Key takeaways:

- In past downturns, private equity has demonstrated more resilience in the face of economic downturns compared with public equities.

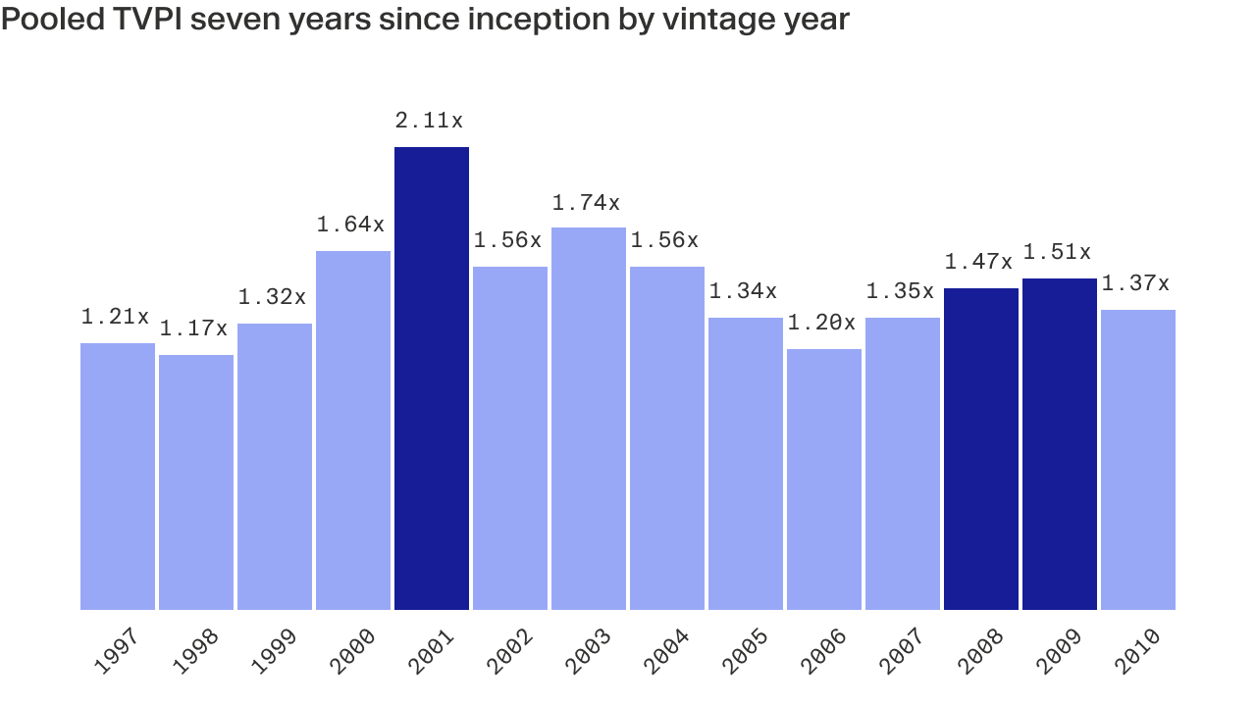

- Some of the strongest vintages in private equity were recession years; the dot-com crash of the 2001 period, for example, produced the best performing vintage in more than 20 years.

- Factors that have contributed to private equity’s success in times of crisis include active involvement with portfolio companies, the ability to deploy capital more flexibly and its ability to insulate investors from panic selling.

In the current economic environment, many private equity (PE) investors are understandably concerned and are looking for answers to how the asset class behaves in downturns. Lessons from recent history, however, suggest that PE worked well for those who didn’t retreat but rather continued allocating, even during more turbulent times.

Indeed, PE generated some of its best performing vintages during the dot-com crash of 2001 and the 2008-2009 global financial crisis (GFC), according to PitchBook data.¹ These vintages produced above-average earnings for investors, with 2.11x and 1.51x TVPI (total value to paid-in or the investment multiple), respectively, calculated seven years into the lifecycle of the fund.

