Key takeaways:

- Deal activity in venture capital rebounded robustly in the first half of the year, closing in on the full-year total for 2024.

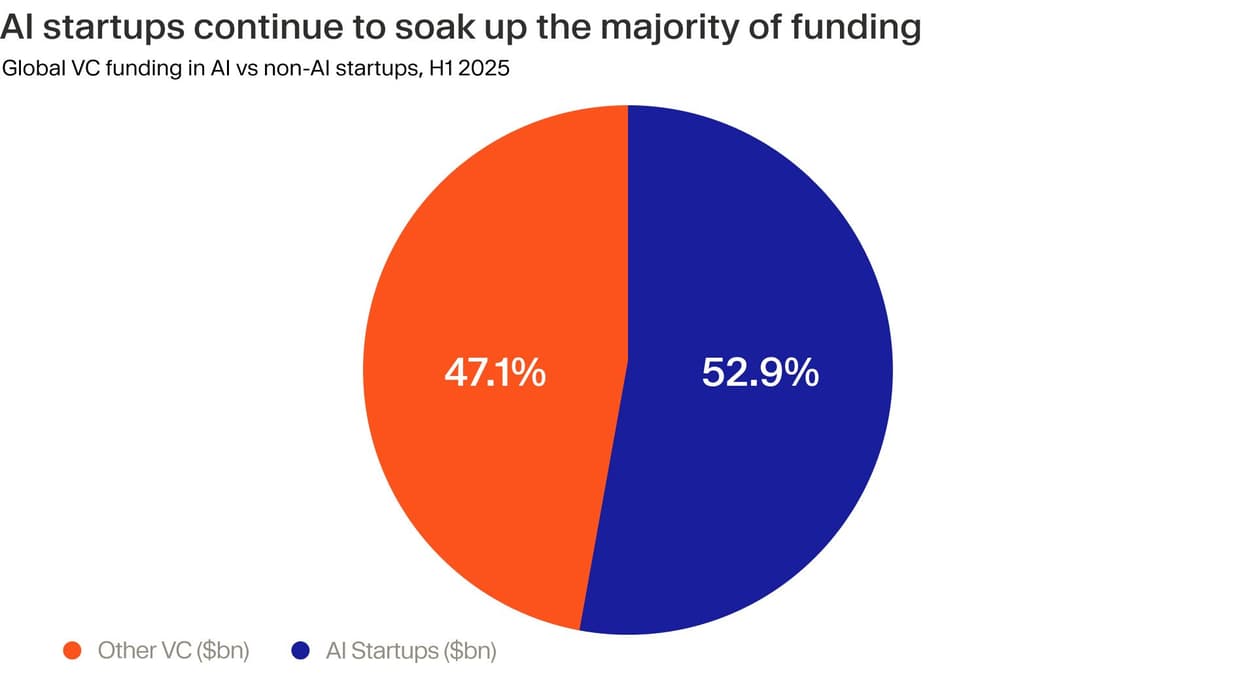

- AI has become the clear investment focus, accounting for more than half of invested VC dollars globally in H1.

- Fundraising remains highly concentrated, with only the strongest brands able to raise fresh capital with ease.

After two difficult years, venture capital is showing signs of life. Investment levels have stabilised and exits are cautiously returning.

Fundraising, however, tells a more uneven story: while large, brand-name firms continue to raise multi-billion-dollar vehicles with relative ease, smaller and emerging managers are finding the process far less forgiving.

Yet one theme stands above all else: artificial intelligence. The search for the next AI champions has become the defining feature of the market in 2025 and that does not appear to be changing any time soon.

