In the book ‘Barbarians at the Gate’, the leveraged buyout of RJR Nabisco, the sense of drama and hubris is all too clear — the deal was emblematic of one of a few iconic waves of mergers.

Like other headline mergers, such as the Vodafone-Mannesmann transaction that marked the dot.com bubble,¹ and the Royal Bank of Scotland bid for ABN Amro in 2005 that preceded the global financial crisis, each wave was defined by a particular deal.

In the mid-1980s the merger wave was shaped by the availability of leveraged finance. In the late 2000s the infrastructure that was laid down by telecoms and internet firms provided the structure in which new corporate colossi were built. The desire to create banking giants defined the pre-GFC merger boom. Arguably the banking merger wave was a more defensive one driven by scale, whereas the aim — at the time — in the telecom deals, was the mapping of new industry structure.

Going back in history, merger waves are often defined by a changing or new industry dynamic, coupled with plentiful capital and a market tolerance for lofty valuations. Often the merger wave is accompanied by an IPO wave, as risk appetite and high valuations create the conditions for companies to come to market.

The state of M&A in 2025

Granted that the M&A cycle, and the IPO pipeline are crucial parts of the capital market process, we ask if the conditions are yet in place for an uptick in merger activity, and how some of the economic shocks of the past six months can impact the shape and quantum of mergers & acquisitions.