Of course, economic turbulence is not positive and investments could suffer in this environment. However, the performance of PE during these past recessionary periods demonstrates the opportunity that fund managers have to capitalise on declining valuations and distressed opportunities that often emerge during downturns.

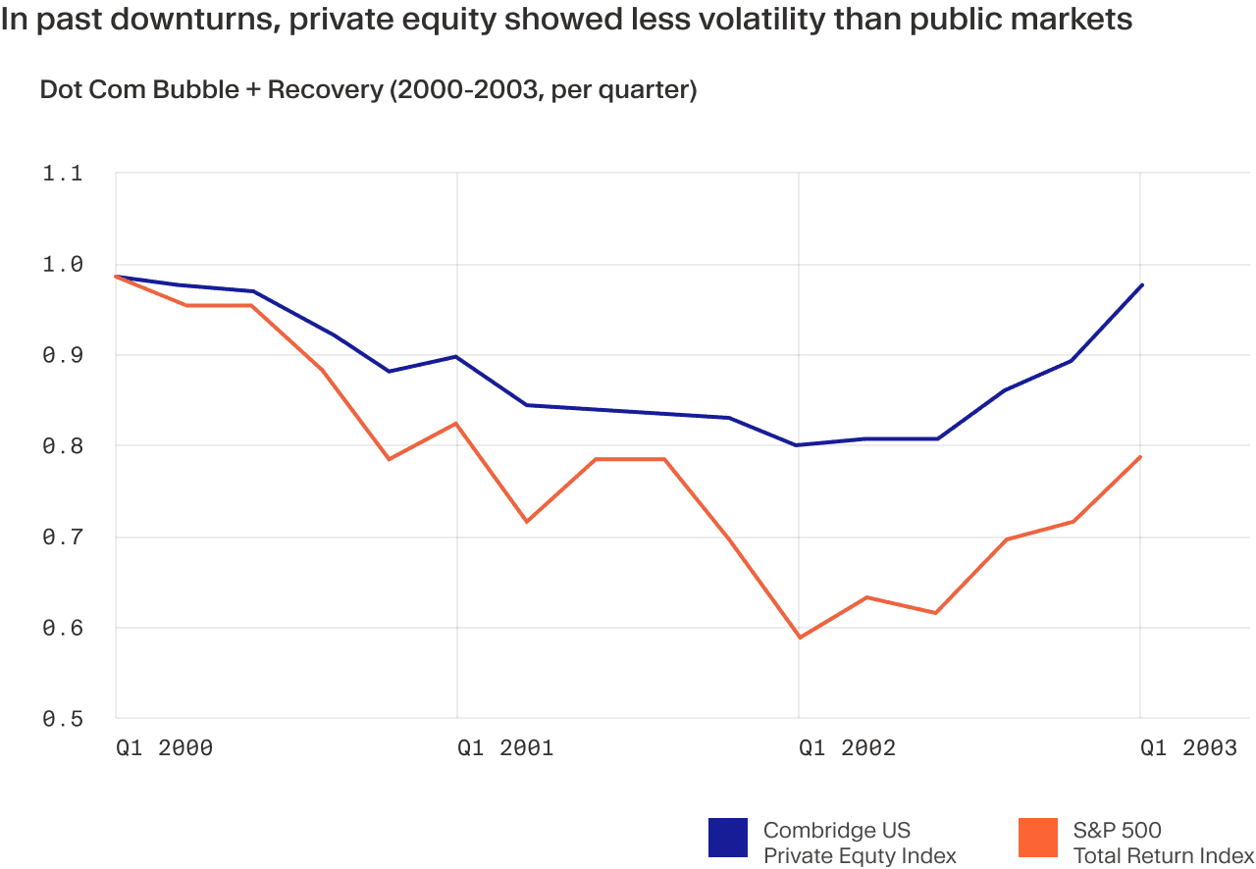

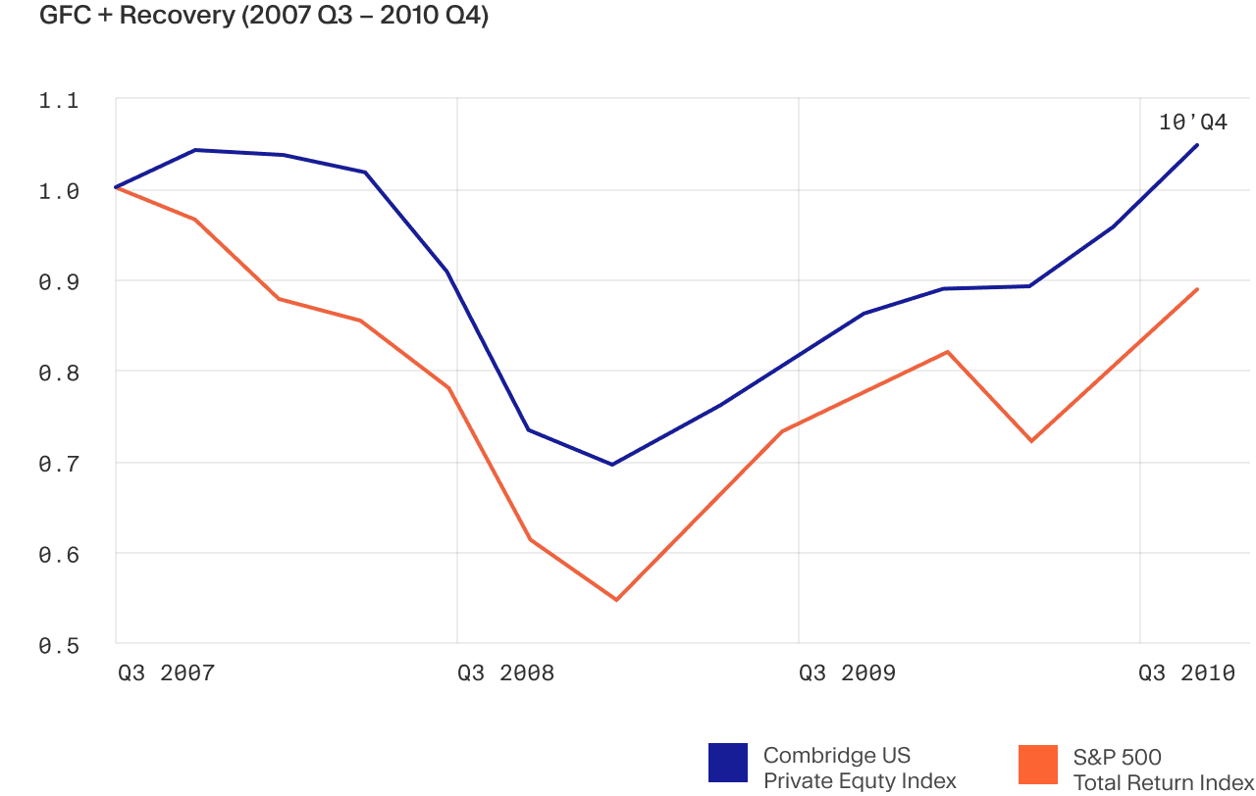

Private equity showed more resilience in recessions than public markets

When markets took a turn for the worse during the dot-com crash and GFC, private equity also showed the ability to weather the storms relatively unscathed, recording less severe hits on the investment multiple compared to public equity indices.²

A closer look at the dot-com bubble underscores the resilience of buyout funds. Although they still exhibit cyclical swings–the US buyout market declined by less than 13%, while the European side lost slightly above 7 percent of its value during the downturn–this pricing volatility was relatively moderate compared with public markets; for example, the S&P 500 declined by 40 percent in the same period.³ Investment manager Neuberger Berman’s study from 2020 arrives at a similar conclusion. According to its research, PE experienced less significant drawdowns and a quicker recovery than public equities, both in the early 2000s and the 2007–09 global financial crisis.⁴

