In 1999, Apax Partners carved-out a little known theme park operator called Vardon Attractions from its eponymous listed parent in a deal valued at less than £60 million.

This began the company’s long history with private equity; it was later sold to Hermes Private Equity under the new moniker of Merlin Entertainments before, in 2005, being the subject of a £102.5 million buyout by Blackstone.

Eight years later, Merlin listed on the London Stock Exchange with revenues in excess of £1 billion, operations in more than 20 countries and a valuation north of £3 billion.

The exit is one of private equity’s many mid-market success stories. And looking ahead, factors such as a slowdown in leverage and spotlight on valuations could mean the segment is in line for renewed focus.

What exactly is the middle market?

Mid-market private equity is a broad church, and data providers as well as managers will categorise the space differently. As a rule of thumb, private equity mid-market firms will usually have an enterprise value (EV) sweet spot of between $50 million and $500 million. However, these ranges can start as low as $5 million and stretch to $1 billion for some firms who identify as mid-market players.

Business software company Visma, for example, was first backed by private equity in 2006 when Hg invested £101 million to take the group private, valuing the business at £382 million at the time.¹

Since then, Visma has made hundreds of bolt-on acquisitions, grown EBITDA at a 23% compound annual growth rate² and at the end of 2021 achieved a $19 billion valuation.

Billion-dollar mega-buyouts may grab the headlines, but lower profile mid-market deals like the above can often be where the best value and returns are to be found.

More levers for growth, more room for returns

One of the main reasons for this is that investments in this segment typically have more room to grow both operationally and in scale.

Smaller, mid-market companies are typically less mature than large cap targets in terms of how developed their businesses are. This can provide more scope for incoming private equity investors to strengthen and supplement management teams, improve financial controls and add new product lines, among other things.

Asset manager Pinebridge notes that the cost of professionalising a mid-market business is lower as the costs are applied against a smaller base of operations. Large, sophisticated companies also present less scope to drive up earnings growth through operational improvement.³

Mid-market companies present inorganic growth potential too, with private equity firms able to provide capital and M&A execution expertise to support market consolidation and buy-and-build strategies. BC Partners, for example, acquired business intelligence group Mergermarket from listed publisher Pearson⁴ for around £382 million in 2014⁵, performed a series of add-on deals, and sold the asset on for $1.3 billion to Irish strategic buyer ION Investment Group around five years later.⁶

