Key takeaways

- The higher cost of capital has made private equity firms more selective in their dealmaking.

- General partners (GPs) are actively looking for companies that are riding powerful secular tailwinds.

- Artificial intelligence, healthcare outsourcing and clean energy are just some of the sector niches and megatrends shaping dealmaking today.

The past two years have been some of the most challenging that investors have ever experienced. Private equity has not been immune to the prevailing inflationary, higher-rate environment by any means. PE funds have become more discerning, prioritising businesses with solid fundamentals, including robust cash flows and profitability over mere growth metrics.

The higher cost of capital has made dealmaking more difficult. As a result, fund managers are having to develop cast-iron investment theses and dive deeper in their due diligence. In essence, sponsors are looking for target companies able to service higher debt repayments and riding secular tailwinds. This flight to quality has inevitably shrunk the pool of viable investments and is reflected in recent market data. According to PitchBook's 2023 annual global report, the global PE market has seen a significant decline, with a 29% decrease in capital deployment. Exit value also fell by 26%, in large part reflecting the pullback in deals¹ — and therefore a lack of secondary buyouts between sponsors.

Technology down but far from out

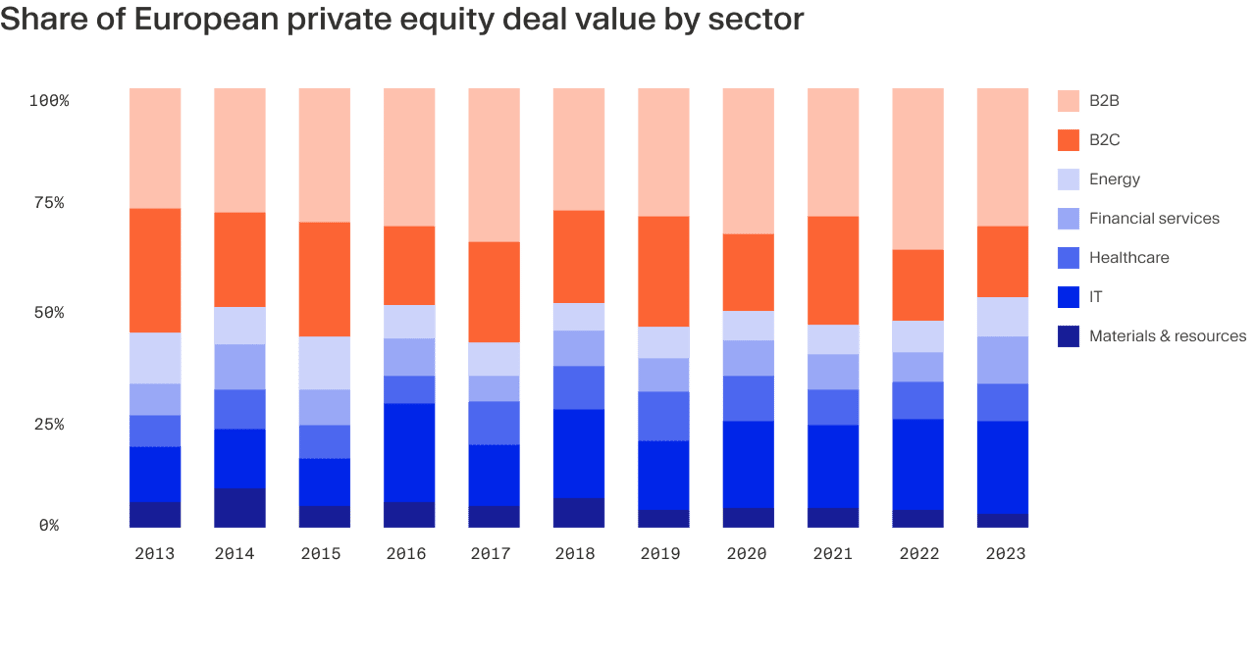

One of the most striking shifts in sector capital flows relates to IT assets in the US. PitchBook data show that in 2023, these investments represented 20.7% of all deal value, down from 29.1% a year prior and the lowest reading for three years.

However, there are a couple of caveats to consider when analysing this kind of data. One is that a smaller number of megadeals — above $5 billion — in any given sector can skew year-on-year figures. Another crucial caveat is that macro conditions have unevenly impacted sector valuations, which can distort industry weightings.

Specifically, the tech sector faced a sweeping valuation reset as central banks started hiking interest rates. An analysis published by McKinsey in August found that recent market corrections depressed software-as-a-service (SaaS) valuations by more than 40%.² The tech reset has been especially acute in the venture capital and growth equity spaces, with 18.5% of funding in Q3 last year being down rounds³ — where companies raise capital at a lower valuation than in their previous round.⁴ Technology has long been viewed as an essential ingredient for economic growth – and that still holds true today. Cloud computing and SaaS remains a point of investment focus, driven by increasing demand for software development, scalable and flexible computing resources, data storage and enhanced security measures.

One of the largest illustrative examples of recent acquisitions in the space is Francisco Partners and TPG Capital’s $6.5 billion take-private of New Relic, a cloud-based analytics platform that helps engineers spot bugs in their software development in real-time.⁵ Similarly, Blackstone recently acquired Civica, a provider of mission-critical software to the UK public sector, for $2.5 billion.⁶ The PE firm shared that it is optimistic on the enduring value of tech that drives efficiency, innovation and contributes to broader societal goals, such as decarbonisation.

