Last year’s Moonfare summer book list proved a great success with readers. So, with the holiday season in full swing, we are putting together a new set of recommendations – along three criteria – books on finance, books that help us understand the changing world and books to take readers' minds off this changing world, enjoyable fiction.

On finance and markets

To start with finance and economics, Britain’s Chancellor Rachel Reeves has had a difficult year, given the backdrop of a high deficit and heavy debt burden. It is a difficult job, as evidenced by Reggie Maudling’s letter to his successor in 1964: "Sorry to leave it in such a mess, old cock."

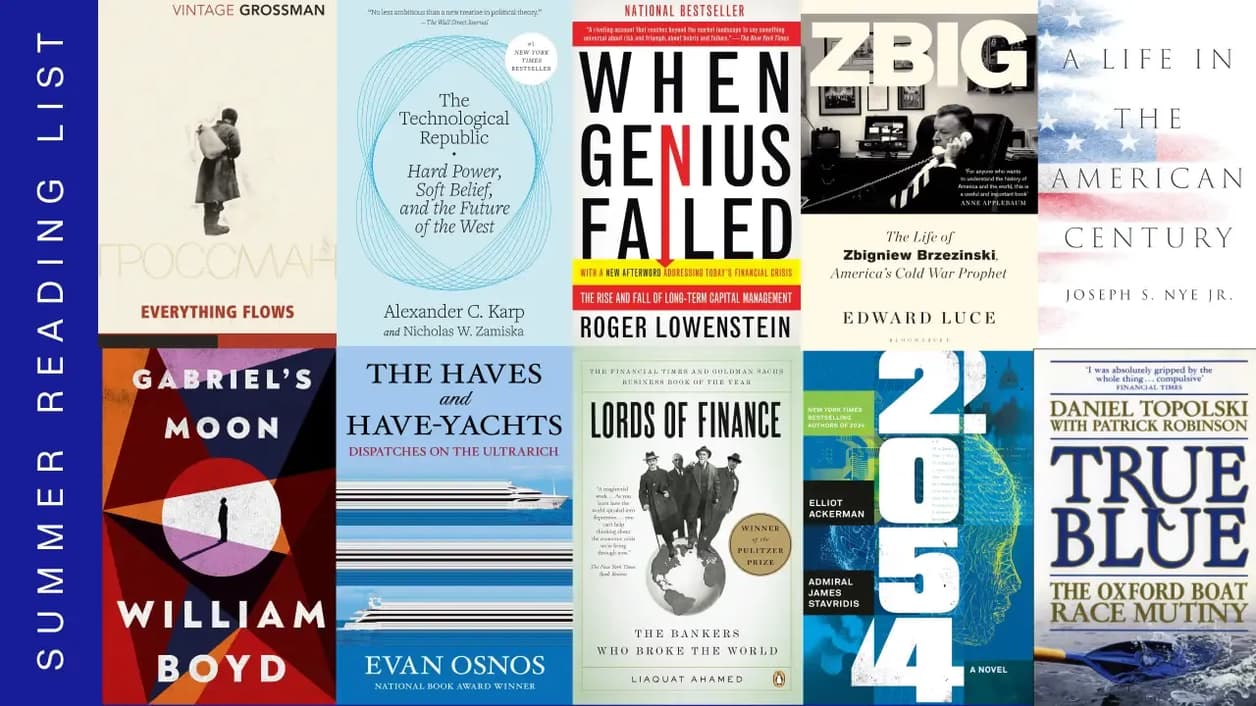

In this respect, Roy Jenkins’ book The Chancellors is worth dusting off, while a few other books by finance ministers are quite analytical (Tim Geithner’s Stress Test and Ben Bernanke’s Courage to Act were fairly dull). However, the other book in this realm that I recommend, with Fed chief Jerome Powell under pressure from the White House, is Liaquat Ahmed’s Lords of Finance.

With some markets creaking nervously (bonds) and others behaving complacently (equities), it is time to re-read Roger Lowenstein’s When Genius Failed, the story of the collapse of the LTCM hedge fund. I recall a seminar where David Modest, a partner in LTCM, recounted, with some emotion, how it came asunder. Another classic, from before the LTCM era but that is relevant to private assets, is Barbarians at the Gate by Bryan Burroughs and John Helyar.

If the summer weather is too hot, it’s always good to have a few trophy books lying around that will certainly never be read but nonetheless confer an aura of wisdom on their owners, such as A History of Interest Rates by Sydney Homer and Richard Sylla.

On politics

Moving on to books that will help steer readers through intense geopolitical change, I want to start with the late Joe Nye’s Soft Power and Life in the American Century, which give a now-nostalgic glimpse of a more internationalist America. Two preoccupations in Washington are defence and wealth. On the former, Alex Karp’s The Technological Republic was more thoughtful than I had expected, and the two futuristic books on the defence threats that the US faces, by Admiral Jim Stavridis and Elliott Ackermann, 2034 and 2054, give us a sense of how conflicts of the future will be fought, even if these books are being overtaken by events.

Then, with the recent Trump budget (Big, Beautiful Bill) set to tilt the economic scales in favour of the wealthy, Evan Osnos’ book The Haves and Have-Yachts is worth a read, as are Oliver Bullough’s books MoneyLand and Butler to the World on the topic of wealth and corruption.

Universities have been in the news this year, and ironically, there are very few good books about university life. In a previous note, I had recommended Tom Sharpe’s Porterhouse Blue, and would add Lucky Jim by Kingsley Amis, Changing Places by David Lodge and for fans of university sports, the classic True Blue by Dan Topolski.

Fiction selection

Switching continents and genre to fiction, a few works of fiction are worth reading to help shape our view of Russia (and Ukraine), most notably Vasily Grossman’s Everything Flows and Mikhail Bulgakov’s White Guard, and then more generally Pushkin’s Eugene Onegin (decent as an audiobook on a long journey).

For well-written fiction, I think William Boyd’s writing is superb (his latest book is Gabriel’s Moon), Shuggie McBain by Douglas Stuart is an example of very original, inventive use of English, and for those readers who can’t escape finance, Lionel Shriver’s The Mandibles gives a glimpse of how it might be to live in a financially broken world. Sentimentally, I wanted to also mention Edna O’Brien, who died this time last year – have a read of Country Girls.

Bonus

As a last word, I am taking a collection of very different books with me this summer. A friend has kindly given me a copy of Ed Luce’s Zbig: The Life of Zbigniew Brzezinski, which I look forward to not only for colour on one of America’s great strategists but I expect for Luce’s generally excellent writing. I would also like to read Kingmaker, Sonia Purnell’s account of the life of Pamela Harriman, former US ambassador to Paris, amongst many other roles. In addition, in a world of ‘deal-making’, I am packing the ancient François de Caillière’s L’Art de négocier sous Louis XIV and the Letters of JRR Tolkien.