Key Takeaways

- The distribution waterfall details how proceeds from a private equity fund are distributed between the investors and the general partner.

- The waterfall preserves the rights and priorities of both parties to participate in cash distributions.

- The waterfall ensures that investors will recover their investments before sharing profits while ensuring that general partners are incentivised to maximise the overall returns of the fund.

What is a private equity waterfall?

A distribution waterfall in private equity is the methodology by which revenues and profits are split between the fund’s investors and the general partner. The waterfall describes how much of the fund’s distributions each party receives, what the priorities are between them, and how those priorities change as breakpoints or hurdle rates of return are achieved.

The waterfall metaphor alludes to water pouring over buckets that subsequently fill up, allowing the remaining water flow to cascade into another bucket and so on. The metaphor is somewhat oversimplified since a private equity waterfall doesn’t necessarily fill the investor's or general partner’s bucket completely before pouring into the next. Instead, there are limits to how much goes into each bucket, which change when certain overall parameters are met.

The need for describing how distributions will be split in a PE fund stems from the fact that private equity funds do not liquidate all at once. Instead, they generate distributions as underlying investments are sold. Since the proceeds of these sales come at irregular times and in varying amounts, and since both investors and general partners of the fund have a financial claim to them, it is necessary to stipulate exactly how these proceeds are to be allocated. The distribution waterfall outlines this process and is typically detailed in the fund’s offering documents.

The waterfall structure also makes sure that the investors initially recoup their initial investments plus a predetermined rate of return (often called a "hurdle rate") before any profits are shared. This arrangement prioritises investor capital protection and aligns the interests of the parties involved by incentivising the general partners to maximise overall fund returns. This is because the general partners typically only receive their share of profits, known as carried interest, after the investors have received their initial investment and the hurdle rate is met. As a result, the waterfall structure is a critical tool to align the financial incentives between the investors and the general partners.

Why are distribution waterfalls important?

A distribution waterfall clarifies how cash from investment sales is allocated, thereby providing clarity to all parties in the investment agreement. This assures the investors that the recovery of their investment will have a priority while at the same time assuring the general partner that they will be able to receive a performance incentive. Distribution waterfalls can be structured in different ways but are all designed to align the interests of the investors with the general partner and to provide transparency about how they will share the risks and rewards of the fund.

The waterfall also ensures that the general partner is incentivised not only to maximise the investors’ return but to achieve those returns in a timely manner.

American vs. European waterfalls

Distribution waterfalls tend to be structured differently between the U.S. and Europe, prompting the labelling of two types: European-style waterfalls and American-style waterfalls.

European-style waterfalls (also called Global-style) give a higher priority to investors, requiring that investors receive all distributions from the fund until they have fully recovered their overall investment and achieved the hurdle rate in returns before the general partner can receive any portion of proceeds. This means that the GP will receive no incentive compensation, even while proceeds are initially coming into the fund.

In contrast, an American-style distribution is applied to individual investment deals rather than to the fund as an aggregate. As long as the hurdle rate is met in each deal the GP can receive their share of the profits. This elevates the priority of the general partner such that they can begin participating earlier as a result of individual sales. At the end of a fund’s life, the aggregate arrangement between investors and general partners must still be upheld. If later deals are not as successful as early ones, then a ‘clawback’ feature is used to bring the GP’s share back in line with the aggregate agreement.

How does a distribution waterfall work?

