Key takeaways:

- Self-directed individual retirement accounts allow retirement investors to diversify beyond traditional stocks and bonds and into alternatives such as private equity and private credit.

- Private market assets provide the potential for outsized returns, reduced volatility and enhanced diversification.

- Private equity’s long-term horizon may align well with retirement planning which typically lasts decades.

An overwhelming majority of people in the US are recognising alternative investing as a way to amplify their retirement wealth. Almost 80% of defined contribution pension plan participants say they would like to see private equity and hedge fund options added to the mix, found a survey from 2023 by investment manager Natixis.¹

The appetite is evidently high, but it’s only slowly being matched by the offering. Currently, 21% of retirement plan sponsors report providing alternative investment options on their 401(k) menu, according to the retirement solutions provider PGIM.² A lack of participant education, operational challenges and costs are some of the factors that sponsors say is holding them back from expanding investment options.

Until private equity and real estate investments become mainstream across most types of retirement plans, a self-directed IRA account (SDIRA) remains your best way to diversify and potentially enhance plan performance.

Self-directed IRA: quick explainer

In contrast with a regular IRA scheme — where a custodian invests your money in a predefined basket of assets — the owner of an SDIRA typically also manages the account. This gives eligible individualists — who, in some cases, have to be accredited investors — more flexibility and a much longer menu of investment possibilities, including almost any type of alternative instrument.

So, what are SDIRA holders choosing from this expanding menu? Most common are rental real estate, private equity, commodities and private credit. Around 30%, for instance, say they primarily use it to make private equity investments, including venture capital and startup investing, according to a 2022 report from custodian business STRATA Trust Company.³ The list further extends to other alternative investments like precious metals, promissory notes, private lending agreements and cryptocurrencies.

Note that there are some exceptions to what can be added to an SDIRA account — life insurance, S-Corporations and collectibles such as coins or art are all prohibited under Internal Revenue Service’s rules.⁴

Pension funds and private equity

Many investors saving for retirement may already be exposed to private equity, although indirectly. Pension funds globally have been allocating to the asset class for decades, with many considering it as one of the strongest performing investments.⁵

The cost of shunning private equity could also be significant. The California Public Employees’ Retirement System, one of the world’s largest pension funds, for example, admitted last year that a decision to effectively pause its private equity programme between 2009 and 2018 had cost it up to $18 billion in lost returns.⁶

Meanwhile, many other pension funds and institutional investors are considering increasing their exposure to private markets further. As we’ve noted in our recent article, they believe these assets will help them generate higher returns than public market investments, and can shield portfolios from volatility and inflationary pressures.

Benefits of private equity

Growing private markets activity is being driven by loads of factors marking it out as a key driver for investors. Below, we outline three benefits that we believe are especially critical in the context of feathering your retirement nest.

Heightened return potential

The historic outperformance of private equity compared with public markets is well-documented⁷; but there’s also emerging research demonstrating the potential implications of its inclusion in retirement plans.

For example, a 2023 analysis from the Center for Retirement Initiatives at Georgetown University found that a mere 5% allocation to private equity and private real estate each would boost median returns by 0.15% per year, representing $35 billion per year in additional net return for the entire US defined contribution plan market. This is a “missed opportunity for retirement plan investors to improve total-return performance, increase diversification and reduce the volatility of asset values,” say the authors of the report.⁸

The Urban Institute, a Washington DC-based think tank, arrived at similar conclusions. In an assessment of 401(k) plans, they found that average retirement savings would increase in 14 of their 16 scenarios if account managers added private equity investments into the mix. Under the most optimistic scenario, the researchers estimate that private equity could boost average account balances by nearly 10% over a full career.⁹

Diversification argument

For decades, conventional wisdom in retirement planning focused on a balanced portfolio, consisting of stocks and an ever-greater share of bonds. The rationale behind such a recommendation was that this type of portfolio created less volatility and offered more income as people approached retirement.

This strategy, however, doesn’t seem to be calibrated to the changing economic climate. Bond exposure alone likely won’t be enough to hedge against major volatility as experienced in 2022 when a traditional 60/40 mix of stocks and bonds lost significant value.¹⁰ The strategy recovered this year, but its returns may still be insufficient to keep pace with elevated interest levels going forward. This makes rethinking portfolios beyond these two assets more critical than ever.

