Key takeaways

- Net asset value (NAV) lending can allow private equity managers to take out loans secured against the underlying assets in their portfolios.

- These facilities can allow GPs to generate liquidity at the NAV of the portfolio, rather than at a discount on the secondary market.

- Investors who provide NAV lending benefit from becoming first in line to receive portfolio distributions, and are inherently placed on a shorter investment timeline.

The spectacular growth of private markets in the last decade has afforded both general and limited partners the opportunity to prosper from the asset class’ tendency to deliver higher risk-adjusted returns than can typically be found in more traditional investments.

However for some, realising the full potential of these investments can prove difficult given the long-term nature of the asset class. LPs may typically have to lock up their capital for 10 years or more, which can make rebalancing portfolios during uncertain periods tricky. GPs, meanwhile, may wish to exit some investments earlier to soothe underlying investors, or in some cases, find ways to hold on to their winning investment for longer than the stipulated ownership period.

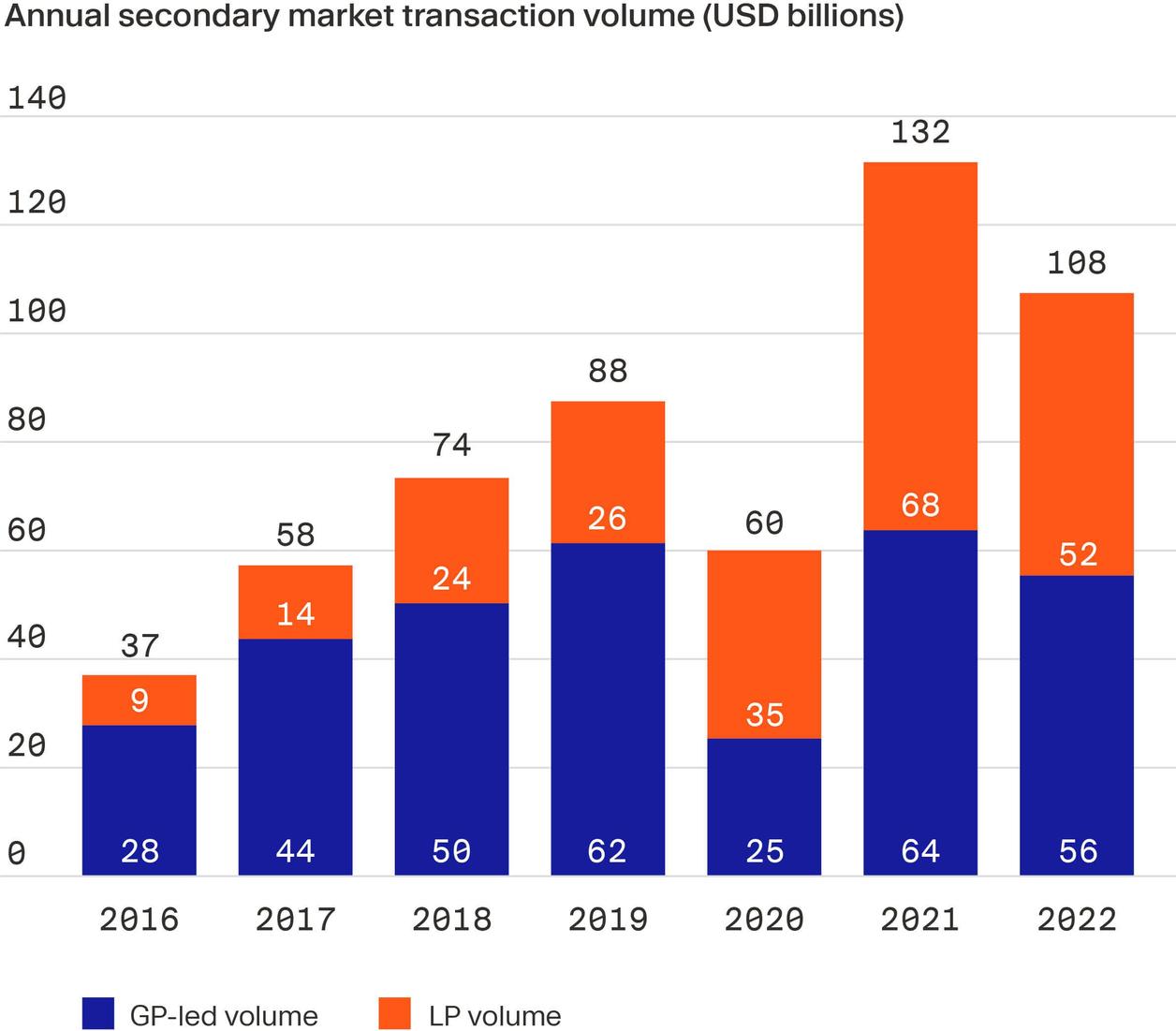

This two-sided demand for liquidity provision and mechanisms to retain investments through further dealmaking has led to a pronounced growth in the buying and selling of pre-existing investor commitments in private market funds — known more commonly as the secondary market.

