Key takeaways

- Dealmaking value is up but heavily concentrated, the dollar value of buyouts leaping while deal count has contracted.¹

- North American exit value reached its highest mark since 2021, though Q2 was soft amid tariff concerns,² forcing many sponsors to lean on continuation funds in the red-hot secondaries market.³

- PE fundraising is tracking its weakest year since 2020,⁴ while secondaries managers have already smashed the full-year record in just six months.⁵

With the first half of the year already passed, it’s time to assess how private equity is faring. Across dealmaking, exits, fundraising, secondaries and VC investment, H1 offered plenty to be positive about, with some important caveats. Beneath the surface, the foundations of a broader recovery may be taking shape.

Dealmaking top heavy, for now

Dealmaking is gaining traction but remains heavily concentrated. Global buyout value rose by 24% year on year to $405 billion, representing 21% of all M&A, yet the number of completed deals fell by around 22% to a five-year low. Mega deals over $10 billion are doing most of the work, while $5–10 billion transactions fell by nearly half.⁶

This bifurcation stems in part from political developments: president Trump’s tariff announcement in April brought fresh uncertainty, stalling the mid-market. Yet top-tier GPs pressed ahead, increasingly relying on add-ons. In Europe, over the past four years around half of all deals have been add-ons. These transactions contributed almost 37% of total deal value in the second quarter, up from just 25% a year prior.⁷ As noted by PitchBook, in some cases these were uncharacteristically large plays, such as Thoma Bravo portfolio company Proofpoint acquiring cybersecurity firm Hornetsecurity for €1.8 billion to expand its European footprint.⁸

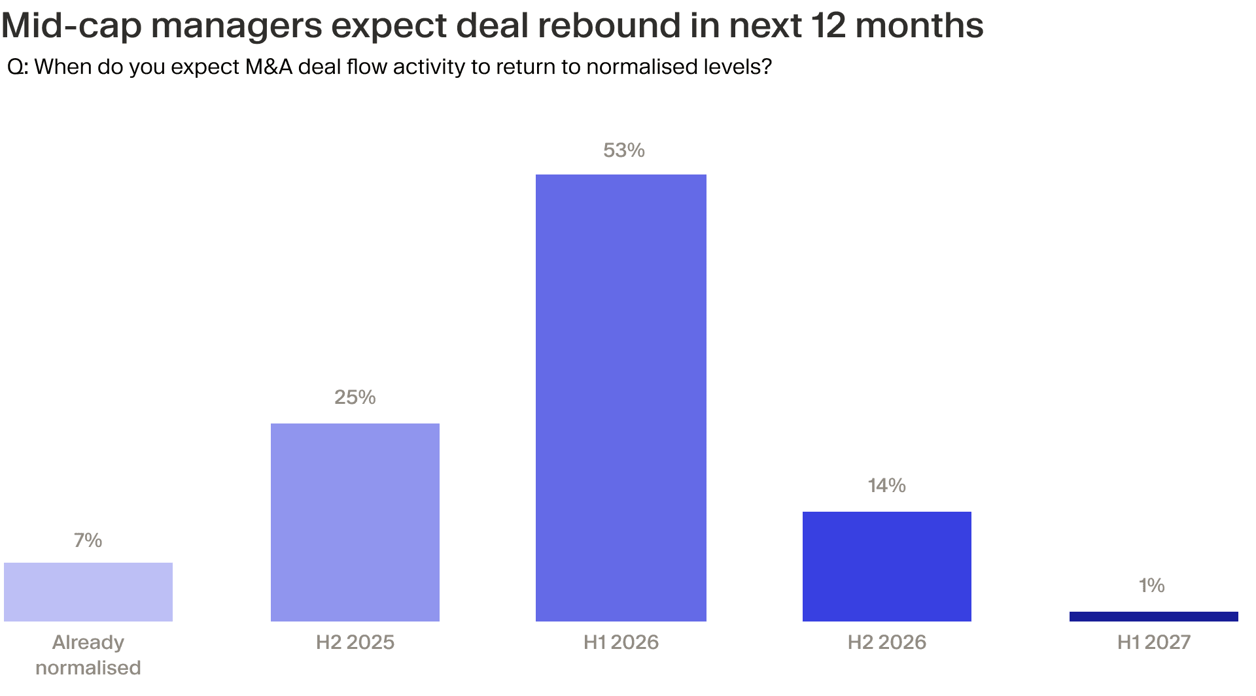

Although recent dealmaking activity has been conspicuously top heavy, mid-market PE fund managers are optimistic about a rebound. A quarter believe that M&A in their segment will normalise in the second half of this year and more than half expect this no later than H1 2026, according to a recent Churchill Asset Management survey.⁹

Among the most prominent transactions, Sycamore Partners was behind a $23.7 billion take-private of embattled pharmacy Walgreens Boots Alliance in early March.¹⁰ Walgreens has succumbed to a steep valuation decline, from a market cap of over $100 billion in 2015 to under $10 billion today,¹¹ prompting management to seek a private-market reboot with Sycamore’s distressed retail expertise.

