The Liberation Day tariff announcement, and the resilience that markets have shown in the face of geopolitical and economic stress have,³ once volatility has died down, caused many investors to re-examine long run asset return assumptions.

Broadly in public markets, conventions regarding drawdowns and volatility are being re-thought, in the sense that the average level of volatility in public markets may be higher now. In addition, many allocators are configuring a long-run weaker dollar. Whilst equities have recovered to close to all time highs,⁴ the dollar remains weak,⁵ suggesting that the near decade long bull market is threatened.

How much private equity?

In private markets, the tariff chaos may result in a short interruption in investment and there are signs that this has fed through to capital market activity, though a recent sprinkling of IPO activity is encouraging. In that respect we revisit a question that many investors put to us — how much private equity (assets) I should hold in my portfolio, in the light of two recent excellent publications.

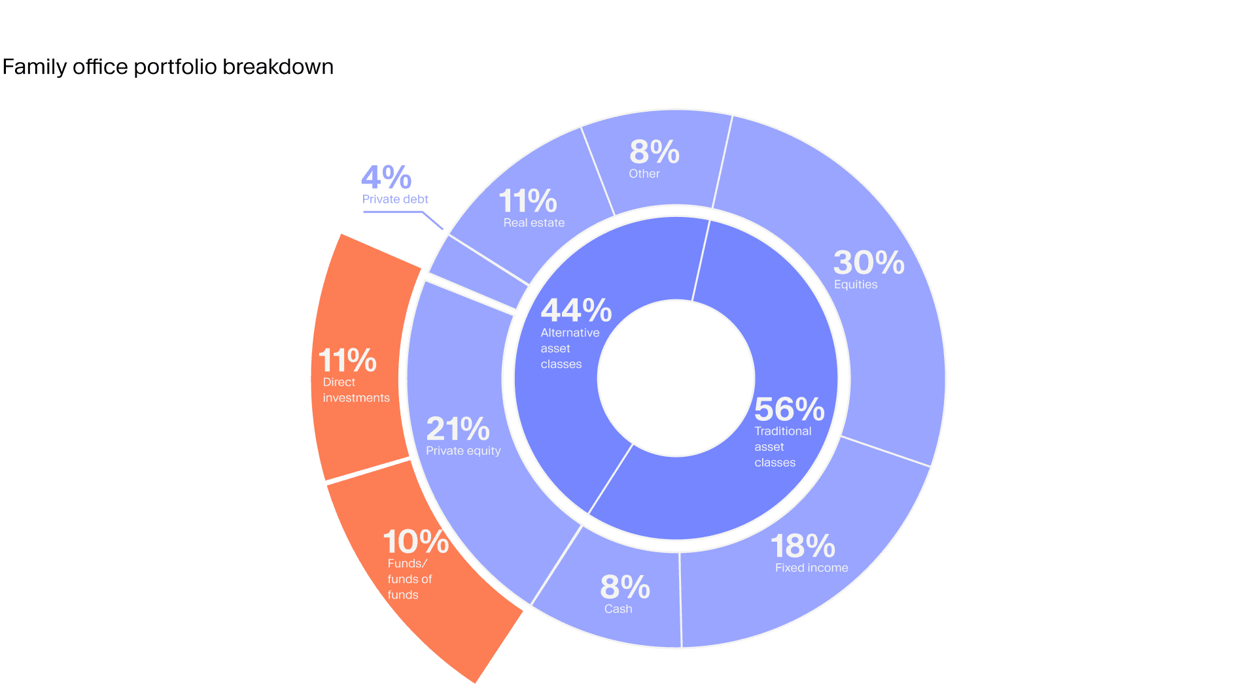

First, starting with the UBS Family Office report⁶ which, based on interviews with some 317 family offices with an average of $1.1 billion in assets, gives detailed accounts of the asset allocations of family offices in a number of regions.

Globally, family offices hold 21% of their total portfolio in private equity (roughly half of this is in fund of funds and the other in direct fund investments), with this figure pushing 27% in the US and Europe (it is much lower in Asia).⁷ With an eye on the future, 37% of the family offices interviewed by UBS said that on a five year view they intended to increase their allocation to private equity, and a similar number see an increase in allocations to private debt.⁸ At the thematic level, family offices report that healthcare, electrification and AI are the technologies they are tracking the most.

Complimenting the UBS report, the CapGemini Wealth report⁹ highlights a steady rise in wealth, and then specifically details that high-net-worth individuals have a steady 15% allocation to private assets (mostly private equity), amidst very high allocations to cash and cash equivalents.

This suggests that investors are happy to invest in less liquid assets like private equity when they have rather large cash buffers that help to reduce overall portfolio risk and allow them to be more opportunistic in the context of public market volatility. Indeed, with cash rates still high in some markets like the US, that investors whittle down fixed income and instead allocate towards higher yielding bond-like private investments like infrastructure.¹⁰

Allocation depends on investor preferences

As a final note, we have parsed the capital market assumptions (effectively long-term asset return forecasts) of ten major investment institutions, and on average the expected five year return for private assets (mostly private equity) is some 3% higher than that for global equities. Inputting this into a portfolio analysis, across a global diversified portfolio, the Blackrock Investment Institute¹¹ arrives at a 40% allocation to private assets for an investor like a European family office that typically has a longterm investment outlook.

In summary, the volatility of recent months has led investors to question certain assets like fixed income and the dollar, but reported and forecast allocations to private assets remain largely in the 15-25% range, depending on investor preferences. It also seems from surveys that family offices in particular are keen to add more exposure to private assets.

¹ https://www.ubs.com/us/en/wealth-management/campaign/global-family-office-report-2025-form.html ² https://www.blackrock.com/institutions/en-zz/insights/charts/capital-market-assumptions#strategic-asset-allocation ³ https://www.reuters.com/business/us-stocks-heal-tariff-pain-trade-news-keep-markets-edgy-2025-06-05/ ⁴ https://www.spglobal.com/spdji/en/indices/equity/sp-500/ ⁵ https://www.marketwatch.com/investing/index/dxy ⁶ https://www.ubs.com/us/en/wealth-management/campaign/global-family-office-report-2025-form.html ⁷ https://www.ubs.com/us/en/wealth-management/campaign/global-family-office-report-2025-form.html ⁸ https://www.ubs.com/us/en/wealth-management/campaign/global-family-office-report-2025-form.html ⁹ https://www.capgemini.com/insights/research-library/world-wealth-report/ ¹⁰ https://www.capgemini.com/insights/research-library/world-wealth-report/ ¹¹ https://www.blackrock.com/institutions/en-zz/insights/charts/capital-market-assumptions#strategic-asset-allocation