

Energy, AI and essential services are themes of the year

As investment pace picks up, we expect activity to cluster around some of the mega-themes transforming global economies today, namely AI and energy transition. Recent experience of economic and geopolitical volatility will also drive investment in defensible essential services.

The race to capture value from AI is clearly the story of the moment for venture capital in start-ups, for buyouts to streamline company operations by implementing AI technologies and for infrastructure managers to support the build out of data centres necessary to train and process AI capability.

Globally, venture capital investment in genAI for H1 2025 soared to nearly $50 billion, outstripping the $44 billion full-year figure for 2024.⁴⁵

Data centres will need $5.2 trillion in investment by 2030 just to keep pace with the demand for compute power,⁴⁶ suggesting a significant opportunity for infrastructure funds.

Massive capital is also required to build energy infrastructure to power and cool computing chips. As a result, data centre and energy investments are increasingly converging. And while tech companies are turning to natural gas as a transition fuel for these centres,⁴⁷ renewable power, such as solar, is faster and usually cheaper to build.⁴⁸ This, together with trends such as reshoring, is creating additional demand for renewable energy.⁴⁹

Several less obvious areas related to these themes and the broader economy should also present attractive private equity opportunities. These include the services essential to running companies, while making them more sustainable and efficient. We see strong deal flow in areas such as testing, inspection and maintenance. In waste and recycling, the UK saw a record £2.2 billion in disclosed funding in the circular economy in 2024, a 64% increase on 2023, driven largely by venture capital and private equity investment.⁵⁰

And, of course, embedding AI and automation in businesses across the economy is a major private equity theme. A recent report concluded that the highly fragmented industrial automation industry would offer “significant opportunities for… private equity looking to build scale, grow internationally and add capabilities across the value chain”.⁵¹

AI is changing the way PE gets things done

Managers are not just implementing AI in portfolio companies, they are adopting it themselves. The next few years could see firm operations transformed from front to back.

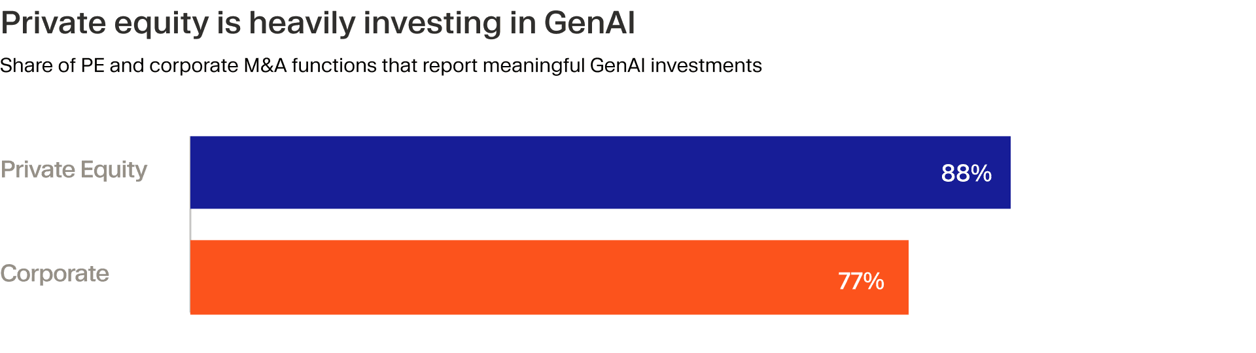

After decades of relying on legacy technologies, private equity is fast catching up. Nearly all (88%) private equity respondents to a recent survey said their firm had made meaningful investment in genAI for deal teams, outstripping the 77% of corporates who said the same. Most also expect a rapid payback, with 69% seeking a return on investment within two years.⁵²

AI’s use cases in private equity extend beyond deal processes. There is high potential in investor relations and fundraising, data-driven decision-making, building repeatable growth and efficiency gains in portfolio companies, talent management and exit planning.⁵³ Small wonder that over half of GPs are expecting to hire more digital transformation, data scientists and AI experts in the next 12 months.⁵⁴

We believe that managers building real AI capabilities will create more value and gain a clear competitive edge over those slower to adapt to the new way of working.

Private markets are becoming wide open

Private markets investing is no longer the preserve of institutional investors. Rising private wealth and a desire to diversify away from public markets are leading more individual investors to private markets. To capture this growing appetite, the industry now offers them a range of access points and a range of strategies with varying risk-return characteristics.

