Key takeaways

- While conditions for exits were tough last year, the environment is expected to normalise towards the second half of 2024.¹²³⁴

- Infrastructure assets and secondaries are expected to remain robust, and the momentum in private credit is likely to continue, even as interest rates fluctuate.⁵⁶

- Investors are shifting focus to sectors that align with broader trends, such as healthcare, energy transition and sustainability.⁷⁸

A focus on value creation may shelter private markets from external headwinds, but they are not entirely immune to them. The past 12 months have presented firms with a fair few challenges. Rising interest rates across many economies inevitably led to increased debt costs on new deals, while the ongoing war in Ukraine and the conflict in Israel affected investor sentiment more broadly.

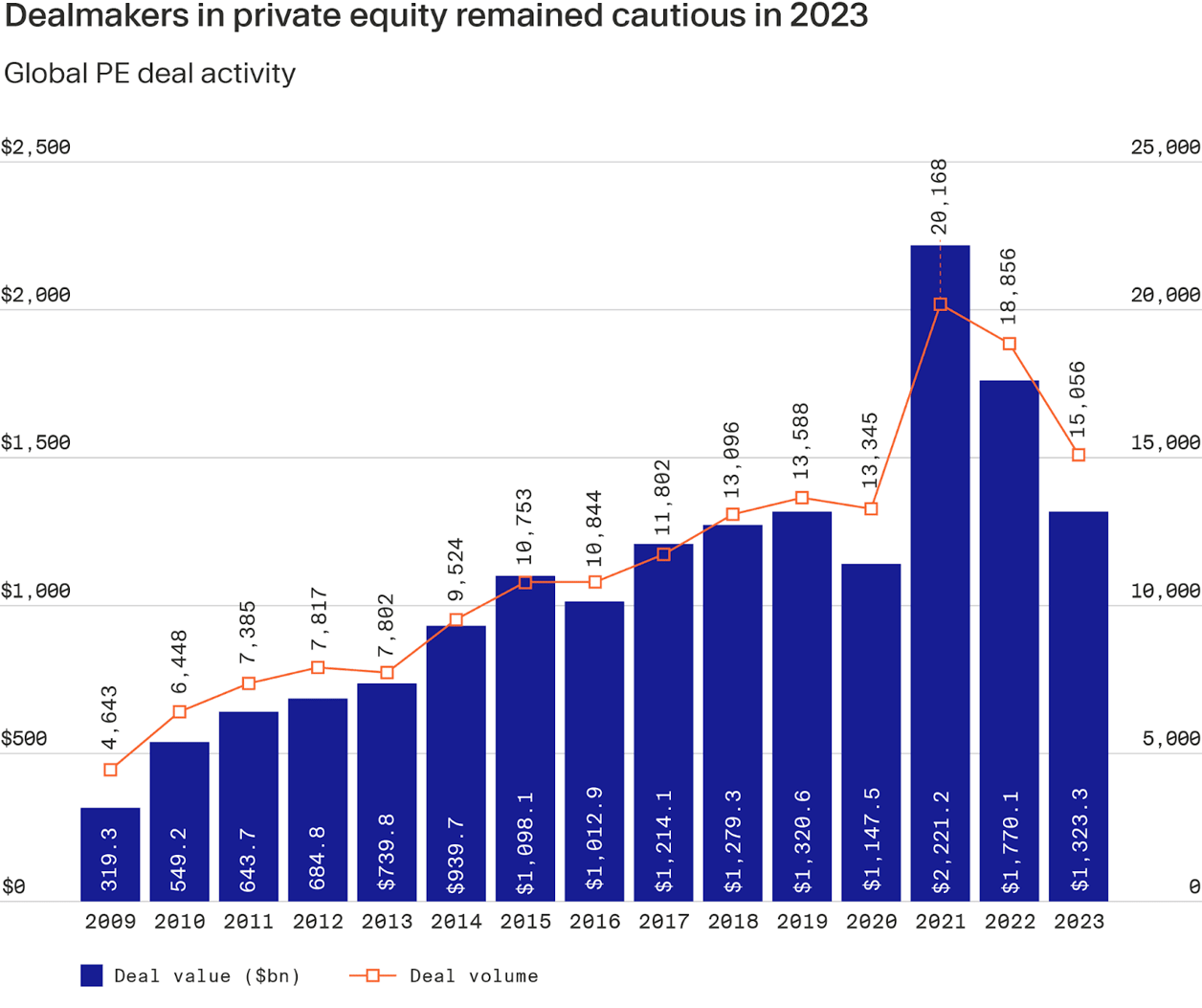

As a result, deal activity in private equity was lacklustre last year, finishing 25% down on 2022 values, according to Pitchbook figures.⁹