Global overview: investment stabilises

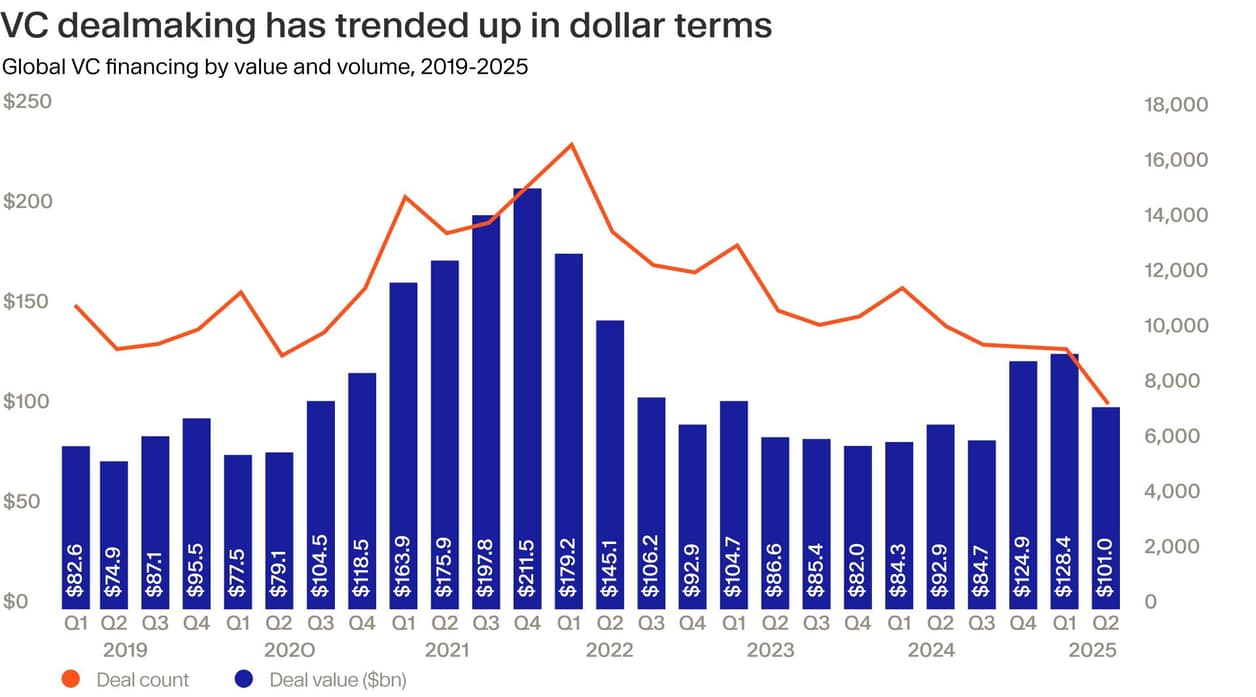

Venture investment has held up surprisingly well given persistent macro headwinds. KPMG data shows global VC-backed companies raised $101 billion across 7,356 deals in Q2, down from $128 billion in Q1.¹ That decline, however, was largely the result of OpenAI’s extraordinary $40 billion raise in March. Excluding that outlier, deal activity has remained steady.

CB Insights reports an almost equally strong showing: VC funding has already reached $219 billion in H1 2025,² closing in on the full-year total of $275 billion for 2024.³ Yet much of this performance stems from a handful of outsized financings skewing global totals.

Geographically, the US continues to dominate. Nearly 70% of global VC investment in Q2 flowed into US startups, including all six billion-dollar-plus rounds during the quarter. Europe has lagged, with investment dipping to $14.6 billion, while Asia remains muted at $12.8 billion, dragged down by a sharp slowdown in China.⁴

AI dominates dealmaking

If 2022 was the year of climate tech⁵ and 2021 the year of crypto,⁶ 2025 belongs to AI.

According to CB Insights, funding to AI startups hit $47.3 billion across 1,403 deals in Q2 alone. Together with Q1, that brings the H1 total to $116 billion, already exceeding all of 2024.⁷

The largest VC rounds underline AI’s grip on investors. Scale AI drew a staggering $14.3 billion investment from Meta, which acquired a 49% stake in the data labelling company.⁸ Elon Musk’s xAI secured a multi-billion dollar raise,⁹ while Thinking Machines Lab¹⁰ and Safe Superintelligence¹¹ each pulled in $2 billion.

In defence tech, Anduril closed a $2.5 billion round in the US,¹² while Europe saw Munich-based Helsing attract $683 million¹³ and Portugal’s Tekever secure $500 million.¹⁴

Defence has become one of the most dynamic AI sub-sectors, with geopolitical tensions creating tailwinds. Helsing’s rise is emblematic of this rise to prominence: once viewed as a niche player, the company is now considered one of Europe’s most strategically significant startups.

Yet while infrastructure and frontier model developers are still raising the biggest rounds, investors are already looking ahead. CB Insights points to a shift from infrastructure to applications, with capital increasingly targeting the vertical integration of AI into sectors such as healthcare, finance and legal tech.

Fundraising: A tale of two halves

Another defining feature of the market is the extreme concentration of fundraising. PitchBook estimates that just 12 firms collected more than 50% of all venture capital raised in H1.¹⁵

Founders Fund led with the largest raise, closing a $4.6 billion vehicle. Lightspeed, Andreessen Horowitz and Khosla Ventures are also in the market with multi-billion-dollar funds.