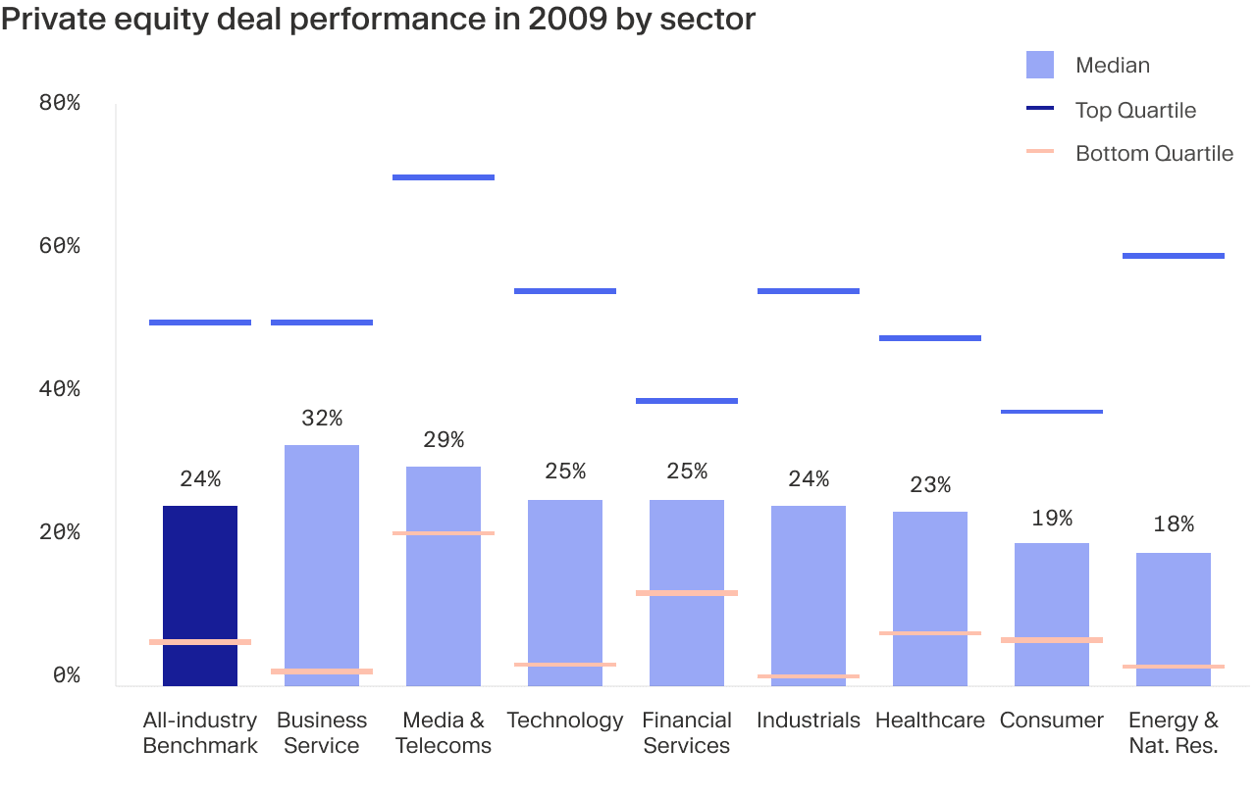

Dealmaking in GFC: media and tech at the forefront

Sector analysis during different stages of GFC shows that after weak returns in 2007, performance stabilized the next year. According to DealEdge research, tech, and healthcare saw the largest median return increases in 2008, while energy & natural resources recorded the sharpest declines. By contrast, the tech sector was a standout performer, with median returns jumping by six percentage points compared with 2007.

In the late part of the recession in 2009, however, the dealmaking landscape bounced back. Median returns across industries were, on average, 15 percentage points higher than in 2008, found the researchers. Business services and media & telecoms deals surged markedly — by more than 20 percentage points, surpassing tech as the highest performing sector. All bottom quartile funds for all sectors also moved back into positive territory.⁵