Global fundraising, on the other hand, remained relatively resilient. In 2023, private equity firms collected $556 billion, which is on par with the previous year and only 10% less compared to the record-setting 2021, per PitchBook.¹⁰ However, the landscape for fundraising has shifted, becoming significantly more concentrated in favour of established managers. A mere 593 firms secured the same volume of fresh capital that a larger pool of 1,337 firms attracted in 2022.¹¹

Indeed, some of the largest fundraises on record have closed last year. In July, for example, European-based CVC Capital Partners amassed the largest private equity fund ever, securing €26 billion to beat its €25 billion target and exceed the €21 billion raised for its previous vehicle.¹²

Meanwhile, Permira beat its target with a €16.7 billion raise¹³ and Warburg Pincus collected $17.3 billion for the largest fund in its 60-year history.¹⁴

The year ahead in fundraising, dealmaking and exits

So what’s in store for 2024? Here are Moonfare’s top ten trend predictions for the coming 12 months.

(1) Exit conditions could improve

An uncertain economic outlook, combined with rising interest rates through 2023 hampered GPs’ exit plans. Sellers attempted to hold onto valuations that buyers were not prepared to pay in a changed environment. At the same time, the initial public offerings (IPOs) were off the table for much of the year as public markets investors adopted a risk-off approach.

In 2024, we should see this start to unwind as interest rates stabilise (or even fall¹⁵) and public market sentiment improves. The IPO window started opening in September as chip maker ARM Holdings and grocery delivery business Instacart listed on Nasdaq, albeit with some share price volatility after going public. General Atlantic-backed fashion retailer Shein has also priced its IPO for launch in 2024, with a reported $90 billion valuation.¹⁶ Depending on market conditions, IPOs could provide an exit avenue for select private equity-owned businesses.

