Key takeaways

- Advances in technology have transformed private equity dealmaking in the last decade.

- PE firms’ use of machine learning, big data and analytics is leading to improved deal-sourcing processes, and is adding value for investors during the ownership and exit stages.

- Technology is increasingly seen by PE as a value-creation driver rather than just a means to generate efficiencies.

The world of private equity has changed immeasurably since its formative years. From its beginnings as an asset class seemingly preserved for wealthy American families in the early 20th century, investing in non-listed companies has now trickled down through the economic pyramid to become a key part of portfolio construction for institutions and, more recently, qualified individuals. Investment strategies have also evolved, with buyouts of more established businesses as well as sector- and geography-specific investment theses complementing the historic preference for earlier-stage venture capital deals.

Yet while the asset class itself may have matured, investment houses in the 21st century are grappling with another, more recent development that is fundamentally altering how they operate; rapid technological change.

"Over the last decade or so, there has been rapid development in the way PE firms use technology throughout the deal lifecycle,” says Victoria James, Investment Manager at Moonfare. “Adopting and continuously improving technological tools is becoming a necessity and key focus for many firms to remain competitive. It’s not just a ‘nice to have’ anymore.”

Indeed, the pace of this change threatens to leave some PE firms behind. In 2010, industry research proclaimed that: "Proactive investors are using…more innovative tools [such as] internet research, web scraping, social media and expert networks."¹ This is already outdated over a decade later. However, it does highlight how fast technology can evolve, and the pace at which PE firms need to adapt.

Maximising deal sourcing

Tech’s impact is seen throughout the dealmaking process. However, arguably its most notable impression is felt at the start.

Historically, PE firms’ investment teams have committed enormous amounts of capital, time and air miles to deal sourcing in the hunt for the best opportunities. “Traditional sourcing methods are resource intensive – both financially and in terms of time – representing an opportunity cost for investment firms,” says James. “More often than not, investment teams’ greatest restriction is time; spending it evaluating one investment opportunity means they can’t spend that time on another.” Research from 2010 suggested that, at the time, PE firms would need to analyse around 80 opportunities before closing one deal.²

Now, many GPs are enlisting the help of big data and artificial intelligence to help streamline their sourcing process and identify better deals early on. “These software tools can ingest many types of data, often enhanced by machine-learning models and automated visualisation, which can help investment professionals identify top-performing companies based on certain metrics,” James adds. “These platforms can analyse vast amounts of information, including financial metrics, credit card data, web page users or app users.To do that they scrape public and paid-for sources to cover thousands of companies and their associated data points.”

An example of this is Motherbrain, a platform developed by EQT Ventures in 2016.³ The firm’s investment professionals harness Motherbrain’s models and analysis of hundreds and thousands of datapoints to help identify promising tech startups. Investments that are a direct result of the platform include Handshake, a career networking business, which at the start of 2022 was valued at some $3.5 billion.⁴

Here, James points out that early stage investors such as EQT Ventures are at the forefront of using tech to support deal sourcing efforts. For firms focused on more mature businesses the use is more nuanced. “For buyout managers, those with sector-focused strategies may also use these tools in screening potential opportunities,” she says. “By contrast, those operating more generalist strategies tend to lean toward traditional sourcing methods given the complexity of identifying metrics to track and compare companies over time.”

Levelling the playing field

Leveraging technology isn’t just the preserve of larger managers, however, In fact, it can help smaller investment firms narrow the resource gap, while also reaching industries and markets not considered feasible previously. “This brings enormous scalability to the investment process,” says James. “It allows them to analyse performance of far more companies than they would be able to using traditional sourcing methods.”

In addition, this can also aid areas where data is scarce. Nowhere is this more acute than at the earlier stages of investing, where unlike at the later stages, information will not be as prevalent and some companies may even be in stealth or pre-product.