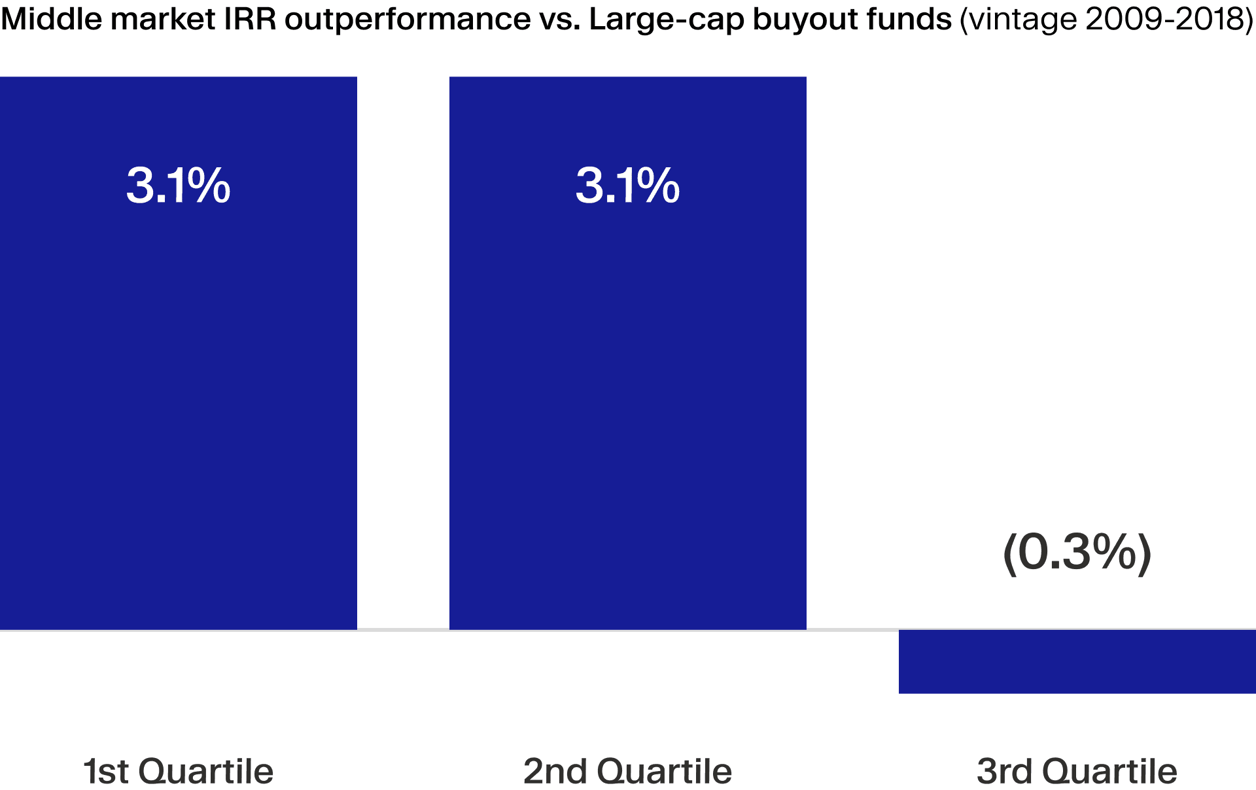

The upshot of this greater room for manoeuvre is that mid-market buyout funds tend to outperform larger institutions. Since 2000, median net IRRs for US mid-market funds have come in at 13.5%, versus 12.7% for large buyouts. Focusing on just upper-quartile funds, mid-market players have posted net IRRs of 22.1% since 2000, versus 19% for large buyout strategies.⁷

Opportunity amid volatility

In times of economic uncertainty, investing in the mid market is on the whole less prone to switching off.During the last 12 months of market dislocation the decline in large and mega M&A activity has been significantly greater than in the mid-market.

According to Mergermarket and White & Case data, global large-cap deal M&A value and volume (deals worth $1 billion or more) was down by 40% and 37% respectively year-on-year in 2022. Transactions in the midmarket $5 million to $999 million range, however, only fell by 19% and 6% over the same period.⁸

The sum of all this is that the mid market can provide a relatively consistent stream of deals for firms during downturns, while large-cap options are likely limited.

In the current market environment, the core characteristics of mid-market deals offer an attractive proposition for investors that must sustain deployment levels even when the wider M&A landscape is more challenging.

There are a number of reasons why the mid-market is attractive right now:

Mid-market deals are less reliant on leverage. One of the biggest obstacles for private equity during the last year has been a reduction in the availability of acquisition finance. For example, high-yield bond issuance in Europe came in at just €44.5 billion in 2022, the lowest figure since 2009.

This can be problematic for larger buyout investors who tend to use financial engineering as a key value lever. In a bull market where credit is cheap and abundant, this tactic is highly effective. In a higher interest rate environment, the model becomes more difficult to deliver. Leveraged loan issuance in the US and Europe, for instance, fell by 50% in 2022 to $203 billion year on year.⁹

Mid-market companies with less than $50 million of EBITDA, by contrast, consistently use less leverage than larger businesses, according to S&P figures.¹⁰ Mid-market deals can be bridged with equity as entry cheque sizes are smaller and do not leave sponsors overexposed to individual assets.

When debt financing is used in mid-market deals, it is easier to source for the same reasons. In addition, the fact that they are less reliant on leverage as a value lever means that they are not as susceptible to credit market volatility.

