Key takeaways:

- Private wealth in the Asia-Pacific is now the dominant source of capital and allocations are rising.

- Semi-liquid vehicles are unlocking this regional demand, giving private wealth more access and flexibility without the 10-year lockups of traditional PE funds. These investments are still suitable only for eligble investors.

- Deployment has shifted from China to Japan, India and Southeast Asia due to more reliable deal flow and clearer exit pathways.

For much of the past two years, the conversation about private equity in Asia-Pacific (APAC) has been one of retreat. For evidence of that, just look at fundraising. APAC-focused private equity funds excluding RMB-denominated vehicles raised only $74 billion last year, the lowest total in more than a decade and less than half of the capital raised at the 2021 peak, according to Bain & Co.¹ On the surface, it appears that conviction has softened.

The reality, as is often the case, is much more nuanced. The contraction in capital raised is driven overwhelmingly by Western institutional LPs, who have been reducing non-core exposure and repatriating capital to the US and Europe. Heightened geopolitical uncertainty and the rollout of the US outbound investment screening programme have not helped.

The industry-wide slowdown in distributions has also been especially acute in Asia, stifling cashflows back to investors. APAC exit value fell from a peak of $208 billion in 2021 to just $106 billion in 2024² — a level that has left many LPs waiting significantly longer for capital to be returned.

Allocation shifts

Tellingly, however, early indicators for 2025 show a sharp rotation in the makeup of APAC fundraising. Asia-based LPs accounted for an estimated 96% of fund commitments in H1 2025, based on analysis of Preqin data.³ The power balance of fundraising is shifting from pensions and endowments in New York and London to private wealth and family offices in Singapore, Hong Kong and Dubai.

A Bloomberg Intelligence survey shows that half of Asia’s wealth managers report their clients’ risk appetite being “higher or much higher” than 12 months ago, with private equity, public equities, digital assets and hedge funds seeing the biggest allocation increases.⁴

Citywire Asia reports that advisers across ASEAN are seeing private wealth investors lift their PE allocations, often from low single-digits into the 10–15% range.⁵ Meanwhile, research from Brookfield Oaktree shows that nearly half of investors in alternative assets in the region would be comfortable with a 25%-plus allocation.⁶

Rise of semi-liquids

This appetite is increasingly being served by semi-liquid private markets vehicles — evergreen funds that offer shorter investment horizons and periodic redemption windows. By reducing the commitment frictions and lock-ups associated with traditional closed-end funds, these evergreen structures are making private markets accessible to a wider pool of investors.⁷

“From conversations with many of the largest global and regional GPs, it’s clear that semi-liquid structures across asset classes are resonating strongly with individual investors. We’re even starting to see growing interest from institutional investors in Asia,” says Adam Banks, Moonfare’s Head of APAC. “In the semi-liquid space, investors seemingly prefer large-cap, diversified managers. They see semi-liquids as a more stable, core component of their private markets portfolio, offering shorter investment horizons and built-in liquidity options, while pursuing alpha in traditional closed-end funds.”

Market opportunities

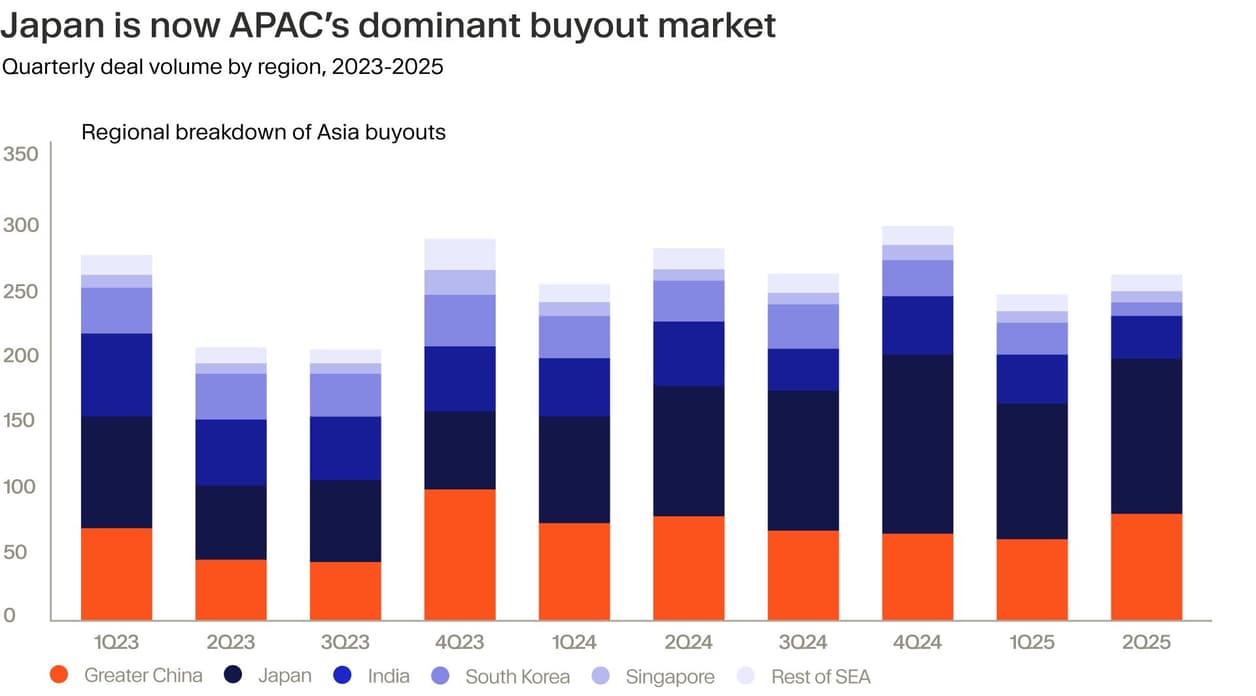

Not only is Asia’s capital base shifting toward regional private wealth, the deployment picture is also beginning to look very different from past cycles. Instead of being defined by China-led growth, today’s private equity activity is increasingly centred on Japan, India and Southeast Asia. Indeed, China’s share of APAC deal value last year settled at 27%, halving in just four years.⁸

