Key takeaways

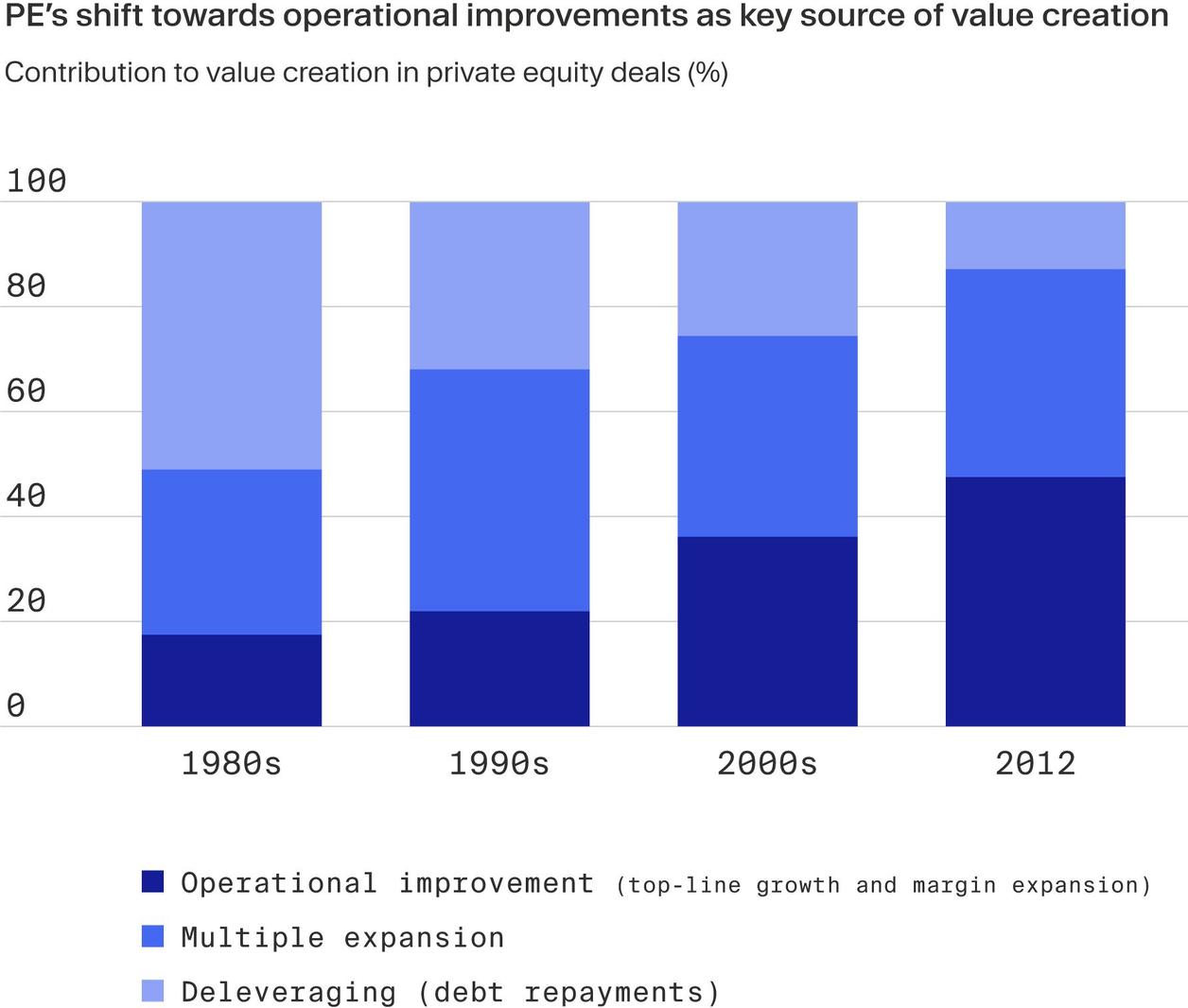

- Operational improvement has replaced leverage and multiple expansion as the primary driver of private equity value creation.

- Successful value creation now depends on combining growth, efficiency, digital and strategic levers rather than relying on a single source of uplift.

- As performance dispersion widens, manager selection increasingly comes down to the depth and consistency of a firm’s operational execution capabilities.

