What is Risk Diversification?

Risk diversification is the process of investing in assets that have a low correlation with each other with respect to performance over time. In other words, diversifying risk is accomplished by building out the investment portfolio using securities and asset classes that should respond differently to circumstances in the market.

Key Takeaways

- Risk diversification aims to dampen the volatility in the investment portfolio — fewer large swings up and down through various market environments.

- Diversification of risk can be accomplished in many different ways, but it is crucial to have more than just one or two asset classes in a portfolio.

- Private equity is an especially helpful class of investments. Within the private equity asset class one can access additional diversification, depending on the type of funds included in the private equity allocation.

Why is risk diversification important?

Risk diversification is a critical aspect of effective portfolio management. By incorporating the principles of modern portfolio theory, minimising business and financial risk is essential. A key strategy to achieve this goal is through diversification, which involves carefully selecting assets with desirable long-term returns while ensuring a relatively low correlation among them.

Risk diversification plays a critical role in private equity investments, just as in any other type of investment. There are different types of risks to evaluate to achieve diversification:

- Portfolio Risk Management: Diversification helps to manage the overall risk of the portfolio by investing in a variety of companies or sectors. This way, even if one or a few investments do not perform well, others in the portfolio may balance out the losses.

- Industry or Sector Risks: Investing in only one sector or industry increases the exposure to sector-specific risks. For example, a portfolio only investing in technology startups could suffer significant losses in a technology downturn. By diversifying across multiple sectors, an investor can mitigate the impact of sector-specific downturns.

- Geographical Risks: Diversification can also be achieved by investing in companies located in different countries or regions. This strategy can mitigate the risk associated with economic or political instability in a specific geographical area.

- Liquidity Risks: Private equity investments are typically illiquid. This means you can't easily sell them like stocks. However, by diversifying the portfolio across investments with varying exit horizons and liquidity profiles, an investor can better manage cash flows and liquidity risk.

- Reduction of Idiosyncratic Risk: By diversifying across many investments, an investor can reduce the idiosyncratic risk, or the risk associated with individual companies. For instance, a company might perform poorly due to bad management decisions, unexpected competition, or other company-specific issues. By investing in a broad array of companies, the investor can lessen the impact of any one company's problems on the overall portfolio.

- Varying Stages of Business Lifecycle: Companies at different stages of their business lifecycle (e.g., startup, growth, mature) have different risk-return profiles. Diversifying across companies at different stages can provide a balance of risk and potential return.

How Private Equity Helps with Risk Diversification

Private equity investments can be diversified by industry sector, geographic location, and perhaps most crucially, by the vintage year in which the fund was initiated. As the portfolio is analysed and constructed, private equity can be used to diversify risk across type of business, location of the business, and timing of the anticipated cash flow stream.

Industry sectors and geographic locations are intuitive, but it is important to also grasp the impact that vintage year can have on a portfolio. When choosing a set of private equity funds, the investor may select different vintages among their private company investments. In this way, a portfolio can be diversified across multiple dimensions—industries, geography, and chronology, using a selection of funds and vintages to smooth risk and cash flow timing.

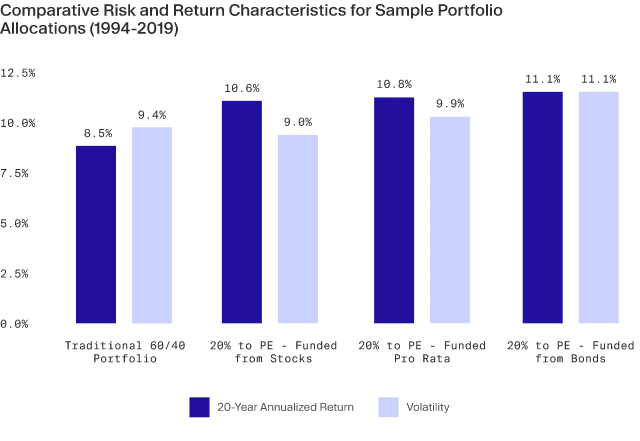

The following example is based on a hypothetical portfolio, illustrating the potential of utilising private equity allocation for diversification purposes and enabling more flexible management of risk and return.

Since private equity funds have far more control over the companies they invest in, their management teams can make active decisions in order to prepare for market changes. Whether the next cycle is a boom or a recession, private equity managers can align their companies accordingly. The result is that private equity funds are well-equipped to weather downturns. See more at Managing risks in private equity for more information. In addition to diversification and risk mitigation, investing in PE offers various other benefits. Explore Why Invest in Private Equity to learn more about these advantages.

Instant Diversification with Moonfare

Moonfare offers an array of private equity funds across different managers, strategies, sectors, geographies, and vintages. Investors with specific portfolio needs can build out their diversified portfolios using a variety of funds.

Additionally, Moonfare’s portfolio funds across different strategies offer investors access to multiple top-tier managers with a single ticket, providing instant diversification at lower minimums starting at €50,000.

To learn more about building a diversified portfolio, see our article on private equity portfolio construction.