Closed Funds

Moonfare Feeder A40 - KKR North America Fund XIII

KKR North America XIII will primarily engage in leveraged buyouts and build-ups of leading businesses in North America

$17bn

$45m

151

$300.000

STATUS OF FUNDRAISING

STYLE

CLOSING DATE

GEOGRAPHIC FOCUS

OPEN FOR FUNDRAISING FOR

# OF INVESTMENTS

INVESTMENT PERIOD

SECTOR FOCUS

Target by country

Investors by profession

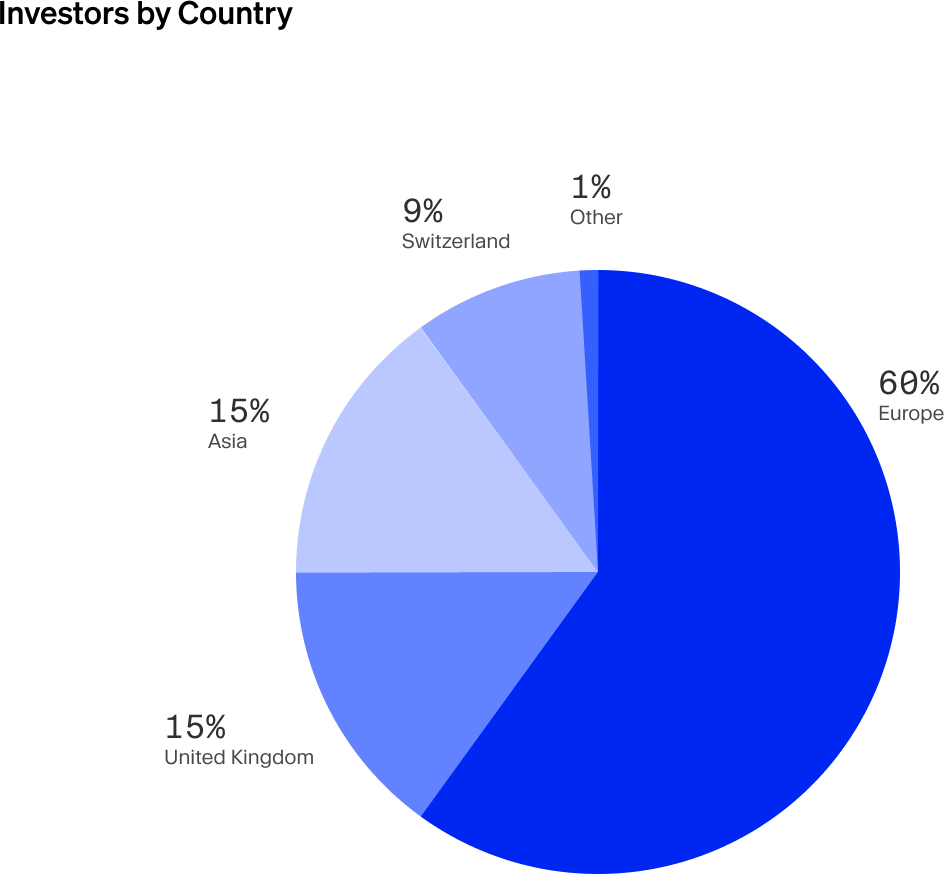

Investors by country

About

KKR

Established in 1976, KKR is a leveraged buyout transaction pioneer and a global, leading investment firm with $367 billion in assets under management.

KKR holds one of the longest and strongest North American private equity track records in the industry, having raised 12 funds and invested more than $57 billion across 215+ North American private equity deals.

Why we invested

Only five percent of the investment opportunities we evaluate pass our rigorous due diligence process. Below are some highlights that helped convince our investment team that this particular fund is worth betting on.

Proven strategy. KKR's 'All-Weather' investment strategy focuses on companies with solid underlying fundamentals — while enabling them to adapt their approach during times of dislocation.

Tenure. The fund benefits from its long-tenured and experienced KKR North America Private Equity team. The 26 Partners, Managing Directors and Directors have an average of 16 years of private equity experience each. Together with the Capstone Partners, the team has an average of 22 years of industry experience and 12 years at KKR.

Collaboration. KKR promotes communication and collaboration across industries and geographies to uncover unique investment opportunities and drive stronger outcomes. The firm engages executives across sectors to gain new perspectives and cross-pollinate ideas. The Consumer and TMT sector teams, for example, might work together to evaluate an e-commerce company.

Skin in the game. The minimum GP commitment is seven percent of total fund commitments — much higher than the standard industry terms. Given the size of the fund, this is an especially strong indicator of GPs' conviction in the strategy.

Global know-how. KKR North America leverages the firm's global resources. Global teams of platform experts provide required operational (KKR Capstone) and financing (KKR Capital Markets) capabilities to execute deals and accelerate operational transformations to create value.

Sector expertise. Investment teams are organised into KKR's five core verticals: Industrials, Health Care, TMT, Consumer and Financial Services. This approach enables KKR to have deep sector knowledge. KKR's North America private equity team has 70 investment professionals — making it one of the largest teams in the industry.

Employee engagement. KKR has a unique employee engagement model. This initiative aims to make all employees 'owners' by granting them the opportunity to participate in the equity return directly alongside KKR. Beyond sharing ownership, KKR also supports employee engagement by investing in training across multiple functional areas, driving improvements in worker safety and supporting the company's involvement in the community.

Stewardship. Since 2009, KKR has been a signatory of the UNPRI and, as a member of the American Investment Council, has helped develop its guidelines for responsible investing. The firm also supports and is actively involved in several other ESG-related initiatives including Out on the Street, Sponsors for Educational Opportunity and the Toigo Foundation.

How does Moonfare work?

Moonfare pools commitments from individual investors in its independent Luxembourg-based feeder funds, which invest directly into the underlying target funds. This structure makes it possible to bring the minimum investments down to a level suited for individual investors and ensures the absolute safety and security of your capital.