![[VIDEO] What is private equity co-investing and why consider it?](/cdn-cgi/image/width=1256,quality=75,format=auto/https://publiccdn-production.moonfare.com/strapi/production/mw_blogs_29895ce8d2_57f23b9295.webp)

Key takeaways

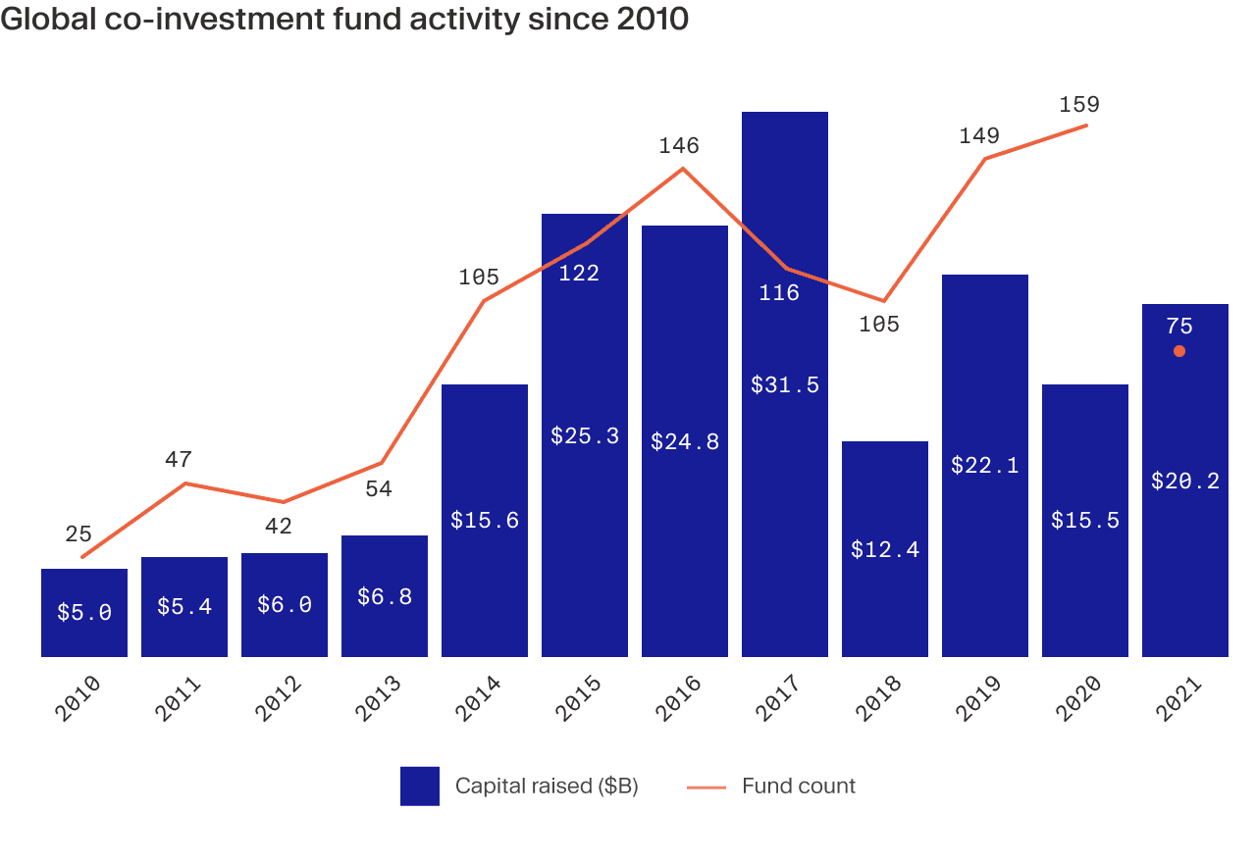

- Appetite for private equity co-investments has exploded during the last decade, according to PitchBook data. Despite the current array of market challenges, interest in the asset class continues to grow.

- Fees and carried interest charges on co-investment opportunities are materially lower than for traditional private equity funds, and offer investors more control, visibility and diversification across their private equity portfolios.

- Co-investing does require careful consideration, as investors need to have additional resources and experience to assess individual deals.

- Co-investments are particularly relevant during periods of macroeconomic volatility by providing flexibility to temper the pace of deployment in line with risk appetite.

Editor's note: This article was updated on 4 May 2023.

What is a co-investment?

Not merely satisfied with having access to private equity funds, some investors are increasingly partnering with general partners (GPs) to invest directly alongside them in individual deals.

Private equity co-investments allow investors to back individual deals alongside managers, rather than investing in 10-year blind pool private equity funds.

Interest in this type of investment has skyrocketed in recent years. Analysis from law firm Troutman Pepper shows that fundraising for co-investment-focused funds has quadrupled over the last decade, climbing from US$5 billion in 2010 to more than US$20 billion in 2021.

