Key takeaways

- The master feeder structure allows fund managers to expand their investor base, enhancing their capital-raising potential.

- This structure helps optimise tax treatment for investors across different jurisdictions, making it attractive for international investment.

- Feeder funds lower the barriers to entry into asset classes like private equity by pooling smaller investors’ capital into a larger ticket that meets the master fund’s minimum subscription threshold.

Definition and concept

A master feeder structure is an investment fund arrangement commonly used in private equity and the hedge fund world. It consists of a "master fund" that pools capital from multiple "feeder funds”. Each feeder fund gathers investments from a specific group of investors, often differentiated by region, currency or investor type. The capital from these feeder funds is then aggregated in the master fund, where investment decisions are executed collectively.

This structure maintains the centralisation of investment processes and a single investment portfolio. Investors in feeder funds indirectly own a proportionate share of the master fund's assets and returns.

Key components of master-feeder structure

Master fund

The master fund is the central entity where all investment activities occur, including buying and selling assets. It pools capital from multiple feeder funds and operates a single investment portfolio. The performance of the master fund directly impacts the returns of the feeder funds.

Feeder funds

Feeder funds are individual investment vehicles that collect capital from specific groups of investors. They are tailored to different needs, often segmented by jurisdiction, currency or investor type. Each feeder fund invests its capital into the master fund, effectively owning a portion of the master fund's assets.

How does a master feeder structure work?

In a master feeder structure, one or more feeder funds connect to a single master fund. Each feeder fund raises capital from its investors and funnels this capital into the master fund. The master fund then uses this pooled capital to make investments in various assets.

The relationship between the feeder funds and the master fund is symbiotic. Feeder funds benefit from the centralised investment expertise and portfolio management of the master fund, while the master fund benefits from the aggregated capital provided by the feeder funds.

Key stakeholders and roles

- Fund manager: Responsible for investment decisions and management of the master fund's portfolio.

- Investors: Provide capital for the feeder funds and benefit from returns generated by the master fund.

- Service providers: Include administrators, custodians and auditors who ensure smooth operation and compliance.

- Regulators: Oversee compliance of both feeder funds and master funds with applicable laws and regulations.

Benefits of master-feeder structure

For investors

- Access to professional portfolio management and diversified investments

- Tailored investment options based on jurisdiction or investor type

- Lower barriers to entry for accessing private markets

For fund managers

- Ability to attract a broader investor base and raise more capital

- Larger investment opportunities through the aggregation of capital

Tax benefits

The structure enables tax optimisation by segregating investors into different feeder funds based on their tax jurisdiction. This can result in more favourable tax treatment for investors and avoid double taxation. For example:

- US taxable investors: A feeder fund structured as a domestic partnership or corporation.

- US tax-exempt investors: A feeder fund structured to avoid Unrelated Business Taxable Income (UBTI).

- Non-US Investors: An offshore feeder fund in a tax-neutral jurisdiction like the Cayman Islands or Luxembourg.

Variations and comparisons

Common variations include:

- Single master, multiple feeders: The most common setup.

- Multi-master, single feeder: Less common, where a single feeder fund invests in multiple master funds.

- Parallel funds: Separate funds invest directly in the same deals or assets, but they are kept as distinct entities with no pooling of capital into a master fund.

Compared to standalone funds or funds of funds (FoF), the master feeder structure enables managers to expand their investor base and lower barriers to entry for smaller investors.

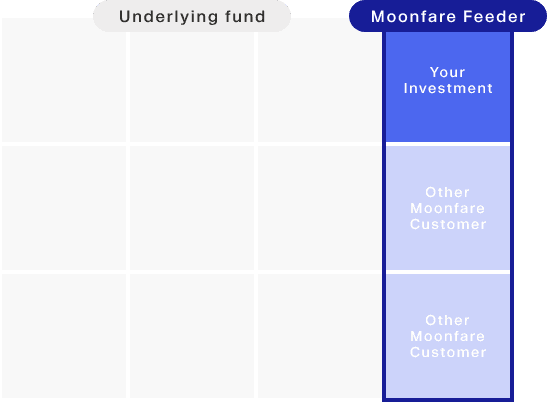

Real-world application: Moonfare

Moonfare utilises a master feeder structure to make private equity accessible to individual investors. It pools commitments from individual investors into Luxembourg-based feeder funds, which then invest directly into underlying target funds. This approach lowers the minimum investment threshold while ensuring secure management of investors' capital. Learn more at moonfare.com/private-equity-investments

Regulatory compliance

The master feeder structure must comply with various regulations depending on the jurisdictions in which the feeder funds and master fund operate. Key areas of regulation include:

- Securities laws

- Tax regulations

- Anti-money laundering (AML) and know your customer (KYC) requirements

Fund managers must ensure compliance with all relevant regulations to avoid legal and financial penalties.

The master feeder structure is a versatile and efficient investment fund arrangement that allows for centralised management of capital while catering to diverse investor needs. Its benefits, including tax efficiency, cost savings and global reach, make it an attractive option for both investors and fund managers. However, complying with strict regulatory obligations is critical to successfully implementing and managing a master feeder structure. At Moonfare, this structure is used to democratise access to private market investment opportunities.

![[WhitePaper] Moonfare Pulse 2024: investment trends in our community](/cdn-cgi/image/width=1256,quality=75,format=auto/https://publiccdn-production.moonfare.com/strapi/production/mw_ctas_1bf8139e3e_c72ee24fda.jpg)