The broader individual investor universe currently has an estimated $4 trillion invested in alternatives, a figure projected to reach $12 trillion in the next decade.⁵⁵ This interest is fuelled largely by the twin objectives of diversifying portfolios and performance, according to a 2025 Hamilton Lane survey of private wealth advisors, 76% of whom report that clients see private markets as higher reward than stocks and bonds.⁵⁶

Responding to demand, private markets firms are launching more products tailored to individual investor needs. Semi-liquid and evergreen funds may offer features such as lower investment minimums, immediate access to diversified portfolios and periodic liquidity. And they are proving popular: by the end of 2024, they had gathered an estimated $350 billion in net assets, with semi-liquid net assets increasing by 60% since 2022.⁵⁷ There is further growth to come. Across the wealth-focused evergreen fund spectrum, assets under management are projected to reach $1.1 trillion by 2029.⁵⁸

With more options than ever for individual investors, being selective remains paramount. In our view, the real advantage will go to those who choose the right strategies and managers in an increasingly crowded market.

Investment playbook for the next era of private equity

- Focus and consistency. Maintaining a consistent investment pace remains important. A barbell approach – anchoring portfolios with core top-tier managers while complementing them with targeted specialists and secondaries exposure – can help balance risk and opportunity.

- Exposure to secondaries. Secondaries may offer attractive risk-adjusted returns, faster capital deployment and distributions and a more muted J-curve — all attractive features in today’s environment.

- Long-term, durable themes. AI adoption, energy transition and essential services have strong fundamentals, defensible demand and resilient exit pathways even in a slower growth environment.

