It may be tempting to assume that pausing fund commitments during periods of uncertainty is a shrewd move. When asset valuations are volatile, sitting on the sidelines can feel safer than leaning in. Yet history shows that this approach rarely pays off.

Market timing is difficult even in public markets, where data is continuous and liquidity immediate. In private markets, capital is typically deployed over several years. Exits can occur six to ten and even twelve years later.¹ Predicting both the entry and exit environment with any precision over these extended periods is impossible.

Manager selection trumps market timing

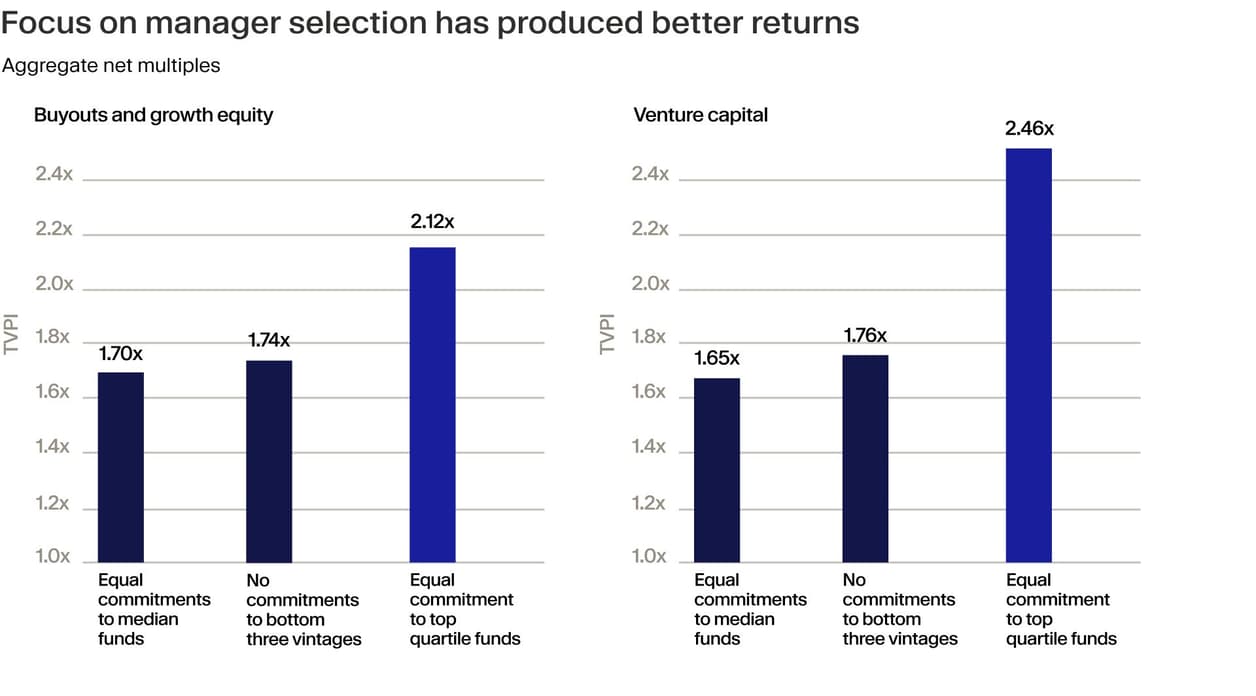

Commonfund’s analysis² of buyout and growth equity vintages from 2000 to 2020 illustrates this point. Even if an investor had somehow managed to avoid committing to the three weakest-performing vintages in that period, the improvement in overall returns would have been marginal. In other words, avoiding “bad” vintages has not historically translated into meaningfully better outcomes.

Manager selection, on the other hand, can make a difference and is potentially a significant return generator. Authors of the research found that the top-quartile funds delivered 2.4x net multiple across 2000-2020 vintage years or 20% more than median funds, minus the three worst vintages.

