Despite significant headwinds in Q2, data from Q3 suggests that uncertainty is lifting and the outlook for sponsors is improving.

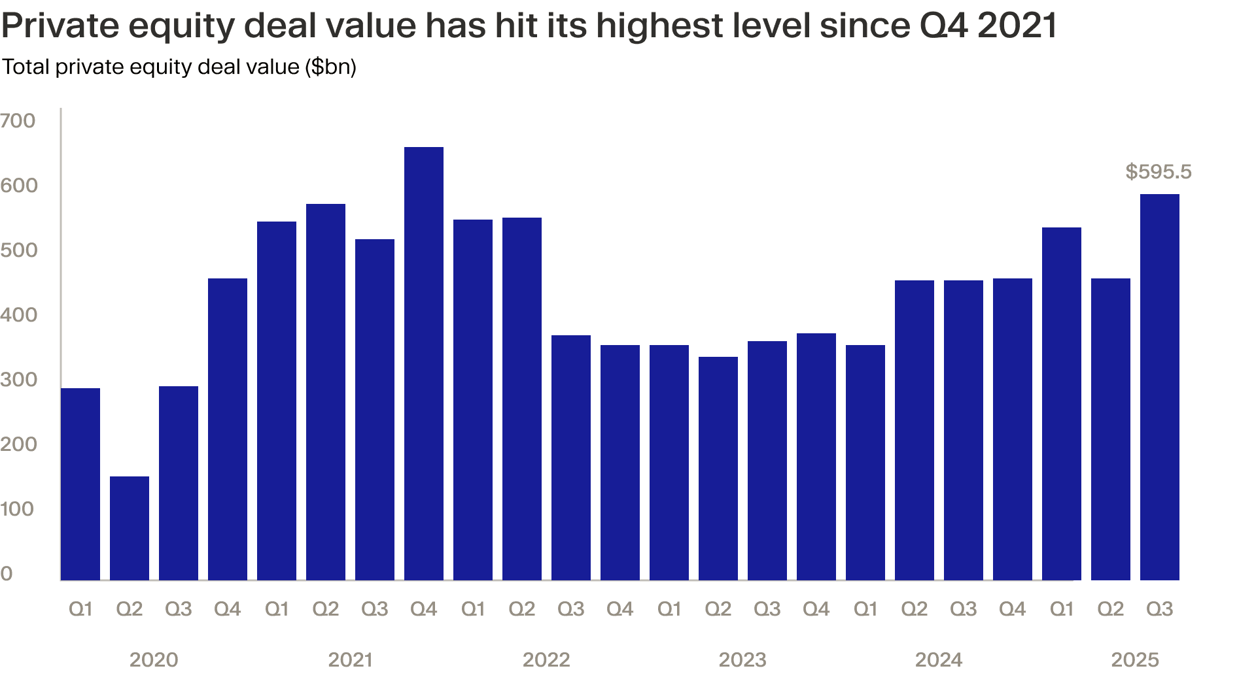

Total deal value saw an uptick to $595.3 million this quarter, reaching its highest level since Q4 2021, making it the second greatest amount in the last decade, per latest Pitchbook figures.¹ Compared to the same period in 2024, the first three quarters of 2025 have seen a 24.6% uptick in deal value.

This activity includes landmark deals such as the $55 billion take-private acquisition of EA sports, now the largest LBO in history.² It appears that PE seems to have adjusted quickly to the new trading regime, following Trump’s tariff announcements on the so-called Liberation Day in April.

This quarter the majority (roughly 61%) of deal value consisted of buyouts/LBOs, whereas add-ons and PE growth expansion accounted for roughly 29% and 10% respectively. Meanwhile, deal counts remained steady this year at roughly 5,000, continuing the trend of elevated levels from 2023 and 2024.

Exit counts and volumes at highest levels since 2021

As sponsors began to return to markets to sell their portfolio companies, exit counts surpassed 1,000 — record levels since Q4 2021. This could be explained by borrowers' increased use of a hybrid financing model (made up of institutional cash, bank cash and private debt), meaning private equity firms can negotiate lower prices, push for more aggressive terms and stretch leverage.

Exit value remained similar to Q2 at $293.7 billion, as 2025 continued to show the highest quarterly exit values seen since 2021. As expected, the majority of this activity was concentrated in North America and Europe.

Fundraising is still lagging behind

Contrary to this, $309.8 billion in fundraising over the first three quarters of 2025 marks a 22% decrease from this time last year. Investors have been reluctant to invest following a slump in exits over the past couple of years, however exit volumes now seem to be on the rise, hinting at a potential shift in momentum for fundraising. Find out more about the activity in exit markets and the current M&A outlook in Moonfare's Chief Economist's recent commentary.

¹ ‘Pitchbook Global PE First Look’: https://my.pitchbook.com/research-center/ALL ² https://www.ft.com/content/be980240-13ec-498c-ba79-71eada30d133