Key takeaways

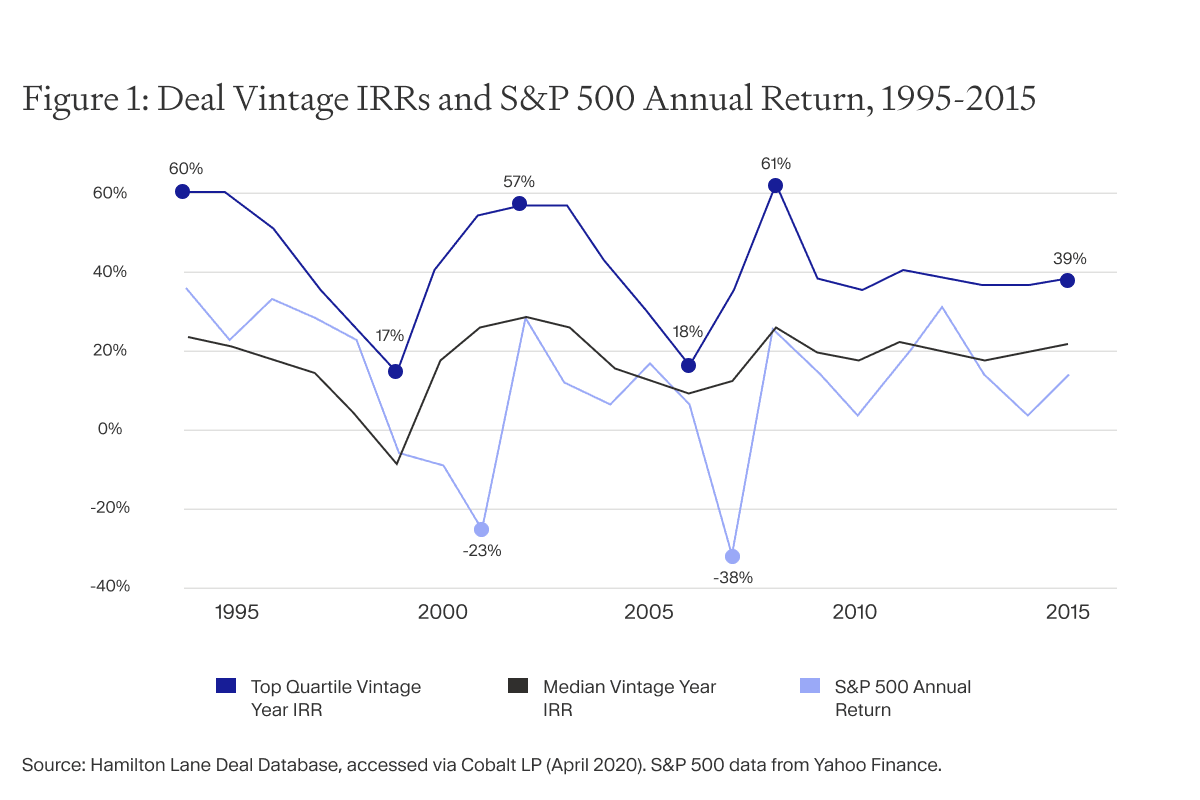

- We’re entering a new and volatile period. However, history shows that private equity is not only well equipped to survive and thrive but also to outperform public markets in times of recession.

- Private equity has the ability and the operational resources to not only react to changing macroeconomic conditions, but go on the offensive and to fundamentally improve businesses and to capitalise on new investment opportunities.

