The world is bigger than publicly traded stocks — much bigger. At Moonfare we believe your portfolio should be too.

Nobel Prize-winning economist Harry Markowitz once called diversification “the only free lunch in finance.” And by diversifying into private equity, investors stand to access one of the fastest-growing asset classes.

The growth of private equity portfolio companies as measured by net asset value far outpaces the increase in market capitalisation of all publicly traded companies, according to global management consultancy McKinsey & Company’s “Global Private Markets Review 2020.”

The net asset value of all private equity companies has grown more than 8 times since 2000, according to McKinsey. The consultancy calculates net asset value as total assets under management by all private equity funds globally minus their dry powder. The market caps of all publicly held companies grew just 2.8 times in that same period.

The value of global private equity portfolio companies has grown more than 8x since 2000 Global private equity net asset value vs. public equity market capitalisation

Source: Based on World Bank and Preqin data, as cited in McKinsey & Company’s “Global Private Markets Review 2020.” McKinsey calculates private equity net asset value as assets under management net of dry powder. Data as of year end 2019. Growth rates indexed to 2000 values.

Diversification in times of volatility

Especially in times of volatility, private equity investments can add an imperfectly correlated asset class to investors’ portfolios. Market watchers have noted that in the wake of Covid-19 stocks, bonds and even haven assets like gold have moved together, limiting investors’ ability to hedge the performance of one asset class by taking a diversified position across these traditional assets.

As The Wall Street Journal reported last month: “Not much of anything is providing good downside protection these days,” referring to government debt, gold and currencies like the Japanese yen, which investors have used to hedge their stock portfolios. The extremely low returns in these assets make it even harder for investors to effectively diversify, without harming the overall return on their portfolio.

For further information about the benefits of adding private equity to your portfolio, please refer to our library of white papers, especially “Private Equity in a Portfolio Perspective.”

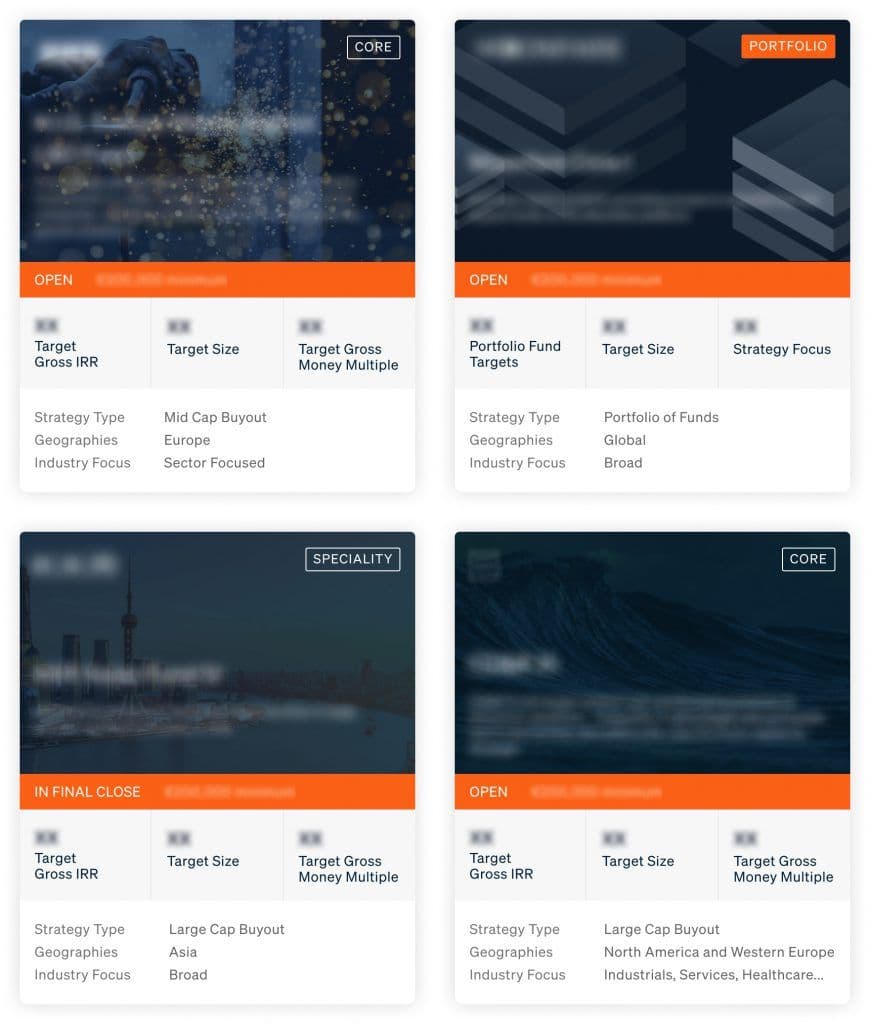

To learn more about opportunities to invest in private equity, please contact our team or your dedicated relationship manager. Please note that for regulatory reasons, Moonfare is only permitted to share specific investment opportunities with qualified registered users, so completing your profile is a great way to get started.