After more than a decade in which suppressed interest rates and rising multiples did much of the heavy lifting, private equity finds itself in a very different environment. Deal activity is recovering, but it is doing so within a reset rather than a return to the old way of doing things.

Global PE deal value reached $1.6 trillion by Q3 2025, up 23% year on year¹, yet fundraising continues to lag and financing conditions remain tight. Even with central banks having begun to ease monetary policy, government bond yields have remained stubbornly high, keeping real-economy borrowing costs elevated and limiting the scope for leverage-led returns.

These macro conditions have further shifted the emphasis on how value is created. Where multiple expansion once played a central role, like leverage it has become a far less reliable source of upside. In its place, operational performance has moved decisively to the fore. In 2024 exits, revenue growth accounted for 71% of value creation², underlining how strongly returns now depend on a company’s ability to grow rather than on favourable market re-ratings.

Bain & Company has similarly argued that the cost of generating market-beating returns is rising, as longer holding periods, slower exits and higher capital costs force private equity firms to rely far more heavily on repeatable operating models and execution-led value creation.³

The implications of this are structural. Return dispersion is widening as operational experience and skill become the key differentiators of PE manager performance. Those with disciplined value-creation strategies and a clear focus on cash generation and Distributed to Paid-In Capital (DPI) are best positioned, with agile mid-market and specialist funds in particular benefiting from lower entry valuations and higher potential to drive hands-on operational change. The bottom line is LPs are now looking for managers with proven execution capability, not just deal access.

Multi-lever value creation is now standard

Operational value creation is becoming broader and more integrated. Rather than pulling a single lever at a time, the best private equity firms are deploying several initiatives in unison, reflecting the complexity of today’s operating environment and the limits of incremental gains.Analysis by KPMG shows that leading firms no longer treat margin improvement, efficiency programmes or technology upgrades as standalone initiatives, but as interlocking parts of a broader value-creation agenda.⁴

These are being applied collectively. Digital tools support efficiency gains; efficiency creates capacity for growth; growth, in turn, reinforces margin expansion through operating leverage. Value creation has become inherently multi-dimensional, with firms seeking to compound smaller improvements across the business rather than relying on any single initiative to move the needle.

Stronger and more persistent external headwinds mean multi-lever value creation is no longer optional. But the ability to execute it well – across growth, efficiency and digital – is uneven, widening the gap between top-tier managers and the rest.

