In my recent letter to the Financial Times I’ve argued that private equity is fundamentally changing. Higher interest rates have eroded the role of financial engineering in the traditional buyout model.

Instead, we believe that managers today must return to the basics of corporate craftsmanship by supporting portfolio companies in their efforts to increase revenue, margins, or ideally, both. This may include rolling out new products, fine-tuning business models, expanding into new markets or optimising costs through lean manufacturing and digitalisation. In short — embracing business 101.

These tactics have already generated very real outcomes for PE investors.¹ Firms focused on operational value-add have seen average internal rates of return that were 2–3 percentage points higher than their peers, found a 2024 McKinsey study of more than 100 PE funds with post-2020 vintages.²

Yet, not all firms have the specialised expertise or hands-on leadership required to drive these improvements. In my view, this capability gap will be the critical differentiator that will separate top performers from the rest of the field.

Operational improvements at the forefront

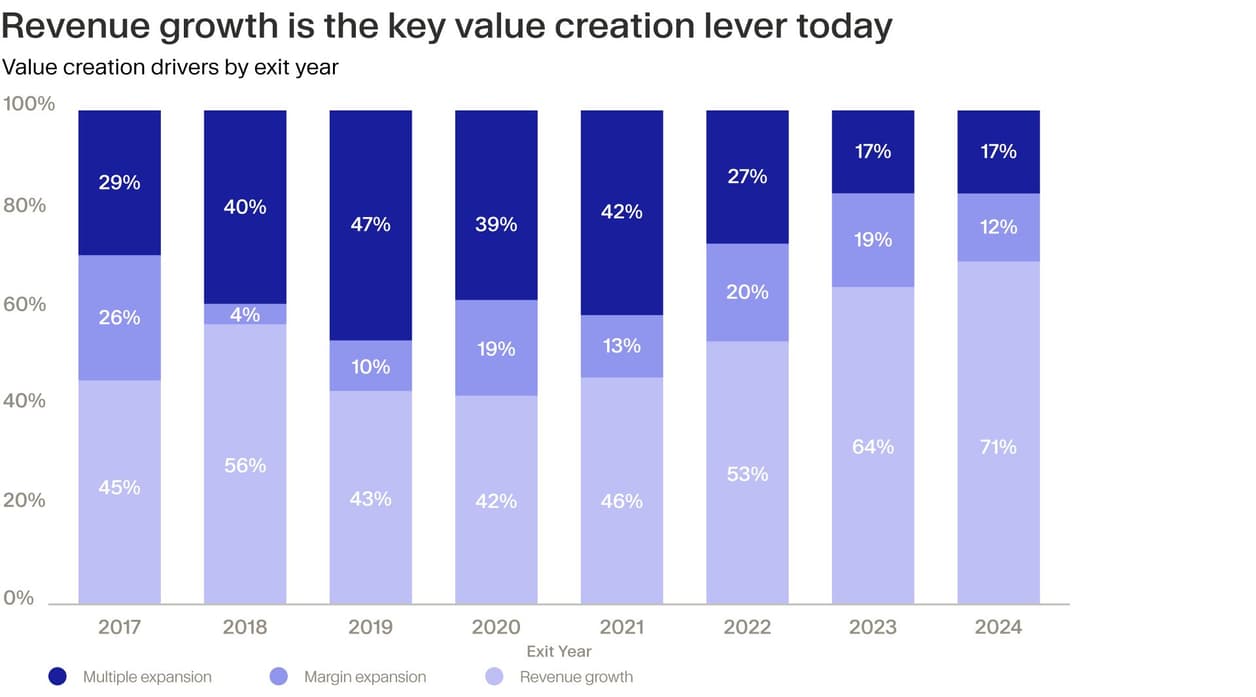

This shift in how managers generate value has been unfolding for more than a decade.³ As capital poured into private markets and competition intensified, the impact of financial engineering as a return driver began to diminish. With today's higher borrowing costs, compressed valuations and a more challenging deal environment, the trend has only accelerated. In response, firms are placing greater emphasis on operational improvements: the one lever they can fully control and consistently use to drive long-term performance.