Hellman & Friedman and Valeas Capital orchestrated a merger in April between Moss Adams and Baker Tilly to form the sixth-largest advisory and accounting firm in the US, valued at about $7 billion and with the aim to grow annual revenue to approximately $6 billion by 2030.¹²

In Europe, Advent International secured the take-private of Spectris, an industrial technology firm listed on the London Stock Exchange, for $5.9 billion.¹³ This transaction typifies the premium PE playbook of public-to-private investments, aiming to target undervalued assets amid public-market mispricing. World PE Ratio estimates the average US stock market price-to-earnings (P/E) ratio is as high as 25.5 versus just 17.8 in the UK, while in Europe the average is only slightly higher.¹⁴

Exits off to promising start

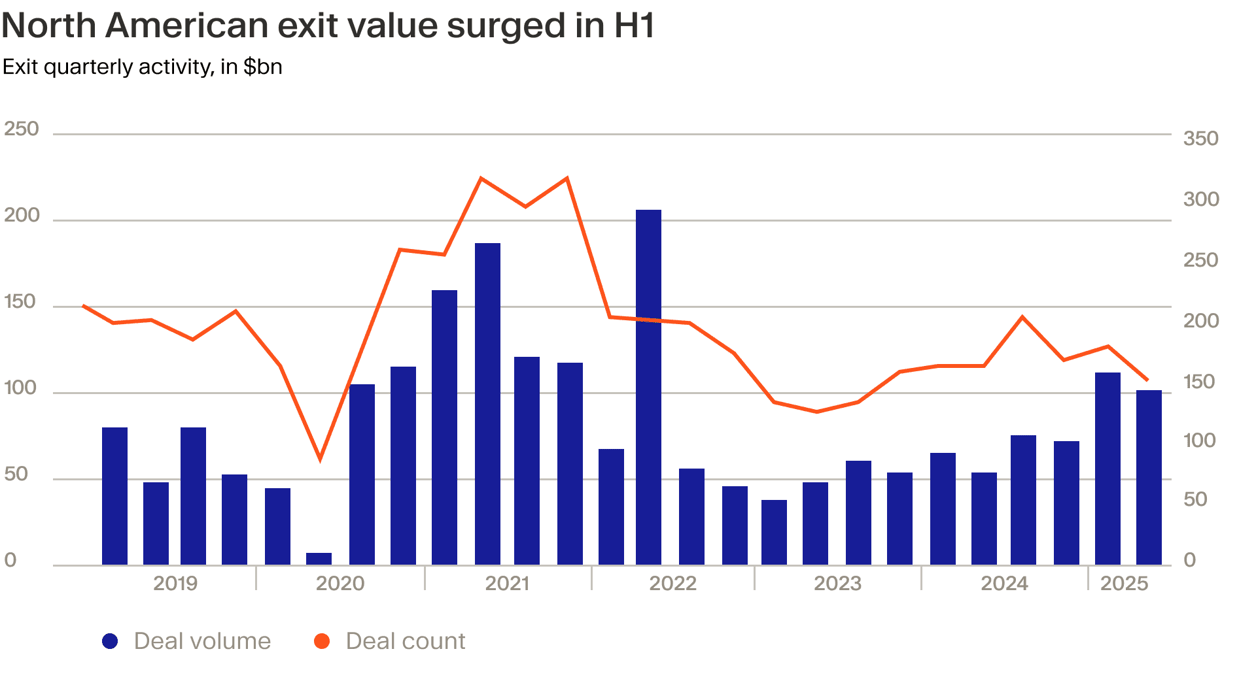

Exit activity got off to a solid start this year before an inevitable slowdown in Q2. The first half’s total of $216 billion in North American exit value represented a strident 78% year-on-year jump,¹⁵ but the second quarter saw momentum falter somewhat amid trade uncertainty jitters. Many sale processes were shelved or delayed after the April announcement of onerous new US tariffs, leaving over 100 sponsor-backed auctions in North America still active but incomplete, according to Mergermarket.¹⁶

