Key takeaways:

- Individual investors are increasingly adding private markets to their portfolios.

- It’s a trend that we think benefits not only private investors but it also boosts the industry’s growth and diversifies its investor base.

- As the returns gap between best and worst performing PE funds widens, the expertise and networks needed to select high-quality managers have become more critical than ever.

Private equity continues to hold appeal for the private wealth market. Almost 80% of individual investors have made a private markets investment over the past 12 months and more than half plan to do so in the next year, according to a new Moonfare survey of 175 respondents.

The survey also reveals that respondents’ allocations are rising — and for good reason: 92% of investors surveyed expect private markets to perform at least as well as public markets, including over half who say they anticipate better performance.¹

Since the survey was conducted around the same time as the so-called Liberation Day US tariff announcements, we believe these results suggest a high degree of confidence in private markets among individual investors, even as the political and economic environment has become more volatile.

The good news for this group of investors is that their options for accessing private markets are expanding rapidly. Since 2019, nearly 300 evergreen funds — investment vehicles with no set end date — targeting the private wealth market have launched, according to Pitchbook.² Between them, they had over $425 billion in assets under management in 2024, a figure projected to more than double by 2029 to $1.1 trillion.³

We believe this is a trend that benefits not only private investors, who gain access to assets that were previously unavailable to them, but it also boosts the industry’s growth and diversifies its investor base.

Why now?

Private equity has attracted wealthy clients for many years, but the industry has intensified its focus on these investors in recent years. Traditional closed-ended fundraising has become more challenging⁴ and many LPs have to grapple with liquidity issues stemming from slower distributions than they had planned.⁵

Despite this, most PE investors are not pulling away from private markets. Quite the opposite: 84% of LPs respondents to a McKinsey study expect to maintain or increase allocations to private equity in 2025,⁶ following on from rises in previous years. CalPERS, the largest US pension fund, for example, is in the process of increasing its private market allocations from 33% to 40% of its plan assets.⁷

Even with this vote of confidence from institutional investors, private wealth is potentially a natural avenue for growth for private markets. Estimates of private wealth’s scale and current exposure to private markets use varying measures, but all suggest a sizeable and expanding addressable client base.