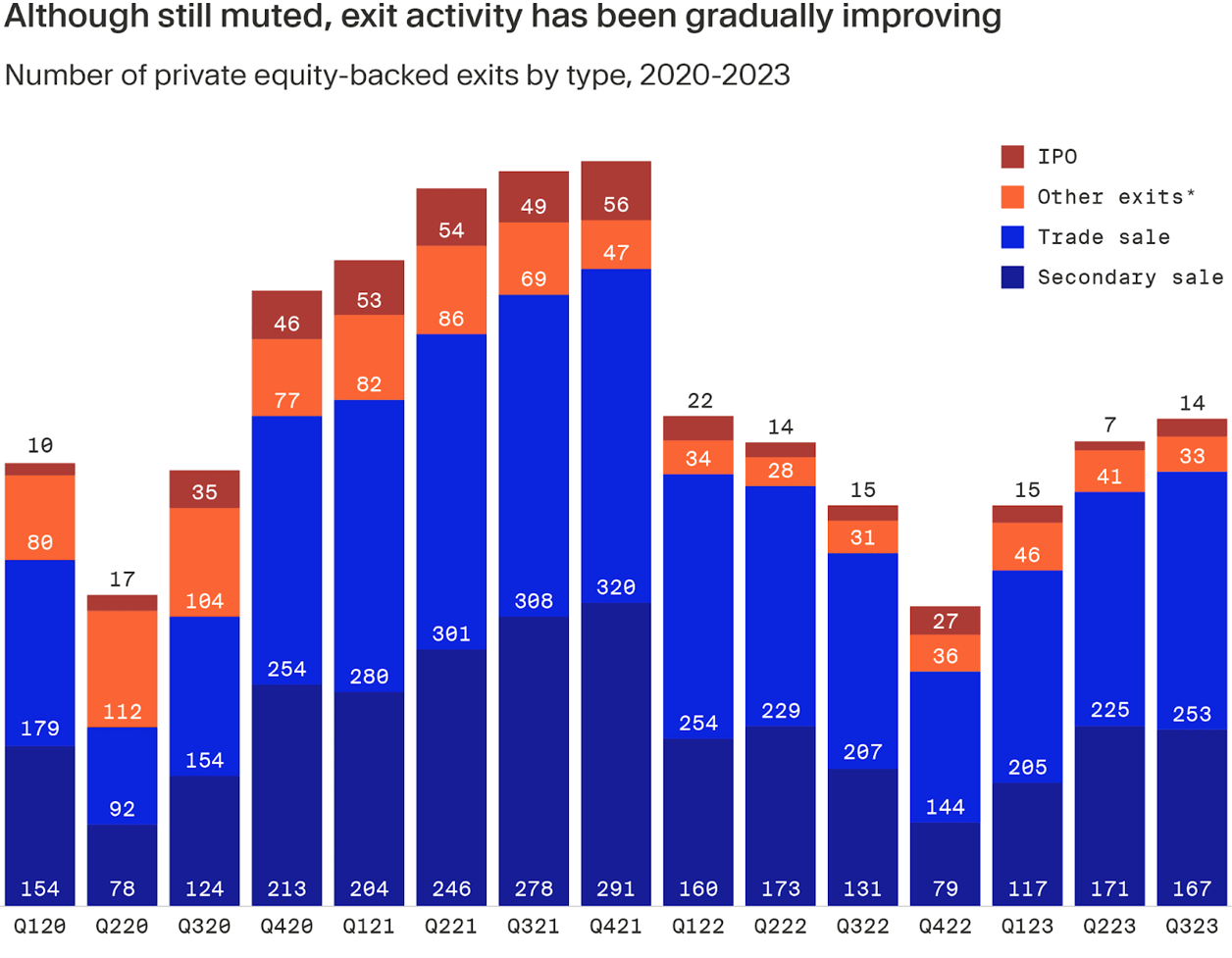

Meanwhile, other exit routes may start to free up as the buyer-seller price expectation gap narrows. Private equity realisations have steadily increased by number through to Q3 2023, as S&P Capital IQ’s chart shows below. This year may not see a flood of exits — just 44% of respondents to an EY survey expect them to pick up over the next 12 months¹⁷ — but the numbers are still likely to be higher than those for 2023.

GPs will also seek alternative ways of generating liquidity for investors. Chief among these is the GP-led secondary market, whereby funds roll asset(s) into a new vehicle, offering investors the chance to roll their investment or crystallise their return at this point.

(2) Secondary funds anticipating a busy year

Secondary funds bucked the challenging 2023 fundraising market, with several large players attracting multi-billion dollar funds. Lexington Partners, for example, raised over $18 billion¹⁸, Goldman Sachs Asset Management amassed more than $15 billion¹⁹, while Ardian had reportedly raised $20 billion of its $25 billion target for its latest secondary fund by June 2023.²⁰

These and other secondary players with capital to deploy look set for a busy 2024. Improved pricing for LP portfolios in most private markets will bring out more sellers²¹, many of whom have been waiting for more favourable conditions before going to market. Meanwhile, demand for GP-led secondary deals will likely remain high in 2024²², even as exit markets start to normalise. GPs increasingly use these transactions to continue building value in some of their best assets, while also providing LPs with liquidity.

Secondary funds will also continue to innovate. We believe NAV lending, for example, looks set to grow further over the coming period.²³ In these deals, GPs or LPs borrow against the net asset value of their portfolio to generate liquidity, while retaining equity control over their assets. The vast majority of NAV lenders or 83% in a Rede Partners survey reported stronger deal flow in 2022 versus 2021 and 2024 could be even busier.²⁴

(3) Primary deal activity will likely start to normalise

Even in challenging markets, GPs find new opportunities. Last year, this was evident in public-to-private activity, as funds saw potential in attractively-priced listed companies: in Q1 2023, 68% of private equity deals were take-privates, according to EY.²⁵

