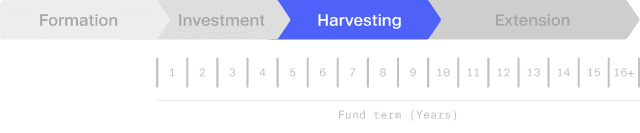

Fund Lifecycle: Harvesting

Once the investment period is complete and the strategy of the fund largely implemented, the General Partner shifts focus from making new deals and growing those investments to realising the value of those investments for the Limited Partners. The GP accomplishes this by arranging exits from target companies that will liquidate the fund’s positions and provide capital to be shared by the GP and the LPs. It is also common for a private equity firm to use this period to set the stage for its next fund.

The harvesting period can be very important in realising the value of the work that the GP has put into selecting and managing target investments. During this period, the GP utilises a different set of skills and judgements aimed at maximising the returns from target investments. Those skills involve determining how and when to maximise the value of each investment and include the following activities:

- Follow-on investments (GP and companies): Often portfolio companies will require further capital beyond the initial investment. This is especially common for early-stage companies going through funding rounds, seeking enough capital to reach certain milestones before the next round begins. Funds take this into account and set aside capital for follow-on investments, to avoid the potential ownership and value dilution if the company were to find funding elsewhere.

- Exiting investments: The goals of an exit are to reap the highest return possible for the fund as well as to provide liquidity to the Limited Partners in the form of capital distributions. In addition, exits are important to the GP as well, since it is largely the source of their incentive compensation. Private equity exit strategies are thus viewed as critical to maximising a fund’s return and General Partners will usually have an exit strategy identified for each investment before it is even made. Common exit strategies include:

- Initial Public Offerings (IPOs). Also known as “going public”, this is where a private company issues shares to the public and becomes a public company. The IPO process is complex and costly, with stringent reporting obligations, but when it is properly executed and timed correctly, it can bring a return for the fund that is generally higher than other strategies. From the General Partner’s perspective, an IPO is not necessarily a “full” exit, since stakes are generally sold to institutional investors before making shares available to the public, at which point the General Partner would likely liquidate their shares.

- Strategic sale. In this scenario, a General Partner sells their stake in the company to a strategic buyer, usually a large public company. For example, if a fund has nurtured and developed a small technology company, it might exit through a strategic sale to a large communications conglomerate looking to acquire the technology or enter new markets.

- Secondary buyout. A secondary sale is similar in nature to a strategic sale, where the buyer is another private equity fund. This would be more common for investments that have not reached the level of maturity required to undertake an IPO or to effect a strategic sale. In some cases the purchasing fund might even be a later-vintage fund managed by the same PE firm. For example, Fund VIII may “sell” their shares of a company to Fund IX to continue growing the investment. This is also known as a ‘continuation fund.’

- Dividend recapitalisations: In some situations, a General Partner will require a company to raise debt in order to pay a special dividend to shareholders, which would include the PE fund. The result is that the fund can recoup part (or all) of its equity investment without exiting, making this a common technique for buyout funds.

- Cash flows and distributions: Once the General Partner starts to exit investments, or carries out dividend recapitalisations, cash will be released to the fund. Capital is then distributed to the Limited Partners and the General Partner in accordance with a payment schedule referred to as a “distribution waterfall”. The distribution waterfall, which is spelled out in the offering documents, is usually customised to the fund and generally has four tiers:

- Return of capital to LPs. Distributions are returned to Limited Partners until they have recouped the full amount that they contributed to the fund.

- Preferred return to LPs. The next step returns distributions to Limited Partners until they receive the “preferred return” stated in their offering materials (usually 8%, but can vary).

- Catch-up and carried interest to the GP. Distributions then go to the General Partner until they have “caught up” with their predetermined percentage of carried interest. For the industry standard of 20% carried interest, the General Partner receives all distributions at this step until profits are split 20% to the General Partner and 80% to the Limited Partners.

- All future distributions are split 80% to Limited Partners and 20% to the General Partner.

Distribution waterfalls can be further characterised as ‘American’ or ‘European’.

- American Waterfall. The distribution schedule is applied on a deal-by-deal basis. This means that only the proportion of Limited Partner commitments and preferred return allocated to that specific deal must be returned to Limited Partners before the General Partner receives distributions. The General Partner benefits here, as they start to receive a return before Limited Partners are fully compensated for their total initial contribution.

- European Waterfall.The distribution schedule is applied on an aggregate fund basis. This means that Limited Partners must receive their full contribution and preferred return before General Partners begin to receive any share of the profit. Limited Partners benefit here, while the General Partner may not see returns until late in the fund’s life. See the importance of cash flows, return profile, and diversification in PE investments for more.

- Extensions: Funds will almost always have optional extensions built into their contracts, usually for two or three years. These extension years are added to the fund’s life if the General Partner feels they are needed to harvest the full potential of investments. For example, if companies have grown at a slower rate than expected but are still on track to IPO or gain significant value within a year or two, the fund might make extensions to take advantage of the expected jump in exit valuation.

- Fund close: At the end of the fund’s life - whether it has been extended or not - all remaining investments must be liquidated and distributions made to all parties. If an IPO or a strategic sale cannot be consummated within the funds expected life, any remaining assets will likely be sold to secondary funds that specialise in acquiring such assets.

Exits represent an integral part of PE fund activities and will have a significant impact on the returns of the overall fund to the investors. Since assets cannot simply be sold on a secondary exchange like public equities, the ability to optimise exits is very much a part of a PE firm’s skill at managing investments.