Private equity investment strategy

A logical approach to private equity investing is to first match your investment objectives with the types of strategies that private equity funds focus on. This will help you narrow the list of available funds to those that fit with your overall objectives – a process that is relatively easy to start with, since you only need to know a fund’s stated strategy to establish whether it is one should look further into.

The strategy will enable you to determine whether the risk/return profile, cash flow, liquidity, or diversification characteristics of the fund are congruent with your investment parameters. You can further establish whether the fund’s style, approach, and vintage are right for you as well.

Once you’ve narrowed the list of funds to consider in this manner, you can then perform the more time-consuming process of due diligence on the fund’s manager and look closer at the details of how they intend to implement their strategy.

Note: If you are open to a variety of PE strategies, you can select a list of the top managers first (a more bottom-up approach), and then select the right strategy from the list below (a top-down process) afterward. That said, we suggest strategy selection first since there are so many private equity funds available, that carrying out manager due diligence on all available fund before narrowing down the list is unlikely to be as efficient an approach.

Types of Private Equity Strategies:

Private equity funds are generally designed to focus on one of the following types of strategies:

- Venture capital – Providing equity start-up capital for early stage ventures, usually in a particular industry sector or geographic region.

- Growth equity – Providing equity capital for later-stage ventures who are looking to scale up their markets or operations.

- Buyout – Focusing on acquiring majority stakes in established public companies in order to take them private and restructure them.

- Private Credit – Providing senior loans to private companies who need working capital.

- Distressed Debt – Loans and borrowings to companies experiencing financial or operational distress, default, or bankruptcy.

- Impact – Investments that are managed with the goal of generating not only a financial return but also a positive social and environmental impact.

- Infrastructure – Supplying capital for large scale projects generally considered to represent public infrastructure.

- Secondaries – Specialising in acquiring shorter-term PE assets from other funds to provide liquidity or assist with arranging exits.

How To Select The Right Private Equity Investment Strategy?

1. Select By Investment Goal (Growth / Value / Income / Diversification)

In public market investing, strategies often direct investors to identify opportunities in style categories, such as Growth, Value and Income. Private equity investors can also split their options into these categories to help identify funds that meet their objectives.

The examples below illustrate how PE investors can match their objectives to the various types of PE funds available. (Please note that these are by no means the only options available and they do not represent recommendations to invest. They are simply intended to help people understand how the various types of PE funds can address common investment objectives.

- Growth.Venture capital and growth equity funds seek out rapid growth, targeting specific industry sectors (e.g. technology) or particular geographic regions. These types of funds will generally invest in a diversified portfolio with minority equity stakes.

- Value.Buyout funds are focused on driving value creation for more mature, developed companies that can benefit from restructuring. Buyout funds will take an active majority role in only one or several companies and will often use leverage.

- Income.Private credit, distressed debt, and some infrastructure funds offer investors an opportunity to generate income or “yield”. Private credit and infrastructure will tend to exhibit a lower risk profile, while distressed debt investments take more risk and may seek both income and appreciation.

- Diversification. Secondaries and buyouts may offer investors the advantages of equity-like growth and appreciation that is less correlated with the performance of public equities and therefore may fit with diversification objectives.

2. Consider The Focus of Investment (Sector/Region)

Most funds will focus their strategy on a particular industry sector or sub-sector. They will also operate in a particular region - even the majority of funds with a global remit will concentrate on a few regions.

In addition to the strategic focus of a fund, you should also consider the following:

- Sectors that might offer diversification benefits with the industries represented in your portfolio

- Sectors that may benefit from long-term themes you have identified

- Regions that might offer geographic diversification benefits

- Regions that may benefit from macroeconomic trends

3. Diversifying across Vintage years

There are several reasons that make it important to diversify private equity investments across vintages:

Smoothing market cycles. Private equity has historically outperformed public equity across full market cycles (see Why invest in private equity?), but returns tend to vary depending on the phase of the business cycle. For example, if a fund starts investing in a downturn, it is likely to have a larger selection of distressed, undervalued assets to choose from, and be able to exit at a point later when the market is peaking. The opposite is true for a fund investing at a market peak: assets are likely to be expensive and run the risk of being undervalued when brought to public markets at exit.

Since the market timing is unpredictable, diversifying across vintages helps to smooth out this cyclical risk, creating a return profile that represents the asset class as a whole.

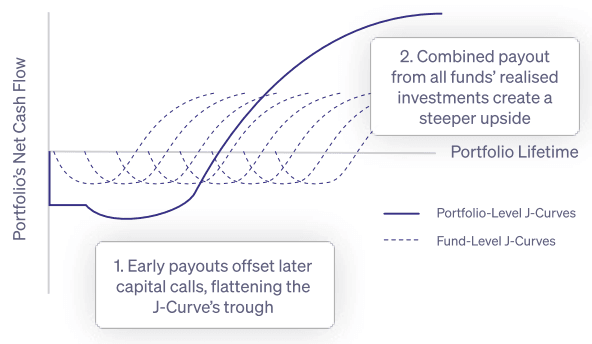

Creating a self-funding portfolio. We covered the structure of private equity returns in How Does Private Equity Work?, and explained why a flatter J-Curve is generally better for smoothing out an investor’s cash flow in Key aspects of PE investments . When it comes to building a portfolio, investors can use this dynamic to their benefit.

By diversifying across vintages, the distributions from an earlier vintage can be reinvested as commitments for a later vintage - creating a self-funding portfolio that increases in value over time.