Early-stage venture firm 645 understood this when they launched in 2014. It also recognised that the proliferation of social media and networking, online product reviews and analytics reviews could lead to beneficial intelligence for investors–if they were willing to look hard enough. “It was this insight that inspired us to augment our networks with a software generated information flow, allowing us to execute an outbound approach at the seed stage that wasn’t historically possible,” the firm wrote in 2020.⁵

Technology doesn’t only help make proceedings more equitable on the investor side, either. Increasingly, data analysis is being used to try and remove biases that often affect minority-owned businesses. This is seen in examples like the U.S. PE firm Trident, which employs technology to help remove unconscious biases present in the investment processes.⁶ “The private equity industry has traditionally lacked gender and ethnic diversity, both with respect to investors, as well as founders receiving PE investment,” says James. “Tech-enabled sourcing at the early stage of the investment process can help remove biases as companies are first identified solely by their performance relative to peers.

Staying ahead of the game

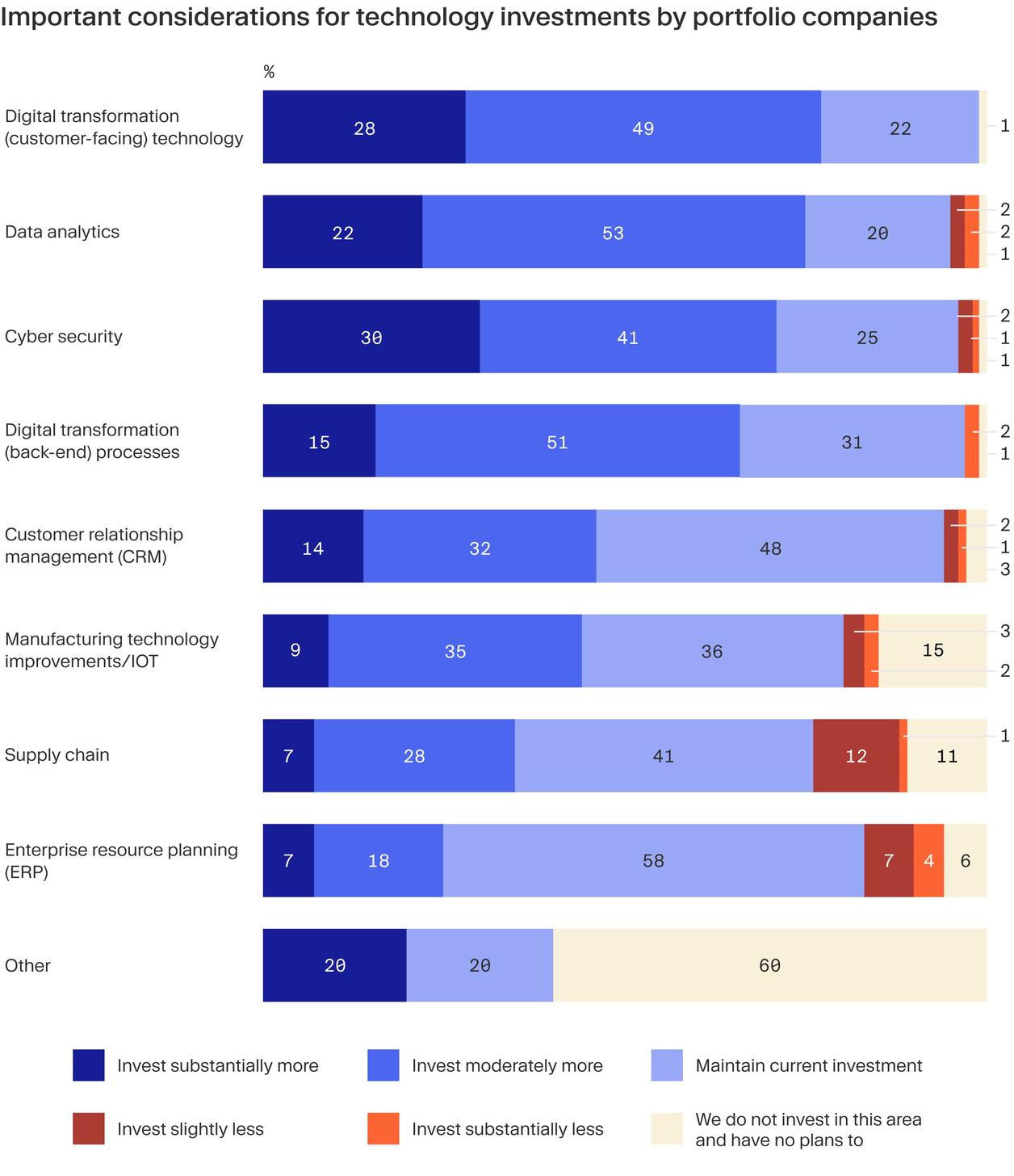

Technology’s role in an investment doesn’t just end when the term sheet is signed, however. When it comes to creating value for portfolio companies, PE firms are becoming more and more aware that leveraging software developments can provide tangible boosts to their businesses. According to a KPMG survey of PE firms and portfolio companies, more than a quarter said that they planned to invest significantly more in digital transformation on the customer-facing side, while data analytics was close as a priority for substantial capital allocation.⁷

According to James, PE firms are seeing digitisation as key to creating value, rather than just a tool to rationalise. “Reducing costs can be a welcome by-product of introducing tech tools, but for many firms not enough time has passed to see the dollar-benefits yet,” she says. “Their main priority is to stay competitive and allow portfolio companies to scale, as well as enhance diligence.”

UK PE firm Hg’s approach to technology encapsulates this. The firm rolled out a data analytics operation at its portfolio company Access, a business software provider, in a bid to enhance cross-selling. Within four months, the initiative helped to boost the sales orders by around 60%.⁸ Elsewhere, software services such as Crossbeam are used by many VC firms to connect and synchronise data across portfolio companies, with the aim of boosting collaboration and growth across their stable of portfolio companies.⁹