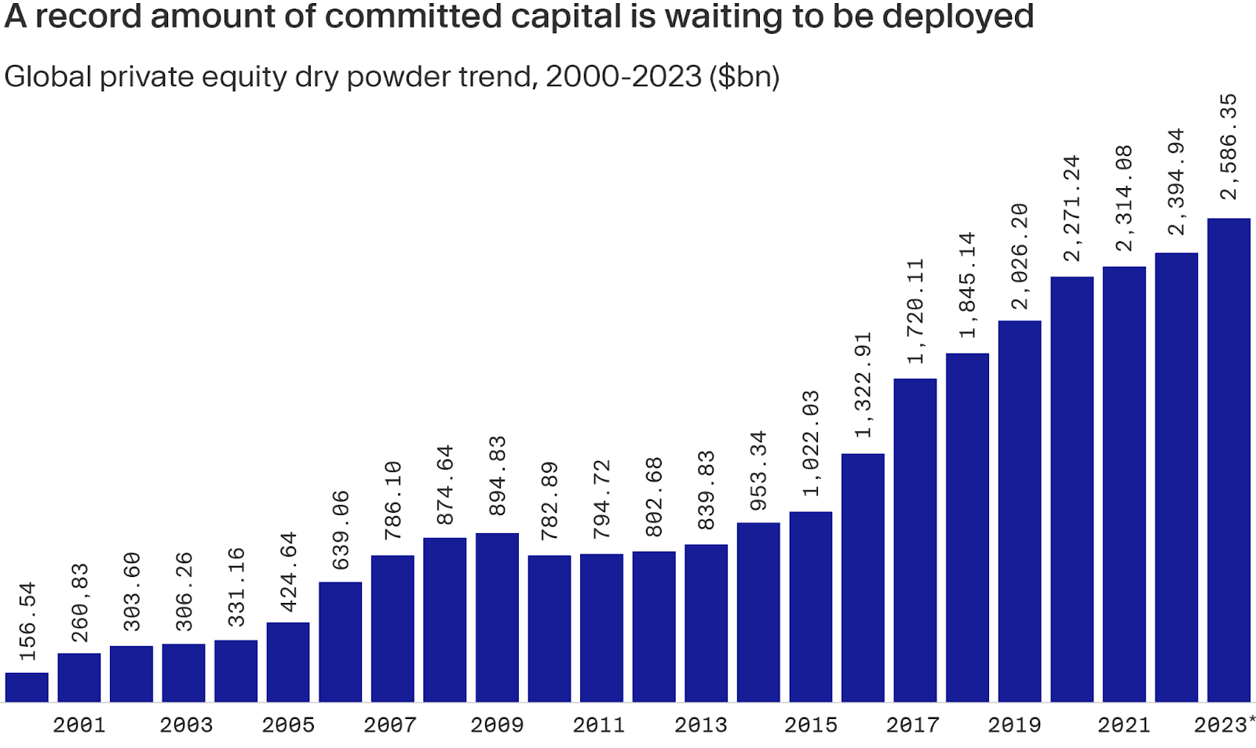

More settled valuations and the weight of capital in private markets — global private equity dry powder reached record levels last December, at $2.59 trillion²⁶ — will drive dealmaking in 2024. Indeed, two-thirds of private equity respondents to an EY survey expect dealmaking to increase through 2024, including over 20% who anticipate a rise of 25% or more.²⁷

(4) GPs could target smaller deals and focus more on operational improvements

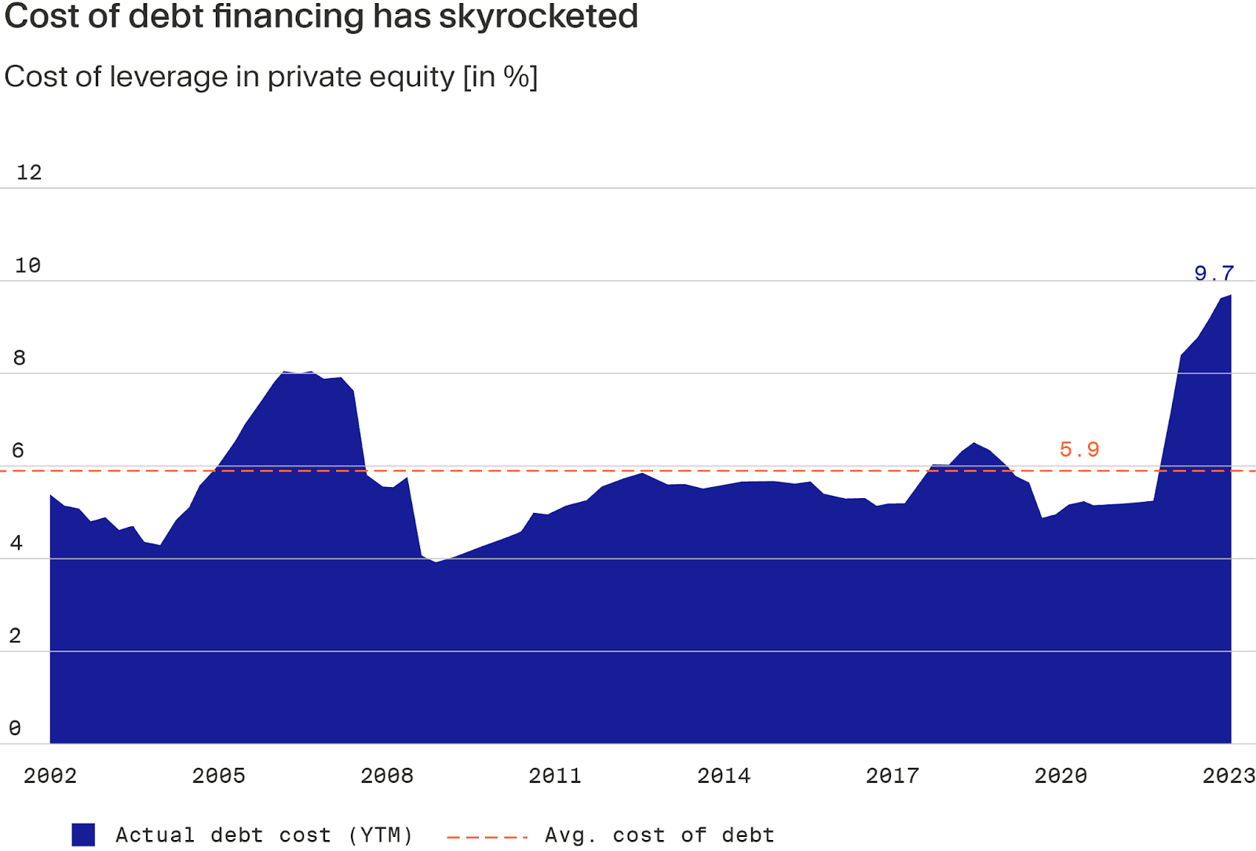

Higher interest rates have increased financing costs considerably over the past 18 months. Although the US Federal Reserve recently signalled a potential 75 bps cut through 2024²⁸, interest rates will likely remain higher than the 12-year period up to early 2022 (see chart).²⁹