The growth in co-investments has opened up new avenues for investors to construct their private portfolios and build out exposure to the asset class. Investors can access co-investment opportunities in different ways too, providing more flexibility in portfolio construction. Single co-investments are offered to existing investors in private equity funds to double down on individual deals. There is also the option to invest in specialised, closed-ended co-investment funds that invests alongside top-tier fund managers that have shown a proven track record.

Well positioned to weather the storm

Appetite for co-investments is expected to increase despite the current market turbulence. According to a December 2022 Private Equity International study, nearly two-thirds of institutional investors plan to participate in co-investment opportunities over the next 12 months. Family offices share similar sentiments. More than a third identified venture co-investments as a future opportunity, according to our recent family office survey, compared with 27 percent currently allocating towards it. Future interest across growth, buyouts and debt also increased relative to their current usage.

Indeed, many institutions see co-investments as a critical element to their long-term strategies. For example, the California State Teachers’ Retirement System — the second largest pension fund in the U.S. as of January 2023 — estimates that co-investments will account for a third of its annual private equity commitments by 2024. This is not only a significant increase from merely five percent in 2018, but also a sizable jump from the current 20-plus percent.

Interest in the asset class is flourishing despite current economic sentiment, with some even predicting co-investments may even capitalise on an overall more depressed fundraising environment. As Alexandre Motte, managing director and head of co-investments at Ardian, one of the largest European private equity funds, recently said: “As fundraising becomes more challenging, firms may want to offer increased co-investment, both due to smaller fund sizes and to please their limited partners (LPs). Debt may also become scarcer as banks pull back, further increasing demand for co-investments.”

How it works

Co-investments give investors the opportunity to make minority investments in individual companies alongside private equity managers. Private equity firms will invite their co-investors to back specific, hand-picked deals, allowing them to have visibility on what they will be investing in, and the discretion to accept or decline as they require. This is unlike investing in traditional, 10-year private equity fund structures where a manager raises money against a specific investment strategy, and investors do not know what companies will be acquired through the life of the fund.

Benefits of co-investing

The product has gained in popularity for several reasons, but arguably the biggest appeal has been the attractive economics of co-investments. Unlike private equity funds, which typically charge a management fee of two percent and carried interest of 20 percent, single co-investment deals will typically be offered without incurring any management fee or carried interest charges at all. Investments made via co-investment funds are typically charged a one percent fee and 10 percent carried interest.

Co-investors can also gain more control over their private equity portfolios. Investors with specific geographical or sector insight, for instance, can leverage their knowledge by choosing deals that map onto their expertise. In a fundraising market where blue-chip managers regularly have to cap allocations to their primary funds to accommodate demand, co-investing gives investors scope to increase their exposure to top-tier managers by investing alongside them on individual deals.

Investors who are still building out their private equity allocations also benefit from co-investing as it helps to accelerate deployment into the asset class. For example, doing due diligence on a relatively illiquid 10-year blind-pool fund for the first time can take significant amount of resources. In a co-investment scenario, however, an investor can deploy additional capital on top of a primary fund commitment, with a manager that has already been vetted. Investing in a deal alongside a manager you have already backed, and are familiar with, is more streamlined than starting a due diligence from scratch. The value of the insight that co-investing offers into how a fund manager sources and executes deals should not be underestimated, either.

Finally, co-investments have proven particularly relevant during and after periods of macroeconomic and geopolitical volatility. When there is little visibility in markets, making a long-term commitment to a 10-year fund can be daunting. Co-investing allows investors to continue deploying money into the asset class while providing the flexibility to temper the pace of deployment in line with risk appetite.