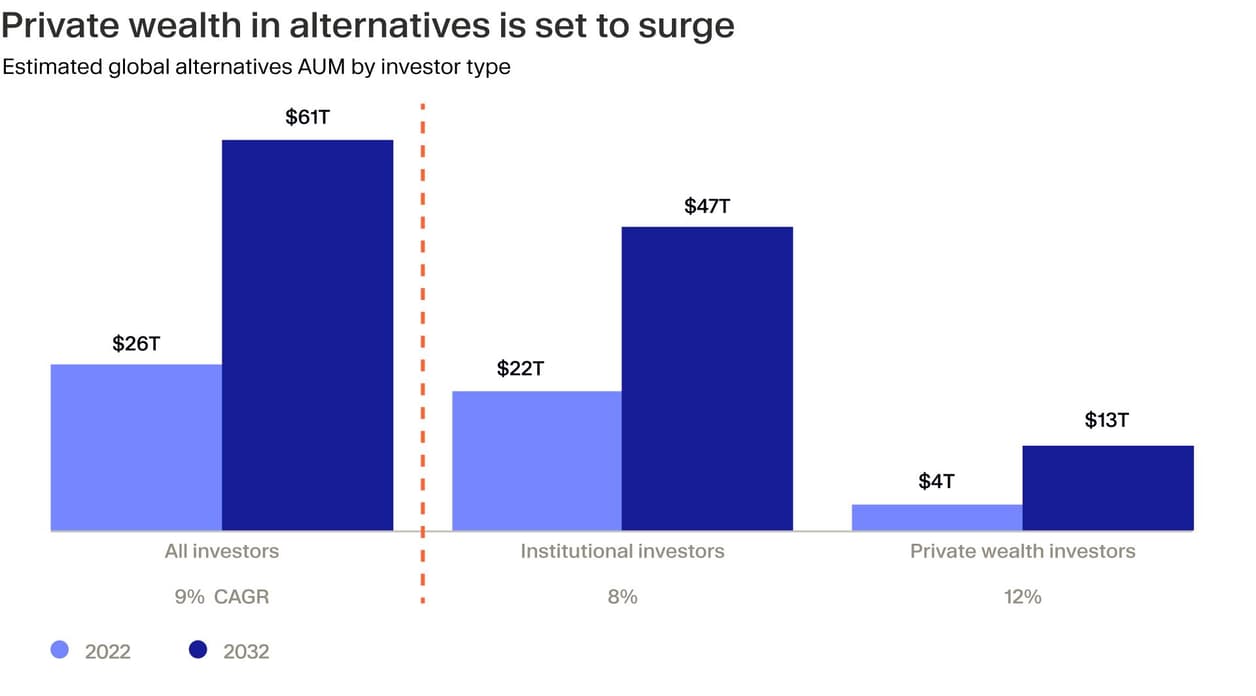

For example, the number of high net worth individuals globally increased by over 5% during 2023, according to Capgemini research, and their wealth grew by 4.7%.⁸ In another research paper, Bain & Company suggests that individuals worldwide hold roughly the same amount of capital as institutional investors, at between $140 trillion and $150 trillion. It estimates that only $4 trillion of individuals’ capital is currently invested in alternatives, but that this will grow by 12% a year to reach $13 trillion by 2032. That’s against an 8% increase in institutional capital in alternatives in the same timeframe.⁹

Rise of tailored investment products

With such strong potential for growth in the private wealth space, PE firms are creating new products and fund structures to meet this client group’s needs. The emergence of digital platforms with simplified investment processes that offer clients a curated selection of funds is opening up private markets exposure to many individuals.¹⁰ These platforms often remove many of the barriers that individual investors have traditionally faced in private markets, such as high minimum investments and the need for experience and expertise in selecting high quality managers in an asset class where return dispersion is particularly wide.¹¹ ¹²

Similarly, firms are finding ways to cater for individual investors’ liquidity needs by launching semi-liquid or evergreen funds that can offer some redemption mechanisms.¹³ These funds now span a range of private markets asset types, including private equity, private credit, real estate and multi-strategies.

We’ve also seen a huge rise in interval funds in recent years – these are a type of closed-ended fund that offers liquidity to investors at stated intervals. In 2021, there were 59 interval funds with an AUM of $50 billion in August 2022, but by January 2025, these figures had almost doubled to 103 funds with $93 billion of AUM according to Morningstar data.¹⁴

The appeal of private markets

The Moonfare study we highlighted earlier is far from alone in demonstrating individual investors’ growing appetite for private markets. Nearly all (93%) respondents to a recent Brookfield and Oaktree Wealth Solutions survey¹⁵ said they were satisfied with their alternatives performance and 88% were open to investing more in the asset class.

Advisors to individual investors report similar trends: Hamilton Lane’s most recent annual survey of financial professionals¹⁶ found that 56% are expecting an increase in their private markets book of business in 2025 and that 47% of their clients are either currently invested or willing to invest, up from 41% a year earlier.

Hamilton Lane’s survey also offers clues as to why private markets are attractive to individual investors, with performance a major draw. Over three-quarters of advisors said their clients viewed private markets as offering a higher reward than stocks and bonds. Their view is backed up by the fact that buyouts have historically outperformed public markets in almost every year since 2000,¹⁷ ¹⁸ ¹⁹ while private credit has outperformed the S&P UBS Leveraged Loan PME every year since then, according to Hamilton Lane data.²⁰ Note, however, past returns are not a guarantee these outperformance will continue in the future.

Yet returns are only part of the story. Diversification is another major attraction for individual investors. Private markets offer a range of investment strategies and assets that are otherwise difficult to access and that provide investors with a range of risk, return and liquidity profiles to choose from.

Companies are also opting to remain private for longer than in the past.²¹ As a result, the private equity universe is growing and offering exposure to a larger pool of investments, while public markets are shrinking and becoming more concentrated in fewer, larger companies. Indeed, there are around 25 times more private markets-backed companies than listed businesses, yet their total capitalisation is just 12% of public equity markets, according to HarbourVest data.²²

We believe that this trend makes access to unlisted company opportunities particularly important in a diversified portfolio. However, it also means that private markets may be one of the few ways investors can gain exposure to emerging technologies that are transforming economies, such as AI and quantum computing, and to key growth sectors, such as healthcare and defence.