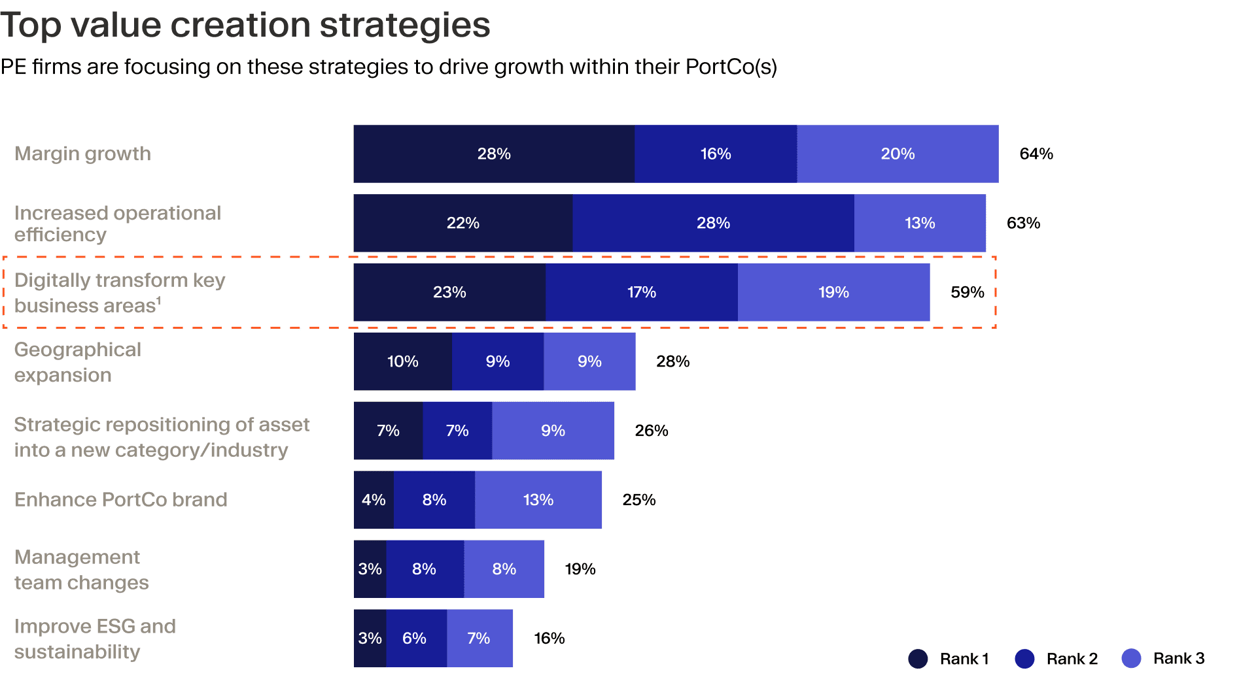

KPMG’s research suggests that, while execution quality varies, value creation has coalesced around a broadly shared operational toolkit. Below are the core areas of focus the firm has identified.

- Margin growth remains central, driven by pricing discipline, cost optimisation and operating leverage as revenues scale in a higher-cost environment.

- Operational efficiency focuses on improving core processes, from procurement and supply chains to working capital management, to protect cash flow and resilience.

- Digital transformation has become a near-term value driver, enabling better decision-making, automation and scalability rather than a long-term IT upgrade.

- Geographic expansion is used selectively to access new demand pools, diversify revenue and reduce reliance on single markets.

- Strategic repositioning involves refining the portfolio company’s value proposition, customer mix or end markets to align with structurally stronger growth trends.

- Brand enhancement supports pricing power and customer retention, particularly in competitive or fragmented markets where differentiation matters.

- Management upgrades remain a critical lever, with targeted changes to leadership teams strengthening execution, governance and accountability.

- ESG improvements increasingly contribute to value by reducing risk, improving operational standards and supporting talent attraction and retention.

What is a value creation plan?

A value creation plan (VCP) is a structured blueprint that sets out how a private equity sponsor intends to grow revenue, expand margins and improve a portfolio company’s operational performance over the ownership period. It typically brings together initiatives spanning operational efficiency, digital improvement, commercial acceleration and strategic repositioning, with clear priorities, timelines and accountability for execution. Increasingly, these plans are guided by data, activated early in the investment cycle and executed at pace, reflecting the need to deliver measurable operational improvements rather than relying on favourable market conditions to drive returns.

By the numbers

Recent data underlines just how decisively private equity value creation has shifted and how much more demanding it has become. According to KPMG, 64% of private equity firms now rank margin growth as a top value driver, as elevated financing costs and tighter exit conditions place greater emphasis on earnings expansion. Operational efficiency is prioritised by 63% of firms, while 59% point to digital transformation⁵, underlining how productivity gains, process discipline and technology adoption now sit at the heart of operational improvement strategies.

Delivering that growth, however, has become more execution-intensive. Research from Bain & Company shows that carve-outs once delivered around 31% revenue growth and 29% margin expansion during ownership⁶, often driven by the separation of underinvested assets and clear standalone cost savings. Since 2012, those figures have fallen to roughly 17% and just 2% respectively, as operational complexity has increased and many of the easier efficiency gains have been competed away, raising the bar for effective value creation.

Real-world examples of private equity creating value

Almost all businesses can be improved in some way. But what does that value creation look like in practice? We explore three cases that deploy various operational levers to deliver returns.

Repositioning software through product and digital capability

EQT first acquired IFS, a global enterprise software provider, in 2015 for approximately €900 million⁷, taking control of the business at a time when its growth was largely driven by on-premise solutions.

In 2020, EQT rolled the company into successor funds alongside TA Associates at a valuation of more than €3 billion⁸, reflecting early progress in repositioning the business. Under EQT’s continued ownership, IFS accelerated its shift towards cloud-based software and industrial AI applications, expanded internationally and deepened relationships with large enterprise customers. This transition required significant investment in product development, go-to-market capabilities and organisational change, as the business moved away from licence-based sales toward a recurring-revenue model.

Operational execution rather than market tailwinds drove the next phase of growth. By 2024, revenues had surpassed €1.2 billion and in 2025 a partial stake sale to new investors valued the company at more than €15 billion⁹, underscoring the impact of sustained, product-led value creation.

