What is a fund of funds?

A fund of funds (FoF) is an investment vehicle that holds shares in other funds rather than in individual securities or private assets. The fund-of-funds approach offers diversification and other benefits to investors in private equity funds.

Key takeaways

- A fund of funds invests in shares of other funds rather than in individual assets or securities.

- A fund of funds offers diversification in asset types or classes as well as in asset managers, locations, strategies and vintages.

- FoF investors get the convenience of a single diversified investment with professional management and in the process, they may have access to individual funds that might not otherwise have access to.

- FoFs include additional fees to investors for their role in fund selection and management.

Private equity fund of funds have been available since the late 1970s and are typically held by high net-worth investors and small to mid-size institutions who want exposure to a portfolio of PE funds in a single investment vehicle.

An individual PE fund typically has a specified strategy or investment focus and consists of numerous assets that fit that focus. A private equity fund, for example, might be focused on venture capital assets, buyouts, growth portfolios, infrastructure or co-investments and hold assets in a particular industry, such as the fintech industry. A fund of funds with a venture capital focus might hold shares of a fintech VC fund along with shares in an edtech VC fund, a SaaS VC fund and a green energy VC fund.

While fund investing provides investors with asset diversification, investing in funds of funds can add several other forms of diversification into the mix, such as:

- Asset class diversification

- Manager diversification

- Strategy diversification

- Geographic diversification

- Vintage diversification

Such diversification can be achieved directly by purchasing shares in multiple funds, but with minimums that can be upwards of $5-10 million or more, that option is only available to large institutional investors who have the necessary capital and the resources to perform due diligence across a wide range of funds and managers to make their selections.

For smaller investors, a fund of funds provides a way to achieve fund diversification across several dimensions with the convenience of a single investment and the expertise of professional managers in constructing the portfolio. In addition, FoFs can sometimes offer investors access to individual funds that might not otherwise be available to individual investors at all.

How funds of funds work in private equity

The structure of a fund of funds is a limited partnership, similar to that of an individual private equity fund. There is a general partner that operates the FoF and manages the investments, while the limited partners provide the investment capital.

The GP decides what funds to invest in and in a FoF the investments can generally be made quickly since the funds are up and running and there is no need to wait for a funding round as can be the case when investing in specific private companies.

