Much has happened in the past 12 months. Private markets have endured a turbulent period with dealmaking and exit activity, in particular, considerably slowing in pace.

This new economic reality has compelled many investors to recalibrate their strategies. But in what specific ways are they adjusting? What assets have become more attractive as the markets have turned downward?

Moonfare’s third annual Investor Survey, carried out in September 2023, has sought to capture the prevailing sentiment. To our delight, 122 members of our community — all qualified individual investors — responded and shared their views.

A full survey report will be made available in the beginning of December. As an Investor Club member, however, you can enjoy an early access to key survey highlights below.

Investors started prioritising diversification

In the past 18 months, diversification has emerged as a key theme for Moonfare’s investor community. More than 45% have said they’ve started prioritising diversification, ahead of increasing cash reserves and becoming a more active investor. Around a quarter reported they haven’t made any changes in their investment strategy.

The survey also showed that Moonfare investors are already relatively well exposed to private markets. Most respondents or roughly 26% have dedicated between 21% to 50% of their portfolio to private markets, in addition to around a fifth with a 16% to 20% share.

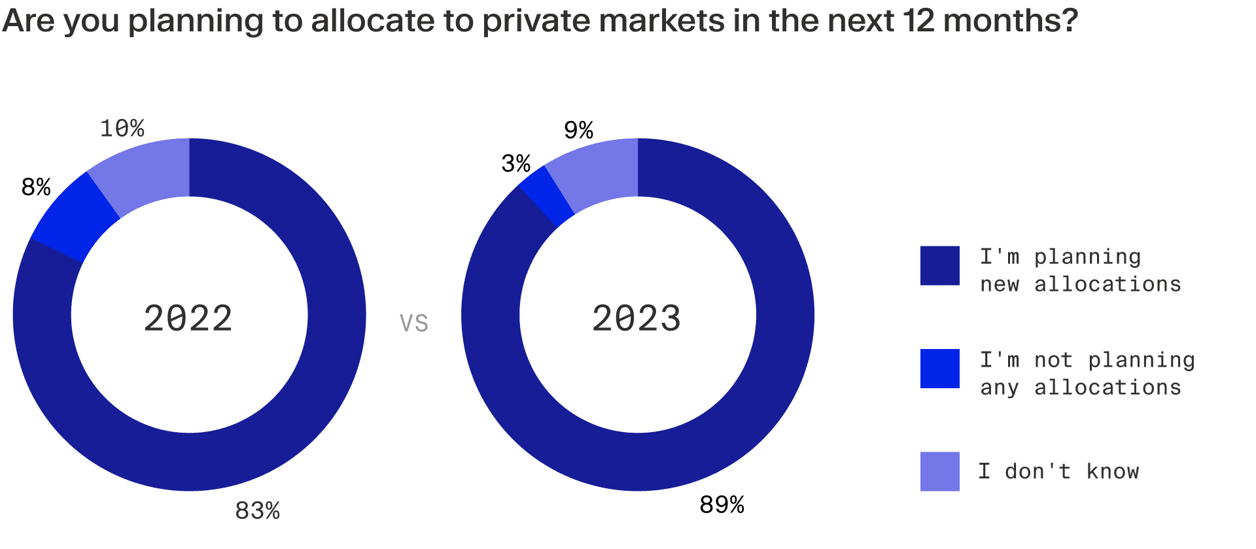

Meanwhile, a vast majority (89%) are planning further increases in the next 12 months.

On average, the private market allocation share of Moonfare survey participants corresponds roughly with that of pension funds, endowments, and foundations, which typically dedicate between 10% and 20% of capital towards private markets.¹

Mounting risks precipitate a longer recovery

While investors' perception of the global economy has improved compared with last year, the overall sentiment remains pessimistic. Forty-seven percent of survey participants say they have a “bad feeling” about the state of the economy, while just 15% said they had a good one. In 2022, 85% of respondents expressed a negative view.

Despite emerging recovery signs, such as a possibility of mild interest rate cuts next year², it’s far too early to assume we’re securely on an upward trajectory. The economic recovery in Europe is slow-paced³, core inflation continues to be persistently high⁴ and elevated interest rates are squeezing borrowers, as some $5.5 trillion of corporate debt will be due for repayment next year.⁵

These risks have weighed on how survey participants view the short-term outlook. Half of them believe the current economic situation will persist for at least a year to two years, while 28% seem somewhat more sanguine, predicting six to twelve months of downturn before things start picking up again.

Buyouts remain popular, while defensive strategies gained in favour

Buyouts continue to be the preferred option for private market investors on the Moonfare platform. The survey found that 83% of respondents own stakes in these investments, a 16 percentage point increase compared with 2022.

On the other hand, venture capital fundraising has languished this year⁶, a sentiment echoed by Moonfare investors who reported a significant reluctance for additional investments in these assets compared to last year.

Instead, they’ve started preferring potentially more defensive strategies and three in particular: private credit, infrastructure and secondaries.

Almost 42% of Moonfare survey respondents report owning interests in secondaries funds, a notable 10 percentage points increase compared to last year's survey. These funds may provide immediate diversification through older vintage, sometimes including hundreds of underlying companies.

The proportion of survey respondents who have increased their exposure to infrastructure has also seen a notable rise. While last year only 15% of respondents reported holding a stake in private infrastructure assets, in 2023 this share has grown to almost a quarter.

Infrastructure assets could be particularly attractive during times of economic uncertainty. Given their negative correlation with stocks, bonds or even real estate,⁷ infrastructure investments can be a welcome addition to a mature, diversified portfolio.

Private credit has also become more popular among the private markets investor base, according to our survey. Around 24% reported exposure to these assets, a three percent increase from the previous year. Notably, 38% of respondents are optimistic about private credit, placing the strategy third in potential performance behind secondaries and buyouts.

The landscape in 2023 has been indeed advantageous for private credit investments, with an increased need for refinancing, a pullback from banks and increasing rates all serving as tailwinds. Since many private credit deals are floating rate, investors could benefit from receiving regular income at a higher yield.

Portfolio management is an ongoing process

The world has changed dramatically in the last year and a half, and as we can see from the survey results, our investor community has taken action, rethinking priorities and deploying capital in various assets accordingly.

From an investor’s point of view, this also means that portfolio management should rarely be considered finished, and that calibrating a private markets investment suite that can withstand a variety of different scenarios should be high on the agenda.

¹ https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/mckinseys%20private%20markets%20annual%20review/2021/mckinsey-global-private-markets-review-2021-v3.pdf ² https://www.forbes.com/sites/simonmoore/2023/10/17/markets-see-measured-fed-rate-cuts-in-2024/?sh=155f81351741 ³ https://www.imf.org/en/News/Articles/2023/10/18/sp-laura-papi-remarks-at-budapest-economic-forum ⁴ https://www.imf.org/-/media/Files/Publications/GFSR/2023/October/English/ch1.ashx ⁵ https://www.imf.org/en/Blogs/Articles/2023/10/10/higher-for-longer-interest-rate-environment-is-squeezing-more-borrowers ⁶ https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2023/venture-pulse-q3.pdf ⁷ https://www.kkr.com/insights/how-to-think-about-private-infrastructure-as-inflation-finds-its-resting-point