GPs are therefore likely to continue taking a conservative stance on the debt quantum for financing acquisitions. Private equity firms increased the equity they invested in deals in 2023, with equity in North American and European transactions averaging 56% of deal value in the first nine months, up from a 10-year average of 46%, according to Pitchbook.³⁰

With more equity invested in portfolio companies, GPs will likely focus more on operational improvements to potentially generate the returns investors expect. They could also skew towards smaller deals than over the past few years to ensure adequate company diversification in funds, while tapping LP capital for co-investments in larger transactions. Exit planning is set to take centre stage, with managers even gauging strategic buyer interest and/or an IPO for assets ahead of deal completion.

(5) Private credit might attract (even) more investors

Private credit has grown substantially as an asset class since the Global Financial Crisis (GFC) as banks retreated from leveraged lending markets. In 2024, private credit could expand further as high interest rates and greater pullback from the banks increase its attractiveness for investors. With 90% of investors saying that private debt has met or exceeded their return expectations in a recent Preqin survey, it’s little surprise that it is forecasting AUM to reach $2.8 trillion by 2028, almost doubling the $1.5 trillion in 2022.³¹

Even with potential interest rate cuts on the horizon, private debt could continue to deliver for investors because returns are partly driven by credit spreads — the difference between base/reference rates and the interest charged on floating rate instruments to companies.

(6) Growth investors will hone in on profitability

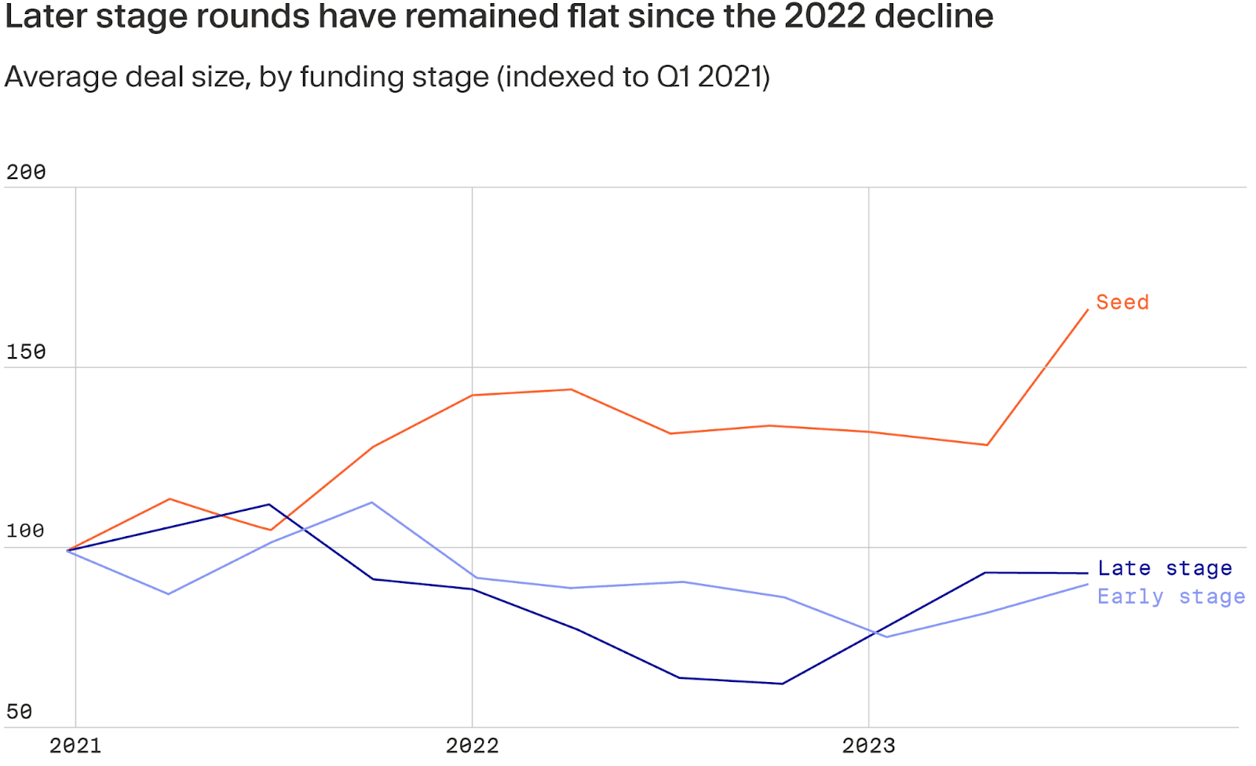

After a heady couple of years, technology stocks fell back to earth in early 2022, with potential repercussions for growth and venture capital investment rounds. Seed stage rounds have continued to grow in value, led by some particularly large investments, including €105 million in French artificial intelligence lab Mistral AI in June 2023³² and $21 million in seed funding for esports business Matchday.³³ However, later-stage rounds have remained flat since the 2022 decline, according to Bain& Co.³⁴

Investors remain cautious, concerned that valuations in some corners of the market could fall further, while a few high-profile venture capital-backed failures, such as cryptocurrency exchange FTX and office group WeWork have dented confidence.