Nonetheless, strong assets continue to transact, as demonstrated by GTCR’s $24 billion sale of Worldpay to Global Payments, completed just 21 months after acquisition and earning the title of the year’s biggest exit to date.¹⁷

Public listings remain a more viable route for buzzworthy venture capital assets than PE portfolio companies. While PE-backed IPOs in 2025 returned just 18% on average above their offer price, VC names such as crypto stable-coin firm Circle and AI cloud computing startup CoreWeave surged by upwards of 450%.¹⁸

This growing disparity is causing many PE sponsors to keep their assets private for longer, waiting for a more accommodating public market that is focused on more than just growth opportunities. Despite the pullback in Q2, many expect a stronger H2 as buyout sponsors actively seek liquidity in preparation of new fund launches.¹⁹ ²⁰ ²¹

Fundraising loses footing

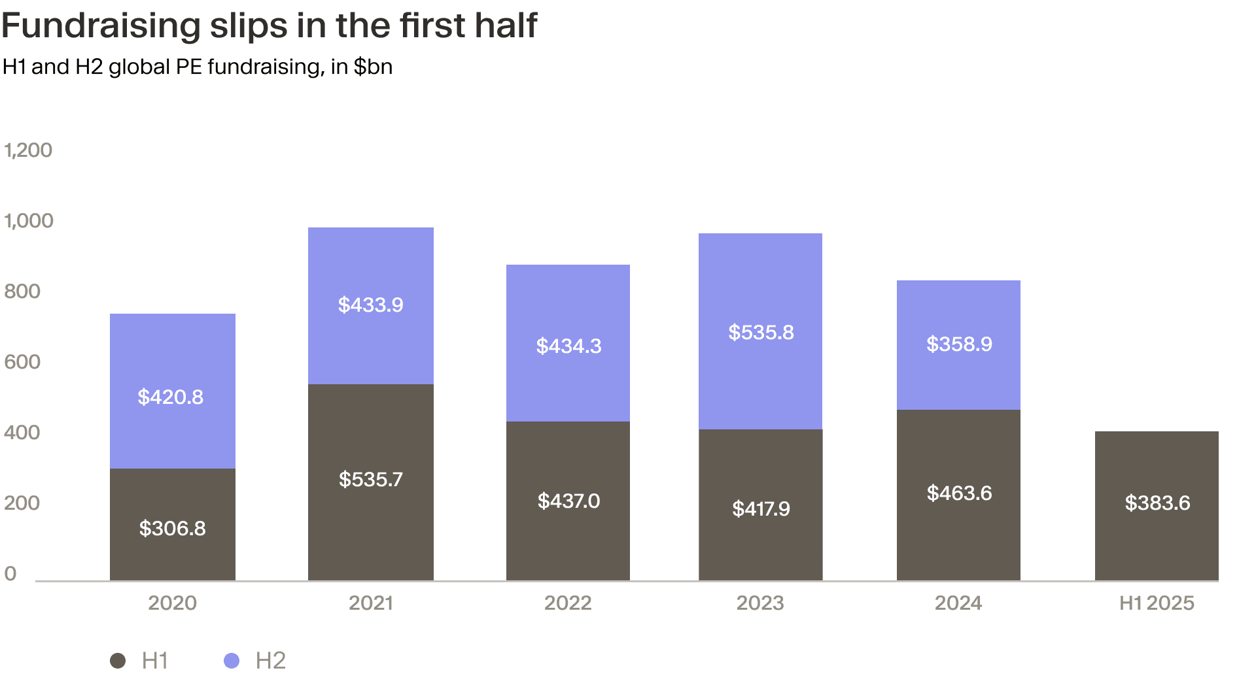

On the fundraising front, GPs have been up against it. LPs are scrutinising managers more closely than ever, rewarding focus and value-creation. The $384 billion amassed in H1 represents a 17% year-on-year contraction and is tracking at the lowest pace since the first year of the COVID pandemic.²²

Part of this decline reflects market fatigue. Many of the largest buyout funds raised vast sums in 2023 and early 2024 and are not currently seeking new commitments, leaving a thinner pipeline of active fundraises. For example, Blackstone Capital Partners IX,²³ CVC Capital Partners IX,²⁴ EQT X²⁵ and Vista Equity Flagship VIII²⁶ collectively brought in close to $100 billion between them over this period.