What unites these firms is a combination of unrivalled deal flow, privileged access to the most promising startups and track records that gives LPs confidence even in uncertain times. These characteristics are precisely what gives them an edge as investors clamour for AI exposure.

The picture looks very different further down the market. Many mid-sized and first-time managers are taking far longer to close funds or are scaling back targets altogether, reflecting LPs’ preference for brand-name franchises.

Median time-to-close for US funds has stretched beyond 15 months,¹⁶ the slowest pace in over a decade. For LPs, the choice is partly defensive: in a riskier environment, they would rather concentrate commitments in a small number of managers with proven access to AI’s hottest companies. The result is a widening gulf between a handful of global firms that can still raise with ease and the long tail of managers who are struggling to keep up.

Exit markets pick up, cautiously

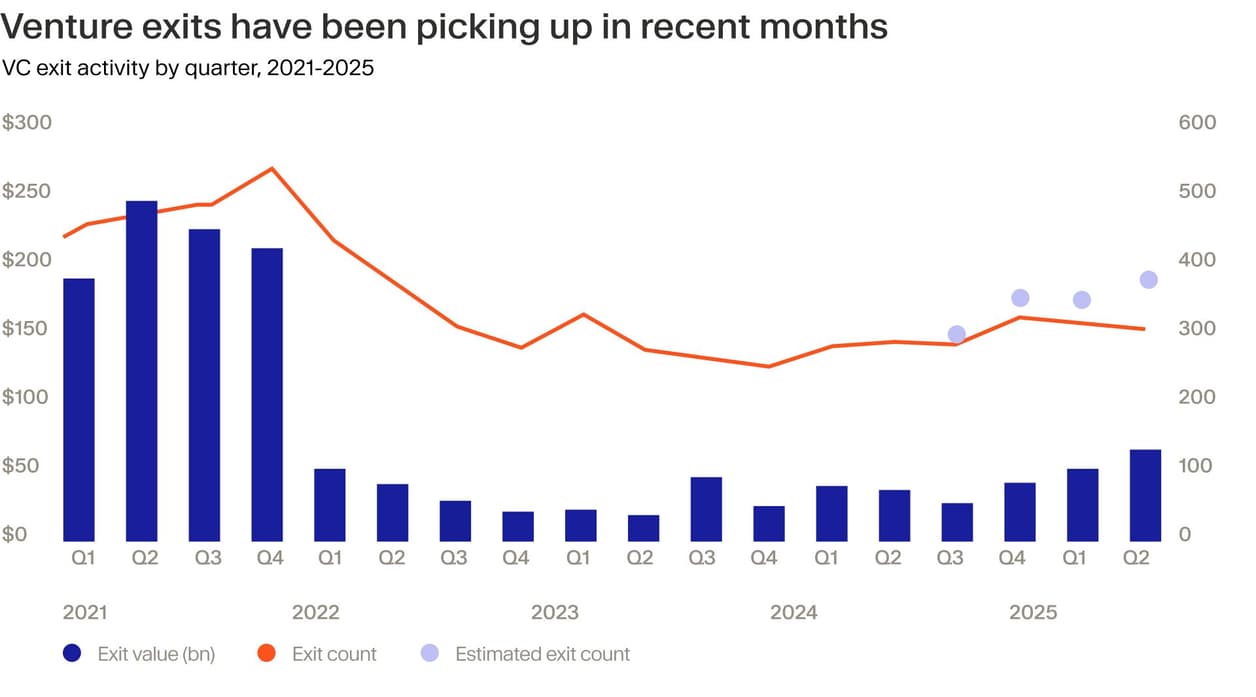

Exits, after three years of drought, are finally stirring. According to PitchBook, exit value climbed to $24.3 billion in H1, up 16% from $20.9 billion a year earlier, even as the number of exits fell 16% year-on-year to 400 from 478.¹⁷ This signals that while liquidity remains selective, quality companies are finally finding paths to market.

VC-backed IPOs and M&A deals gained momentum in Q2, particularly in sectors aligned with US policy priorities such as AI, defence, fintech and crypto. The second quarter saw high-profile listings from USDC stablecoin issuer Circle, neobank Chime and trading platform eToro, alongside continued speculation about payments fintech Stripe and xAI preparing to go public.

