Key takeaways

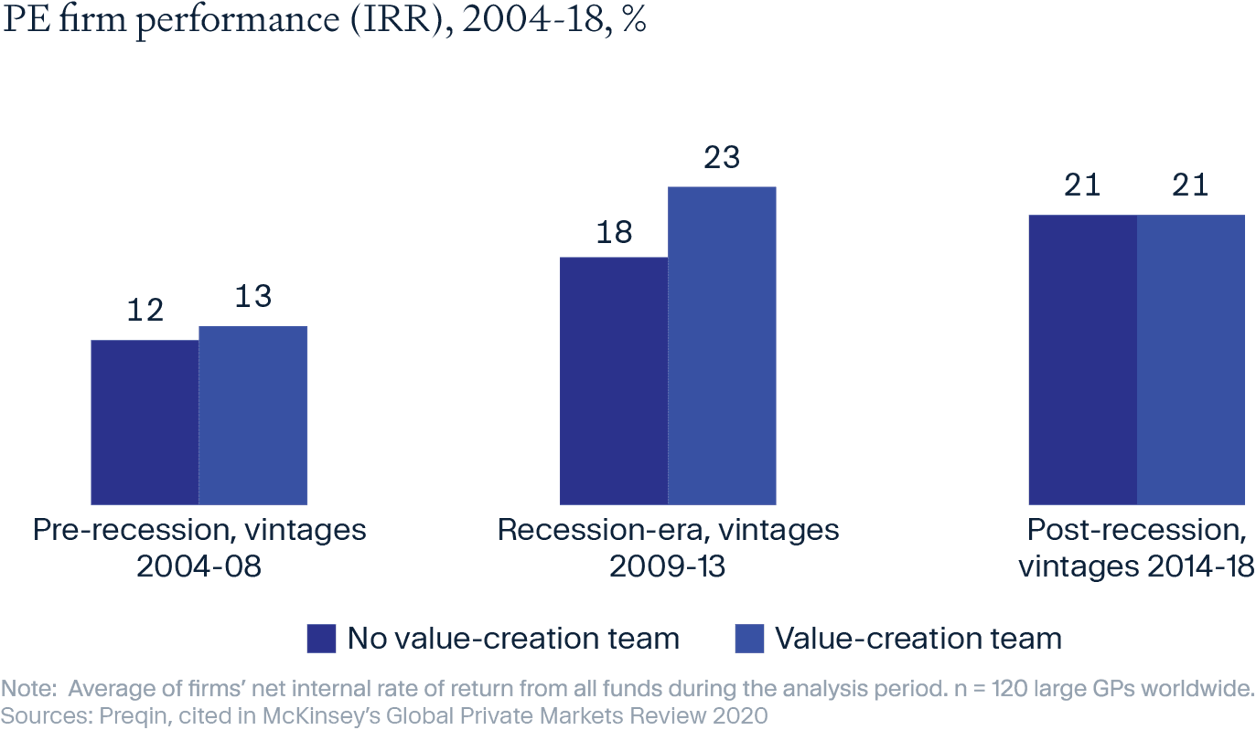

- During turbulent economic times, the performance gap between top and bottom quartile funds is amplified.

- The best fund managers are skilled in identifying not only strong investment opportunities, but also opportunities to boost a portfolio company's growth and profit across its life and market cycles.

- Identifying managers with the knowledge, experience and network to deliver capital appreciation in all market conditions, is key to successful private equity investing.

In times of economic uncertainty, investing in private equity can be an effective way to unlock higher returns even when your other holdings fluctuate¹. With high levels of cash ready to invest, experienced fund managers can capitalise on compelling opportunities as they arise and add considerable value through active management.

However, the performance gap between the top and bottom quartile funds can be amplified during turbulent market conditions, particularly in private markets. That is why fund manager selection and due diligence should be much more than a box-ticking exercise. It is imperative to invest in top-tier funds with strategies and teams most capable of delivering capital appreciation and mitigating risk regardless of the market conditions.

“It is easy to perform well when market conditions are favourable,” explains Victoria James, Investment Manager at Moonfare. “However, the strongest managers are able to maintain performance and continue to identify investment opportunities even in market downturns.”

