Key takeaways

- Dry powder refers to the unallocated capital reserves held by private equity (PE) funds, ready for deployment into investments.

- It represents committed capital from limited partners (LPs) that has been formally pledged but not yet called or invested by the general partner (GP).

- It serves as a strategic reserve, providing PE firms potential flexibility in timing investments, capitalising on market dislocations and acting quickly on opportunities.

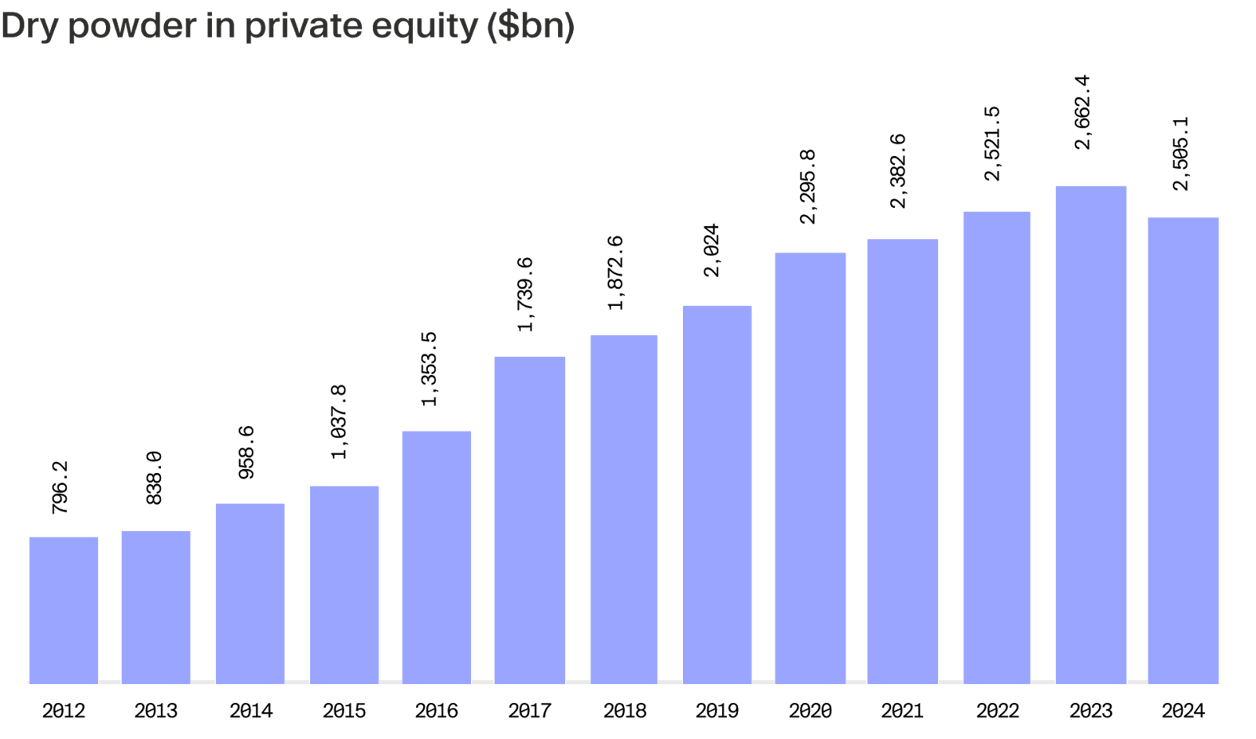

- Global private equity dry powder reached record levels in 2024, peaking at $2.62 trillion mid-year, indicating significant undeployed capital across the industry.

What is dry powder in private equity?

In a broad financial context, "dry powder" is a term derived from military history (referring to keeping gunpowder dry and ready for use) that signifies readily available cash reserves set aside for future deployment.

Within private equity, dry powder refers to the amount of capital committed by investors to a PE fund that the fund manager has not yet called for investment. It is essentially the deployable capital sitting on the sidelines, waiting for suitable investment opportunities to arise.

It's crucial to distinguish dry powder from committed capital. Committed capital represents the total amount an LP has agreed to provide to a fund over its lifetime. Dry powder is the portion of that committed capital that remains uncalled and undeployed. When a GP identifies an investment, they issue a capital call to LPs, requesting a fraction of their total commitment. This drawn-down capital is then invested, reducing the fund's dry powder balance. The LP-GP relationship governs this process, outlined in the limited partnership agreement (LPA), which specifies the terms under which capital can be called and invested during the fund's investment period, which is typically the first 3-5 years of a fund's life.

Why does dry powder matter?