The advent of AI

Generative AI has been the big story of the past year or so and VC has been pouring into the space. Capital raised by AI companies exceeded funding totals in every other tech category in 2023, much of this going to OpenAI and Anthropic.⁷ Given the nascency of this technology, venture capital’s higher-risk, early-stage focus is a more natural fit for emerging AI applications. However, buyout funds will look to capitalise on the ongoing foundational shift of AI being layered and integrated into SaaS products to enhance their capabilities, making them smarter and more efficient. A case in point, cybersecurity firm Proofpoint, owned by PE firm Thoma Bravo, in October acquired Tessian, which leverages AI to detect and safeguard against data loss and email threats.⁸ Data centres and other digital infrastructure are another focal point for PE, as demand for data storage, processing and connectivity skyrockets. This trend is driven by the exponential growth of digital content, cloud computing services and GPU-heavy AI applications. Bain Capital took full control of Chindata Group Holdings last August after agreeing a $3.15 billion take-private with the Chinese data centre operator.⁹ There are many more examples of such deals, particularly in the rapidly digitalising Asia-Pacific region.¹⁰

B2B and cost containment

PitchBook’s data for the US also show that capital deployment was weighted more heavily towards the B2B sector last year. The sector accounted for a third of all investment in this market in 2023, up from 28.8% a year prior. In many ways, B2B deals follow the same playbook as tech. It’s all about cost containment. Outsourced business services in areas such as IT support, logistics and professional consulting can improve end clients’ profitability. This is especially relevant in the recent inflationary environment, which has seen businesses’ input and labour costs rise sharply.

As recently as February this year, Hellman & Friedman and Valeas Capital Partners collaborated on an estimated $1 billion buyout of US accounting firm Baker Tilly.¹¹ The pair is seeking to capitalise on an ongoing overhaul of the vertical’s historic partnership model.

Healthcare’s enduring appeal

Ageing demographics and the prevalence of chronic illness have made healthcare one of the most reliable sectors for private equity firms, which are drawn to its non-cyclical characteristics. In the US, the sector accounted for 12.4% of the PE market measured by total capital, up from 11.2% in 2022. In Europe, healthcare has historically taken a smaller share of PE investment — 8.3% in 2023. The predominance of publicly owned healthcare systems in the region compared to the largely private healthcare system in the US somewhat limits the scope for PE investment. That is quickly changing. A government-led push to enhance the efficiency of health and social care delivery and transition towards non-acute care environments by outsourcing to private providers is opening the door to financial sponsors. In the UK, for example, there has been an influx of PE investment into service providers helping to reduce waiting times in the overstretched National Health Service (NHS).¹² In just one example, mid-market firm Fremman Capital last year acquired Medinet, which supports the healthcare service by providing NHS staff outside of their working hours to alleviate the system’s patient backlog.¹³

The ongoing energy transition

Europe’s lead in transitioning to a net-zero world, which has been followed by the US Inflation Reduction Act’s generous tax credits for sustainable energy investments is another powerful tailwind for PE.

A number of the industry’s largest firms including Brookfield Asset Management, Apollo Global Management and Blackstone have been leaning heavily into the strategy. In 2022, Apollo launched a dedicated sustainable investing platform, with the lofty goal of putting $50 billion to work into clean energy and climate capital by 2027.¹⁴ For its part, Blackstone closed its latest green private debt fund on its $7.1 billion hard cap last August¹⁵ and is understood to be more than halfway through raising a $6 billion equity fund, Blackstone Energy Transition Partners IV.¹⁶

Seeking value

ESG more generally is now fundamental to PE’s value-creation toolkit and is being applied across every sector imaginable. Whether it’s cleaning up industrial companies’ production and redirecting their value chains towards more sustainable markets, or acquiring consumer goods companies that align with society’s increasing climate-consciousness, ESG will continue to be a common theme that shapes PE dealmaking.

Above all, PE funds’ multi-year investment horizons means they can take a long-term view that looks beyond any short-term market turbulence. They are now taking a more pinpoint approach, scanning for opportunities to deploy capital into sector niches and industry verticals playing a role in transformative business, technological and societal shifts.

To continue delivering outsized returns, firms are actively positioning themselves to capitalise on unstoppable, era-defining megatrends.

¹ https://pitchbook.com/news/reports/2023-annual-global-pe-first-look ² https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/private-equity-investments-in-tech-services-three-considerations ³ https://carta.com/blog/down-rounds-2023/ ⁴ https://www.chronograph.pe/top-5-private-equity-deals-and-dealmaking-trends-of-2023 ⁵ https://newrelic.com/press-release/20230731 ⁶ https://www.penews.com/articles/blackstone-agrees-2-5bn-civica-deal-20231122 ⁷ https://www.axios.com/pro/media-deals/2023/05/24/generative-ai-funding-openai-anthropic ⁸ https://www.proofpoint.com/uk/newsroom/press-releases/proofpoint-signs-definitive-agreement-acquire-tessian ⁹ https://www.privateequitywire.co.uk/bain-capital-agrees-chindata-take-private-at-3-15bn-valuation/ ¹⁰ https://mergers.whitecase.com/highlights/dealmaking-is-shaping-apacs-digital-future# ¹¹ https://www.ft.com/content/ca7d9384-7255-4b43-a84e-01a8b48b232d ¹² https://www.ft.com/content/94184d66-517b-4893-8e06-df16efd135b3 ¹³ https://pe-insights.com/news/2023/07/10/fremman-capital-bets-on-nhs-backlog-with-recruitment-agency-deal-with-volpi-capital/ ¹⁴ https://www.apollo.com/insights-news/pressreleases/2023/04/apollo-launches-clean-transition-capital-strategy-to-support-firmwide-target-to-deploy-50-billion-by-2027-2654978 ¹⁵ https://www.privatedebtinvestor.com/blackstone-closes-on-7-1bn-energy-transition-fund ¹⁶ https://www.newprivatemarkets.com/blackstone-halfway-to-6bn-target-for-energy-transition-pe-fund/