However, it’s also true that distributions remain slow,²⁷ limiting the available capital LPs can recycle into new commitments. Meanwhile, the tariff-induced stock market slump in April saw the denominator effect resurface, skewing allocation weightings and giving investors reason to pause commitments.²⁸

Yet there are pockets of resilience. In Europe, mid-market firms have already captured 75% of 2024’s total capital haul after amassing €48.6 billion,²⁹ showing that focused funds and clearer alpha potential still resonate with LPs. This bodes well for mid-cap dealmaking in the region. With fresh capital at their disposal, these firms may be well positioned to capitalise on a rebound in transaction volumes.

Secondaries: the PE market’s pressure valve

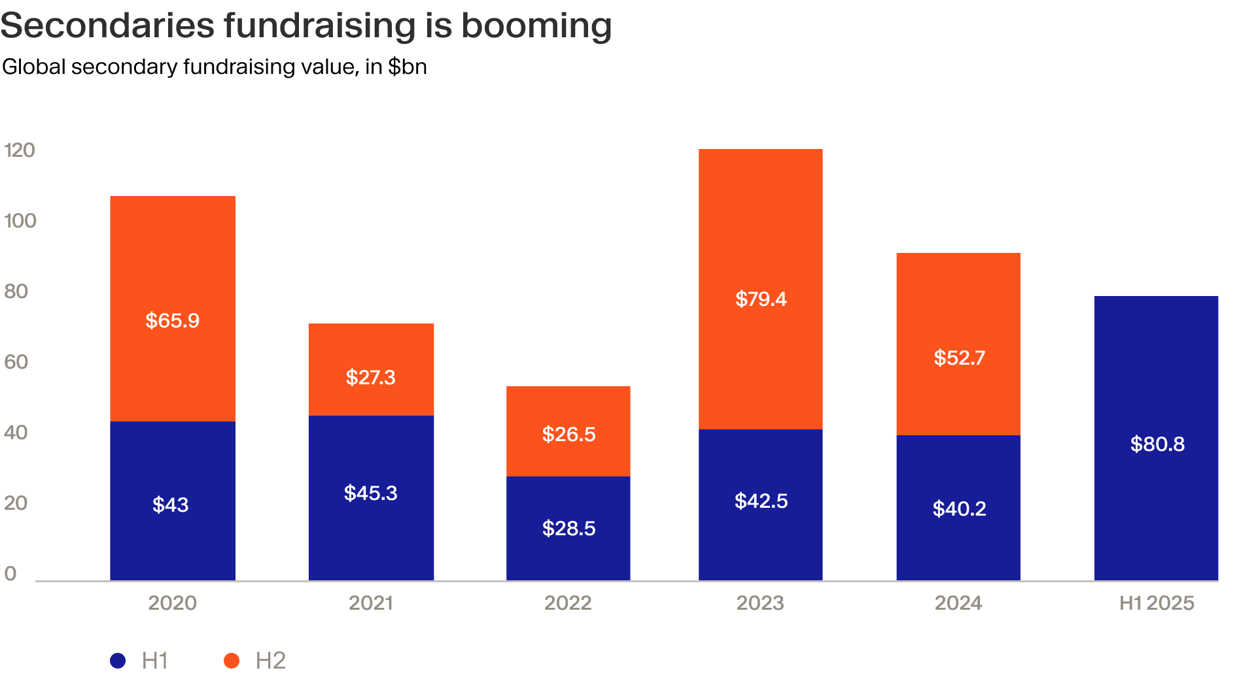

The strongest segment of the market, by far, has been secondaries. Managers raised $81 billion in H1, already surpassing 90% of the total 2024 fundraising. ³⁰ Even adjusting for Ardian’s recent record-breaking $30 billion flagship secondary fund, momentum remains formidable.³¹

Secondaries deal activity is equally hot right now. Evercore estimates that more than $100 billion worth of assets changed hands on a secondary basis compared with $162 billion for the entirety of 2024.³² The GP-led market remains buoyant, too, providing a necessary liquidity channel back to LPs in the face of exit delays.

There are several reasons behind secondaries’ kinetic growth. Many LPs are seeking liquidity in a slower exit environment, with institutional sellers including pension funds, endowments and sovereign wealth funds like China Investment Corporation launching billion-dollar-plus processes.³³ Secondary dry powder is also abundant and discounts have narrowed as buyers grow more confident in asset pricing, particularly for high-quality portfolios, resulting in more deals closing.

