Key takeaways

- Prominent US endowments are tapping the secondary market to rebalance their private equity allocations.

- These sales, often from high-performing portfolios, are generating a well-stocked pipeline of what we believe to be attractive opportunities for secondary buyers.

- Despite ongoing market uncertainty, institutional investors seem to remain fundamentally committed to private equity and many plan to increase their exposure.

A string of recent headlines has highlighted moves by elite US university endowments to sell parts of their private equity (PE) fund stakes on the secondary market. In our view, these sales are a sign of mature, strategic portfolio management and one that could be unlocking high-quality, attractively priced opportunities for secondaries buyers.

Yale University, one of the most revered institutional investors in private markets, is reportedly selling up to $6 billion worth of private equity holdings,¹ representing a significant chunk of its nearly $41.4 billion endowment.² Harvard, whose endowment totals approximately $53.2 billion,³ is conducting a separate transaction estimated at around $1 billion, with Lexington Partners in the frame as a potential buyer.⁴

Both sales were set in motion well before the Trump administration’s recent push to revoke tax exemptions and limit federal funding to elite universities⁵ — though political pressure has certainly added urgency. Both institutions have also made it clear that they remain committed to private equity over the long term.⁶

Driving these decisions are several converging drivers, including the so-called “denominator effect” — where falling public market values inflate private asset allocations — and a slower pace of distributions, which has hampered liquidity across portfolios. We think that Harvard and Yale’s actions are best viewed as tactical responses to these headwinds.

Exploring sales

These high-profile sales are unlikely to remain isolated. Press reports suggest other university endowments are now actively exploring similar moves. While future deals may not rival Yale’s in scale, early-stage discussions and buyer outreach are already underway.⁸

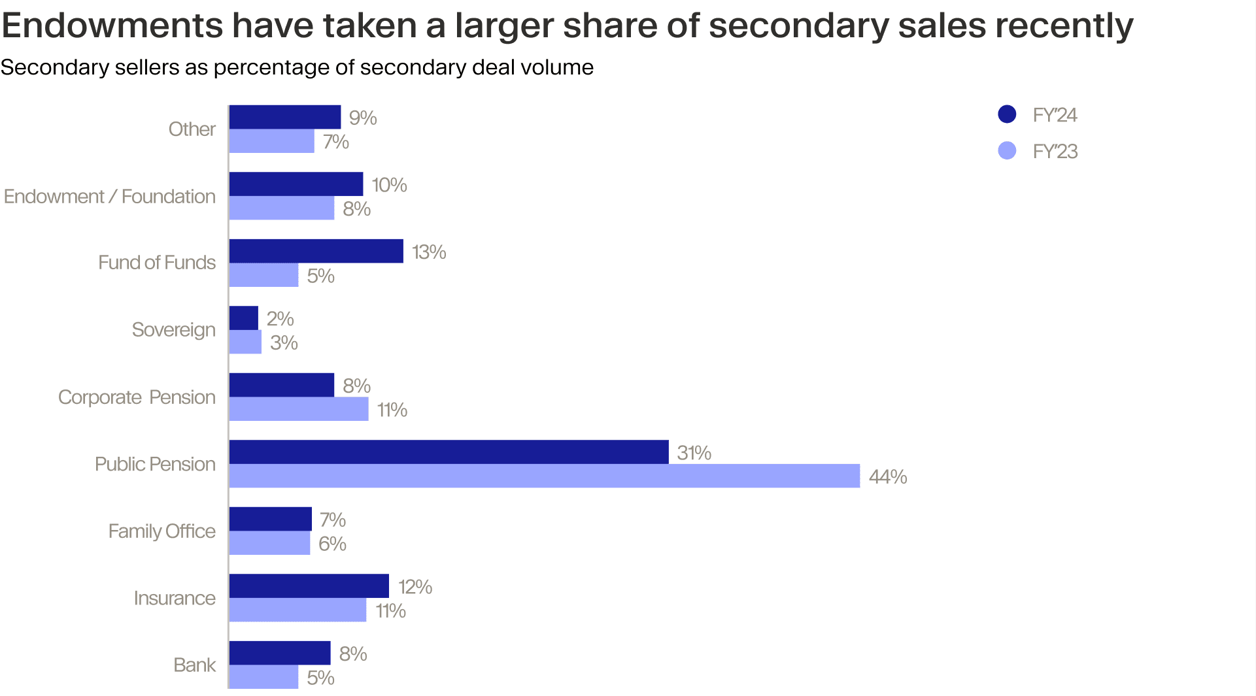

This has already begun to show up in the numbers. Endowments made up 10% of the $89 billion in LP-led secondary transaction volume in 2024, up from 8% the year prior, according to Evercore.⁹ If the political and funding environment remains strained, we believe that figure could rise further in 2025.