GFC: a missed opportunity

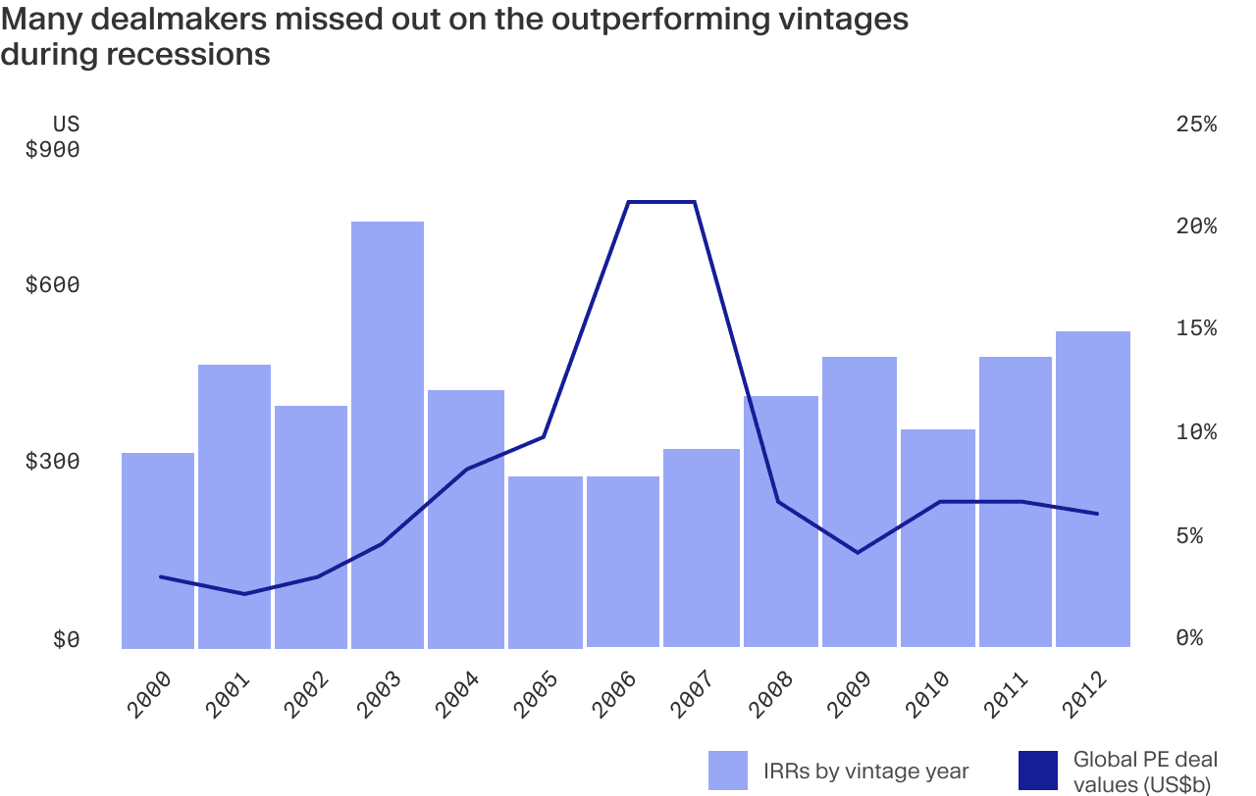

In hindsight, however, many fund managers in private equity missed these past opportunities to acquire high-quality assets at steep discounts.⁶ Instead, they retreated and significantly scaled back their investment activities: between 2007 and 2009, for example, new acquisitions fell almost 80%, from a peak of nearly US$800 billion to just US$170 billion, according to a report from Ernst & Young.⁷

Some fund managers didn’t only miss the window for lucrative deals, but they also suffered additional tough hits on their net asset value by investing heavily during bullish periods preceding downturns. This made them more vulnerable to the market contractions that followed. For instance vintages just before the dot-com bubble (1998-1999) and the GFC (2005-2006) under-performed in both buyout and VC markets, according to eFront analysis.⁸

What made a winner in past recessions

The GFC, especially, is today seen as PE’s first real test. At the time, many predicted that the industry’s leverage-dependent model would not stand up, and instead falter under massive defaults. However, as historical data shows, PE’s downfall didn't materialise; in fact, the asset class survived the market crash relatively intact. We believe that the following three key characteristics provided PE with a decisive support it needed:

Better access to capital and more freedom to deploy it

The ability to deploy capital flexibly can be essential to preventing the bankruptcies of portfolio companies. An oft-cited study by Hamilton Lane shows that the risk of ‘catastrophic loss’ (defined as a 70% or greater decline in peak value with minimal recovery) of a PE-backed company is 18%, which is half as high compared to a public company.⁹

In addition, researchers found that PE-backed companies, operating during GFC, could increase capex compared with peers lacking PE sponsorship. As a result, these companies were able to increase market share and experience higher asset growth during crisis. Positive investment effects of PE were particularly large in companies more likely to be financially constrained at the time of the crisis, according to researchers from Stanford University and The Kellogg School of Management.¹⁰

Further demonstrating the resilience of private equity, a study of almost 500 PE-backed companies in the UK during the GFC found that these firm recovered faster from the crisis and captured more market share relative to comparable non-PE-backed competitors.¹¹

Active management and focus on operational value creation

Most global funds have value creation teams to help their portfolio companies during adverse economic circumstances. Their support shouldn’t be understated. McKinsey's research shows that firms with value-creation capacities outperformed during the GFC.¹²

Fund managers can help portfolio companies develop new capabilities and drive transformation projects. Value creation services are especially valuable in areas with hard-to-access expertise such as information technology, data and analytics, digitalisation and new market entry. Importantly, in 2008, only the larger PE firms had operating expertise. Today, most portfolio companies can receive such support to overcome challenges and to grow more quickly. To learn more about the value creation levers and how are they being used in real-world cases, read our dedicated article.

Illiquidity in downturns

Private equity tends to be more illiquid compared to other asset classes and especially public markets. Although the inability to sell stakes quickly may seem like a definitive disadvantage, it can help insulate investors from panic selling, which typically comes with higher losses.¹³ Being a long-term investment, managed by professional fund managers, PE gives investors some protection against day-to-day volatility.

The rise of private credit

In the aftermath of the GFC, sweeping regulatory changes required banks to limit exposure on their balance sheets, increase liquidity and strengthen capital requirements.

As banks’ lending capacities decreased, private credit stepped in and it surged. The asset class has experienced unprecedented growth since 2009, going from $320bn in 2010 to $875bn at the end of 2020, according to Preqin data.

The rise of private credit strategies also gave PE funds another avenue to provide flexible capital across the entire capital structure. Strategies developed under the umbrella of private credit can today mitigate the consequences of economic distress and provide an important buffer to economic shocks — both to companies and the broader economy. Dive deeper into private credit and learn more about its role in a modern portfolio in our white paper.

Manager selection is crucial, especially in downturns

But although PE has certain inherent advantages, success largely depends on the skills and experience of the individual fund manager.

Top-performing managers tend to have extensive sourcing capabilities, industry expertise and a value-creation team that can help give them an edge in different circumstances, including downturns. For investors, rigorous manager selection is therefore crucial. To learn more about what a due diligence process should encompass, we invite you to jump over to our dedicated article on fund selection.

¹ Pitchbook 2020. Private Market Playbook ² Investments and Wealth Monitor 2020. Private equity offers resilience in a downturn ³ Efront. Private markets in downturns: 3 observations ⁴ Neuberger Berman 2022. The Historical Impact of Economic Downturns on Private Equity ⁵ Deal Edge 2022. Case Study: Private Equity Performance During a Recession ⁶ Institutional Investor 2020. Private Equity Firms Won’t Waste Another Crisis ⁷ EY 2020. Why private equity can endure the next economic downturn ⁸ Efront. Private markets in downturns: 3 observations ⁹ Hamilton Lane 2018. Market Overview ¹⁰ SIEPR 2017. Private Equity and Financial Fragility during the Crisis ¹¹ SIEPR 2017. Private Equity and Financial Fragility during the Crisis ¹² McKinsey 2020. Lessons for private equity from the last downturn ¹³ Morgan Stanley 2022. Top 5 Mistakes Investors Make in a Market Sell-Off