We may see more activity in growth and later-stage investment if valuations continue to stabilise, but the bar will be high. GPs will emphasise company profitability over the kind of future growth projections that captured investor attention in 2020 and 2021.

Overall, VC and growth funds will likely seek to de-risk investments by backing repeat entrepreneurs in non-cyclical sectors, including healthtech and biotech, climate tech, enterprise software and companies with an edge in applying generative AI technology.

Having grown up in a more capital-constrained environment, the next wave of growth companies should be more resilient than those of the recent past – some of the world’s most successful companies, such as AirBnB and Uber, were founded during or just after the GFC.

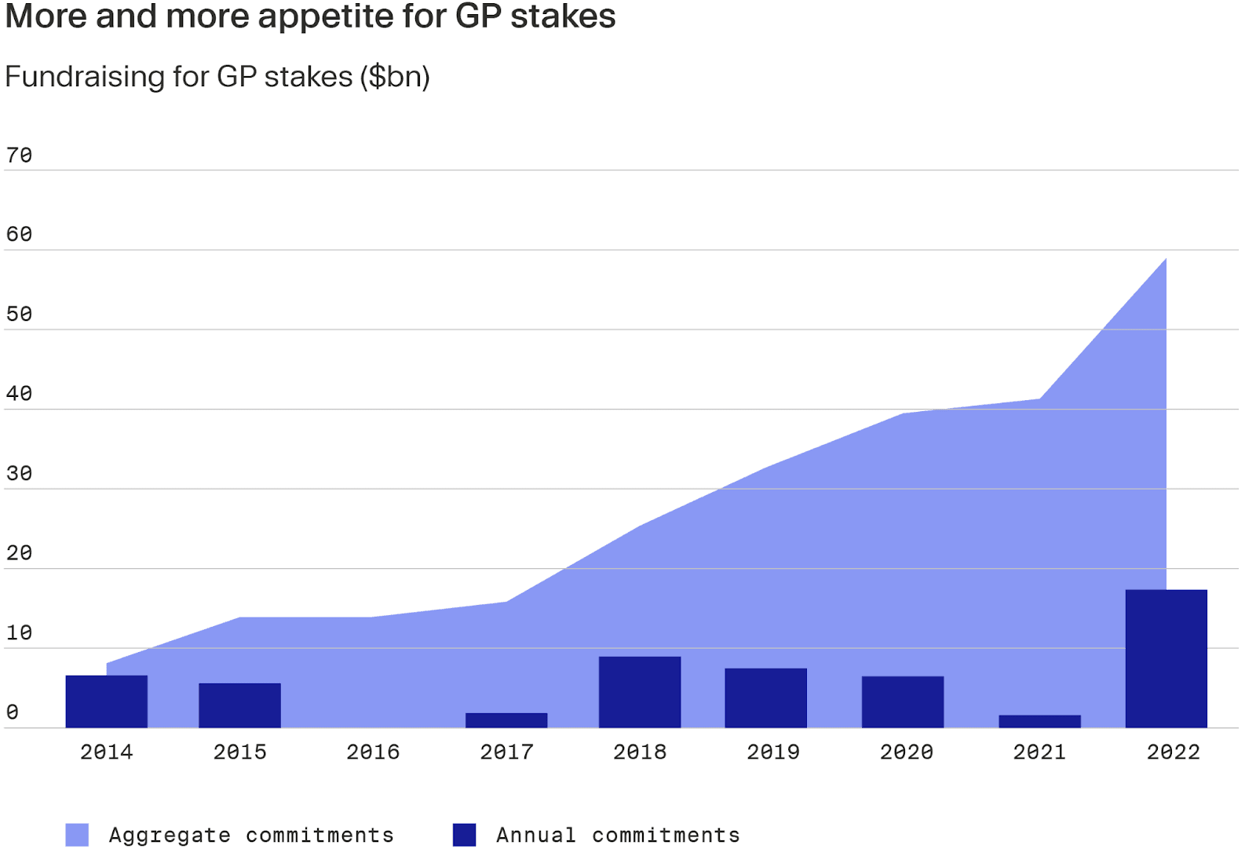

(7) GP stakes sales could come to the fore

These deals which see GPs sell a minority position in their management company in return for a small proportion of the firm’s earnings from fees and carried interest have been around since the early 2000s, but they have gained in popularity over recent times. We expect their number to increase over the next months in what will continue to be a capital-constrained environment — GPs typically use sale proceeds to expand into new strategies, open new offices, buy out retiring founders or finance GP fund commitments.

