Key takeaways:

- The changed public market and economic environment may be causing some liquidity issues for institutional investors today, and this may impact private markets over the short term.

- Yet over the long term, most institutions are increasing their exposure to private markets as they seek to generate higher returns than in public markets and shield portfolios from volatility and inflationary pressures.

- Institutions intend to up their allocations to infrastructure to capitalise on largely inflation-linked contracts and energy transition, and to private credit, where loans are usually floating rate.

Private markets have come a long way in institutional portfolios — those belonging to such as pension funds or insurance funds — from just a couple of decades ago. Back then, typical pension fund allocations to the asset class were below 5%, while family offices and endowments set aside less than 10% on average¹; today, they average 24% of institutional portfolios², with some investors allocating considerably more than this.

For these large institutions with ample capital, the benefits of higher private market exposure in portfolios is clear. Private equity and venture capital investments outperformed US public equities over the last five, 15 and 25 years, according to Cambridge Associates. The research also found evidence to support higher private markets exposure. Over the past decade, investors with an allocation of 30% or more to private equity and venture capital outperformed those with 10% or less by 200 basis points.³

The experience of CalPERS, one of the world’s largest pension funds, bears this out. Its chief investment officer, Nicole Musicco, last year admitted that its decision to effectively pause its private equity programme between 2009 and 2018 had cost it up to US$18 billion in lost returns.⁴

What’s coming down the line?

Past performance is all well and good, but how are institutional investors considering their private markets allocations in an environment of high inflation and rising interest rates?

In the short term, volatility in the stock markets and concern about the macroeconomic outlook may overspill into the private markets. Rising interest rates, for example, have increased the cost of financing takeover deals, such as buyouts, making it more challenging to get these over the line.

The overall environment is one in which it is more challenging to raise capital. Globally, private capital funds raised, $1.33 trn in 2022, a 10% decline versus 2021, accord to Bain & Co data.⁵

The long view

Yet over the long term, the picture is different.

When viewed in a historical context, the fall in fundraising last year suggests more of a market normalising than one collapsing. The total for 2022 was, in fact, 6% higher than the average across the 2017-2021 period.⁶

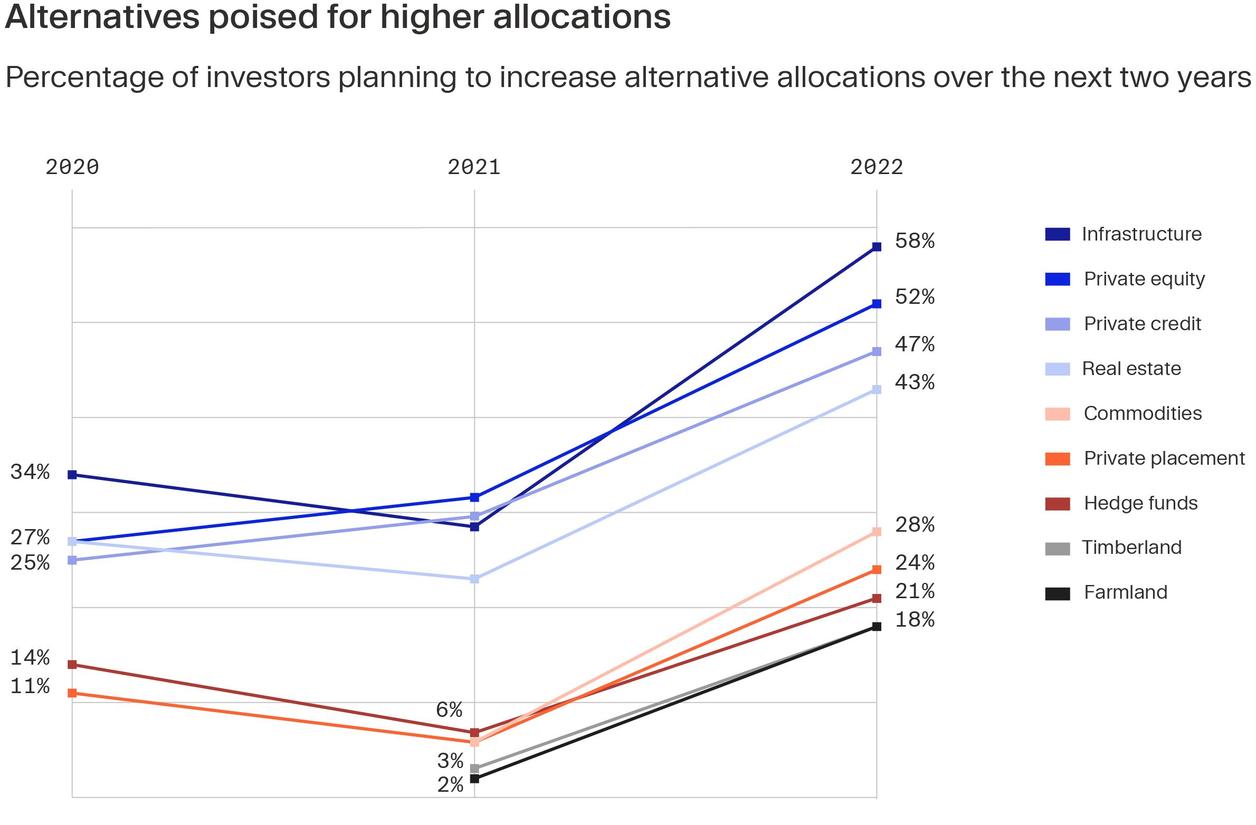

Looking ahead, many established investors remain committed to investing in private markets and, in some cases, are even doubling down on their exposure. Some 72% of institutional investors will increase their allocations to private markets over the next five years, according to a recent survey by investment manager Nuveen.⁷