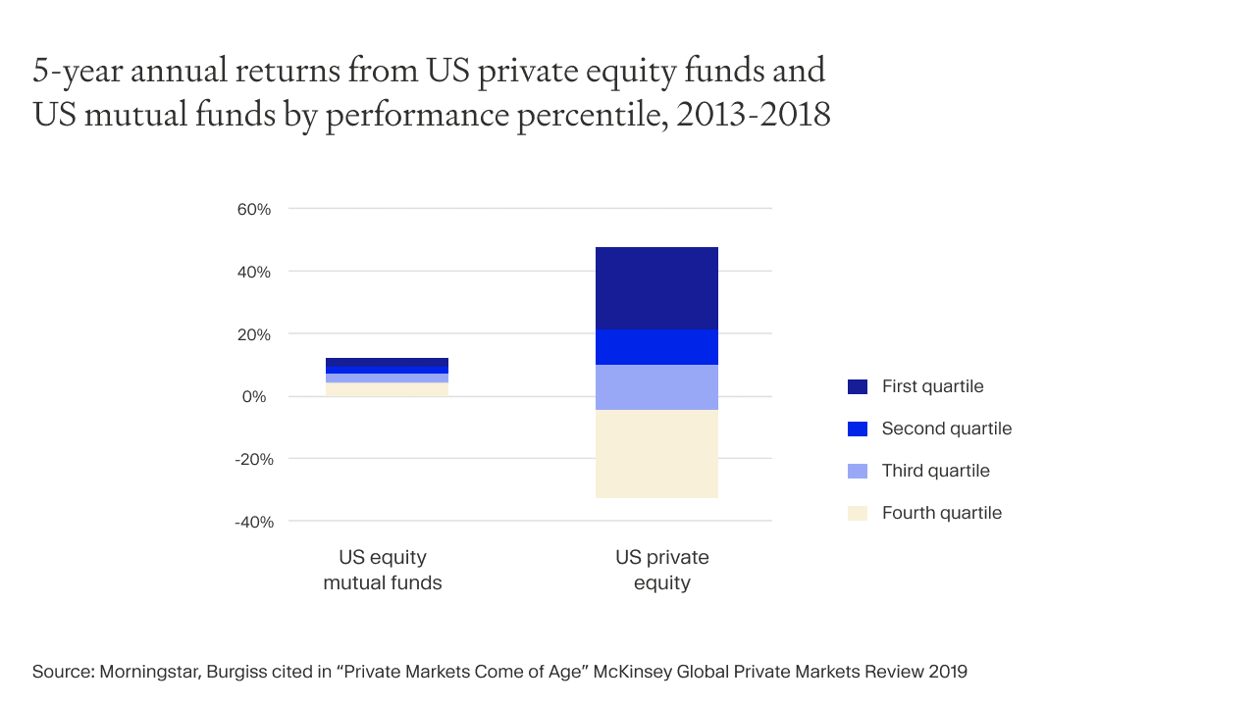

Compared to public markets, too, private equity funds show a much greater return dispersion between top and bottom quartiles, as shown in the chart below.

Uncovering the most lucrative private equity opportunities

There can be barriers to investing in private equity. It is challenging for the average investor to identify which opportunities are most likely to generate strong returns without taking on excessive risk.

In venture capital, especially, rigorous selection of managers is vital. Research shows that managers’ performance tends to show persistence over successive funds. For subsequent funds, the top-quartile have a 69% probability to perform above the median². Moreover, VC fund manager invests early in a company’s life, which generally carries a higher degree of risk than investing in mature companies with proven, successful business models. As a result, VC-backed companies have a relatively low success rate. Overall, roughly two-thirds of the VC-backed companies ended up either failing or self-sustaining.³

However, as James notes, “besides investing in the right companies, strong value creation capabilities can be a real differentiator and give a skilled fund manager a competitive advantage. By identifying and executing growth initiatves during this early stage, the manager can have a significantly positive effect on portfolio companies. In turn, there is an opportunity to boost returns more than they could if similar initiatives were carried out at more mature companies.” Generally, across private equity, this can be seen in the significant impact that value-creation teams have on fund returns, particularly in recession-era vintages.

To access the most potentially lucrative opportunities, investors must rely on private equity fund managers to source, evaluate and acquire deals on their behalf. Investors place a lot of trust in fund managers to look after their investments effectively, but not all fund managers are created equal. They have varying degrees of skill, expertise and insights, all of which can impact how successful their strategy will be.

The challenge for investors, then, is selecting the right fund manager. When investing in a private equity fund, you usually invest at the beginning of a fund’s life, where you may have very few investments (or sometimes no investments) to evaluate. So, instead of assessing the performance of the fund or its assets, you must assess the expertise of the manager.

