Key takeaways:

- Open-ended secondaries funds seek to combine the flexibility of evergreen structures with mature secondary assets.

- The compounding effect can be even more pronounced when employing a secondaries strategy, as capital is recycled more quickly compared to a primary open-ended fund.

- While providing a compelling route into private equity, these vehicles have specific risk considerations.

Private markets are currently shaped by several powerful forces. Two of the most prominent are the rise of secondaries¹ and the ever increasing adoption of open-ended (also called evergreen) funds.²

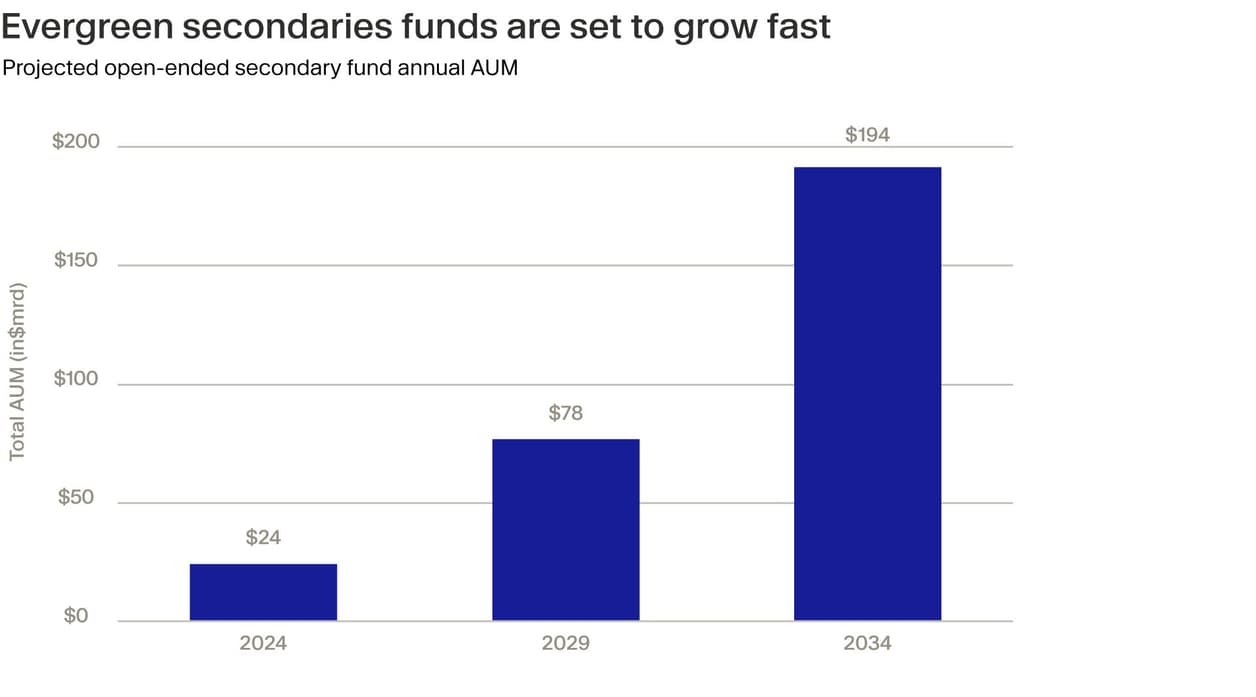

Now, the two trends are converging, with a notable uptick in open-ended funds specifically designed to execute secondaries strategies. Evercore estimates that 46% of secondary buyers are planning on raising such a vehicle while a financial services firm Baird believes the total AUM of evergreen secondaries funds will triple over the next five years, from today’s $24 billion.³

We don’t think this confluence is merely coincidental. We believe PE secondaries possess inherent characteristics that may align well with the semi-liquid fund structure and the objectives of these open-ended vehicles.*

Evergreen secondaries funds aim to provide ongoing access to the asset class by investing in existing private equity interests, all while providing periodic opportunities for potential liquidity. For those seeking a more flexible and potentially faster route into private equity, understanding how open-ended secondaries funds operate, and the benefits they can offer, is a must.

A symbiotic relationship*

We believe that one of the most powerful symbiotic alignments between secondaries and open-ended funds is their liquidity profiles. Secondary assets typically consist of more mature private equity interests. This means they have shorter remaining lifespans compared with committing to a primary fund from its inception. This also means they can potentially become cash generative earlier, mitigating the J-curve effect, arguably one of secondaries’ main attractions.⁴

In the context of open-ended funds, this characteristic is even more advantageous. Because evergreen funds may allow for partial periodic redemptions, they may potentially keep some of their net asset value (NAV) allocated to cash and highly liquid, low-yielding instruments to plan for these potential investor withdrawals. This creates an effect known as “cash drag”, which refers to the dampening of returns caused by this exposure.

