What is mezzanine debt?

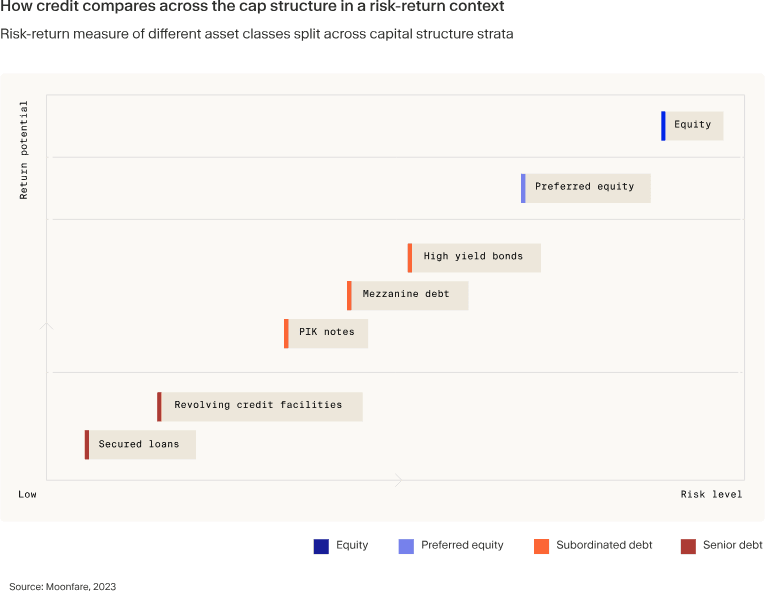

Mezzanine debt, also known as mezzanine financing, is a form of hybrid capital that combines features of both debt and equity financing. It sits between senior debt and equity in a company's capital structure and, at a more granular level, below subordinated debt.

Key takeaways

- Mezzanine debt is subordinate to senior debt but ranks above equity in the capital structure.

- It often includes embedded options, such as warrants or convertible features, allowing lenders to participate in the company's potential upside.

- Mezzanine financing is typically unsecured and carries higher interest rates than senior debt due to its higher risk profile.

- It can be an attractive option for companies that have reached their borrowing limits with senior debt and want to avoid diluting equity ownership.

How mezzanine debt works

Mezzanine debt can take various forms, but it typically includes embedded options that provide lenders with the potential for equity participation. These options may include warrants or convertible features. Mezzanine lenders may also receive rights, such as board observer seats or information rights, to monitor their investments more closely.

Due to its position in the capital structure, in the event of a default or bankruptcy, senior debt holders are paid first, followed by subordinated debt holders and then mezzanine lenders, and lastly, equity investors.

Example: Imagine a company, Company A, with the following capital structure:

- $50 million in senior debt

- $20 million in mezzanine debt

- $30 million in equity

If the company were to default and faced liquidation, with a total asset recovery worth $60 million, senior debt holders would be made whole, while mezzanine holders would recover $10 million. Equity investors would be wiped out as there would be no residual value remaining.

Mezzanine debt vs. other forms of debt

Senior debt

Senior debt, such as bank loans or senior secured bonds, ranks highest in the capital structure. It typically carries lower interest rates and is secured by the company's assets, making it less risky for lenders. In contrast, mezzanine debt is usually unsecured and commands higher interest rates to compensate for the increased risk.

Subordinated debt

Subordinated debt, also known as junior debt, ranks below senior debt but above mezzanine debt in the capital structure. Like mezzanine debt, it carries higher interest rates than senior debt due to its higher risk profile. However, subordinated debt typically does not include the equity participation features that are common in mezzanine financing.

Equity financing

Equity financing involves selling ownership stakes in the company to investors, diluting the ownership of existing shareholders. Mezzanine debt allows companies to access additional capital without diluting ownership, as it is structured as debt rather than equity. However, the embedded options in mezzanine financing may result in some equity dilution if exercised.

Equity features of mezzanine financing

What sets mezzanine debt apart from subordinated debt is its hybrid nature. Equity features such as warrants and conversion rights provide lenders with the potential for additional returns and equity participation in the borrowing company. These features are designed to compensate lenders for the higher risks associated with mezzanine financing and align their interests with those of the company's shareholders.

Warrants give lenders the right, but not the obligation, to purchase a predetermined number of shares in the borrowing company at a specific price, known as the strike price, within a certain time frame. Warrants are typically detachable from the debt instrument, meaning they can be exercised independently of the loan.

Meanwhile, conversion rights allow mezzanine lenders to convert their debt into equity under predetermined conditions, such as the achievement of certain financial milestones or the occurrence of a liquidity event like an IPO or sale of the company. The conversion ratio is typically set at the time of issuance. If the company performs well, the lender can convert their debt into equity and participate in the company's growth. If the company struggles, the lender can choose to remain a debt holder and maintain their priority in the capital structure relative to equity holders.

Pros and cons of mezzanine financing

Pros for borrowers

- Access to additional capital without diluting equity ownership

- Flexibility in structuring repayment terms and covenants

- Potential for lower overall cost of capital compared to equity financing

Cons for borrowers

- Higher interest rates compared to senior debt

- Potential for equity dilution if embedded options are exercised

- Increased complexity in the capital structure

Pros for lenders

- Higher interest rates and potential equity upside

- Greater control and monitoring rights compared to senior debt

- Diversification of investment portfolio

Cons for lenders

- Higher risk compared to senior debt

- Longer investment horizons and limited liquidity

- Potential for losses in the event of default or bankruptcy

Mezzanine debt offers a unique financing option for companies seeking growth capital or undergoing leveraged buyouts. While it carries higher risks and costs compared to senior debt, it provides an attractive alternative to equity financing, allowing businesses to access additional capital without significantly diluting ownership. This can be especially beneficial for businesses that are considered too risky for traditional lenders. For creditors, mezzanine debt offers the potential for higher returns and equity participation, but it also comes with increased risks and longer investment horizons.

![[WhitePaper] Private credit's path to becoming a portfolio cornerstone](/cdn-cgi/image/width=1256,quality=75,format=auto/https://publiccdn-production.moonfare.com/strapi/production/mw_ctas_5977f155bc_05d5652bb1.webp)