Further endowment sales would also mirror what has already become common practice among public pensions. Names like CalPERS,¹⁰ CPPIB¹¹ and Kaiser Permanente¹² have all executed multi-billion dollar secondary sales in recent years, often returning to the market repeatedly to rebalance portfolios and redeploy capital toward new opportunities.

Discounts and spreads

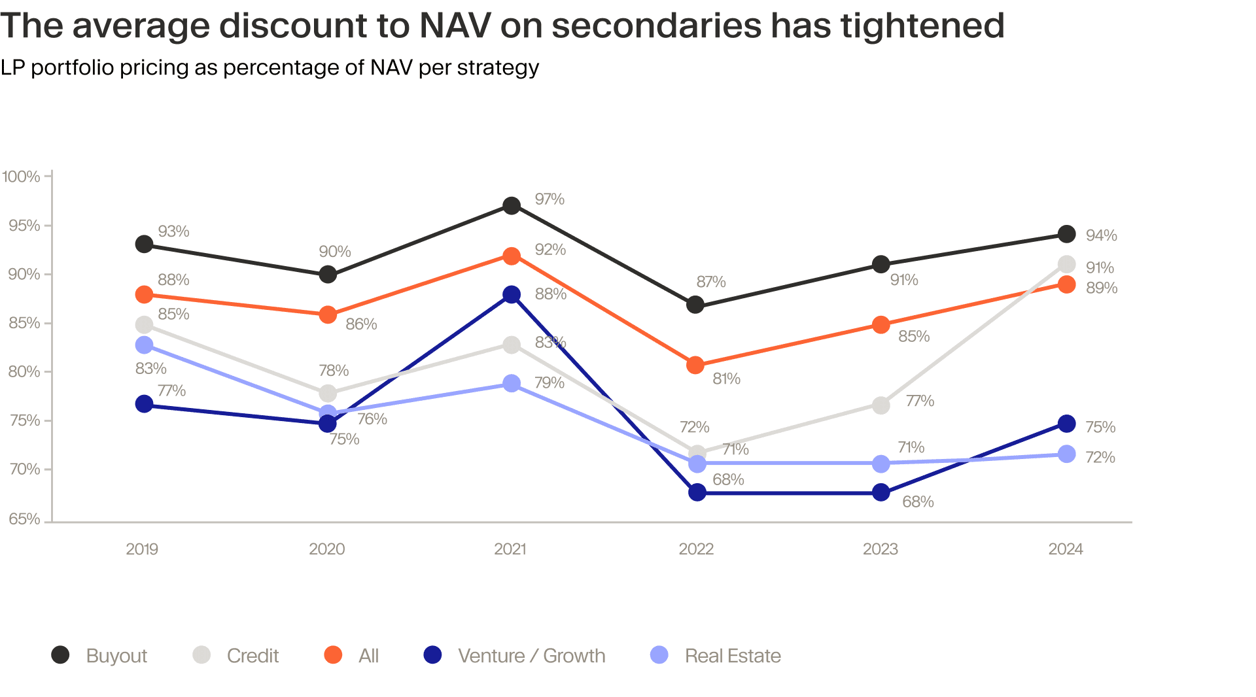

Secondary market pricing offers a window into how investor sentiment is shifting. Discounts widened significantly in 2022 and 2023, with buyout funds trading at an average of 13% below their net asset value (NAV), per Jefferies data.¹³ These discounts narrowed to just 6% in 2024 due to strong investor appetite and high-quality assets coming to market.

It’s a common misconception that sellers trim the weakest parts of their portfolios. On the contrary, it may pay for investors to offer fund interests that will draw demand. HSBC’s global head of alternatives Mathieu Forcioli recently shared that sellers often carve out “the better-performing part of the portfolio” in order to attract more buyers and command stronger pricing.¹⁴

Still, even at tighter discounts, the fact that sellers like Harvard and Yale are offering access to portfolios that would otherwise be unavailable to most investors may present a significant buying opportunity.

Programmatic selling

The rise of secondaries in recent years, in our view, is largely part of a broader shift toward “programmatic selling”, an industry term for systematic portfolio management across institutional private market investment portfolios.¹⁵

CalPERS, which sold billions in PE stakes to Ardian, AlpInvest and Partners Group earlier this year,¹⁶ remains one of the most committed allocators to private equity — and is currently seeking to expand its exposure.¹⁷

The secondary market offers both a way to trim and add private equity holdings. For example, GIC, Singapore’s sovereign wealth fund, acquired 50 fund interests in 2023 alone.¹⁸ Many sophisticated, globally renowned investors increasingly view secondaries as a rebalancing tool rather than a means of withdrawing from the asset class.