Mid-market buy-and-build at scale

Buy-and-build remains a powerful route to value creation, particularly in fragmented markets. The strategy involves acquiring a strong platform company and accelerating growth through a series of well-executed add-on acquisitions. By combining smaller businesses into a larger, more integrated group, private equity firms can create scale, broaden capabilities and reduce operational complexity. As platforms grow in size, sophistication and geographic reach, they often attract higher valuation multiples than their individual components, allowing managers to unlock value through both operational integration and improved market positioning.

Hg acquired Visma for approximately €550 million in 2006¹⁰, backing the Nordic business software provider as a regional platform serving SMEs and public-sector customers. The investment thesis centred on long-term buy-and-build execution in a highly fragmented European software market, rather than short-term financial optimisation.

Over more than a decade of ownership, Hg supported an extensive buy-and-build strategy, completing 300+ bolt-on acquisitions across Europe. These add-ons expanded Visma’s geographic reach, broadened its product offering and deepened vertical specialisation, while integration focused on standardising platforms, improving recurring revenues and strengthening governance at scale.

As the group grew, Visma transitioned from a Nordic player into one of Europe’s largest cloud-based business software providers. At the time of writing, Hg is weighing an IPO of the company on the London Stock Exchange at a valuation of €19 billion.¹¹ The listing promises to crystallise years of operational and acquisitive value creation, demonstrating how disciplined buy-and-build strategies can deliver substantial outcomes even as leverage and multiple expansion play a more limited role.

ESG as operational and exit value creation

ESG has increasingly moved from the margins of private equity investing into the core of value creation strategies. Rather than being driven primarily by disclosure or compliance, ESG initiatives are now more often deployed to improve operational resilience, manage risk and support long-term value.

These efforts can span energy efficiency and resource optimisation, supply-chain resilience and human rights due diligence, governance and incentive structures, and data-driven decision-making. When applied deliberately, ESG programmes can also strengthen talent retention and enhance the commercial positioning of portfolio companies ahead of exit.

CVC Capital Partners acquired a majority stake in Breitling in 2017, backing the Swiss luxury watchmaker as it sought to modernise its brand, operations and governance. The deal valued the business at a reported €800 million.¹²

Under CVC’s ownership, value creation focused on premiumisation and repositioning, with ESG embedded directly into that strategy. Initiatives included improving supply-chain transparency and responsible sourcing, strengthening governance and reporting standards, and reducing environmental impact across manufacturing, packaging and logistics.¹³ These measures supported a broader brand refresh, helping align Breitling with evolving consumer expectations around sustainability, authenticity and corporate responsibility.

Crucially, ESG improvements were not pursued in isolation. They reinforced pricing power, enhanced brand credibility and supported global retail expansion, contributing to stronger margins and growth. In 2023, CVC sold a minority stake in Breitling to Partners Group in a transaction that valued the company at around €4 billion¹⁴, securing a significant uplift from entry and illustrating how ESG levers can support commercial and valuation outcomes even in non-ESG-native sectors.

A new phase

It’s clear that value creation in the private equity industry has entered a more demanding, hands-on phase, in which success depends less on financial engineering or multiple expansion and more on the ability to deliver sustained operational improvement.

As leverage and multiple arbitrage fade as reliable sources of performance, the firms that stand out will be those with clear VCPs, deep operating capabilities and the discipline to execute across cycles. The remaining path to premium returns is through the relentless pursuit of building better businesses.

¹https://pitchbook.com/news/reports/q3-2025-global-pe-first-look

²https://www.gain.pro/insight-reports/value-creation

³https://www.bain.com/insights/pe-backed-carve-outs-global-private-equity-report-2025/

⁴https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2025/10/value-creation-in-private-equity.pdf

⁵https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2025/10/value-creation-in-private-equity.pdf

⁶https://www.bain.com/insights/pe-backed-carve-outs-global-private-equity-report-2025/

¹⁰https://www.privateequityinternational.com/hgcapital-offers-e552m-for-norways-visma/

¹¹https://pe-insights.com/hg-backed-visma-targets-blockbuster-ipo-in-london-in-e19bn-tech-listing/

¹³https://www.breitling.com/nl-en/about/sustainability/

¹⁴https://pe-insights.com/breitling-valued-at-4-5bn-as-private-equity-owners-sell-controlling-stake/