What is a J-Curve in Private Equity (and Venture Capital)?

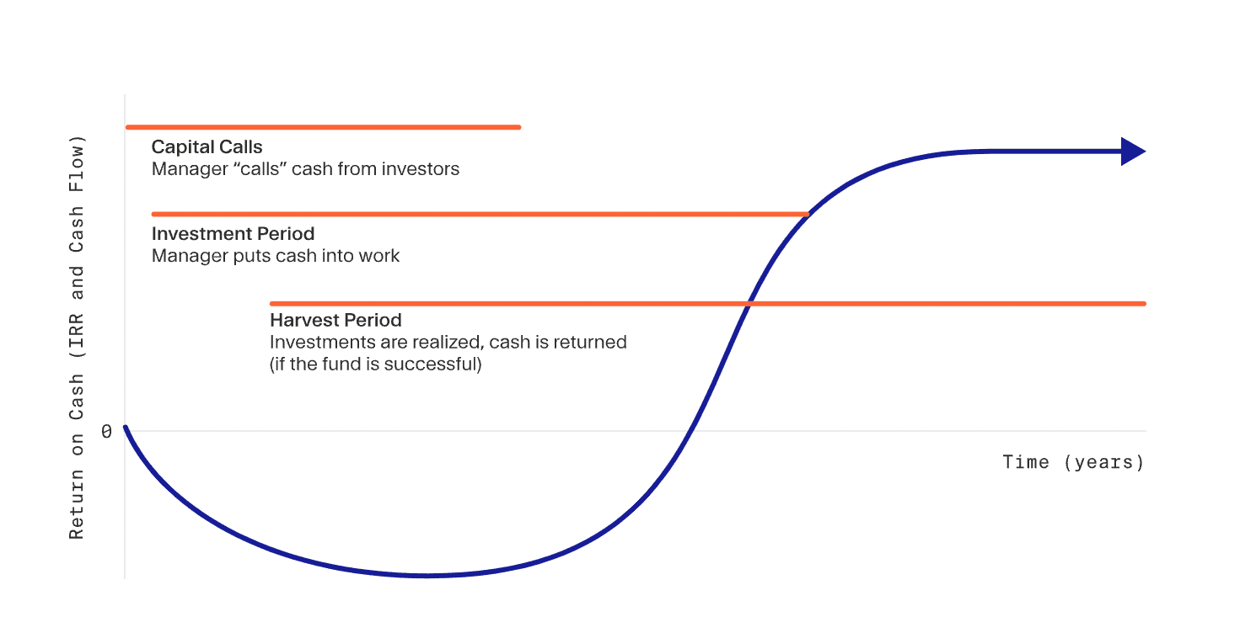

A “J-curve” is a plot of an investment’s performance versus time where the shape of the plot initially dips to negative values and then recovers to increasingly positive values, thereby producing a pattern resembling the letter “J”. Since private equity and venture capital investments typically display negative returns in their initial stages followed by increasingly positive returns in later years, graphs of their returns commonly conform to the shape of a J-curve.

Graphs for private equity and venture capital funds that plot cash flows, IRRs, or TVPI (Total Value to Paid-in Capital) over time will all typically show a J-Curve pattern, though the shape of the pattern will vary. In addition, the type of fund (venture, buyout, infrastructure, etc.) will also tend to show a characteristically different type of ‘J’ pattern as well.

A conceptual J-Curve graph is shown below:

Key Takeaways

- J curves are graphic plots of returns or cash flows over time that resemble the letter “J”.

- Graphs of returns over time for private equity and venture capital typically conform to J curves.

- Different types of funds will be characterized by J-Curves of different shapes.

What does J Curve tell the private equity investor?

The J-Curve helps investors understand the nature of how returns are realized in private equity and venture capital. For investors who have little experience in the private equity markets, understanding what the J-Curve represents helps to match their expectations to the way private equity funds are structured and returns are delivered. For experienced private equity investors, the J-Curve provides valuable comparison information about the cash flows, the manager’s strategy, and the type of private equity represented.