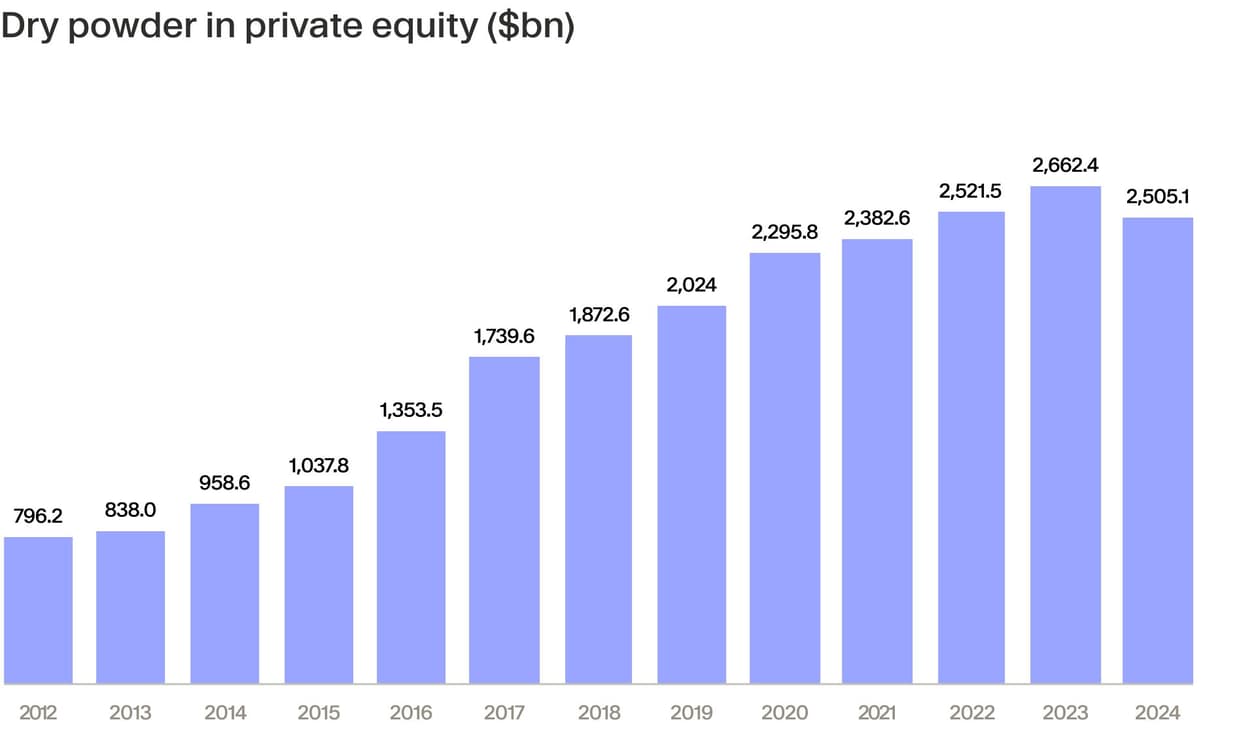

First, the liquidity outlook is improving. Major central banks (with the exception of Japan) have been cutting interest rates² as inflation has fallen³ and broad money supply (M2) has now turned positive for the first time in three years.⁴ Corporate balance sheets are strong,⁵ and very much the opposite of governments in terms of the nature of debt accumulation. Some analysts estimate that there is more than $7 trillion in cash on balance sheets of US corporates,⁶ and some $2.5 trillion in cash or ‘dry powder’ in private equity.⁷

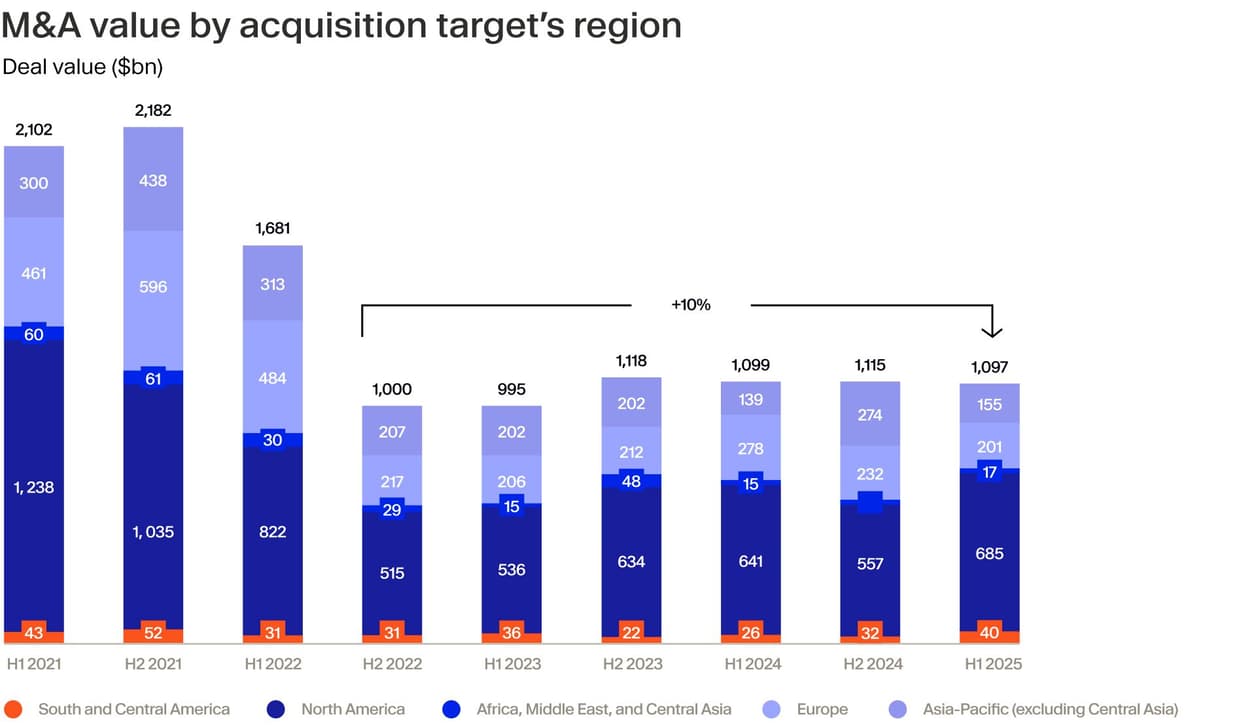

Second, despite the ongoing trade war, there are signs that risk appetite is strong — equities are at new highs⁸ and corporate bond spreads are tight,⁹ while ‘sentiment’ assets like bitcoin are hitting new highs.¹⁰ In this light, global M&A activity in the first half of 2025 totalled $1.1 trillion, down slightly on the prior six months and below the long-term average. Activity was still dominated by the US, according to BCG.¹¹

