What is a Venture Capital Fund?

A venture capital fund pools money from investors to finance early-stage startup companies. Venture funds focus on companies that have high long-term growth potential and are in need of capital to fuel their growth and development. Venture funds will often look to invest in a particular industry sector, business type, or geographic region where there is substantial growth potential and where they can make the best use of the general partner’s expertise and experience.

Risks at startup ventures are expectedly higher than for public companies and many VC-funded companies are developing new products, trying new business models, or scaling their businesses to a much larger audience. Some have yet to show profitable operations. Venture funds are uniquely suited to offer both financing and expertise to such companies where the rewards for success are proportionately higher as well.

Due to the high number of startup ventures that will inevitably fail, venture funds tend to place modest amounts of capital with a relatively large number of companies that accordingly have larger growth prospects when they succeed. In addition, venture fund managers take a much more active role in their target investments, working directly with entrepreneurs to optimise strategy, use capital efficiently, and go to market quickly.

Venture funds typically aim to exit their investments through an initial public offering (IPO) or through an acquisition by a larger public or private company. GPs may also sell their venture interests to entities that specialise in the purchase of such assets. In this manner, venture firms are able to return capital to their investors in accordance with the fund’s duration expectations.

Venture funds fill an important financing gap for higher-risk companies at early stages of growth, where public equity markets are unavailable and investments are too risky for banks. Venture fund managers also provide seasoned expertise for entrepreneurs with exceptional business ideas and enhance their credibility through their financing relationships.

Ventures have different stages of financing, beginning with the Seed stage (typically investments of $3m or less for the earliest stage startup companies) and progressing to successive rounds of financing (Series A, B, C, etc.) geared to the further development and scaling of the company’s products or services. Venture capital firms may invest only in specific financing stages or may also invest in later stages of the same companies, depending on their strategy.

Key Takeaways

- Venture capital funds provide early-stage financing to companies that have the potential for exceptional long-term growth.

- Venture capital funds typically make small investments for minority stakes in a relatively large portfolio of companies.

- Venture capital managers take an active strategic involvement in target companies, providing guidance and experience to the founders.

- Venture capital funds generally have a longer holding period than other types of private equity funds, working toward IPOs or M&A transactions for their eventual exits.

Venture capital fund structure: A brief explainer

Venture capital funds are typically structured as limited partnerships that are managed by a general partner (GP) and financed by investors who serve as limited partners (LPs). The limited partnership structure has ‘pass-through’ tax benefits over corporate structures that make it preferable for venture funds. GPs and LPs may be individuals or business entities and the partnership structure also offers the flexibility to allow the GP to participate in the profitability of the fund, which aligns the GP’s interests with those of the investors.

The general partner is usually a dedicated venture capital firm with experience and expertise in venture financing. The GP assumes full legal responsibility for the fund’s operation, handling investor administration, and managing the target investments of the fund. The GP is paid a fee by the fund for these responsibilities in addition to a share of the profits. GPs are generally set up as limited liability corporations (LLCs) and larger venture firms may operate as GPs for multiple funds at the same time.

The limited partners are the fund’s investors. They can be high net-worth individuals or institutional investors such as pension funds, insurance companies, or family offices. LPs provide the capital as passive investors and their liability is limited to their investment since management responsibilities and legal liabilities are absorbed by the GP in partnership structures.

A limited partnership agreement (LPA) details the relationship and roles of the GP and LPs in a limited partnership. This legally binding agreement spells out all of the particulars of how the partnership will operate as well as what it plans to invest in and how the proceeds of those investments will be shared.

While the LPs and GPs are legally independent of one another, their interests in the fund are financially aligned and they often work together to resolve issues that arise in the funds.

Venture capital fund life cycle

Venture capital funds tend to progress through four stages in their life cycle. These are described below.

Stage 1:Fundraising

During the fundraising stage, a VC fund will set up its partnership structure, finalise its strategy and LPA, and solicit investors. During this stage, the GP will already be researching and identifying potential targets, setting up its LLC, and assembling its team.

Stage 2:Investment

The investment stage is where the GP identifies specific targets for investment, meets with the founders, and evaluates the target as a potential investment. Once this initial due diligence is accomplished, the fund will begin placing investment capital with selected companies. To make its investments, the fund will issue capital calls to the investors and receive their funds.

Stage 3:Value Creation

During the value creation stage, the GP will monitor its investments, meeting regularly with target companies and providing guidance and strategic advice where warranted. VC funds do not generally assume management roles in their investments, as may occur in other types of private equity funds such as buyouts, but the GPs will work with the company’s founders and management team at a strategic level to offer their expertise and connections.

Learn more about how VC managers add value.

Stage 4:Exits

During the exit stage, the GP works with target companies toward identifying and arranging exits in order to return capital to the investors in the form of distributions. Exits may take the form of IPOs, acquisitions, or secondary sales to other funds or investors. The uncertainties surrounding such exits will frequently require more time than anticipated, which is why holding periods tend to be longer for VC funds than other private equity funds.

Why invest in a venture capital fund?

Venture funds have long held an appeal for investors who want to invest in early-stage, private companies that have the potential to grow into the “next big thing”, such as Google, Airbnb, Uber, Facebook, and Zoom, all of which were initially venture-backed. Investors know that the ability to participate in truly ‘game-changing’ investments like these before they go public happens only through venture capital and other private equity funds rather than public equities.

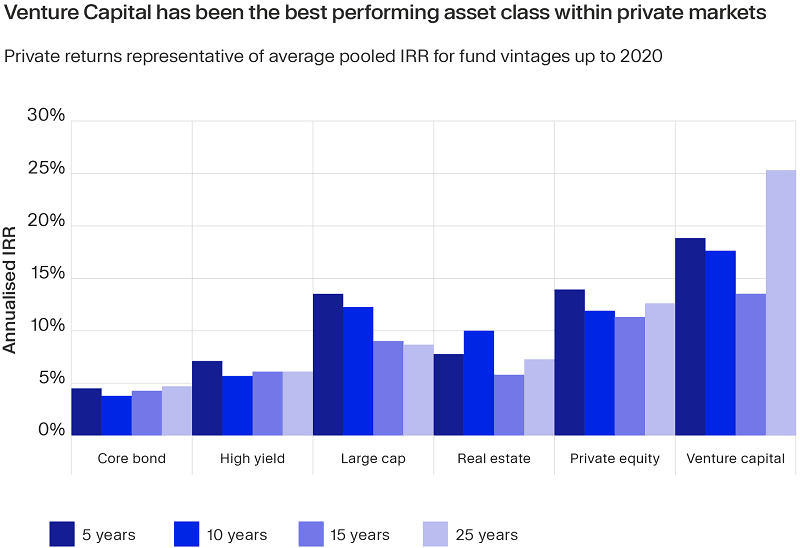

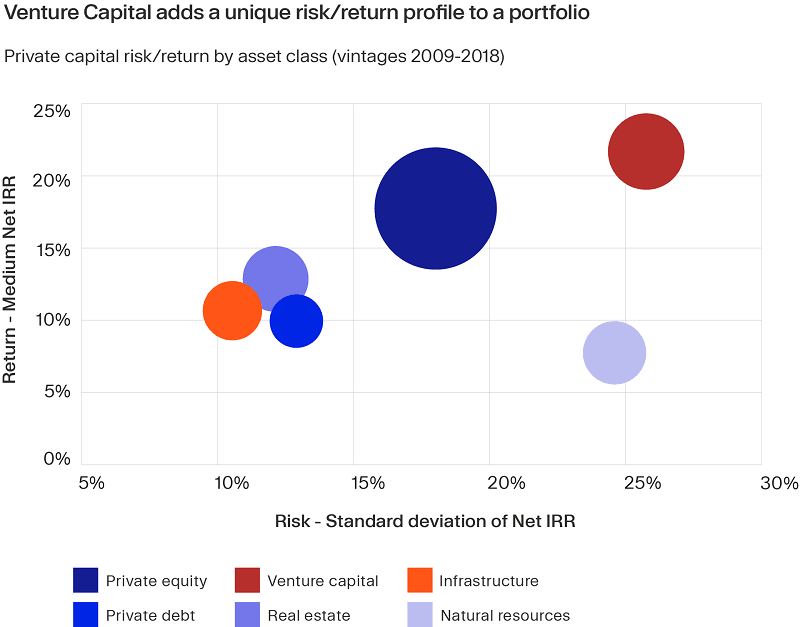

In addition to providing investors with the ability to help drive major technological advancements and unfold new business models, venture investments also have tended historically to outperform public equity as well as other private investment categories.

Data in the table below from Cambridge Associates as of December 2017 shows the performance of the Cambridge Associates LLC US Venture Capital Index vs. a number of public equity indexes.

| Index | Annualised 30-year return |

|---|---|

| Cambridge Associates LLC US Venture Capital Index | 19.07% |

| Dow Jones Industrial Average | 11.68% |

| NASDAQ Composite | 10.66% |

| Russell 2000 | 10.46% |

| S&P 500 | 10.70% |

| Wilshire 5000 | 10.74% |

As shown in the charts below, VC funds have also historically provided the highest returns among the various types of private equity funds.

How to invest in VC funds with Moonfare

Venture capital funds have traditionally been difficult for individual investors to access, catering instead to institutional investors by imposing high minimum investments. Through its feeder fund program and online platform, however, Moonfare provides access to venture capital funds for accredited investors with minimums as low as USD 75K.

Through its expertise in private equity and its due diligence capability, Moonfare can offer funds from top-tier venture capital managers.