According to research from investment bank Jefferies, global private equity secondary transactions from both GPs and LPs peaked at $132 billion in 2021, compared with just $37 billion just five years earlier.

This release valve can provide both fund managers and underlying investors with an earlier exit route or way to retain ownership. However, this typically comes at a cost. In particular, sellers in need of liquidity typically have to accept a lower-than-market price in order to drum up demand.

And during times of economic turbulence — when liquidity needs are exacerbated and exit windows are tighter — potential buyers have leverage to drive even harder bargains on sellers. According to UBS, for example, LP buyout secondary deals were executed at an average 13% discount to NAV as of December 2022, compared with just a 3% price cut a year previously.

Given the context, many GPs and LPs are exploring alternative ways of generating liquidity without taking such steep discounts on their assets. This is where funds providing NAV lending have come to emerge as a potentially key source of financing for fund managers and underlying investors alike. (Click to learn more about Net Asset Value (NAV) Definition and Calculation)

The role of NAV lending

Simply put, NAV lending involves providing finance to the GP of a private equity fund, typically at a time leading to a liquidity need. In return, the lender’s loan is secured against the underlying assets in the fund’s portfolio.

NAV lending is still a relatively small area — the Fund Finance Association (FFA) pegs the market for NAV credit facilities at around $100 billion, for example — however, it is expected to expand quickly. According to the FFA, the current $100 billion market is expected to grow to some $600 billion by 2030.

This method of financing is also coming to the attention of some of the biggest managers in private markets. Blackstone COO Jon Gray, for example, said in a recent investor call that “NAV lending to funds is another area in the asset-backed space [where] we see a lot of opportunity.”

Benefits of NAV lending

Borrowing against your underlying portfolio via NAV lending instead of outright selling aspects of it has a number of advantages for GPs. As the name suggests, NAV lending allows GPs to generate liquidity at the NAV of the portfolio, rather than at a potential discount on the secondary market.

This is even more pronounced in the current environment, as more acute liquidity demands from sellers mean they have to discount their assets even further to sell. Industry Ventures, for example, forecasts that VC firms looking to sell early on the secondary market could be forced to sell at a 50% discount to NAV this year.

Being able to liquidate at par, while keeping equity control of the assets, also affords borrowers with more capital to work on improving the underlying portfolio companies.

On one hand, this can mean pushing investment toward existing successful portfolio companies rather than being forced to exit them before full value creation has been realised. On the other, the capital can be used to refinance existing portfolio companies at potentially a lower cost than can be found in the public markets.

NAV lending can also provide a solution for GPs looking for ways to fund their own commitments, something increasingly salient as fund sizes grow and commitments become bigger. For example, KKR’s recent closing of its $8 billion European buyout fund — its largest to date — including $1 billion from the firm itself and employee commitments.

The lender’s perspective

The benefits of NAV lending to the GP therefore are clear. But what are the benefits for the fund actually lending the money?

One initial advantage relates to the lender’s position in the capital structure. Given it is debt, this naturally sits above the underlying fund’s limited partners when it comes to order of repayment. In practice, this means that NAV lenders are paid from the fund’s distributions in full before LPs receive anything.

From the lender’s perspective, being first in line to receive distributions — and often the last injection of capital into the PE fund — can help shorten the lender’s investment timeline, a welcome bonus in the current environment’s dearth of liquidity. Being at the head of the queue also gives the lender repayment priority ahead of others should something untoward happen to the indebted PE fund.

Looking ahead

Private markets are entering a new era of high rates and inflation, which has caused many GPs and LPs to reassess how to approach investing, as well as how to finance it in an age where less capital is available to deploy for new deals, refinance existing ones and provide liquidity to others. In this context, NAV lending has emerged as a way to enable GPs and LPs to realise this liquidity while not giving up on potential upside.

- https://www.jefferies.com/CMSFiles/Jefferies.com/files/IBBlast/Jefferies-Global_Secondary_Market_Review-January_2023.pdf

- https://www.ubs.com/global/en/wealth-management/our-approach/marketnews/article.1587793.html

- https://www.businesswire.com/news/home/20230228005134/en/NAV-Facilities-Gain-Momentum-Among-Alternatives-Funds

- https://s23.q4cdn.com/714267708/files/doc_events/2023/Blackstone-First-Quarter-2023-Investor-Call.pdf

- https://www.afr.com/street-talk/bargain-bin-vc-backed-tech-secondaries-at-deepest-discounts-since-gfc-20230228-p5co96

- https://media.kkr.com/news-details/?news_id=b46a3697-69dd-4aea-a7eb-44706aa345bf&download=1