However, what is not at all clear is whether the hiatus in corporate investment that was provoked by the Liberation Day tariff announcement will also hinder merger activity. It may be that diverging regulation (in AI for instance) and heightened geopolitical risk, as well as protectionism, makes cross border acquisitions more difficult to realise (at least at the level of the US-EU-China). In addition, there are signs that deal approval and anti-trust regulation are stymieing deal closure.

However, there are several sub-industry and regional trends to watch out for as drivers of M&A (and related IPO activity).

US financial deregulation: impending plans to de-regulate banks and financial institutions in the US,¹² in addition to the challenge that the de-centralised finance sector poses to payment firms and asset managers has the potential to drive deals given changes in industrial structure. We also note that several large European fintech IPOs appear ready to list in the US,¹³ though the ongoing tariff war may test this.

EU champions: the EU is in a geopolitical maelstrom, and whilst the concepts of ‘strategic autonomy’ and ‘national champions’ have been part of the European lexicon for years, there is a real sense of urgency that may push policymakers to permit more cross border mergers in sensitive areas like infrastructure and defence, in addition to sectors like banking where they have been slow to greenlight deals.

China overcapacity: China is now the technological leader in many industrial segments. Innovations in manufacturing, bolstered by state aid, have compressed production costs. With output in sectors like chemicals and electric vehicles significant relative to demand,¹⁴ ¹⁵ there may be scope for consolidation within China, and also in Europe in industries like chemicals that suffer from the effects of aggressive competition from China.

AI disruption: AI is the most interesting disruptive factor across industries and can drive mergers in many ways. Most AI ‘start-ups’ are private, and there is a growing trend for them to be funded by large technology firms, acquired, or have their talent acquired. Beyond this specific effect, one trend we are watching is whether AI permits enough aggressive cost cutting in consumer oriented firms (in finance and advertising), and this in turn unleashes a wave of scale-driven mergers as these firms compete for clients.

¹ https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/dotcom-bubble/ ² https://www.reuters.com/business/finance/global-markets-cenbank-2025-06-19/ ³ https://www.morganstanley.com/insights/articles/economic-outlook-midyear-2025# ⁴ https://fred.stlouisfed.org/series/M2SL ⁵ https://www.forbes.com/sites/christianweller/2025/06/18/highly-profitable-corporations-amass-trillions-in-cash-and-pay-out-trillions-in-dividends ⁶ https://www.forbes.com/sites/christianweller/2025/06/18/highly-profitable-corporations-amass-trillions-in-cash-and-pay-out-trillions-in-dividends/ ⁷ https://www.spglobal.com/market-intelligence/en/news-insights/articles/2024/7/private-equity-dry-powder-growth-accelerated-in-h1-2024-82385822 ⁸ https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview ⁹ https://fred.stlouisfed.org/series/BAMLC0A0CM ¹⁰ https://uk.finance.yahoo.com/quote/BTC-USD/history/ ¹¹ https://www.bcg.com/publications/2025/looking-for-signs-of-a-second-half-rebound ¹² https://www.brookings.edu/articles/what-will-deregulation-look-like-under-the-second-trump-administration/ ¹³ https://news.crunchbase.com/fintech-ecommerce/f-prime-companies-ipo-2025-stripe-klarna/ ¹⁴ https://www.iea.org/reports/global-ev-outlook-2025/executive-summary ¹⁵ https://www.deloitte.com/us/en/insights/industry/chemicals-and-specialty-materials/chemical-industry-outlook.html