Most private equity funds do not deploy capital all at once and are funded over time as managers identify target investments and acquire assets. That process may take up to several years or more, during which there are initial fees and expenses that are realized but little or no appreciation in valuations. Once target investments are acquired by the fund, they are then valued quarterly, creating a lag between the time the assets are acquired and the realization of an increased valuation in the holding.

Knowing that PE investments operate this way, investors can diversify their investments to coincide with the timing of expected cash flows among multiple funds. For example, an investor might wish to pair two or more private equity investments that have different J-Curve expectations to smooth out their combined cash flows or time their purchases to allow the distributions of one to fund the investments in another.

What is the J Curve effect?

The J-Curve effect stems from the way private equity and venture fund investments are structured and how they provide returns to investors. The three-stage nature of private equity funds is illustrated in the diagram above as:

Stage 1 – Capital Calls

Stage 2 – Investment Period

Stage 3 – Harvesting

In the initial stage of a private equity fund, the managers typically require several years to identify and acquire target investments. During that time, they do not want to dilute their returns with unallocated capital that is awaiting investment, so they take commitments from investors and call capital from investors as needed during this period.

Since private equity and venture capital involve primary investments made directly into target companies, there is an inherent time lag during which the companies deploy that capital into their operation, thereby generating revenue growth that enhances valuation. This lag is exacerbated by the fact that private company assets are valued quarterly.

In Stage 2, the fund manager starts executing the value creation plan and the value of the underlying portfolio starts to grow. At this stage, valuations tend to grow at the accelerated rates associated with venture-backed companies, buyouts, and other private company investments. Distributions also begin to investors during this stage. This acceleration in valuation enhancement is what drives the steep rise in the J-Curve during the middle years of a private equity fund.

The harvesting stage usually starts at year 6 of a fund’s life cycle. As the manager harvests the remaining investment gains and distributes returns to investors, cash flows flatten and the fund ultimately closes. Stage 3 of the fund’s performance is when the top of the J-Curve tends to level out.

Factors that influence its shape

J-Curve shapes can be expected to differ among different types of private equity funds. An infrastructure fund, for example, would likely have a flatter shape, with a lower initial dip and less of a Stage 2 acceleration. A buyout fund, on the other hand, might have a deeper dip and greater acceleration.

Different managers and general partners may also operate their funds in unique ways, preferring to complete capital calls earlier or looking for opportunities that might take longer to exit.

In addition, market conditions can impact the shape of a J-Curve by causing strategies to shorten or lengthen to seize quicker opportunities in the beginning or hold assets longer at the end to achieve more prosperous exits.

How to mitigate the J Curve?

Private equity investors can mitigate the effect of the J-Curve by building it onto their overall investment strategy. That may involve several considerations by the investor:

- Deciding how to invest committed capital while maintaining the liquidity to meet capital calls

- Diversifying across multiple vintages and asset classes helps investors use distributions from earlier investments to fund the capital calls of other ones. Building a self-funding portfolio can help investors mitigate the J-Curve effect and smooth out their cash flow needs.

- Borrowing to meet capital calls when deemed more cost-effective than pulling from other investments.

- Laddering multiple private equity funds such that the anticipated distributions from one can fund the capital needs of others.

The J-Curve represents an important distinction between private and public equity investments. Knowing what the J-Curve represents and understanding the differences between J-Curves of different fund types and managers, investors can use the J-Curve to help decide between public and private equity opportunities and to compare different private equity funds. In addition, for those who choose private equity investments, the J-Curve enables investors to plan their cash flows to take maximum advantage of available opportunities.

![[WhitePaper] The J-Curve](/cdn-cgi/image/width=1256,quality=75,format=auto/https://publiccdn-production.moonfare.com/strapi/production/mw_ctas_a558e92a0c_e35d0a4bc7.webp)