Multiple on invested capital (MOIC)

What is Multiple on Invested Capital (MOIC)?

Multiple on Invested Capital (“MOIC”) is a metric used to describe the value or performance of an investment relative to its initial cost, commonly used within private markets. MOIC is among the most relevant metrics to be assessed while conducting fund due diligence. It is also often referred to as Equity Multiple.

In fund investments, MOIC is expressed as a measure of the total value (i.e., both realized and unrealized, see below) of all shares in the fund divided by the initial investment.

Since the individual securities held in a fund will have exit transactions at different times, the MOIC of the fund at any particular time combines the value of securities that have been sold (i.e. realized proceeds) with the value of securities that remain active (i.e. unrealized value). Unrealized value consists of stakes in companies (whether public or still private) that have not yet been liquidated. Such reasoning is applied to single assets as well as to the portfolio of companies in a private market fund.

Net MOIC uses values from which fees, expenses borne by limited partners (“LPs”) and carried interest have been deducted. Gross MOIC does not reflect deduction of such expenses in its calculation.

Key takeaways

- MOIC is a measure of how much value a private equity investment has generated/is generating.

- MOIC is a quick, easy measure that does not involve time-weighted calculations.

- MOIC is a quick way to assess the potential of a specific investment, compare alternatives, or measure the value-accretive capabilities of the general partner (“GP”).

Why is MOIC important in private equity?

MOIC offers investors and industry professionals a metric that is simple to understand and easy to calculate from reported figures. In addition, MOIC provides a useful reference figure for comparing different private equity funds or assessing the investment acumen of a general partner.

MOIC at different points in time can also provide limited partners with a measure of how the overall fund value is progressing on a quarterly or annual basis.

MOIC formula and calculation

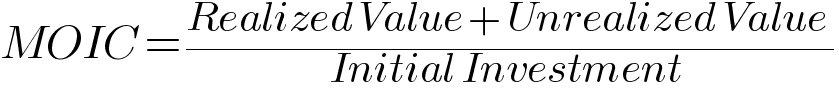

The formula for MOIC can be shown as:

Where:

- Realised value is the total capital from investments that have been exited.

- Unrealised value, also referred to as residual value, is the total value of the remaining portfolio’s active investments that have not yet been liquidated (i.e., either private or public).

- Initial investment is the total initial investment cost.

- MOIC is typically expressed as a number with one decimal followed by “x” to indicate that it is a multiple of the initial investment. A typical MOIC might be 2.4x or 3.1x.

How to calculate MOIC

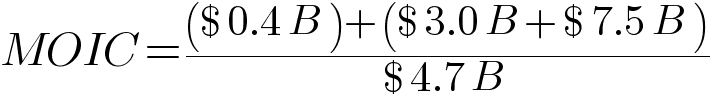

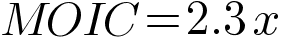

Data for a sample private equity fund after three years might look as follows:

Using the formula above, gross multiple on invested capital can be calculated as follows:

Limitations of MOIC

MOIC does not produce time-weighted returns and therefore does not consider the timing of capital calls or distributions, nor does it consider the portfolio’s net asset value at any point other than at the specified valuation date.

Also, investors should be aware of whether they are looking at a gross MOIC or net MOIC to make sure they are making proper comparisons.

MOIC vs IRR: what role does time play?

Internal Rate of Return (IRR) is another metric by which private equity investments can be measured. As a widely accepted measure of time-weighted returns, IRR is a traditional approach to measuring the profitability of any investment with both negative and positive cash flows over time.

An IRR is essentially the single compounded rate of return that equates the present values of all the negative cash flows with those of all the positive cash flows. Essentially, that means it finds the equivalent rate of return that one would realize if the total investment were made all at once, compounded over the period in question, and liquidated at the end.

MOIC tells you how the value of an investment has grown on an absolute basis, while an IRR tells you how that investment has generated returns on an annualized basis. A 2.0x MOIC over 3 years reflects an attractive annual return, equating to an IRR of c. 26%, while the same MOIC over 5 years equates to an IRR of c. 15%.

As an example of how IRR differs from MOIC, the following table represents the calculations for two similar-sized investments in different funds:

| Year 0 | Year 3 | Year 5 | |

|---|---|---|---|

| Investment A | |||

| Investment Outlay | $100,000 | ||

| Realized Value | $40,000 | $185,000 | |

| Unrealized value | $108,000 | $85,000 | |

| MOIC | 1.5x | 2.7x | |

| IRR | 14% | 22% | |

| Investment B | |||

| Investment Outlay | $100,000 | ||

| Realized Value | 0 | $245,000 | |

| Unrealized Value | $120,000 | $75,000 | |

| MOIC | 1.2x | 3.2x | |

| IRR | 5% | 26% |

Learn more about private equity fund performance.

MOIC vs TVPI: what is the difference?

TVPI (total value of paid-in capital) is similar to MOIC in that both are used to represent the total gross value (realized plus unrealized) of a private equity investment. The difference is in the denominator. MOIC divides the total value of the investment or fund by the initial investment, whereas TVPI divides the total value of the investment by the paid-in amount.

When a fund is fully funded and all capital calls have been met, then TVPI will equal MOIC. But when investors are not yet fully paid-in, the TVPI will be greater than MOIC because it considers only paid-in capital.