What are private markets?

The term “Private Markets” refers to investments in debt or equity instruments that are not traded on public exchanges. The debt and equity components of private markets are individually referred to as Private Debt and Private Equity.

Publicly accessible markets (both primary and secondary) exist in numerous countries for investments that qualify and register as public securities with the regulatory oversight body in each country. In the U.S., for example, securities offered in the public markets must be registered with the Securities and Exchange Commission (SEC).

Only a relatively small percentage of companies tend to be publicly held, so private markets usually consist of many more potential companies, though most are smaller than their public counterparts. According to Forbes magazine, less than 1% of U.S. corporations with employees are publicly traded.

Private market investments are subject to local regulatory requirements, which often restrict buyers of such securities to high-net-worth individuals or institutional investors.

Private markets do not have formal, regulated exchanges and are instead transacted directly between interested parties. To achieve diversification, most private equity and debt investors purchase shares in funds that invest in a portfolio of private companies. Funds will generally contain either debt or equity positions so that investors can choose which of the two types serves them best.

Key Takeaways

- Private markets consist of debt and equity instruments that are not publicly traded.

- Private market investments provide access to innovative, high-potential companies in their early stages of growth.

- Private market investments can be made directly, but are most often made by funds as part of a larger portfolio.

Private vs. Public Markets: What’s the difference?

| Public Markets | Private Markets | |

|---|---|---|

| Who can access? | Anyone | Typically qualifying investors only |

| Types of companies | Public companies | Private companies |

| Available asset types | Stocks, bonds, ETFs | Equity, debt, real estate, closed-end funds |

| Minimum investment size | No minimum | Moonfare minimums\*: €50k in Europe and Asia $75k in the US |

| Access to pre-IPO strategies such as venture investing, infrastructure, and buyouts | Not generally available | Available |

| Access to data on company financials | Publicly available | Available only to private market investors |

| Liquidity | High | Low |

What is Private Market Investing?

Private market investing involves equity and debt financings of private companies. Investors seek private market investments either directly or via funds as part of an alternative investment strategy that can diversify other public market investments.

Private market investments provide access to innovative, high-potential companies in their early stages of growth, thus offering investors a set of investment options that can complement public market assets and provide opportunities for higher long-term returns.

Institutional investors such as pension funds, endowments, insurance companies, and family offices have long been advocates of private market investing (See Types of PE investors for more details). Today, upwards of 25% or more of institutional assets are held in private market investments.

Private markets have been experiencing consistent growth, with their market capitalization outpacing that of public markets on a global scale since approximately 2007. For further details, refer to Private Equity Market Size.

Private Market Investing: Benefits & Challenges

Benefits:

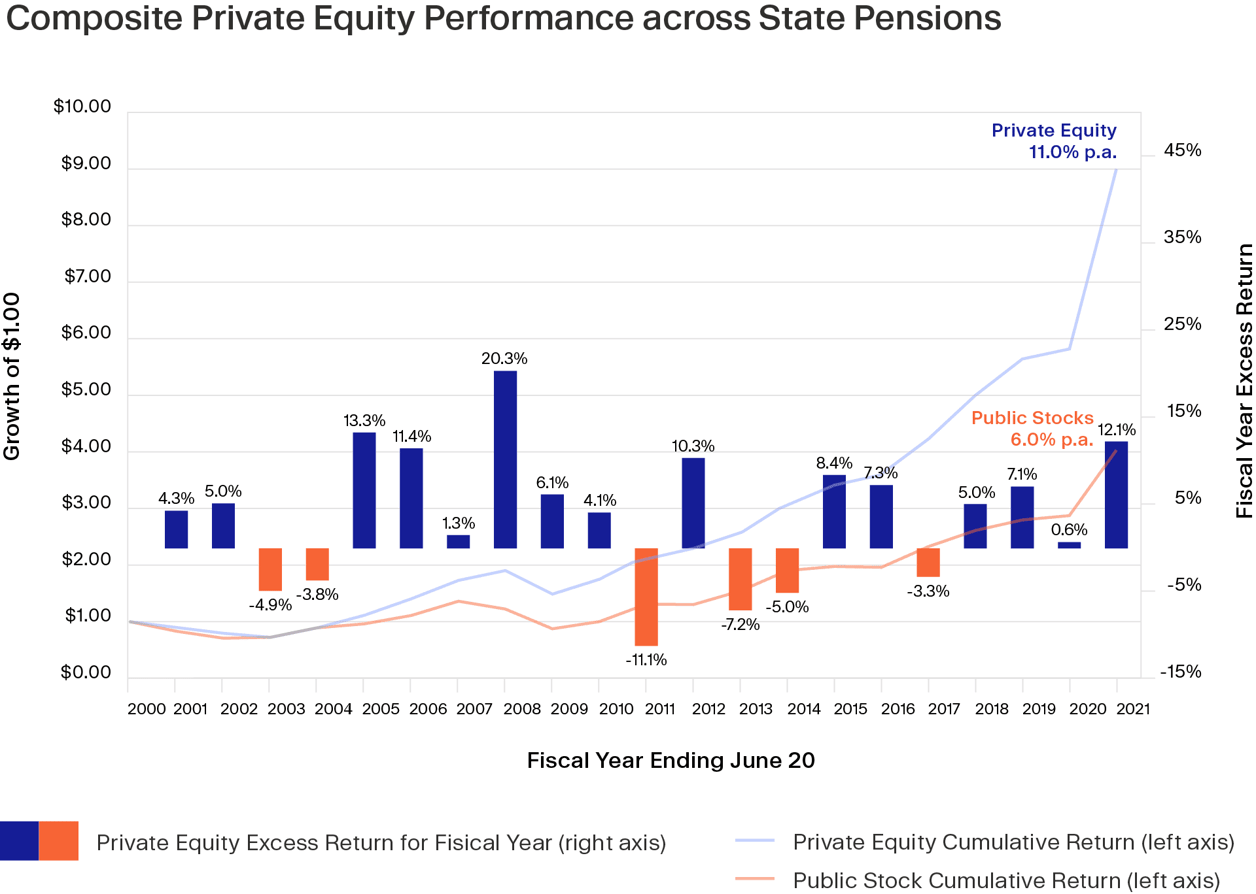

- Higher potential returns – Data shown in the chart below was compiled from state pensions by the Chartered Alternative Investment Analysts Association (CAIA). It shows that for the 21-year period ending June 2021, private equity investments made by state pension funds outperformed public equity investments at 11.0% per year vs. 6.9%.3

- Diversification – Private market assets are not highly correlated with either public equities or fixed income, making them attractive diversification prospects in portfolios with those instruments.

- Choices available – Private companies represent a larger opportunity set. Less than 1% of companies in the US with employees are publicly held. The overwhelming majority are private.

- Unique opportunities – Private assets often represent innovative business opportunities in their early stages.

- Types of assets – Assets such as early-stage startup ventures, pre-IPO buyouts and infrastructure are generally not available in public market securities.

Challenges:

- Low liquidity – There is no formal secondary market for private market assets.

- Long-term investment horizons – Private assets can have time horizons of 10-15 years.

- Historically difficult to access – There is no unified marketplace for private funds. In addition, many private funds are not available to individual investors, even if they are qualified to invest.

- Limited access – Open only to qualifying investors.

- Higher risks – Performance of private assets is typically tied to smaller and younger companies with higher failure rates than public companies.

- High minimums – Some private funds may have minimums of $5-10 million or more.

How to invest in private markets with Moonfare?

Private markets have traditionally been difficult for individual investors to access, catering instead to institutional investors by imposing high minimum investments. Through its feeder fund program and online platform, however, Moonfare provides access to private market funds for qualifying investors with minimums as low as €50,000.

Moonfare also offers a secondary market opportunity through its online platform that provides an opportunity for enhanced liquidity twice each year.

https://www.forbes.com/sites/sageworks/2013/05/26/4-things-you-dont-know-about-private-companies

https://caia.org/blog/2022/07/20/long-term-private-equity-performance-2000-2021