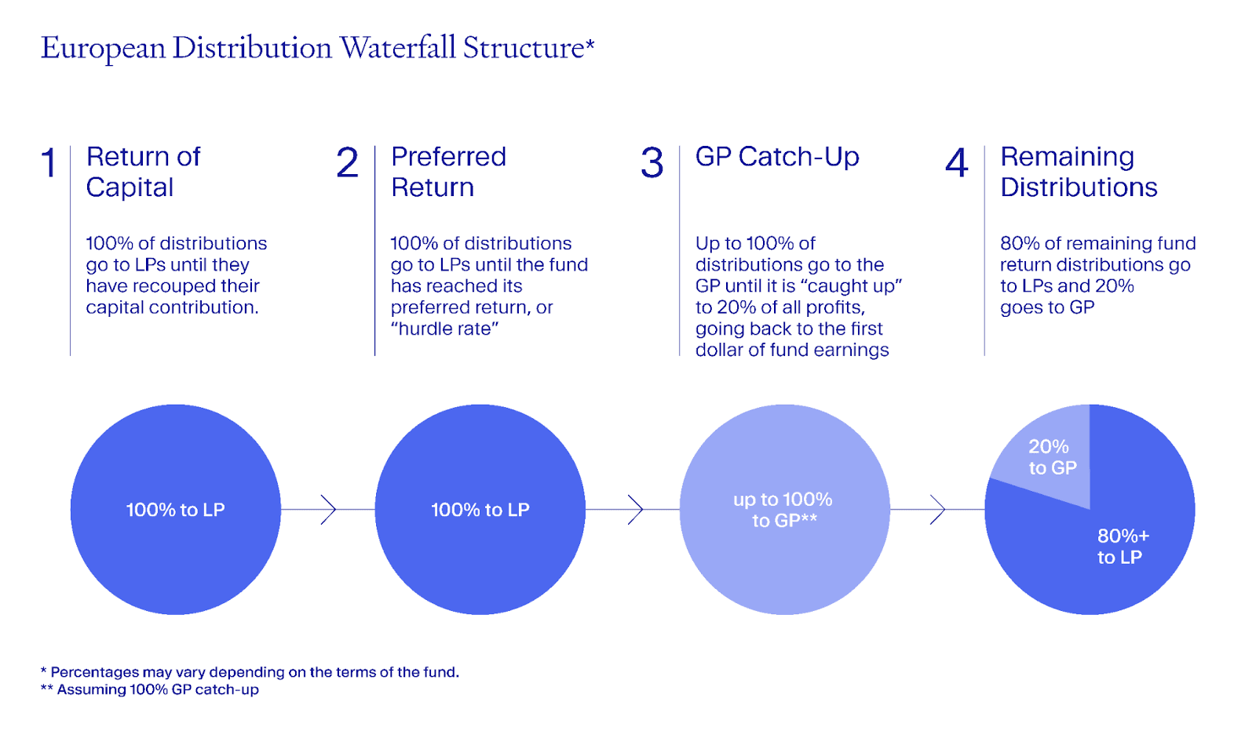

Distribution waterfalls will typically identify four tiers, which serve as the ‘buckets’ into which cash will flow as investments are liquidated. The tiers are as follows:

Return of Capital (ROC) – This tier is the first into which cash will flow and 100% of it will normally go to the investors as their return of capital.

Preferred Return – Once the investors have received an amount equal to their initial investment, the next allotment goes to them as their preferred return or hurdle rate. This is essentially the minimum return that investors are entitled to receive before the GP can begin taking their share.

Catch-Up Tranche – Once the investors have achieved their preferred return, the GP receives 100% of the cash flow until they have achieved their specified participation percentage.

Carried Interest/Residual Split – When the hurdle rate is achieved, this is the portion of investment returns that will accrue to the general partner.

As a fund sells its assets and begins distributions, the waterfall process proceeds through the tiers in accordance with the amounts, percentages, priorities and hurdle rates stipulated in the offering documents. Once all assets have been liquidated, if the GP has retained more than what they are entitled to overall, there is usually a clawback feature that requires the GP to relinquish any excess funds that may be due to the investors.

Private equity waterfall example

The diagram below illustrates a hypothetical distribution waterfall.

Distribution waterfalls represent an important part of the agreement between investors and general partners in private equity funds. They offer clear and concise details regarding how much both parties will receive as a fund closes investment sales and commences distributions. In the process, the waterfall ensures that priorities are respected and that the proper incentives exist for GPs to maximise returns and provide them in a timely fashion.