This can extend beyond sales, as well, toward fostering prosperous business relationships and networks. “Some funds will have entire platforms with resources, such as playbooks, for their portfolio companies to access,” explains James. “Now, GPs are using these to connect portfolio companies and encourage the exchanging of ideas, best practices and creating communities.” Early-stage VC Kindred Capital exemplifies this, with the investor even making the founders it invests in limited partners in its fund to encourage a supportive network.¹⁰

What technology means to the Moonfare investment team

As technology’s role in PE dealmaking has increased, so has the weight that analysts put on PE firms keeping up with the latest advances in this area. At Moonfare, our investment team aims to select strong managers and funds, which more often than not correlates with staying ahead of the game in terms of technology.

“Through our diligence, we are identifying firms with a strong competitive advantage, and where we have conviction that they will continue to perform,” says James. “Part of this conviction stems from a GP’s ability to focus on high standards and continuous business improvements – including investments in and enhancements through technology. This is a key consideration in our process.”

The use of advanced analytics in the wider M&A market could generate hundreds of millions of dollars in value, according to Accenture.¹¹ With a PE lens, it is not difficult to see that similar amounts of value could be generated in the buyout and venture spaces through diligent use of emerging technology to rationalise the dealmaking process, widen the sourcing net and optimise portfolio companies. And those firms who do not will, inevitably, end up being left behind.

¹ https://jpe.pm-research.com/content/14/1/32 ² https://hbr.org/2010/06/time-for-investors-to-get-social ³ https://eqtgroup.com/motherbrain ⁴ https://www.prnewswire.com/news-releases/no-network-required-handshake-raises-200m-to-help-gen-z-launch-careers-301463445.html ⁵ https://645ventures.com/voices/articles/welcome-vardan-gattani-to-645-ventures-investment-research-team ⁶ https://www.themiddlemarket.com/news-analysis/trident-deploys-proprietary-tech-to-remove-bias-from-deal-sourcing

⁷ https://assets.kpmg/content/dam/kpmg/xx/pdf/2022/03/delivering-on-the-promise-of-value-creation.pdf ⁸ https://hgcapital.com/wp-content/uploads/2020/12/Data-Analytics-Deploying-AI-to-accelerate-cross-sales.pdf ⁹ https://www.crossbeam.com/blog/vc-firms-use-crossbeam-grow-portfolio-companies-at-scale/ ¹⁰ https://kindredcapital.vc