AI breathes new life into venture capital

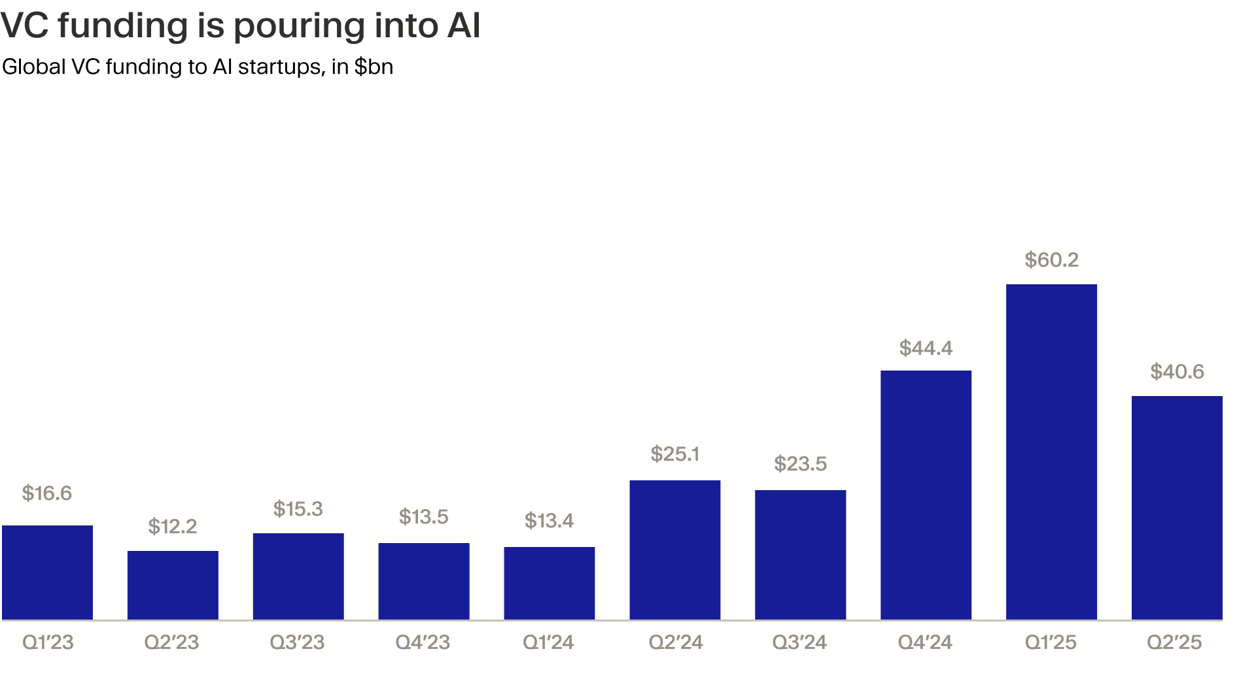

Venture capital, meanwhile, is enjoying its strongest half-year since H1 2022. Total global VC funding hit $205 billion, up 32% on the year, but that growth is highly concentrated.³⁴ More than a third of total capital went to just 11 companies, and 45% of Q2 funding was directed toward AI startups. Flagship rounds such as Scale AI’s $14.3 billion raise have drawn extraordinary attention, and much of that capital is flowing into late-stage companies.

Despite AI spurring a bona fide investment bonanza, some cracks are also showing in the broader funding ecosystem. VC firms are struggling to raise new funds, with US venture GPs registering only $26.6 billion across 238 funds in the first half of the year, a 33.7% decline from the previous year. This is driven by a slowdown in LP commitments and increasing scrutiny over fund performance. The median fundraising duration in the space has also stretched to over 15 months, the slowest pace in more than a decade.³⁵

What’s next?

The broad outlook for private equity is constructive. Credit markets are open, buy-and-build remains an effective strategy and a backlog of seasoned portfolio companies, collectively representing a $1 trillion capital overhang,³⁶ will eventually need to exit.

If trade policy clarity improves and interest rate expectations stabilise, sponsors and LPs should expect a more active second half of the year and further strength in 2026. The coming months will likely test investor patience, but everything is in place for a sustained rebound. Undoubtedly, it is a broad-based recovery in exits and, in turn, fundraising that will make this a reality, providing the necessary liquidity for investors to recycle capital and set the industry’s flywheel back in motion.