Looking beyond past performance — Key characteristics of top-performing fund managers

Identifying the fund managers best placed to succeed demands thorough research into the firm and its track record of adding value to companies. It involves analysing and evaluating a large body of data and documentation to assess the following key qualities:

Signs of a successful team

A fund manager's team should have expertise across the investment lifecycle from origination and sourcing, to deal execution and value creation. Developing deep knowledge and networks in a particular industry, sector or geography is key to a fund manager's success and can be a major competitive advantage.

It’s also important that the firm has low employee turnover, as this ensures that its intellectual property (relationships, networks, knowledge) stays within the business and supports growth. Remuneration plays another key role in fund manager success. Team compensation should be structured in a way so that employee incentives are aligned with the interests of investors.

Sound strategies

Each fund manager has its own strategy — a good one is resilient and proven. At the same time, it is important that managers are agile and able to adapt their approaches when market conditions require them to fix an aspect that isn’t delivering results.

Robust track record

Strong fund managers can identify compelling opportunities, even in market downturns. We need to evaluate fund managers’ track records by looking beyond absolute returns (the actual growth figure) to consider the risk taken to achieve that return. A good track record outperforms peers and is consistent through market cycles.

A strong position for deal sourcing

The average private equity company reviews more than 80 opportunities before making one investment, so being part of the right networks to access high-quality deal flow is essential. A broad and deep network that includes investors, lenders, business leaders and industry experts can put a fund manager in a better position to receive a high volume of deals before others do, and to negotiate favourable prices or terms.

Ability to create value

Investors want to see returns, and fund managers should demonstrate how they've partnered with portfolio companies to achieve growth. It is important that these managers understand the different drivers of growth and are able to use them effectively when opportunities arise, or market conditions require it. The ability to implement operational improvements has become increasingly important as a means of adding value, responsible for approximately 54% of value added to private equity investments during the 2010s⁴. A good fund manager will also have expertise around pricing and timing of entry and exit of positions, allowing them to maximise returns.

How we source the top fund managers

Moonfare is giving more individuals a platform to invest confidently in private equity. Our rigorous due diligence process means we only work with fund managers that have the key characteristics we discussed above, along with the geographical scale and processes needed to consistently generate returns. Only around 5% of the managers that we review meet our standards and make it onto the Moonfare platform.

In conversation below, our investment team explains the Moonfare approach to sourcing top performing fund managers.

Where do you start when searching for new fund managers?

Our team has an ear to the ground in the industry. Drawing on our strong and growing network of fund managers and other industry players across the world, we get a full picture of the current market view, as well as what's coming. This insight allows us to plan for fundraises of the top fund managers and ensures we're well positioned to request allocation.

How do you assess a fund manager?

We use both qualitative and quantitative analysis to review target fund managers. Quantitative measures include considering all performance metrics and benchmarking these alongside competitors and public indices. Qualitative assessments involve evaluating their reputation (including anything from executive background checks, to ESG record, to previous investors), their ability to execute on strategy, and having in-person sessions to understand their approach and company culture. We also look for teams that learn from their successes as well as their challenges. Our aim is to make sure there is no doubt that we are picking managers that we believe will outperform their peers through market cycles.

Do you ever get a second opinion?

Yes, we often involve representatives from portfolio companies or existing limited partners (LPs); it’s important that we work with managers who prioritise their fiduciary responsibility to investors. Gaining these inside perspectives helps us to get a clear, unbiased picture of the fund manager’s approach.

Are top performing fund managers selective about which platforms they work with?

Top tier funds are difficult to access and are often oversubscribed, but that is not to say that they are closed to new investors. We have been building relationships with fund managers over the last few years, so we can be competitive when bidding for allocations. Our rigorous analysis doesn’t hold us back either. We can usually act quickly in our process to create new partnerships and open opportunities for our investors.

How many funds make it to the Moonfare platform?

Only around 5% of the funds that we evaluate are approved for launch on the Moonfare platform and offered to investors. That’s because we draw on the diversity and depth of experience of our global team of 170 experts to conduct rigorous due diligence on all prospective fund managers. We don’t earn any fees from fund managers, giving you confidence that we select funds based on their merit alone.

² https://bfi.uchicago.edu/wp-content/uploads/2020/11/BFI_WP_2020167.pdf

³ https://www.cbinsights.com/research/venture-capital-funnel-2/

⁴ Goldman Sachs; BCG-IESE estimate