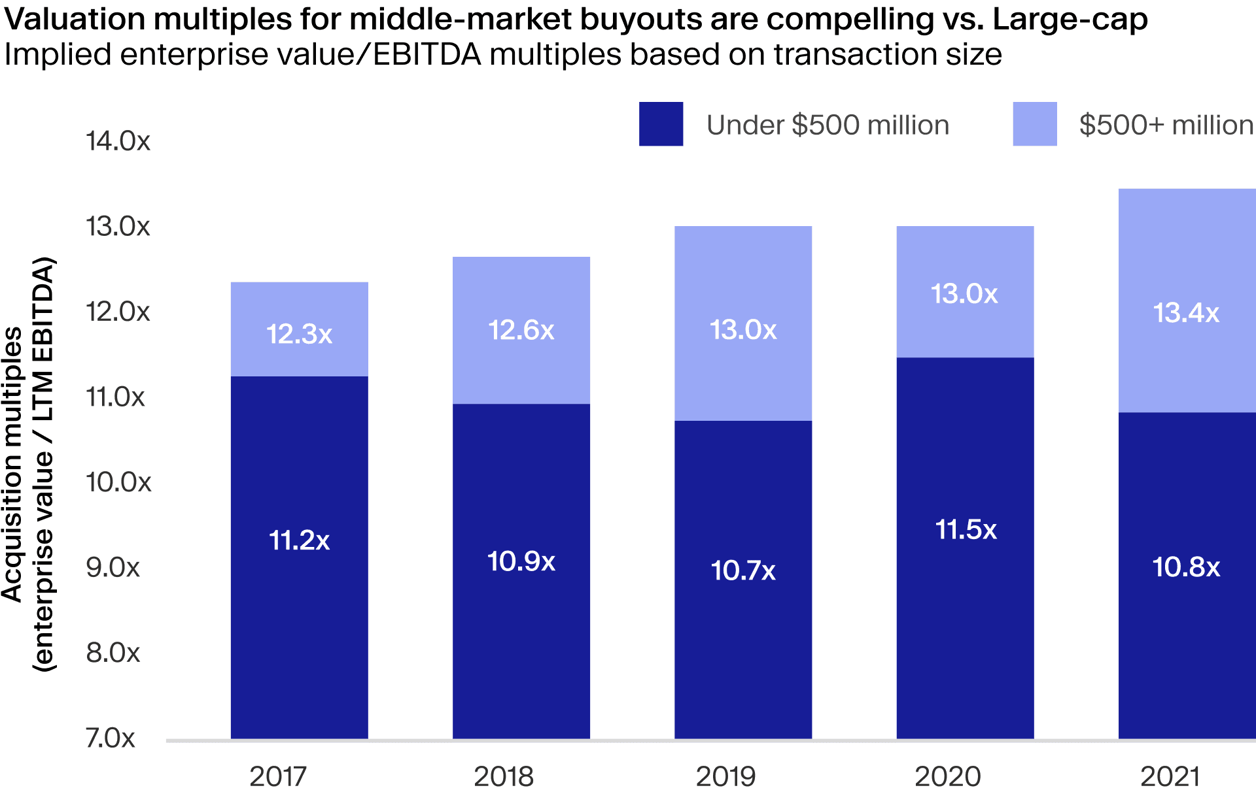

Lower entry valuations, greater willingness to deal. After M&A asset valuations crested record highs in 2021, buy-side dealmakers have become increasingly sensitive around pricing and very careful not to overpay for companies on entry. Historically, mid-market companies have presented lower entry multiples for buyers. According to research from PineBridge, the average multiple paid for companies with EV of less than $500 million has come in 17% lower than for entry multiples for bigger assets during the last five years.¹¹

Exit windows are wider. For large-cap strategies, assets are typically exited via IPOs or in sales to large strategic players, as seen with Blackstone’s US$13.4 billion exit of healthcare technology company Change Healthcare to strategic buyer Optum.¹² Global IPO value and volume, however, were down by 61% and 45% in 2022, according to EY¹³, and strategic buyers have been unwilling to pursue transformational, big-ticket M&A in a period of uncertainty. Large cap players have had to sit on their hands and extend hold periods unwillingly until exit routes reopen.

In the mid-market, however, exit routes can be more fluid. Trade buyers have been more comfortable buying smaller, complementary businesses that don’t dent balance sheets too much, and mid-market sponsors have also been able to sell up the private equity chain to bigger managers in secondary buyouts. Estimates from Lazard, for example, put total GP-led private equity secondaries transactions in 2022 — of which 80% were secondary buyouts — at $102 billion, the second-largest figure on record after the previous year.¹⁴

This is doubly attractive in an environment where price levels are in the midst of a reset and mid-market companies will be more willing to partner with private equity for operational support. A recent survey by law firm Katten of mid-market US private equity executives, for example, found that falling valuations was the primary catalyst for them to go after opportunities in financial services.¹⁵

⁶https://www.reuters.com/article/bc-partners-divestiture-acuris-idUSL4N22P2GG

⁹https://www.bain.com/insights/topics/global-private-equity-report/

¹³https://www.ey.com/en_gl/ipo/trends

¹⁴https://www.lazard.com/media/452373/lazard-secondary-market-report-2022.pdf

¹⁵https://katten.com/Files/2023_Katten_Middle_Market_PE_Report.pdf. See page 8, col 2