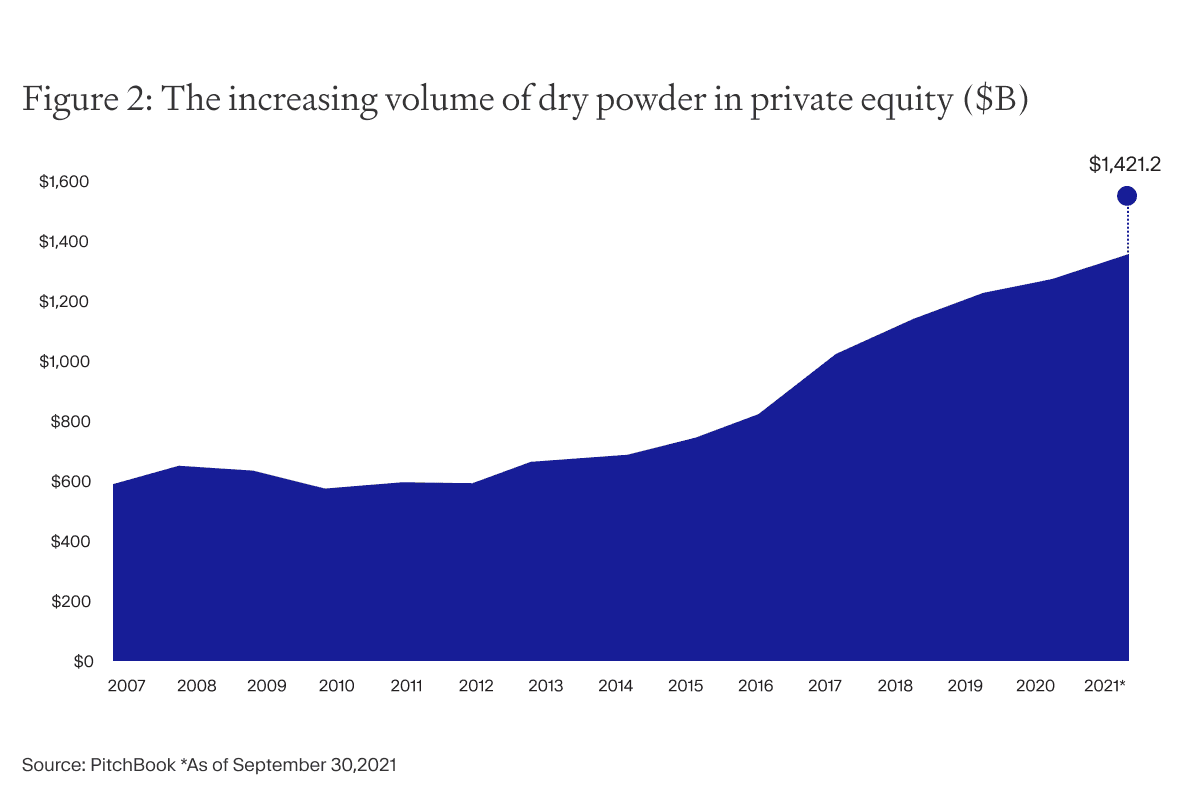

- High levels of dry powder could lead to positive outcomes as managers deploy capital in a healthier valuation environment.

After a blockbuster 2021 for private markets, investors are now understandably feeling nervous.

The war in Ukraine has weighed on risk appetite this year, while the recent surge of coronavirus cases in China has also brought into question the future path of growth.

Simultaneously, soaring energy prices and supply-chain disruptions have pushed inflation higher, locking major central banks into tightening monetary policy. These factors have stoked fears we could be entering a period of stagflation, characterised by prolonged high inflation and underwhelming economic performance.

On the face of it, none of this sounds like good news for private investors. However, this surface-level view ignores the value that private equity can provide amid times of stress. And while PE is by no means immune from volatility, it’s suited to survive and potentially even thrive amid the chaos.

Lower valuations mean healthier investment environment

Public markets have evidently suffered in this year’s downturn. Indeed, last week the S&P 500 was, at one point, down 20% from this January, having fallen for seven consecutive weeks, its worst stretch since the dot-com bubble burst over two decades ago. ¹

“We have seen a steep drop in valuations and prices in public markets, but the decline has not yet been fully diffused to private market valuations,” says Pavel Ermoline, Investment Manager at Moonfare. “These tend to follow suit eventually but often in only a limited capacity. Private markets may be more resilient thanks to active ownership and insulated from public market volatility given the long-term focus.”

Despite this, average late-stage valuation decreased by a wide margin in Q1 2022 from the highs of 2021, and some analysts expect this cooldown to continue through Q2. ² ³ Recent examples of this in action include the reported recent down-rounds by late-stage startups Instacart and Klarna. ⁴ ⁵

While this seems worrying on the surface, this could be a healthy rebalancing for newer entrants into the markets. “The current valuation reset offers attractive opportunities for recently and newly launched funds, as these will evolve in a healthier valuation environment,” says Ermoline.

It’s also worth noting that 2021 was a ridiculous outlier. ⁶ Not hitting those levels again doesn’t mean PE in 2022 has failed, it simply means the market is correcting to a natural level.

Private equity fund managers well equipped for macro concerns

Despite a potentially beneficial valuation reset, investment managers still need to navigate inflationary pressures, rising interest rates and geopolitical disruptions, placing a cloud over the longer-term outlook. However, for Ermoline, private equity firms as a whole are in better shape to face these challenges than before.

“Managers are much better positioned to face the increased cost of capital than a decade ago,” he says. “For existing investments, fixed rate financing will provide some room to revisit capital structure before refinancing. For new investments, rate hikes will be priced into entry valuations with likely lower leverage.”