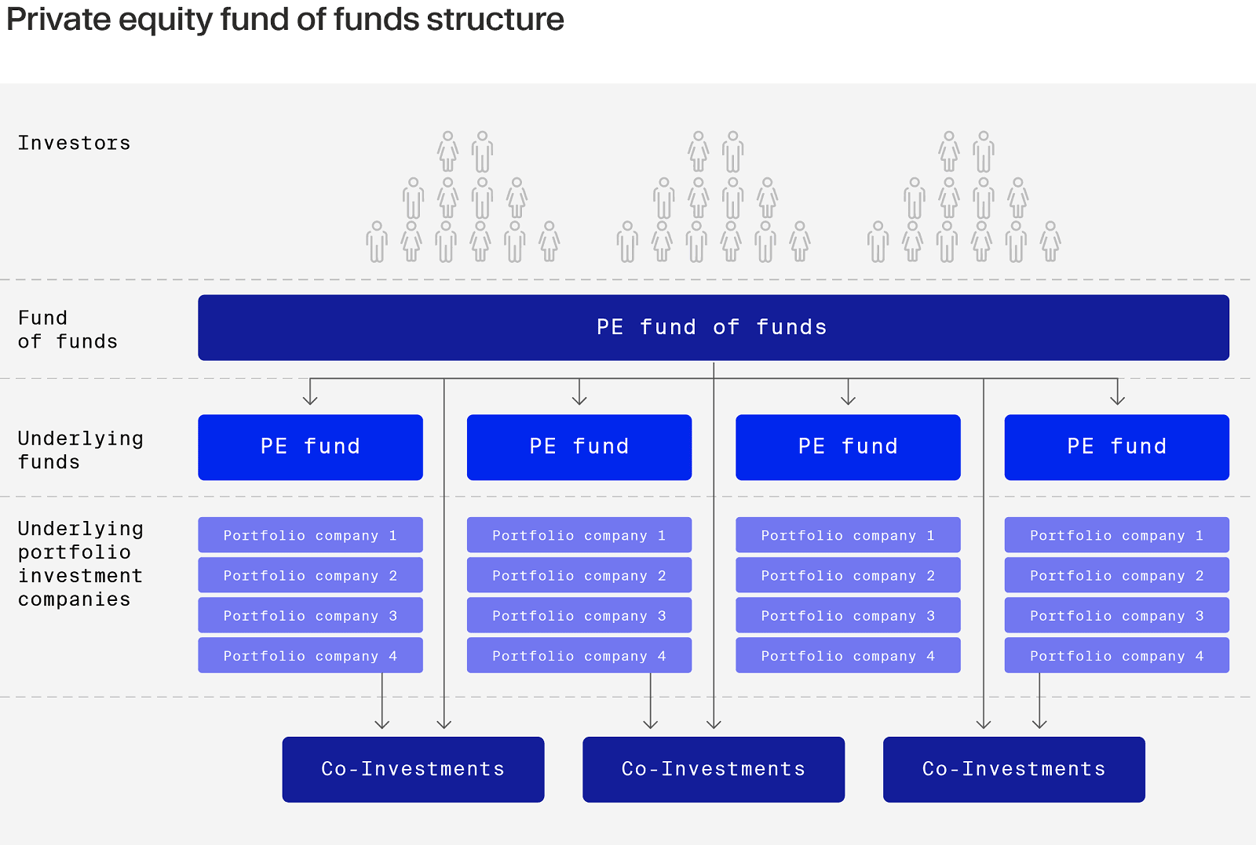

The diagram below illustrates the structure of a fund of funds.

Points to consider

Investors should be aware of several considerations that are unique to funds of funds vehicles:

- Blind pool risk: Unlike regular private equity funds where investors have knowledge of the asset class, industry, manager and type of assets included in their fund, funds of funds are considered 'blind' investments with no prior knowledge of the specific funds the FoF invests in. However, Moonfare addresses this risk by creating portfolio funds focused on specific strategies and pre-selecting managers prior to launching the portfolio, thus providing a level of risk mitigation.

- Longer fund duration: FoF investments may span longer time intervals as their duration must accommodate the longest duration fund in the portfolio. Moonfare, however, seeks to deploy its FoF products on an annual vintage basis rather than over several years to mitigate the impact of longer duration.

- Double layer of fees: FoFs include an extra layer of fees to the FoF general partner.

Benefits of private equity funds of funds

Benefits to investors in fund-of-funds investments include:

- Additional diversification in asset classes, fund managers, geographic locations and fund vintages

- Due diligence on fund selection (which can be particularly beneficial due to the dispersion of returns among PE funds and managers)

- Lower minimum investments and access to funds with high minimums or to niche funds that are otherwise closed to individual investors

Funds of funds structure and fees

The fee structure for a fund of funds includes the fees charged by the managers of the individual funds in the portfolio plus a fee charged by the general partner of the FoF. The typical fee structure for private equity funds, particularly traditional buyout funds, is described as “2 and 20”. That means the general partner charges a 2% management fee on your investment plus a performance fee of 20% on your gains from the investment.

The FoF charges investors a fee on top of the individual funds, which is similarly structured, though lower. A typical FoF fee would be “1 and 5”, which means a 1% management fee on your investment plus a 5% performance fee on the gains from the investment. Similar to individual funds, most FoFs also have to meet a certain hurdle rate in order to receive their share of the performance fee, also known as ‘carried interest’.

How to invest in PE funds of funds through Moonfare?

Moonfare provides access for individual investors to FoF investments through feeder funds that aggregate investor capital to meet the high minimums in portfolio offerings. In addition to providing minimum investments as low as €50,000, Moonfare conducts rigorous assessments on available funds, establishes long-term relationships with fund GPs and helps investors with administration and cash flow requirements on their investments.

Moonfare’s portfolio offerings include:

- Moonfare Venture Portfolio

- Moonfare Buyout Portfolio

- Moonfare Growth Portfolio

- Moonfare Co-Investment Portfolio

- Moonfare Infrastructure Portfolio