Private equity. Invest with the best.

- Top-tier funds from the world's leading private equity managers

- Local, personal service from your dedicated point of contact

- World-class investment committee of industry insiders

- Global community of like-minded investors

Premier digital platform for PE investing

Members

0+Assets under management

€0bnCountries

0Funds to date

0+Maximize return potential with diversification.

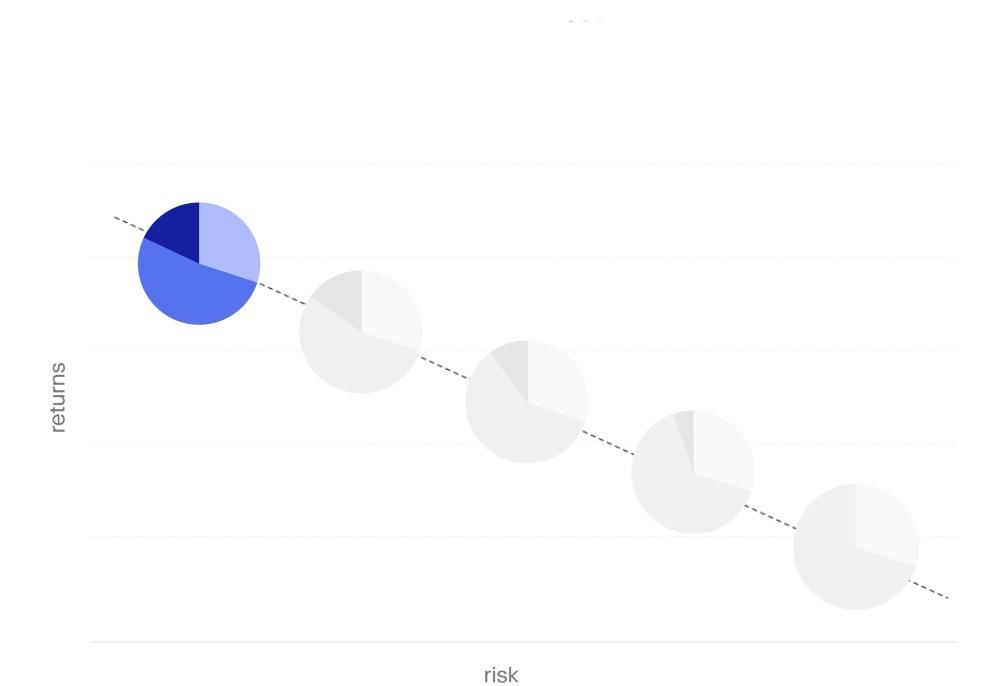

Diversifying through private equity funds from top-tier managers can yield superior risk-adjusted returns. That's how institutional investors aim to outperform traditional stock and bond portfolios.

Now you too can adopt this elite investment strategy.

Adding private equity to your portfolio could potentially help you reduce risk and increase returns.

bonds

stock

private equity

Hypothetical model portfolios shown above are for illustrative purposes only. Past performance is not indicative of future results. Model portfolios are a hypothetical representation of data compiled from various sources including: the modified correlation matrix in Swensen, D. F. (2009), Pioneering portfolio management: An unconventional approach to institutional investment. New York: Free Press; Rethinking Asset Allocation (Rep.). New York: KKR Global Institute. Actual performance will vary.

Flagship fund investments

Pick and choose specific funds to construct your own portfolio.

Flagship investments

Portfolio fund investments

Instant diversification across a range of strategies and funds.

Portfolio investments

*Minimum investment may vary by country and local regulation.

Some of our partners.

International

Investment Manager

Fidelity International is a strategic investor in Moonfare.

Independent

Tax Services

Deloitte is Moonfare’s global tax adviser.

International

Philanthropy

Moonfare is a strategic partner of Greater Share’s philanthropic investment model.

German Startup

Association

Moonfare is a member of the German Startup Association (Startup-Verband) Scaleup working group.

Our investment committee is tried and tested.

The Moonfare Investment Committee carefully curates a dynamic selection of private equity funds from top-tier managers.

Using our proprietary due-diligence framework, the in-house investment team applies nearly 200 years of private equity experience to select the most attractive funds.

See how it works

Drag to explore

Over 110 carefully curated funds from top-tier managers.

A selection of managers offered on the Moonfare platform or via portfolio products

Buyout

46 funds (41%), €1.25bn in AUM

Growth

33 funds (30%), €875m in AUM

Venture Capital

16 funds (15%), €592m in AUM

Speciality

16 funds (14%), €266m in AUM

See past funds

Secondary market. Your path to early liquidity.

Moonfare is the first platform to offer a digital secondary market for private market funds.

Together with Lexington Partners, our secondary market enables you to buy and sell stakes in funds before the lifecycle is complete — bringing the potential for liquidity to the asset class.

Press coverage and awards.

View press coverage