Buyer beware: manager selection is key

Despite these benefits, investing in private markets does present risk. It requires a sophisticated approach founded on experience and deep knowledge of the opportunities and the quirks of the asset class. Key among these is wide dispersion of returns between the best and worst performing funds. In the decade from 2014 to 2024, the best performing global large cap equities managers returned 9.3%, while the worst returned 7.5%, according to JPMorgan analysis.²³ By contrast, the best performing global private equity funds generated 22% and the worst just 1.6%.

We believe that this performance gap is set to widen further over coming years as rising interest rates and more muted asset valuations have reduced returns potential from multiple expansion and financial engineering. If they are to receive strong risk-adjusted returns, today’s investors need exposure to managers with real operational capabilities.

Selecting the best quality managers has always been important in private markets, but has become more critical than ever against this backdrop. This takes the kind of resources that individual investors typically lack, such as time, expertise and strong relationships with fund managers.

¹ https://www.moonfare.com/white-papers/investor-survey-2025 ² https://files.pitchbook.com/website/files/pdf/2029_Private_Market_Horizons_19168.pdf ³ https://files.pitchbook.com/website/files/pdf/2029_Private_Market_Horizons_19168.pdf ⁴ https://files.pitchbook.com/website/files/pdf/2024_Annual_Global_Private_Market_Fundraising_Report.pdf ⁵ https://www.bain.com/insights/private-equity-midyear-report-2025/ ⁶ https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/mckinseys%20global%20private%20markets%20report/2025/global-private-markets-report-2025-braced-for-shifting-weather.pdf ⁷ https://www.calpers.ca.gov/newsroom/calpers-news/2024/calpers-will-increase-private-markets-investments ⁸ https://www.capgemini.com/news/press-releases/global-high-net-worth-population-and-wealth-back-to-record-levels-despite-global-instability/ ⁹ http://bain.com/insights/why-private-equity-is-targeting-individual-investors-global-private-equity-report-2023/ ¹⁰ https://www.ey.com/en_lu/insights/private-equity/the-boom-of-private-equity-fintech-untapping-retail-investors ¹¹ https://www.ey.com/en_lu/insights/private-equity/the-boom-of-private-equity-fintech-untapping-retail-investors ¹² https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-alternatives/ ¹³ https://www.privateequityinternational.com/inside-the-semi-liquid-fund-boom/ ¹⁴ https://pitchbook.com/news/articles/asset-managers-wealthy-investors-cliffwater ¹⁵ www.brookfieldoaktree.com/sites/default/files/2024-10/Alts%20Institute%20Survey%20Results.pdf ¹⁶ https://www.hamiltonlane.com/getmedia/5a74ae29-3398-4cb1-bcb2-3b107f9e49c2/2025-hamilton-lane-annual-global-private-wealth-survey.pdf ¹⁷ https://www.bain.com/insights/outlook-is-a-recovery-starting-to-take-shape-global-private-equity-report-2025/ ¹⁸ https://www.schroderscapital.com/en/global/professional/insights/private-equity-s-resilience-during-major-crises-a-25-year-analysis/ ¹⁹ https://files.pitchbook.com/website/files/pdf/Q3_2024_PitchBook_Benchmarks_with_preliminary_Q4_2024_data_Global_18997.pdf ²⁰ https://shareholders.hamiltonlane.com/2025-03-12-2025-Hamilton-Lane-Market-Overview-Private-Markets-Reach-an-Inflection-Point,-though-Long-Term-Fundamentals-Remain-Strong ²¹ https://indexes.morningstar.com/insights/analysis/blt81d5614b4c2ccd2b/unicorns-and-the-growth-of-private-markets ²² https://www.harbourvest.com/insights-news/insights/cpm-how-does-the-size-of-private-markets-compare-to-public-markets/ ²³ https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-alternatives/mi-guide-to-alternatives.pdf