There are now several firms managing dedicated GP stakes funds, including Blackrock, Petershill (launched by Goldman Sachs), Blue Owl Capital and Investcorp, while others, such as Wafra and Morgan Stanley Investment Management, have also invested in these deals.³⁵ And while there was some initial scepticism about how these deals might exit, some clear routes have emerged as the market has matured. Petershill, for example, sold the interests from its first fund to Affiliated Managers Group back in 2016³⁶, some have generated returns via securitisations, while in others, GPs have re-acquired their stakes.

Investors, meanwhile, appear to have generated solid risk-adjusted returns from GP stakes. With low loss ratios, LP returns have, according to Pitchbook, been in the range of 7% to 10%, or higher in mature portfolios, where firms have grown since the transaction.³⁷

(8) Established firms will retain their allure, but investors will look further afield for alpha

Uncertain times lead investors to tilt their commitments towards established, brand-name managers whose performance they perceive to be reliable and less volatile. We’d therefore expect a continuation of the long-term trend for well-known firms with strong track records to attract substantial amounts of capital.

Yet investors need to build diversification and alpha generation capability into their portfolios and so they will not shy away from smaller funds this year. The top three sectors of interest to LPs in a recent Probitas Partners survey were US mid-market buyouts (78%), US small-market buyouts (60%) and European mid-market buyouts (49%), all of which had improved their standing since the previous year’s poll.³⁸

LPs are likely to target managers with strong track records based on realised investments, and so while some may look at first-time funds, the quality threshold will remain high through 2024.

(9) Private markets firms will invest heavily in AI for their portfolios – and their firms

The market for artificial intelligence (AI) is forecasted to grow 20-fold by 2030, from close to $100 billion in 2022 to nearly $2 trillion.³⁹ And with the potential for massive AI-related disruption, in 2024 private markets firms will likely make significant investments in both new transactions and existing portfolio companies to capitalise on the opportunity. SaaS and other technology-related businesses are likely to be a key focus for investment, but GPs could also target sectors that support AI growth — datacentres, for example, are already a major theme. However, with incumbent tech giants, including Microsoft, Nvidia, Google and IBM, investing heavily in AI capability, standalone AI start-up investment activity may be more muted.

Some firms are also adopting AI technologies in their own organisations. EQT started developing its own AI-based capability, Motherbrain, in 2016⁴⁰, and Blackstone uses AI to assess risks in due diligence and employs data scientists to sit on its investment teams to improve decision-making.⁴¹ We expect others to follow suit over the coming 12 months and beyond.

(10) Deal makers will likely focus on infrastructure, health and other non-cyclical sectors

Economic uncertainty will possibly lead GPs and LPs to investments with low exposure to discretionary spend and that capitalise on the energy transition mega-trend. In a recent survey by Rede Partners, for example, healthcare and impact/sustainability were the top two segments where LPs planned to increase allocations.⁴²

Decarbonisation — aided by policy incentives, such as the US Inflation Reduction Act and the EU’s European Green Deal — will drive more investment into areas such as clean tech, renewable energy, storage solutions, grid networks and mobility sectors. McKinsey, for example, estimates that annual capital spending to phase out fossil fuel-based power generation by 2050 will require an annual average of $1 trillion for power generation, $820 billion for power grids and $120 billion for energy storage.⁴³ In addition, new investment will be necessary to make existing infrastructure assets more resilient to climate change.

Meanwhile, healthcare investments have always been a classic non-cyclical play⁴⁴, but investor interest has been particularly strong since the pandemic brought medical supply security to the fore and accelerated vaccine and new treatment development.⁴⁵

Three key considerations for investors in 2024

In periods of uncertainty, there are three main points investors should keep in mind:

- Look beyond today’s headlines. Private markets faced a challenging 2023 and there are some risks ahead in 2024. However, private market investments made during dislocations have historically outperformed other asset classes over the long run.

- There is virtue in patience. Fund managers’ active management style and built-in flexibility to wait out storms while continuing to build value in companies before exiting are differentiating private markets features.

- Diversification shields against volatility. The scope of private markets investments has widened considerably over the past decade, offering investors the opportunity to diversify and fine-tune their exposures to benefit from different stages of the economic cycle. Our recent survey among Moonfare investors bears this out, with secondaries, infrastructure and private credit strategies all gaining ground among respondents over the past 12 months.