In this context, private equity can be used as a natural diversifier. Data from the investment manager Abrdn suggest that US and especially European buyouts exhibited only a modest correlation with public equity indexes on a three-year rolling basis.¹¹ This potential downside protection that private equity may provide in mature portfolios is typically explained by the fact that fund managers have far more control over the companies they invest in. They can make more active decisions to react to market cycles, whether approaching a boom period or a recession.

In addition, the argument for enhanced diversification in retirement portfolios becomes increasingly relevant as future generations shift their investment preferences.

Only 25% of millennials believe stocks and bonds guarantee above-average returns, compared to 68% of those aged 43 and older, according to Bank of America’s 2022 survey of participants with household investable assets of over $3 million. To find better returns, wealthy millennials are turning to alternatives; they are three times more likely to embrace non-traditional investments compared to their parents or grandparents. They consider cryptocurrencies, real estate, and private equity especially attractive.¹²

Long-term fit

The usual trade-off of private market assets is their relative illiquidity compared with public stock and bond markets, where assets can be traded much more frequently. For investors with a shorter-term horizon, or greater liquidity needs, the requirement to lock in funds for several years may appear daunting.

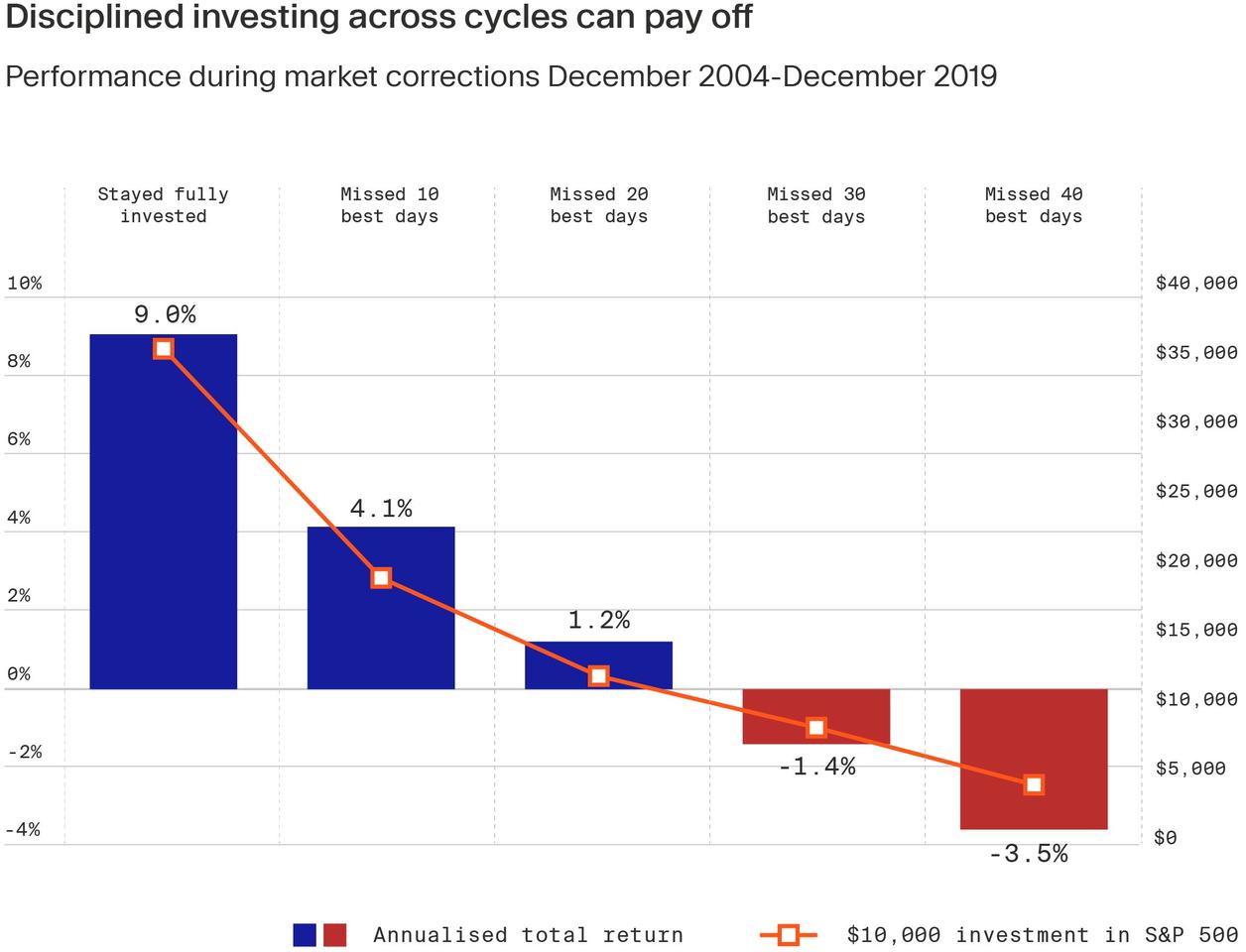

However, saving for retirement is typically a decades-long project, which makes private equity potentially an even more compatible investment. The longer hold has another upside; restrictions on portfolio redemptions could prevent investors from panic selling during a market downturn. Equity market research from Putnam Investments, for example, suggests that investors who stayed fully invested during volatile periods gained the most in terms of risk-adjusted returns.¹³

At the same time, it's worth noting that private equity is not without its redemption possibilities. Those who need to sell their interest can do so through a rapidly growing secondary market which allows investors to make an early exit, rebalance portfolios or prematurely lock in gains from high-quality investments. Learn more about how secondaries work in our article.

IRA and accredited investors

An IRA is legally a trust and is not an individual or a “natural” person, which means that the individual IRA owner’s financial status is used to determine if the IRA satisfies the accredited investor rules. An IRA can therefore receive accredited investor status if all owners of the account meet the criteria.

This is important because most non-publicly traded or investment funds, such as private equity, are structured as Reg A or Reg D type private placements. Individuals who want to invest in these funds are required to qualify as accredited investors.