This is reflected in various research on return dispersion. One study by J.P. Morgan Asset Management, for example, shows that across a representative sample of global buyout funds from 2015-2025, the gap between top-quartile and bottom-quartile performers is not only consistently wide, the delta reaches up to 2,000 basis points.³ Put simply, choosing where to invest in private equity is a far greater determinant of success than choosing when to invest.

Performance during market turbulence

The question of investing during market downturns also raises a question whether investors are better advised to turn to public equities to weather the storm?

If the past is any guide, the answer is no: private equity outperformed stocks during and in the 12 quarters following the dot-com crash, the global financial crisis and COVID-19, a Moonfare analysis of Pitchook indices found. Homing in on the GFC, the S&P 500 index declined in value as much as 45.8%, whereas the private equity index only declined by 24.8%.

Commonfund found similar results.⁴ Using direct alpha — which compares private equity returns with public market performance, adjusting for the timing of capital calls and distributions — the research demonstrates that the median buyout and growth equity manager has outperformed global public equities across nearly every vintage year.

Specifically, median managers have beaten public markets by 3.1% per year. Top-quartile managers did significantly better, generating excess returns of around 9.2% above median, with some vintages as high as 11.7%. Even bottom-quartile managers delivered modestly positive results (1.5%), showing relative consistency and resilience in this segment.

As the research points out, this outperformance persists even through the past couple of years which many would say have been among the most challenging for the industry in the last 15 years.

The picture is similar in venture capital, though returns are inherently more volatile. Sharp markdowns during downturns are often followed by outsized recoveries as innovation cycles restart. Investors with access to high-quality managers have typically been rewarded for staying invested through market turbulence.

The portfolio impact

Beyond the return implications, there is also a structural consequence to skipping vintages. Private market allocations depend on a careful pacing strategy to balance commitments, capital calls and distributions over time. Because these cash flows are irregular, maintaining target allocations requires consistent commitment activity.

Commonfund modeled a $100 million portfolio under three scenarios: one in which commitments were made consistently, one in which an investor skipped a vintage year midway to target allocation and one where commitments were paused after the target allocation was achieved. In both cases where vintages were skipped, the portfolio ended up underweight private equity by 2–4% relative to the steady allocator. Even after increasing subsequent commitments to compensate, the shortfall persisted for five or more years.

“For those investors who are targeting total portfolio returns of inflation plus spend, a multi-year decreased private equity allocation could be detrimental in achieving intergenerational equity,” the report found.

Consistency is key, but so is flexibility

We believe that the key to investment success in private markets is patience and persistence. Each vintage may contribute to long-term diversification, smoothing returns across market cycles and capturing opportunities that emerge in less favorable periods.

Consistent pacing not only builds resilience, it also allows investors to benefit from the compounding nature of private market performance over time when distributions are reinvested back into the asset class. By continually recycling distributed returns into new commitments, investors can keep capital working through changing market conditions, increasing exposure to successive cycles of value creation.

Committing steadily through cycles should also be coupled with flexibility. That may mean leaning into co-investments to potentially achieve higher net returns, allocating selectively to secondaries to mitigate the J-curve and accelerate distributions, or using semi-liquid structures to maintain private markets exposure while having the possibility to manage liquidity for future commitments or new fund opportunities.

Equally, it may involve prioritising managers with differentiated sourcing capabilities or the ability to create operational alpha when leverage-driven strategies are less effective.

In the end, consistency could be the foundation for long-term outperformance and flexibility is the edge.

¹ https://pws.blackstone.com/emea/wp-content/uploads/sites/20/blackstone-secure/Life-Cycle-of-Private-Equity-EMEA.pdf?v=1638976450 ² https://www.commonfund.org/research-center/articles/mind-the-gap-the-strategic-risk-of-skipping-a-vintage-in-private-equity ³ https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-alternatives/ ⁴ https://www.commonfund.org/research-center/articles/mind-the-gap-the-strategic-risk-of-skipping-a-vintage-in-private-equity