¹ https://www.moonfare.com/blog/private-equity-exit-environment-2023 ² https://www.pionline.com/alternatives/alternatives-managers-hope-rate-cuts-spawn-more-deals-2024-while-battling-new-money ³ https://techcrunch.com/2023/11/28/shein-reddit-ipo-plans/ ⁴ https://techcrunch.com/2024/01/04/vcs-predict-more-exits-in-2024/ ⁵ https://www.buyoutsinsider.com/signs-of-a-banner-year-ahead-in-secondaries/ ⁶ https://www.preqin.com/news/private-debt-in-2024-what-gps-expect-in-the-year-ahead ⁷ https://www.esgtoday.com/blackrock-predicts-low-carbon-transition-mega-force-will-drive-investment-opportunities-in-2024/ ⁸ https://files.pitchbook.com/website/files/pdf/H1_2023_Healthcare_Funds_Report_Preview.pdf⁹ ⁹ https://pitchbook.com/news/reports/2023-annual-global-pe-first-look ¹⁰ https://pitchbook.com/news/reports/2023-annual-global-pe-first-look ¹¹ https://pitchbook.com/news/reports/2023-annual-global-pe-first-look ¹² https://www.ft.com/content/dc45174f-532e-42b2-a0cd-521f77261d22 ¹³ https://www.permira.com/news-and-insights/news/permira-closes-buyout-fund-above-target-at-167-billion ¹⁴ https://warburgpincus.com/2023/10/10/warburg-pincus-closes-on-17-3-billion-global-private-equity-fund ¹⁵ https://www.morningstar.com/economy/fed-inches-closer-2024-rate-cuts ¹⁶ https://pe-insights.com/news/2023/11/28/general-atlantic-and-mubadala-backed-shein-files-for-ipo-in-u-s-targets-90bn-valuation/ ¹⁷ https://www.ey.com/en_uk/private-equity/pulse ¹⁸ https://www.secondariesinvestor.com/lexington-nears-20bn-finish-line-for-largest-ever-flagship/ ¹⁹ https://www.gsam.com/content/gsam/global/en/about-gsam/news-and-media/2023/goldman-sachs-asset-management-raises-15-billion-for-private-market-secondaries-strategies.html ²⁰ https://www.ft.com/content/f7c7abbc-9a26-4df8-a4f3-c86e63b09564 ²¹ https://info.pjtpartners.com/PJT_Park_Hill_Secondary_Market_Insight_Q3_2023.pdf ²² https://www.buyoutsinsider.com/signs-of-a-banner-year-ahead-in-secondaries/ ²³ https://www.preqin.com/news/private-debt-in-2024-what-gps-expect-in-the-year-ahead ²⁴ https://static1.squarespace.com/static/64490f0ae7870656fbebb50f/t/646dd2287bba422d84e4670a/1684918831702/rede_partners_nav_report_2023.pdf ²⁵ https://www.ey.com/en_uk/private-equity/pulse ²⁶ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-firms-face-pressure-as-dry-powder-hits-record-2-59-trillion-79762227 ²⁷ https://www.ey.com/en_uk/private-equity/pulse ²⁸ https://www.ft.com/content/ff1f4787-57fb-4187-a215-5a32c55deeed ²⁹ https://www.commonfund.org/cf-private-equity/the-rising-cost-of-debt-impact-on-private-equity ³⁰ https://www.commonfund.org/cf-private-equity/the-rising-cost-of-debt-impact-on-private-equity ³¹ https://www.preqin.com/LinkClick.aspx?fileticket=g5B8rg94lPI%3d&portalid=0 ³² https://sifted.eu/articles/june-seed-rounds-2023 ³³ https://news.crunchbase.com/venture/seed-stage-funding-trends-2023/ ³⁴ https://www.bain.com/insights/global-venture-capital-outlook-latest-trends-snap-chart/ ³⁵ https://www.institutionalinvestor.com/article/2bstrn5r5qzj5u9yc9a80/portfolio/gp-stakes-investing-remains-robust ³⁶ https://ir.amg.com/news-releases/news-release-details/amg-announces-agreement-invest-leading-alternative-firms ³⁷ https://pitchbook.com/blog/what-is-gp-stakes-investing ³⁸ https://probitaspartners.com/wp-content/uploads/2023/12/Probitas_PESurvey_final_1204_2023.pdf ³⁹ https://www.statista.com/statistics/1365145/artificial-intelligence-market-size ⁴⁰ https://eqtgroup.com/motherbrain/ ⁴¹ https://www.institutionalinvestor.com/article/2c5n7hypxbs38zj9xsutc/portfolio/how-blackstone-sprinted-ahead-of-its-peers-in-ai ⁴² https://www.rede-partners.com/news-insights-database/publication-rede-liquidity-index-1h-2023-report ⁴³ https://www.mckinsey.com/capabilities/operations/our-insights/global-infrastructure-initiative/voices/infrastructure-for-a-net-zero-economy-transformation-ahead⁴ ⁴⁴ https://www.blackrock.com/us/individual/insights/healthcare-stocks-for-resilience-plus-growth ⁴⁵ https://files.pitchbook.com/website/files/pdf/H1_2023_Healthcare_Funds_Report_Preview.pdf