Still, the rebound is more of a reset than a recovery. The IPO window can best be described as half open: listings are possible, but only for the highest-quality names or those positioned in politically favoured sectors. Many IPOs are pricing below peak private valuations¹⁸ and overall liquidity remains constrained. That has amplified the importance of the VC secondary market, now estimated at $48.1–$71.5 billion annually (midpoint $60 billion).¹⁹ Venture secondaries have become a strategic tool rather than a last resort, allowing LPs and employees to cash out while giving companies more time before a public listing.

Valuations: AI pulls away

The valuation story is similarly bifurcated to fundraising performance. Investors are paying up for scarce access to frontier technology. SVB notes that late-stage AI companies command a 100% premium over non-AI peers at Series C.²⁰ KPMG data shows global median pre-money valuations rebounding sharply in 2025, but those gains are concentrated in AI.²¹

Elsewhere, founders face a slower reset. Rounds are smaller, down rounds remain common and boards are pushing management teams to extend their runways. Many startups have shifted away from growth-at-all-costs to prioritise efficiency and profitability. SVB highlights that more companies are reaching breakeven earlier in their lifecycle, a dynamic that investors now reward.

In practice, this means capital continues to flow, but only to those startups that can demonstrate either a clear AI advantage or a credible path to profitability.

A new chapter

The venture market has not fully recovered. Fundraising outside the top tier is difficult, liquidity remains patchy and geopolitical risks abound. Yet the resilience of investment flows, the tentative re-emergence of exits and, above all, the sheer scale of AI activity mark a new chapter for the industry.

AI has become an almost singular focus. From defence applications to enterprise integration and new consumer interfaces, it is attracting talent, capital and strategic interest at unprecedented levels.

The winners of this era will be the companies that can turn cutting-edge technology into high-growth, sustainable businesses, and the VC fund managers with the foresight and conviction to back them early. For LPs, that means accessing the right GPs has never mattered more.

¹ https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2025/07/kpmg-private-enterprise-quarterly-q2-25-global-report.pdf ² https://www.cbinsights.com/research/report/state-of-venture-q225-report/ ³ https://www.cbinsights.com/research/report/venture-trends-2024/ ⁴ https://www.cbinsights.com/research/report/state-of-venture-q225-report/ ⁵ https://www.goodwinlaw.com/en/insights/publications/2024/09/alerts-otherindustries-state-of-the-climate-tech-market ⁶ https://www.gate.com/learn/articles/the-evolution-of-crypto-venture-capital-a-15-year-review ⁷ https://www.cbinsights.com/research/report/ai-trends-q2-2025/ ⁸ https://www.forbes.com/sites/janakirammsv/2025/06/23/meta-invests-14-billion-in-scale-ai-to-strengthen-model-training/ ⁹ https://techcrunch.com/2025/07/01/xai-raises-10b-in-debt-and-equity ¹⁰ https://www.wired.com/story/thinking-machines-lab-mira-murati-funding ¹¹ https://news.crunchbase.com/business/biggest-rounds-april-2025-safe-superintelligence-plaid ¹² https://techcrunch.com/2025/06/05/anduril-raises-2-5b-at-30-5b-valuation-led-by-founders-fund ¹³ https://www.reuters.com/business/aerospace-defense/german-defence-start-up-helsing-raises-600-million-euros-latest-investment-round-2025-06-17/ ¹⁴ https://odessa-journal.com/the-defense-it-company-tekever-which-has-an-office-in-ukraine-has-become-a-unicorn-after-raising-500-million ¹⁵ https://pitchbook.com/news/articles/us-venture-capital-firm-concentration-first-half-2025-founders-fund ¹⁶ https://files.pitchbook.com/website/files/pdf/Q2_2025_PitchBook-NVCA_Venture_Monitor.pdf ¹⁷ https://files.pitchbook.com/website/files/pdf/Q2_2025_PitchBook-NVCA_Venture_Monitor.pdf ¹⁸ https://www.axios.com/newsletters/axios-pro-rata-95cb1e51-2a4a-49b2-9736-e7586390fae9 ¹⁹ https://files.pitchbook.com/website/files/pdf/Q2_2025_PitchBook-NVCA_Venture_Monitor.pdf ²⁰ https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2025/07/kpmg-private-enterprise-quarterly-q2-25-global-report.pdf ²¹ https://www.svb.com/globalassets/library/uploadedfiles/reports/state-of-the-markets-h1-2025.pdf