¹ https://www.axios.com/pro/merger-deals/2025/06/26/big-private-equity-deals-2025 ² https://ionanalytics.com/insights/mergermarket/pe-exit-momentum-stalls-in-2q25-dealspeak-north-america ³ https://www.pionline.com/alternatives-investments/pi-evercore-record-secondaries-volume-continuation-funds/ ⁴ https://www.privateequityinternational.com/side-letter-h1-fundraising-data/ ⁵ https://www.secondariesinvestor.com/download-secondaries-fundraising-breaks-h1-record ⁶ https://www.axios.com/pro/merger-deals/2025/06/26/big-private-equity-deals-2025 ⁷ https://files.pitchbook.com/website/files/pdf/Q2_2025_European_PE_Breakdown.pdf ⁸ https://files.pitchbook.com/website/files/pdf/Q2_2025_European_PE_Breakdown.pdf ⁹ https://www.churchillam.com/wp-content/uploads/2025/06/Mid-Year-2025-Private-Equity-Survey.pdf ¹⁰ https://investor.walgreensbootsalliance.com/sycamore-transaction ¹¹ https://www.ft.com/content/722dfbf1-82a1-435d-9f6f-8586c4f0f038 ¹² https://hf.com/baker-tilly-and-moss-adams-to-combine-to-create-an-industry-defining-advisory-and-accounting-firm-in-a-strategic-merger-backed-by-hellman-friedman/ ¹³ https://www.reuters.com/markets/deals/advent-acquire-spectris-59-billion-deal-2025-06-23/ ¹⁴ https://worldperatio.com/ ¹⁵ https://ionanalytics.com/insights/mergermarket/pe-exit-momentum-stalls-in-2q25-dealspeak-north-america ¹⁶ https://ionanalytics.com/insights/mergermarket/pe-exit-momentum-stalls-in-2q25-dealspeak-north-america ¹⁷ https://www.forbes.com/sites/hanktucker/2025/07/02/how-this-chicago-private-equity-firm-scored-the-biggest-exit-of-2025/ ¹⁸ https://ionanalytics.com/insights/mergermarket/ipo-market-shifts-in-2025-as-venture-capital-outperforms-private-equity-ecm-pulse-north-america ¹⁹ https://pitchbook.com/news/articles/pe-exits-decline-25-in-q2-as-deal-activity-cools ²⁰ https://pitchbook.com/news/articles/buyout-firms-hope-for-improved-ipo-window-in-h2 ²¹ https://www.legalbusiness.co.uk/practice-areas/buyers-are-out-there-why-ma-partners-are-feeling-positive-despite-geopolitical-thunderstorms/ ²² https://www.privateequityinternational.com/side-letter-h1-fundraising-data/ ²³ https://www.buyoutsinsider.com/blackstones-latest-buyout-flagship-tops-20bn-stays-in-fundraising-mode/ ²⁴ https://www.cvc.com/media/news/2023/2023-07-20-cvc-raises-26bn-for-its-ninth-europeamericas-private-equity-fund/ ²⁵ https://eqtgroup.com/news/eqt-x-hits-the-hard-cap-raising-eur-22-billion-usd-24-billion-in-total-commitments-2024-02-27 ²⁶ https://www.axios.com/2024/04/18/vista-equity-new-fund-raise-20-billion ²⁷ https://pitchbook.com/news/articles/pes-gap-between-investments-and-exits-reaches-a-decade-high ²⁸ https://www.privateequityinternational.com/lps-expect-pes-fundraising-woes-to-deepen-amid-tariff-volatility/ ²⁹ https://files.pitchbook.com/website/files/pdf/Q2_2025_European_PE_Breakdown.pdf ³⁰ https://www.secondariesinvestor.com/download-secondaries-fundraising-breaks-h1-record/ ³¹ https://www.ardian.com/news-insights/press-releases/ardian-raises-record-30-billion-worlds-largest-ever-secondaries ³² https://www.secondariesinvestor.com/secondaries-volume-surpasses-100bn-to-reach-half-year-record-evercore/ ³³ https://www.reuters.com/markets/asia/chinese-sovereign-fund-cic-sell-1-billion-us-private-equity-investments-sources-2025-04-30/ ³⁴ https://news.crunchbase.com/venture/global-funding-climbs-q2-2025-ai-ma-data/ ³⁵ https://www.reuters.com/business/us-ai-startups-see-funding-surge-while-more-vc-funds-struggle-raise-data-shows-2025-07-15/ ³⁶ https://www.reuters.com/business/private-equity-sits-1-trillion-amid-uncertainties-ma-stalls-pwc-says-2025-06-18