Total value to paid-in capital (TVPI)

What is Total Value to Paid-In Capital (TVPI)?

Total Value to Paid-In Capital (also known as the ‘Investment Multiple’) is a measure of the performance of a private equity fund. It represents the total value of a fund relative to the amount of capital paid into the fund to date.

TVPI thus provides investors with a key metric on the performance of their investment at any point in time. This is particularly useful for a private equity fund since returns consist of both distributed capital and residual holdings, TVPI provides a way to combine both of these and measure them relative to the initial investment.

The total value of a fund is the sum of realised value (all distributions made to investors to date) plus the unrealised value (residual value of investments) still held by the fund.

TVPI is expressed as a multiple, such as 0.9x or 1.6x. Multiples less than 1.0x represent funds that are currently valued at less than the paid-in investment amount.

Key Takeaways

- TVPI is a measure of the performance of a PE fund.

- TVPI considers both realised and unrealised value of the investment.

- TVPI relates the current value of the investment to capital actually paid in by investors.

- TVPI does not take the time value of money into account.

TVPI in Private Equity

TVPI measures the performance of a private equity fund relative to what the investor has put into the fund at a particular time. Given that private equity investments are not liquid and that they provide returns to investors at irregular times throughout their life, TVPI is a valuable measure of ongoing fund performance and investors rely on it to provide an easy-to-understand barometer of performance relative to the initial investment.

TVPI provides investors with a number of performance insights on their investment:

- Whether they are showing a positive return at the current point in time and how much relative to their current stake.

- How well the GP is doing at realising exits on behalf of investors. The DPI component informs investors as to how much cumulative capital has been returned to them and therefore reflects how much liquidity has been provided to investors.

- The RVPI component tells them the value of what remains in the fund and provides a perspective on the remaining upside potential of the fund.

For these reasons, TVPI is a widely used metric in private equity and is important to both investors and fund managers alike.

Pros and Cons of TVPI

Pros

- Easy to obtain, calculate and understand. TVPI is provided by the fund’s general partner in accordance with industry standards and provides a quick measure of absolute value, which can be benchmarked against funds of similar type and vintage for competitive purposes.

- Widely used throughout the industry by both investors and fund managers.

- Measures the absolute return on invested capital, making it easy to see when the return turns positive.

- Incorporates both realised (distributed) and unrealised (residual holdings) and can therefore track the GP’s success at both identifying opportunities and realising exits.

- Is not subject to the different interpretations and assumptions of an IRR (internal rate or return) calculation.

- Can provide a cumulative performance measure at any point during the life of the fund

Cons

- Does not consider the time value of money, which would require assumptions about interest rates, timing of investments and distributions, and reinvestment rates. Thus, cannot be compared to an IRR.

- Relies heavily, especially in the early years of a fund term, on the GP’s estimates of residual unrealised value, which may or may not pan out as expected.

TVPI Formula and Calculation

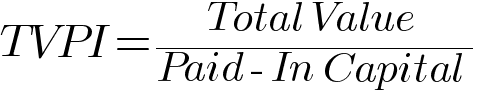

The formula for TVPI is as follows:

Where:

Distributed Capital is distributions made to investors to date.

Residual Value is the estimated current value of investments still held by the fund.

Paid-in Capital represents the total capital contributed to the fund by the investors.

How to calculate TVPI: An example

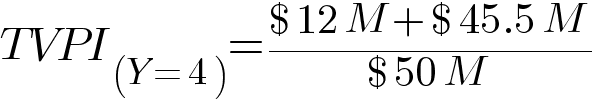

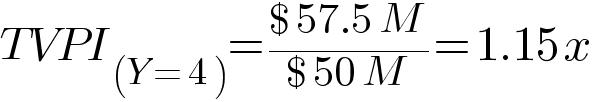

The following is an example of a hypothetical PE fund:

- Investors have contributed a total of $50 million to the fund.

- The fund has distributed $12 million to investors from realised deals.

- It is 4 years since the fund opened and the residual value of investment assets held by the fund is estimated to be $45.5 million.

Calculating the TVPI for year 4 would produce the following result:

If we calculate the TVPI each year of the fund’s life, we might see the following hypothetical values (in $ millions):

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Distributed | 0 | 0 | 2.0 | 12.0 | 14.5 | 29.0 | 47.5 | 62.5 | 4.5 | 100.5 |

| Residual | 26 | 30 | 33 | 45.5 | 55.5 | 54 | 46 | 34.5 | 24.5 | 0 |

| Total Value | 26 | 30 | 35 | 57.5 | 70 | 83 | 93.5 | 97 | 99 | 100.5 |

| Paid-in Capital | 30 | 42 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 |

| TVPI (at year-end) | 0.87x | 0.71x | 0.70x | 1.15x | 1.40x | 1.66x | 1.87x | 1.94x | 1.98x | 2.01x |

Plotting those values for each year, we would see how they conform to the ‘J-curve’ pattern typical of private equity funds shown below.

The chart above shows how the TVPI of a private equity fund typically progresses over time. TVPI commonly dips in the first few years of a fund, reflecting multiple factors such as investment costs and management fees coupled with expenditures in marketing and operations at portfolio companies that need to be recovered before significant enhancements will appear in valuations. In addition, some underperforming assets may be written off in their early days.

As the target companies in the fund achieve revenue growth and as the general partner is able to secure gainful exits through IPOs or acquisitions, TVPI grows rapidly, creating the appearance of the pattern seen above. A pattern of this general shape is common in private equity and is referred to as the 'J-curve'.

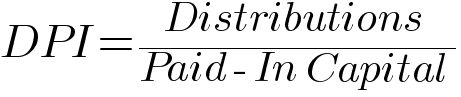

TVPI vs. DPI and RVPI

DPI and RVPI are important measures of investment performance and together they represent TVPI.

DPI (Distributed Value to Paid-in Capital) represents returns to investors that have already been distributed by the fund. This is an important measure of the fund’s ability to return capital to investors through exits such as IPOs, dividend recapitalisations and strategic sales.

RVPI (Residual Value to paid-in Capital) represents the value of unrealised assets still held by the fund on behalf of investors.

To obtain the TVPI for a PE investment at any point in time, the DPI is added to the RVPI.

This is shown by the following formulas:

The formula for TVPI can thus be rewritten as:

which equates to:

TVPI FAQs

What does TVPI stand for?

TVPI stands for Total Value to Paid-in Capital.

What is a good TVPI?

TVPIs will vary for different types of funds and economic conditions. In addition, TVPI grows over the life of any fund. Therefore, it can be misleading to assign a particular number as a “good” value for TVPI.

As capital in a fund is deployed to target companies the first few years, a TVPI of less than 1x is not uncommon. Therefore, in the early going, a TVPI greater than 1x is good as it means an investor is currently on track for a positive return at that point. In the later stages of the fund, when more distributions have been made to the investors, TVPIs will expand in accordance with the type of investments being made.

Does TVPI include fees and carry?

TVPIs are generally net of fees and carried interest. However, Gross TVPIs may be calculated without considering fee or carry.

TVPI vs MOIC

TVPI and MOIC (Multiple on Invested Capital) are both quick measures of PE fund performance that combine realised and unrealised value and express it as a multiple of the investment. The only difference is TVPI is a multiple of capital calls paid in by the investor, whereas MOIC is a multiple of the investment commitment, which may not have been totally paid in yet.

For practical purposes TVPI is equal to MOIC when an investor has paid in their full commitment and slightly larger than MOIC when an investor has not yet met all capital calls.