Dry powder is a critical metric in private equity for several reasons:

- Strategic timing advantage: Holding substantial dry powder allows PE firms to be opportunistic. They can deploy capital during market downturns or periods of dislocation when asset prices may be lower, potentially leading to higher returns. This was evident in 2024, where PE firms utilised dry powder for take-private deals, capitalising on valuation differences between public and private markets, particularly in Europe.

- Operational agility: It enables GPs to act decisively and quickly when attractive investment opportunities arise, without the delay associated with raising equity financing for each deal.

- Market signal: The aggregate level of dry powder can signal different market dynamics. High levels might indicate strong fundraising success, reflecting LP confidence in PE as an asset class. However, persistently high levels can also suggest a slowdown in capital deployment, possibly due to high valuations, economic uncertainty or a lack of attractive targets, putting pressure on GPs to find suitable investments. Conversely, rapidly depleting dry powder may indicate a high pace of investment activity.

Latest trends in dry powder accumulation

The period leading into 2025 has seen unique dynamics:

- Record levels: Global PE dry powder hit a peak of $2.62 trillion in mid-2024. While some sources estimated a slight decline towards year-end 2024 to $2.51 trillion, reflecting slower US fundraising and some deployment, the overall levels remain historically elevated.¹

- Fundraising slowdown and concentration: Overall PE fundraising experienced a decline in 2024, falling 20% year-over-year to $476 billion globally. What’s more, the531 fund closures, down over 48% year-over-year, was the lowest count since at least 2008.² There are signs of increasing capital concentration, with some data suggesting LPs show a preference for larger, more established GPs and megafunds, while mid-market managers face challenges. This concentration is contributing to the large stores of dry powder held by top firms.

- Cautious deployment: While dealmaking showed signs of recovery in 2024 compared to the previous sluggish years, GPs remained cautious. High valuations and lingering economic uncertainty led to more selective capital deployment.

- Ageing dry powder: Despite a small reduction in the buyout industry’s total dry powder stockpile last year, to $1.2 trillion from $1.3 trillion, a growing concern is the increase in ageing capital; funds held for four years or longer now constitute 24% of the total, up from 20% in 2022.³

- Pressure vs. flexibility: While offering flexibility, the sheer volume of dry powder creates pressure on GPs to deploy capital effectively and generate target returns in a competitive and potentially high-priced market environment.

See What the data reveals about private equity in 2024 for a more detailed overview.

How do private equity firms manage dry powder?

GPs manage dry powder primarily through:

- Capital calls: Strategically timing capital calls to align with investment closings, minimising the time capital sits idle.

- Fund structuring: Funds typically have a defined investment period (e.g. 5 years) during which most of the dry powder is expected to be deployed. GPs typically aim to balance the pace of deployment against finding quality deals at reasonable prices.

- Deployment strategy: Navigating high-valuation markets requires discipline. GPs may focus on specific sectors, value-creation strategies like operational improvements or buy-and-build, or explore alternative deal structures like take-privates or secondaries.

- Performance metrics: The timing of capital calls and deployment directly impacts the fund's internal rate of return (IRR). Idle dry powder drags down IRR because the performance clock starts on committed capital, not just invested capital. Efficient management can play an important role in supporting investor returns.

Risks of excess dry powder

While having capital ready is advantageous, holding excessive dry powder may carry risks:

- Market overheating: A large, industry-wide overhang of dry powder may intensify competition for deals, potentially inflating asset valuations beyond their fundamental value.

- Deployment pressure: GPs may feel pressured by LPs or the fund's timeline to deploy capital, potentially leading to rushed decisions or paying high EBITDA multiples for lower-quality assets.

- IRR dilution: Capital that remains uncalled for extended periods doesn't generate returns for LPs but remains part of the committed capital base against which performance is measured, thus diluting the overall fund IRR.

- LP dissatisfaction: If capital deployment significantly lags expectations set during fundraising, it may strain LP relationships and impact future fundraising efforts.

Dry powder is a fundamental concept in private equity, representing the undeployed financial firepower available to fund managers. It offers strategic flexibility, enabling firms to capitalise on market timing and investment opportunities. However, the near-record levels seen entering 2025, coupled with a challenging investment and exit environment, may pose challenges for some firms.

Effectively managing this capital typically involves disciplined deployment, careful navigation of high valuations, and balancing investment pressure with return expectations. For LPs, understanding a GP's dry powder level and deployment strategy can offer valuable insights into their investment discipline, fundraising approach, and preparedness to execute their strategy in current market conditions.

![[WhitePaper] Moonfare Pulse 2024: investment trends in our community](/cdn-cgi/image/width=1256,quality=75,format=auto/https://publiccdn-production.moonfare.com/strapi/production/mw_ctas_1bf8139e3e_c72ee24fda.jpg)