Japan has become one of the region’s most reliable buyout markets thanks to structural catalysts. The Tokyo Stock Exchange’s corporate governance reforms introduced in 2022-2023 are forcing companies to improve capital efficiency, shed non-core assets and prioritise shareholder returns. This has seen the country’s aggregate PE deal value surpass ¥3 trillion for four consecutive years, while Q1 2025 achieved the second-highest quarterly deal value ever recorded in Japan’s PE market.⁹

It is not only large-cap public market assets that are delivering deal flow – succession is a second engine. Thousands of profitable mid-sized firms are run by ageing founders with no heir, creating a steady pipeline of control deals. Valuations remain attractive, too. Dealogic data shows that Japan’s median EV/EBITDA multiple was 12.0x in 2024, compared with 14.4x across Asia, and GPs are often able to secure entry valuations at 10.0x or below.¹⁰ These dynamics have led Japan to become the region’s most active buyout market.

India, by contrast, is the epicentre of Asian growth. The country is the fastest-expanding major economy in the world and the most populous globally, having overtaken China in 2023.¹¹ Investment is clustering around themes such as consumer platforms, technology services and financial inclusion, which are benefitting from this vast and increasingly digitally native consumer base’s rising purchasing power. The private market ecosystem is also showing clear signs of maturity, Bain & Co reporting that India was Asia’s largest PE exit market in 2024, generating more than $35 billion in sale proceeds and surpassing China thanks to IPOs and strategic sales now being highly tappable liquidity routes.¹² Naturally, clearer divestment pathways are boosting GPs’ confidence to deploy in the market.

Meanwhile, Southeast Asia is benefiting from “China +1” as manufacturers continue to diversify production into Vietnam, Indonesia and the Philippines. Vietnam recorded its highest-ever foreign direct investment (FDI) disbursement in 2024, at $23 billion, while total foreign investment pledges reached $37 billion, much of it flowing into manufacturing and export-oriented production.¹³ Over the same period, Indonesia recorded $50.3 billion in realised FDI, led by electric vehicle battery and critical minerals processing.¹⁴

Private equity is actively pursuing opportunities for investment in the infrastructure that supports this supply chain shift such as manufacturing, warehousing and cold chain, as well as sectors like consumer healthcare and fintech that are benefitting from Southeast Asia’s urbanisation and consumption story.

“There’s some nervousness around tariffs and global trade exposure, but investors here are more patient and less reactive than in Europe or the US,” says Banks.

A new dawn

After years of hype, the current cycle is rooted more in fundamentals than speculation. Japan is delivering a steady buyout pipeline through governance reform and succession. India is leading growth and exit liquidity. Southeast Asia is capturing investment through supply chain realignment and rising domestic consumption. The Asia-Pacific opportunity set has never been as broadly distributed as it is today.

Western institutions may be on the sidelines awaiting distributions and geopolitical and regulatory clarity, but as Oaktree Capital’s revered founder Howard Marks once famously said: “You can’t do the same things others do and expect to outperform.”¹⁵ Asian private wealth investors appear to be taking this sentiment to heart, leaning in rather than pulling back.

¹ https://www.bain.com/insights/asia-pacific-private-equity-report-2025 ² https://www.bain.com/insights/asia-pacific-private-equity-report-2025 ³ https://www.hsfkramer.com/insights/2025-07/asia-private-capital-second-quarter-data-and-trends ⁴ https://www.bloomberg.com/company/press/asias-private-wealth-management-industry-anticipates-annual-growth-of-at-least-6-over-next-five-years-bloomberg-intelligence-survey/ ⁵ https://citywire.com/asia/news/yield-and-diversification-hunt-drives-semi-liquid-demand-across-asean/a2472644 ⁶ https://www.brookfieldoaktree.com/sites/default/files/2024-09/KeyFindings_Asia.pdf ⁷ https://www.morganstanley.com/im/en-us/individual-investor/insights/articles/evergreen-private-equity-funds.html ⁸ https://www.bain.com/insights/asia-pacific-private-equity-report-2025 ⁹ https://www.bain.com/about/media-center/press-releases/japan/japan-private-equity-off-to-a-strong-start-in-2025-continues-to-be-a-hotspot-for-investors ¹⁰ https://www.cambridgeassociates.com/wp-content/uploads/2025/04/2025-04-Asia-Insights-Managing-Risk-Through-Diversification.pdf ¹¹ https://www.pewresearch.org/short-reads/2023/02/09/key-facts-as-india-surpasses-china-as-the-worlds-most-populous-country/ ¹² https://static.levocdn.com/WGLBUT82/bainreportindiaprivateequityreport2025-rSC5lHhPwWhe.pdf ¹³ https://www.ft.com/content/61ae72f0-45a0-4fcc-99b5-126c7ef1b04c ¹⁴ https://www.reuters.com/markets/asia/indonesias-fdi-553-bln-2024-2025-01-31 ¹⁵ https://www.oaktreecapital.com/docs/default-source/memos/2006-09-07-dare-to-be-great.pdf