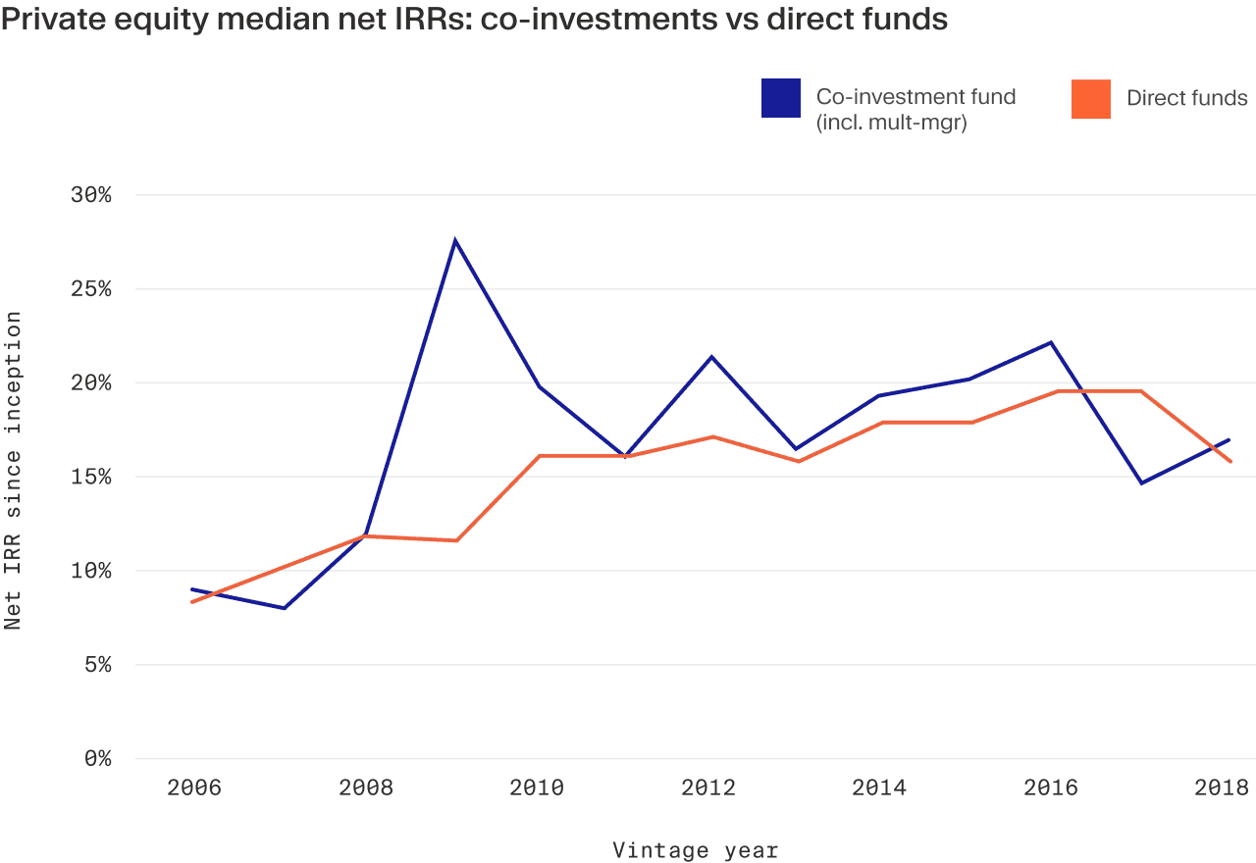

Co-investments have also been shown to potentially deliver outperformance over time. A 2016 study by academics from the universities of Munich and Oxford, for example, suggests that well diversified portfolios of 10 or more co-investments outperform fund returns. In addition, BlackRock’s analysis of Preqin’s performance data shows that co-investment funds outperform direct private equity funds in 9 out of 10 recent vintage years based on the median net internal rate of return (IRR).

Risks of co-investments

As with any investment, co-investing comes with certain risks and investors stand to lose all capital invested. Co-investments should only comprise a small percentage of the overall portfolio. Issues include a lack of visibility of what the deal pipeline is; it is impossible to tell in advance what the quality of the deals will be that come forward as opportunities. Co-investing also requires spending resources on teams with the experience to assess deals on an individual basis. LPs need to make quick decisions off the back of these assessments as well, which requires resources and experience.

Investors who go in with their eyes open, however, can mitigate these risks to some degree. Adverse selection, for example, is less likely with reputable private equity managers who are inclined to offer the pick of their deal flow up for co-investing, given the importance of nurturing long-term investor relationships. It is important to remember however, that even for managers with strong track records, past performance is not indicative of how future investments might perform.

Investors also have the opportunity to undertake their own due diligence, adding an additional layer of scrutiny to investment decisions. Even in a scenario where a co-investment deal ends up underperforming the multiple on invested capital (MOIC) of a fund as a whole, the lower fees and carry on co-investment can still see an investor come away with net returns that are on par–or even better–than overall fund performance.

Co-investing in practice at Moonfare

The Moonfare platform has built up extensive experience sourcing, executing, and managing co-investment deals. The firm has a team of 10 investment professionals with extensive experience and a pool of more than 250 active GP relationships.

This scale has given the team the resource and insight to screen the market for the best opportunities, secure quality co-invest deal flow, conduct effective due diligence and execute on the selected deals.

The firm undertakes its own due diligence, works through all GP due diligence and has been known to close a co-investment deal within four to five weeks. Moonfare’s capability, and the team’s experience, has enabled Moonfare to land co-investments with some of the industry’s best managers. Highlights include deals alongside top-quartile managers Insight Partners and Cinven to acquire data aggregation and analytics platform Inovalon and wealth manager True Potential respectively.

Embarking on co-investments does require careful thought and preparation, but private equity investors should be considering it given the attractive economics, diversification, and flexibility it offers.