This is evidenced by the rising turnover rate of PE fund assets. Lexington has estimated this rate, measured by the percentage of funds raised in a given year that later trade into the secondary market, grew to 12% by 2023. This is more than double the rate seen in the mid-2000s.¹⁹

Record momentum

As LPs have grown more familiar with active portfolio management via the secondary market, the mainstreaming of programmatic selling has led to an explosion of deal activity. Last year, global secondaries volume touched $162 billion for the first time in history, a 45% year-on-year gain.²⁰

This surge of deal activity is matched by growing enthusiasm on the buy-side. Sophisticated investors are leaning heavily into the strategy, with major LPs like New York State Common Retirement Fund and Maryland State Retirement and Pension System making hefty commitments to new secondaries funds last year.²¹

And that momentum is far from waning. This year began with one of the strongest fundraising quarters for secondaries on record. A total of $50.7 billion was collected by secondary fund managers, multiplying the sub-$10 billion that was amassed in Q1 of 2024.²²

Meanwhile, about 45% of institutional LPs plan to increase their overall allocation to private equity in the next year, up from 31% in 2024, according to PEI’s LP Perspectives 2025 survey.²³ Secondaries may offer a way to quickly ramp up that exposure.

The long view

So, while further examples of endowments and other large institutions shopping parts of their PE portfolios may surface in the media, these are not fire sales. Rather, we see them as tactical moves from investors who remain committed to private markets — and who have historically achieved their returns by taking the long view.

For secondary buyers, quality assets are entering the market, often at prices below intrinsic value. As volatility lingers across public markets in the face of uncertain US trade policy and global economic growth, we believe this may be one of the most attractive entry points into private equity in years.

¹ https://www.secondariesinvestor.com/yale-sells-up-to-6bn-of-its-pe-portfolio-amid-federal-funding-challenge/2 ² https://your.yale.edu/sites/default/files/fy24-financial-report-10_25_24.pdf ³ https://finance.harvard.edu/files/fad/files/fy24_harvard_financial_report.pdf ⁴ https://citywire.com/pro-buyer/news/harvard-in-talks-to-sell-1bn-pe-portfolio-to-franklins-lexington-report/a2464535 ⁵ https://www.reuters.com/world/us/trump-take-away-harvards-tax-exempt-status-2025-05-02/ ⁶ https://www.secondariesinvestor.com/yale-remains-committed-to-pe-as-it-confirms-portfolio-sale/ ⁷ https://www.secondariesinvestor.com/a-second-chance-for-endowments/ ⁸ https://www.secondariesinvestor.com/a-second-chance-for-endowments/ ⁹ https://www.evercore.com/wp-content/uploads/2025/02/Evercore-Full-Year-2024-Secondary-Market-Survey-Results.pdf ¹⁰ https://www.secondariesinvestor.com/calpers-closes-multi-billion-sale-to-ardian-alpinvest-partners-group/ ¹¹ https://www.theglobeandmail.com/business/article-cppib-ardian-private-equity-fund-investments/ ¹² https://www.buyoutsinsider.com/kaiser-permanentes-6bn-secondaries-sale-mostly-done/ ¹³ https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf ¹⁴ https://citywire.com/pro-buyer/news/wealth-investors-in-the-dark-over-secondary-discounts-amid-endowment-sales/a2464927 ¹⁵ https://www.secondariesinvestor.com/the-next-wave-of-programmatic-secondaries-sellers/ ¹⁶ https://www.secondariesinvestor.com/calpers-closes-multi-billion-sale-to-ardian-alpinvest-partners-group/ ¹⁷ https://www.calpers.ca.gov/newsroom/calpers-news/2024/calpers-will-increase-private-markets-investments ¹⁸ https://www.bloomberg.com/news/articles/2024-12-10/singapore-s-cautious-wealth-fund-gic-takes-more-private-markets-risk ¹⁹ https://www.benefitscanada.com/canadian-investment-review/post-event-coverage/gic-2023-coverage-understanding-the-secondary-private-equity-market ²⁰ https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf ²¹ https://financefundsupdate.com/funds/the-biggest-lp-commitments-to-secondaries-funds-in-2024 ²² https://www.secondariesinvestor.com/download-behind-2025s-hot-secondaries-fundraising-start/ ²³ https://www.privateequityinternational.com/lp-perspectives-2025-seven-key-lp-opinions/