A similar study by BlackRock found that 43% of investors were expecting to increase their allocations to private equity substantially in this year — on top of 29% who said they would see a small increase.⁸

Among those who may be looking to increase their exposure to the asset class is Norway’s sovereign wealth fund — one of the world’s largest — which has been asked by the government to assess whether it should be adding private equity to its portfolio.⁹

Adapting investment for a changing environment

The simple explanation for why this is happening is the potential for solid returns: the vast majority of investors (86%) believe that private markets will outperform their public markets peers over the long term according to a survey from investment manager Adam Street partners.¹⁰ However, digging deeper into the factors behind the shift towards private markets hints at how these assets can play a role in mitigating difficult circumstances.

For example, many are seeing private markets as an opportunity to hedge against inflation. Nearly two-thirds of institutions are looking to bolster efforts to mitigate inflation and volatility, according to Nuveen, with many pointing to increasing exposure to alternative credit and private markets as a means of doing so.

The survey also found that 38% of investors are making tactical asset allocation shifts, and 27% are making more strategic or long-term moves on their allocations. Well over half (59%) are either considering changes or taking actions to change their portfolio strategies. The moves further in favour of private markets are therefore because of the more challenging conditions investors face, not in spite of them.

Institutional thinking can act as a signpost for others

As long-term investors, often with strict fiduciary responsibilities, institutions have to weigh their allocations and decisions carefully and deliberately. Each organisation will have different priorities, obligations, regulatory frameworks and views on the outlook of various types of investment.

Yet on the whole, there is a clear shift towards private markets among institutions, as they seek to generate the returns they require and build out portfolios that will be resilient to the wider economic and geopolitical climate.

While smaller investors have a variety of idiosyncratic needs and requirements for their own portfolios, they can still learn valuable lessons from larger players that may help chart a path forward in what is a markedly different environment from the one we’ve seen over the past decade. Here are two below.

Don’t underestimate the opportunity in infra and credit

Institutional investors are targeting inflation protection through infrastructure, an asset class which often features inflation-linked, long-term contracts. The Nuveen survey shows that 58% of investors are looking to increase allocations in infrastructure — the highest of all asset classes offered as a response —, while an Invesco survey of sovereign wealth funds globally found that allocations had risen from 4.9% of assets under management in 2022 to 7.1% in 2023.¹¹ There are also long-term tailwinds in play, such as supportive public policy as energy transition and security, which are creating opportunities in this space.

Private credit is also benefiting from the new high interest rate environment, in particular because many funds arrange debt on a floating rate basis, meaning that rates charged to borrowers move in line with interest rate changes. Nearly half (47%) of the Nuveen survey respondents said they were looking to increase allocations to private credit, the third-most selected response behind infrastructure and private equity.

The UK’s BT Pension Scheme is one example of an institution tapping into this trend. In an interview with the Financial Times, Wyn Francis, chief investment officer for the scheme’s manager, Brightwell, explained that rising interest rates were leading banks to reduce their lending, creating opportunities for private credit.

“As it becomes more difficult in the traditional lending market, this then plays into some of the private credit managers,” he said. Explaining the benefits to the scheme, Francis added: “We find that private credit gives us not just cash flow generation, but there’s also a risk premium in there.”¹²

Fund manager selection is now even more important

Yet despite institutional investors’ enthusiasm for private markets, it’s clear they are proceeding with caution. During more challenging periods, the difference in returns generated by the best managers and the rest increases markedly, and this is reflected in responses to the Adams Street survey.

Investors are seeking out managers with strong track records (32% say this is important, up six percentage points from 2022), and a third emphasise value creation capability. This is perhaps why investors are increasingly targeting managers with sector expertise—63% say this is critical to performance, up 14 percentage points versus 2022.

¹ https://www.seca.ch/getattachment/325b2af8-4302-4a82-b8fa-0ec0e8b4832b/Adveq-Research-on-private-equity-allocation.aspx ² https://www.blackrock.com/institutions/en-zz/literature/whitepaper/global-private-markets-survey.pdf ³ https://www.institutionalinvestor.com/article/2bswsuwdgq6uzmjek9i4g/portfolio/the-institutions-with-the-biggest-allocations-to-private-markets-outperform-their-peers ⁴ https://www.ft.com/content/ff5587af-bdd0-405b-a151-7e187b697ef4 ⁵ https://www.bain.com/insights/private-equity-outlook-global-private-equity-report-2023/ ⁶ https://www.bain.com/insights/private-equity-outlook-global-private-equity-report-2023/ ⁷ https://documents.nuveen.com/Documents/Global/Default.aspx?uniqueId=5309d6ea-dd7a-4d74-b337-ded2e30eef81 ⁸ https://www.blackrock.com/institutions/en-zz/literature/whitepaper/global-private-markets-survey.pdf ⁹ https://www.reuters.com/business/norway-wealth-fund-consider-investing-unlisted-equities-2023-03-31/ ¹⁰ https://www.adamsstreetpartners.com/insights/2023-global-investor-survey/ ¹¹ https://www.invesco.com/apac/en/institutional/insights/multi-asset/global-sovereign-study.html ¹² https://www.ft.com/content/d28ce3b9-f830-46a6-9ece-9f5f4e933c56