¹ https://pitchbook.com/news/reports/q3-2025-global-pe-first-look ² https://publiccdn-production.moonfare.com/strapi/production/Q3_2025_Global_PE_First_Look_Pitch_Book_ddf88bb7ef.xlsx ³ https://publiccdn-production.moonfare.com/strapi/production/Q3_2025_Global_PE_First_Look_Pitch_Book_ddf88bb7ef.xlsx ⁴ https://www.bcg.com/publications/2025/the-brave-new-world-of-dealmaking-in-the-global-market ⁵ https://www.ey.com/en_gl/insights/ipo/trends ⁶ https://publiccdn-production.moonfare.com/strapi/production/Leveraged_loan_amendment_activity_rises_in_July_as_2026_maturity_wall_eases_Pitch_Book_a593fe9dd2.pdf ⁷ https://marketing.gain.pro/hubfs/The-Private-Equity-Value-Creation-Report-2025-Gain.pro.pdf ⁸ https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2025/10/value-creation-in-private-equity.pdf.coredownload.inline.pdf ⁹ https://www.simon-kucher.com/en/insights/private-equity-operational-era-value-creation-accelerates ¹⁰ https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2025/10/value-creation-in-private-equity.pdf.coredownload.inline.pdf (page 27) ¹¹ https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-alternatives/mi-guide-to-alternatives-us.pdf (page 9) ¹² https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-alternatives/mi-guide-to-alternatives-us.pdf (page 49) ¹³ https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/noindex/documents/ey-gl-pe-exit-readiness-study-2025-full-findings-report-10-25.pdf?mkt_tok=NTIwLVJYUC0wMDMAAAGeMJD2Inp1NZqj8W31t-H2RImg2OdSTzDDcPGL09FGp1tgc1rF1QRpNR1I_4jH1TY0oZgPNl7v8NFmREhdDxG0_PF-I44lkfgvPZClbEB8Fjd7uMLgFA4P ¹⁴ https://eqtgroup.com/news/eqt-ab-publ-q3-announcement-2025-2025-10-16 ¹⁵ fsinvestments.com/fs-insights/chart-of-the-week-2025-1-24-25-middle-market-garp/ ¹⁶ https://www.commonfund.org/cf-private-equity/edging-out-the-competition-the-sector-specialist-advantage ¹⁷ https://pitchbook.com/news/reports/q3-2025-global-pe-first-look ¹⁸ https://www.reuters.com/business/global-ma-activity-up-10-first-nine-months-2025-study-shows-2025-10-28/ ¹⁹ https://www.ey.com/en_us/insights/ipo/ipo-market-trends ²⁰ https://www.ey.com/en_uk/insights/private-equity/pulse ²¹ https://files.pitchbook.com/website/files/pdf/Q3_2025_European_PE_Breakdown.pdf ²² https://files.pitchbook.com/website/files/pdf/Q3_2025_US_PE_Breakdown.pdf (page 19) ²³ https://www.renaissancecapital.com/IPO-Center/News/114903/The-US-government-is-finally-reopening.-Here-are-the-IPOs-we-could-see-befo ²⁴ https://www.spglobal.com/marketintelligence/en/mi/research-analysis/us-equity-market-investor-sentiment-improves-with-reduced-macro-concerns-Nov25.html ²⁵ https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/noindex/documents/ey-gl-pe-exit-readiness-study-2025-full-findings-report-10-25.pdf?mkt_tok=NTIwLVJYUC0wMDMAAAGeMJD2Inp1NZqj8W31t-H2RImg2OdSTzDDcPGL09FGp1tgc1rF1QRpNR1I_4jH1TY0oZgPNl7v8NFmREhdDxG0_PF-I44lkfgvPZClbEB8Fjd7uMLgFA4P (page 17) ²⁶ https://info.pjtpartners.com/PJT_Park_Hill_Secondary_Market_Insight_Q3_2025 (page 4) ²⁷ https://files.pitchbook.com/website/files/pdf/Q3_2025_US_PE_Breakdown.pdf ²⁸ https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/noindex/documents/ey-gl-pe-exit-readiness-study-2025-full-findings-report-10-25.pdf?mkt_tok=NTIwLVJYUC0wMDMAAAGeMJD2Inp1NZqj8W31t-H2RImg2OdSTzDDcPGL09FGp1tgc1rF1QRpNR1I_4jH1TY0oZgPNl7v8NFmREhdDxG0_PF-I44lkfgvPZClbEB8Fjd7uMLgFA4P (page 8) ²⁹ https://www.bain.com/insights/outlook-is-a-recovery-starting-to-take-shape-global-private-equity-report-2025/ ³⁰ https://www.bain.com/insights/outlook-is-a-recovery-starting-to-take-shape-global-private-equity-report-2025/ ³¹ https://www.bain.com/insights/private-equity-midyear-report-2025/ ³² https://go.jefferies.com/l/399542/2025-07-22/5tb4pk/399542/17531934550cfOYM0Q/Jefferies___Global_Secondary_Market_Review___July_2025.pdf?utm_term=66011475,48 ³³ https://files.pitchbook.com/website/files/pdf/Q3_2025_US_PE_Breakdown.pdf ³⁴ https://go.jefferies.com/l/399542/2025-07-22/5tb4pk/399542/17531934550cfOYM0Q/Jefferies___Global_Secondary_Market_Review___July_2025.pdf?utm_term=6601147548 ³⁵ https://info.pjtpartners.com/PJT_Park_Hill_Secondary_Market_Insight_Q3_2025 ³⁶ https://www.nb.com/en/global/insights/whitepaper-navigating-secondary-growth-opportunities-beyond-the-horizon (page 3) ³⁷ https://www.williamblair.com/-/media/downloads/ib/2025/williamblair-pca-secondary-market-report-survey-march-2025.pdf ³⁸ PitchBook, Global PE First Look, Q3 2025 ³⁹ https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/mckinseys%20global%20private%20markets%20report/2025/global-private-markets-report-2025-braced-for-shifting-weather.pdf (page 19) ⁴⁰ https://media.privateequityinternational.com/uploads/2025/07/h1-2025-fundraising-report-pei.pdf ⁴¹ https://www.bain.com/insights/topics/global-private-equity-report/ ⁴² https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/mckinseys%20global%20private%20markets%20report/2025/global-private-markets-report-2025-braced-for-shifting-weather.pdf (page 20) ⁴³ https://files.pitchbook.com/website/files/pdf/Q3_2025_European_PE_Breakdown.pdf ⁴⁴ https://www.ft.com/content/c86ba8ca-de0f-40e0-a33a-4712cf594b48 ⁴⁵ https://www.ey.com/en_ie/newsroom/2025/06/generative-ai-vc-funding-49-2b-h1-2025-ey-report ⁴⁶ https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-cost-of-compute-a-7-trillion-dollar-race-to-scale-data-centers ⁴⁷ https://www.spglobal.com/en/research-insights/market-insights/daily-update-nov-13-2025 ⁴⁸ https://www.reuters.com/business/energy/rush-data-centers-creates-us-solar-hotspots-2024-02-22/ ⁴⁹ https://www.iea.org/reports/renewables-2025/executive-summary ⁵⁰ https://www.bdo.co.uk/en-gb/news/2025/venture-capital-and-private-equity-drive-record-investment-in-uks-maturing-circular-economy ⁵¹ https://www.alixpartners.com/media/iljl3awg/alixpartners_industrial-automation-market_january-2025.pdf ⁵² https://www.deloitte.com/us/en/what-we-do/capabilities/mergers-acquisitions-restructuring/articles/m-and-a-generative-ai-study.html?nc=42 ⁵³ https://www.ey.com/en_ch/insights/strategy-transactions/ai-in-private-equity ⁵⁴ https://www.ey.com/en_uk/insights/private-equity/pulse ⁵⁵ https://www.bain.com/insights/have-secondaries-reached-a-tipping-point-global-private-equity-report-2024/ ⁵⁶ https://www.hamiltonlane.com/getmedia/5a74ae29-3398-4cb1-bcb2-3b107f9e49c2/2025-hamilton-lane-annual-global-private-wealth-survey.pdf ⁵⁷ https://www.morningstar.com/business/insights/research/semiliquid-funds-report ⁵⁸ https://pitchbook.com/newsletter/forecasting-the-growth-of-wealth-focused-evergreen-funds