The Securities Exchange Commission defines an individual accredited investor as either having a net worth of $1 million, excluding the value of one’s primary residence, or having earned at least $200,000 per year in each of the past two years — or $300,000 with spouse or partner — and expect to do so again in the current year. Accredited investors can also be individuals with a securities representative license or “knowledgeable employees” of a private fund.¹⁴

Moonfare bridges the gap

The flexibility of SDIRAs is an obvious advantage to many but is not without its share of risks. Account holders are responsible for their asset selection and monitoring, which demands a greater level of understanding and involvement. SDIRAs are therefore ideally held by experienced investors who also have the necessary capacity to address the illiquidity considerations of private equity and similar assets.

But how to access private market opportunities? Historically, these were reserved for institutional investors or the ultra-wealthy. Now, platforms like Moonfare offer a simplified solution to either dip your toes into private markets for the first time or to start building a well-diversified portfolio of assets across private equity, venture capital, private credit, infrastructure, secondaries and other strategies.

To get started, register for free in a couple of minutes or contact one of our investment solutions managers for more information.

¹ https://www.im.natixis.com/us/resources/2023-defined-contribution-plan-participant-survey-full-report ² https://www.pgim.com/press-release/most-plan-sponsors-taking-steps-solve-retirement-income-challenge-pgim-survey ³ https://stratatrust.hflip.co/93285f71cd.html#page/7 ⁴ https://www.iraresources.com/blog/5-examples-prohibited-transactions-in-self-directed-ira ⁵ https://www.institutionalinvestor.com/article/2bswsuwdgq6uzmjek9i4g/portfolio/the-institutions-with-the-biggest-allocations-to-private-markets-outperform-their-peers ⁶ https://www.ft.com/content/ff5587af-bdd0-405b-a151-7e187b697ef4 ⁷ https://caia.org/blog/2022/07/20/long-term-private-equity-performance-2000-2021 ⁸ https://cri.georgetown.edu/wp-content/uploads/2023/06/GeorgetownCRI-CEm-Benchmarking_Lack-of-Asset-Diversification-CRI-paper.pdf ⁹ https://www.urban.org/sites/default/files/publication/104729/how-might-investing-in-private-equity-funds-affect-retirement-savings-accounts.pdf ¹⁰ https://www.cbsnews.com/news/stock-market-performance-retirement-funds-60-40/ ¹¹ https://www.abrdn.com/en-gb/institutional/insights-and-research/private-equity-as-an-investment-portfolio-diversifier ¹² https://ustrustaem.fs.ml.com/content/dam/ust/articles/pdf/2022-BofaA-Private-Bank-Study-of-Wealthy-Americans.pdf ¹³ https://www.ninepoint.com/media/617767/liquidity-whitepaper.pdf ¹⁴ https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor