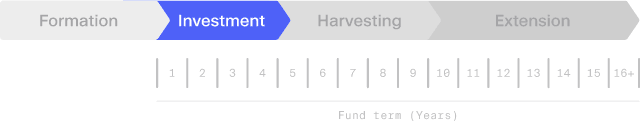

Fund Lifecycle: Investment

Once the formation of a private equity fund is complete, the General Partner will have initiated a limited partnership structure and have received capital commitments from investors. The fund can now enter the “investment period”, wherein the General Partner will identify target companies that fit within the intended strategic goals of the fund and will begin acquiring those shares. To do that, the GP will issue capital calls to investors as capital is required to consummate deals.

As soon as the fund documents are signed, investors become Limited Partners and the General Partnership is born. An investment period usually lasts from three to five years, as would be projected in the offering materials.

An investment period will typically encompass the following activities:

- Management fees are incurred: The formation stage of a PE fund occurs prior to the fund being capitalised. As such, the PE firm creating the fund does not receive any direct compensation for its efforts in creating a fund. During the investment period, however, the PE firm becomes the GP and begins its work on behalf of investors. For these efforts, the GP begins receiving management fees on the Limited Partner’s commitment. This fee is paid whether or not the fund calls the capital or invests using that capital. Some funds charge on invested capital rather than committed capital, but many firms argue that this encourages managers to enter less beneficial deals purely to earn a higher fee. The typical management fee is 2%, but many funds charge less as an incentive to potential Limited Partners to invest. There are usually discounts for certain limited partners, for example, those who commit particularly large amounts to the fund or those who subscribe during the initial closing period.

- Deal sourcing and portfolio construction: In line with the fund’s predetermined strategy, the General Partner actively sources potential investments, develops a pipeline of potential opportunities and carries out due diligence on them. This is a busy period during which the GP negotiates term sheets with target companies and closes deals. To make the investments, the GP will then issue capital calls to the Limited Partners (see below).

- Capital calls: As deals are closed with target companies, the General Partner will contact the Limited Partners - in writing - requesting that they transfer a specified amount of capital (up to their commitment) to the GP within a specific time period (usually 7-10 days). These Capital calls are also referred to as “drawdowns” and the first part of the investment period is also referred to as the “commitment period”, as described in the fund’s offering materials.

- Value creation: The main goal of a private equity firm is to exit an investment at the highest possible value (measured as an “exit multiple” - see “Key Metrics” below). During the holding period (the time between making and liquidating an investment) the General Partner takes an active role in adding value to companies in the portfolio.

Depending on the fund’s strategy, this value creation can take various forms and levels of involvement. Common initiatives include:

- Operational transformation: In modern private equity, this is where the majority of company value is created, with larger firms running dedicated value creation teams that carry out a range of initiatives. Top-line growth can be improved by developing new products, expanding to new markets or carrying out digital transformation. Margin expansion is also a common tactic and might be achieved by reducing operating costs through restructuring to increase efficiency and divesting non-core assets.

- Team development: It’s very common among private equity firms not just to help steer a company in the right direction with board seats, but to help make new management hires. For lower level staff, investments might be made in training and upskilling programs as well as increased hiring efforts - especially when there is a major restructuring as part of the overall strategy.

- Buy-and-build: This refers to the strategy of buying a “platform” company with the intention of making multiple acquisitions as “add-ons” to the base platform. Properly executed buy-and-build strategies add a huge amount of value by expanding scale - both horizontally and vertically - resulting in the final platform company’s valuation being greater than the sum of its parts.

- Multiple expansion: In addition to growing the fundamental value of a company via the examples above, there are other ways to increase the exit multiple of an investment. Since the market perception of a company defines how it will be valued upon exit, multiple expansion through enhanced public perception is one of these techniques. This can be achieved by improving a company’s growth narrative, lowering its risk profile and enhancing the company’s visibility in the marketplace.

- Deleveraging: By improving the cash flow of a portfolio company and paying down debt, the liabilities on a portfolio company’s balance sheet decrease, thereby increasing the company's net value over time. In the early decades of private equity, this method generated the majority of added value, but it is far less of a value driver in modern deals.

The investment period of a private equity fund is the stage in the life of a fund in which the General Partner gets down to the business of putting the investors’ capital to work. This is the stage where the GP applies their skill and experience to identifying, acquiring, and managing the fund’s investments on behalf of the investors in concert with the fund’s intended strategy. While critical to the fund’s ultimate success, however, the investment stage is not the end of the process. Exiting the investments occurs next in the harvesting period.