Latest research from Gain.pro, a private market intelligence platform, based on over 10,000 global PE deals and exits, underscores this development.⁴ They found that revenue growth has accounted for 71% of total value creation at exit in 2024 and 64% a year prior. Margin expansion contributed an additional 10–20% but tends to be a much more powerful lever in operationally challenged companies, where untapped efficiency gains and restructuring potential are more substantial.

The move away from financial engineering is anticipated to accelerate further. In EY’s 2024 survey, respondents identified operational improvements as the primary return driver for deals expected to exit over the next two years. The authors emphasised that even as holding periods lengthen, the pace of value creation remains strong. That consistency in approach is no accident or as the report points out: “PE has always had an interventionist approach and a relentless focus on what matters most.”⁵

Operational alpha in practice

But what does this operational focus look like on the ground?

During my time on the value creation team at KKR — and now as CEO of Moonfare, engaging closely with the operators behind many of our platform funds — I’ve seen first-hand how deeply embedded and professionalised this function has become.

Firms now employ dozens or even hundreds of operational specialists. These are experts across key functions such as HR, supply chain, commercial strategy and digital transformation. Many are former CEOs or successful founders who’ve walked the walk.

They bring proven playbooks, tools and templates into each deal. They monitor portfolio-wide KPIs and data trends, surfacing what’s working and benchmarking across companies. Perhaps most importantly, they facilitate collaborative communities by connecting leaders across portfolio companies to share insights, solve problems and accelerate execution together.

The impact of hands-on support can be seen in real-world success stories. One private equity firm I know well supported its portfolio company — a global education provider — in scaling through acquisitions, centralizing operations and building out its digital infrastructure, as well as expanding the range of its products such as personalized learning tools. Today, that business is a multibillion-dollar leader in its sector.

In another example, a PE sponsor led a full-scale operational turnaround of a US manufacturing company. They professionalized the leadership team, implemented lean practices to improve safety and efficiency, while expanding capacity through strategic hiring. The outcome was more than 3.5x EBITDA growth and significantly stronger margins.

Another leading PE firm acquired a legacy pharmaceutical manufacturer. Following the takeover, the new owners carved out its respiratory device business and refocused it on sustainably manufactured inhalation devices. This transformation involved consolidating operations across formerly disparate sites, uniting internal talent with new leadership while investing heavily in greener alternatives. The repurposed and scaled business is today a market leader in low‑carbon respiratory care.

AI as the new frontier

The transformation stories described above are increasingly being accelerated by technology, with artificial intelligence at the forefront.

Research from Accenture shows that generative AI, specifically, presents both defensive and offensive opportunities, with their analysis estimating a 6–7% productivity gain and a 3–4% revenue uplift — particularly in business functions such as customer service, knowledge management, sales and marketing, and product development.⁶ In practice, this translates to capabilities like intelligent pricing, improved forecasting accuracy, automated workflows and the discovery of new revenue streams.

However, these gains won't materialize by default. The firms best positioned to capitalize on AI will be those that connect the macro and micro, says the authors of a recent report in Harvard Business Review. This means understanding how AI intersects with broader industry trends while executing against high-impact use cases that produce measurable improvements in productivity, profitability and growth.⁷

¹ The use of these strategies does not guarantee returns in the future. ² https://www.mckinsey.com/industries/private-capital/our-insights/bridging-private-equitys-value-creation-gap ³ https://www.bcg.com/publications/2024/creating-value-by-improving-operational-performance ⁴ https://marketing.gain.pro/hubfs/The-Private-Equity-Value-Creation-Report-2025-Gain.pro.pdf ⁵ https://www.ey.com/en_lu/insights/strategy-transactions/how-the-drivers-of-private-equity-value-creation-are-changing ⁶ https://www.accenture.com/us-en/blogs/business-functions-blog/private-equity-generative-ai ⁷ https://hbr.org/2025/06/how-private-equity-firms-are-creating-value-with-ai