However, since secondaries are in more mature portfolios, they typically generate more predictable, although not guaranteed, cash flows, potentially reducing the fund's reliance on holding extensive low-yielding reserves, which may help minimise cash drag from these mostly idle assets.⁵

Higher compounding rates

As discussed in our article on open-ended funds, these evergreen structures may also benefit from powerful compounding effects that can magnify returns over long enough investment horizons.

This effect can be amplified in a secondaries strategy.⁶ Because mature assets are typically further along their value creation journey and may be closer to generating cash flows compared to primary investments, distributions can potentially be crystallised sooner.

Instead of these proceeds being entirely paid out to the fund's investors, the open-ended structure allows the manager to strategically reinvest this capital back into new secondary assets, potentially creating a virtuous, compounding cycle.

Dialling up diversification

Another advantage of evergreen funds as a whole is the fact that investors typically gain immediate exposure to an already constructed, and often diversified, portfolio from day one. This contrasts with the traditional approach of committing to a new closed-ended fund that builds its holdings over several years.

When an open-ended fund employs a secondaries strategy, we believe that this diversification benefit can be taken to an entirely new level. This is because a single secondary market transaction often involves acquiring a portfolio of multiple fund interests.⁷ Each of these fund interests, in turn, typically holds stakes in numerous individual portfolio companies.

The result is that an investor in an open-ended secondaries fund can potentially achieve a highly granular level of diversification from a single entry point. This isn't just diversification across a few companies, it often spans a wide array of general partners (GPs), various vintage years, industry sectors and multiple geographic regions. It can include exposure to different private equity strategies, such as buyout, growth equity or even venture capital, all bundled within the acquired secondary portfolios.

We believe that this extensive diversification is particularly valuable for private wealth investors who may be making their sole allocation to private markets through such a vehicle.

What are the downsides

There are some potential downsides to open-ended funds versus traditional funds, including cash drag, NAV pricing sensitivities and higher absolute fees.

Regarding secondaries specifically, one risk that observers have highlighted is the incentive for open-ended secondaries funds to bid more aggressively on assets, which could dampen returns.

Unlike traditional closed-end funds that have a defined fundraising period followed by an investment period, open-ended vehicles receive ongoing subscriptions. If investors allocate more heavily to these funds when they see asset valuations performing well, the inflows may coincide with seller’s markets.

Put another way, the need to consistently put money to work means that in frothier market conditions, managers of open-ended funds might feel compelled to be more assertive in bidding for assets to ensure timely deployment. There is an argument to be made that this results in evergreen funds overbidding for assets.⁸ However, a counterargument is that they simply have a lower cost of capital, bidding in line with the parameters of their specific investment targets. For example, a secondaries evergreen fund manager may be comfortable paying a premium on a deal, knowing that over time this will be more than offset by compounding.

Stronger together

Above all, we believe that combining open-ended funds with secondaries harnesses the inherent strengths of both: the potential liquidity* and cash flow advantages of mature secondary assets, together with the flexibility and compounding potential of the evergreen model.

While it's important to be aware of the unique dynamics that apply to this strategy, we believe that a mindful integration of open-ended secondaries funds can be an efficient means of accessing the long-term growth potential of private markets.

* Liquidity is not guaranteed. Liquidity in this context refers to the option of redeeming up to 5% NAV on a quarterly basis. Redemptions are not guaranteed, may not be eligible to all investors and are subject to demand and to general partner approval.

¹ https://www.preqin.com/news/secondaries-in-2025-the-outlook-for-fundraising-deals-and-performance ² https://www.privateequityinternational.com/inside-the-semi-liquid-fund-boom/ ³ https://www.privateequityinternational.com/secondaries-evergreen-funds-are-sprouting-story-of-the-year/ ⁴ https://www.hamiltonlane.com/en-us/education/private-markets-education/secondaries ⁵ https://www.privateequityinternational.com/secondaries-offer-new-liquidity-options-to-managers/ ⁶ https://www.privateequityinternational.com/pantheon-evergreens-come-of-age/ ⁷ https://www.harbourvest.com/insights-news/insights/opportunities-for-buyers-of-limited-partner-led-secondaries/ ⁸ https://www.secondariesinvestor.com/are-semi-liquids-more-competitive-on-pricing-the-answer-is-nuanced/