This positioning is helped by the industry’s overall shift from one that is primarily debt focused to one that now prioritises operational improvements to add value. “The private equity industry has significantly transformed since its early days,'' explains Ermoline. “In the 1990s, private markets were highly inefficient and less competitive, with most managers using financial engineering in the form of leverage to generate returns. Now, the value creation strategy has progressively transitioned, starting from the early 2000s, to focus on operational improvements.”

This alteration has helped the industry come through a number of historical market episodes, even as recently as two years ago. “Increased focus on hands-on value creation with a more conservative use of leverage proved to be a winning combination when the pandemic hit,” says Ermoline. “They were able to weather the storm and service a manageable stack of debt.”

This transformation has led the way for private equity firms being able to outperform even in times of crisis. In particular, private market funds’ tendency to deploy capital over a period of three to five years, thus mitigating exposure to a single entry point and valuation environment. We have seen this before with the great financial crisis, with private equity’s 2008 and 2009 vintages delivering solid performances at a time of an incredibly volatile and uncertain environment. ⁷

Record dry powder prepares soft landing

These firms will be armed with an unprecedented amount of capital to deploy as well. By the end of the third quarter of 2021, private equity firms were sitting on a record $1.4 trillion of dry powder. ⁸ This, says Ermoline, adds an extra layer of comfort. “A similar situation happened during the early days of the pandemic when lockdowns and supply chain chaos generated a wave of panic on public markets. The significant amount of dry powder back then proved vital, as managers benefitted from valuable capital to support existing portfolio companies and avoid any liquidity shortfall.” This was evident in fundraising rounds like Travelport’s June 2020 $500 million financing. Travelport, a service-provider for airlines and travel agencies, was facing a number of pandemic-related liquidity issues and PE backers Siris Capital, Elliott Management, Evergreen Coast Capital stepped in to give the firm some much needed breathing room. ⁹

Soaring inflation in today’s environment is causing companies to focus again on their bottom lines. For fund managers, the high amount of dry powder should lead to positive outcomes as they are able to deploy capital in a healthier valuation environment. With this in mind, we’re already seeing the creation of a number of huge new funds. These include Insight Partners’ 12th flagship fund, which closed with more than $20 billion in commitments earlier this year, ¹⁰ and KKR’s $19 billion KKR North America Fund XIII - its largest ever vehicle. ¹¹

Private equity is well placed to capitalise on downturns

Not only can top-tier funds help companies survive downturns, they may also have the skills, tools and expertise to navigate and capitalise on volatility. Active ownership means PE managers may be able to identify ways to lift earnings, pivot strategies when necessary and step in to assist portfolio companies. As Ermoline says, the pandemic is a great example of this. “Private equity managers proved to be very innovative and swift in capturing new opportunities in the early days of the crisis, which led to an accelerated transition to digital and provided significant opportunities in the technology space.” Private equity quickly sought out tech firms solving problems the pandemic exacerbated. These included companies such as edtech start-up Newsela, which provides online textbooks for virtual learning. It became a unicorn in early 2021 following a $100 million Series D. ¹²

Something similar is unfolding now as General Partners begin to capitalise on solutions for today’s crises. The ongoing disruption of global supply chains is seeing cash surge into logistics companies. In March of this year, Berlin-based Forto, a logistics tech company, saw its valuation double to $2.1 billion in just eight months after a $250 million funding round. ¹³ Two months before that, US logistics tech firm Flexport was valued at $8 billion after completing a $935m Series E. ¹⁴

All this, Ermoline notes, suggests private investors don’t need to be too concerned. “Markets are cyclical and diversifying entry points is the best hedge to generate stable long term returns. Current market conditions appear pretty favourable for investors and managers deploying capital.”

This doesn’t mean, however, that private investors should get into the business of trying to predict volatility, he says. “The statistics tell us that timing the market is never a good idea in private markets. The best strategy remains discipline and consistency, which means regular and long term commitments to the asset class.”

¹ https://www.nytimes.com/live/2022/05/20/business/stocks-bear-market

² https://files.pitchbook.com/website/files/pdf/Q1_2022_US_VC_Valuations_Report.pdf

³ https://www.cbinsights.com/research/report/mid-q222-report-state-of-venture/

⁴ https://www.uktech.news/fintech/klarna-down-round-uk-fintech-valuable-startup-20220520

⁵ https://www.reuters.com/business/instacart-slashes-valuation-by-nearly-40-24-bln-2022-03-25/

⁸ https://files.pitchbook.com/website/files/pdf/PitchBook_Q3_2021_Private_Fund_Strategies_Report.pdf

¹³ https://forto.com/en/blog/press_releases/forto-announces-new-investment-of-250-million/