Moonfare’s investment team lays out the advantages of investing in a diverse portfolio of fund managers, each with its own liquidity profile and investing style.

“Investors have asked us for one product that would allow them to broadly diversify their private market investments. That’s how Moonfare portfolios were created,” explains Magnus Grufman, Head of Investments team at the firm, in conversation with Sweta Chattopadhyay, Moonfare’s Investment director.

Portfolios provide investors with exposure to ten different fund managers with one ticket, very often diversified across sectors and geographies. “This way we created portfolios with very strong names and with big upside potential but a balanced-risk downside,” says Sweta Chattopadhyay. Note that even with the benefits of diversification, investing in PE is a high risk strategy.

Diversification has become a major theme with private markets investors. According to a recent Schroders institutional investor survey, 80 percent of investors said the need to diversify was driving their private assets allocations. The authors of the survey highlight that the opportunity for diversification lies not only across the public-private spectrum but also within private assets themselves.

Mitigating J-Curve dynamics

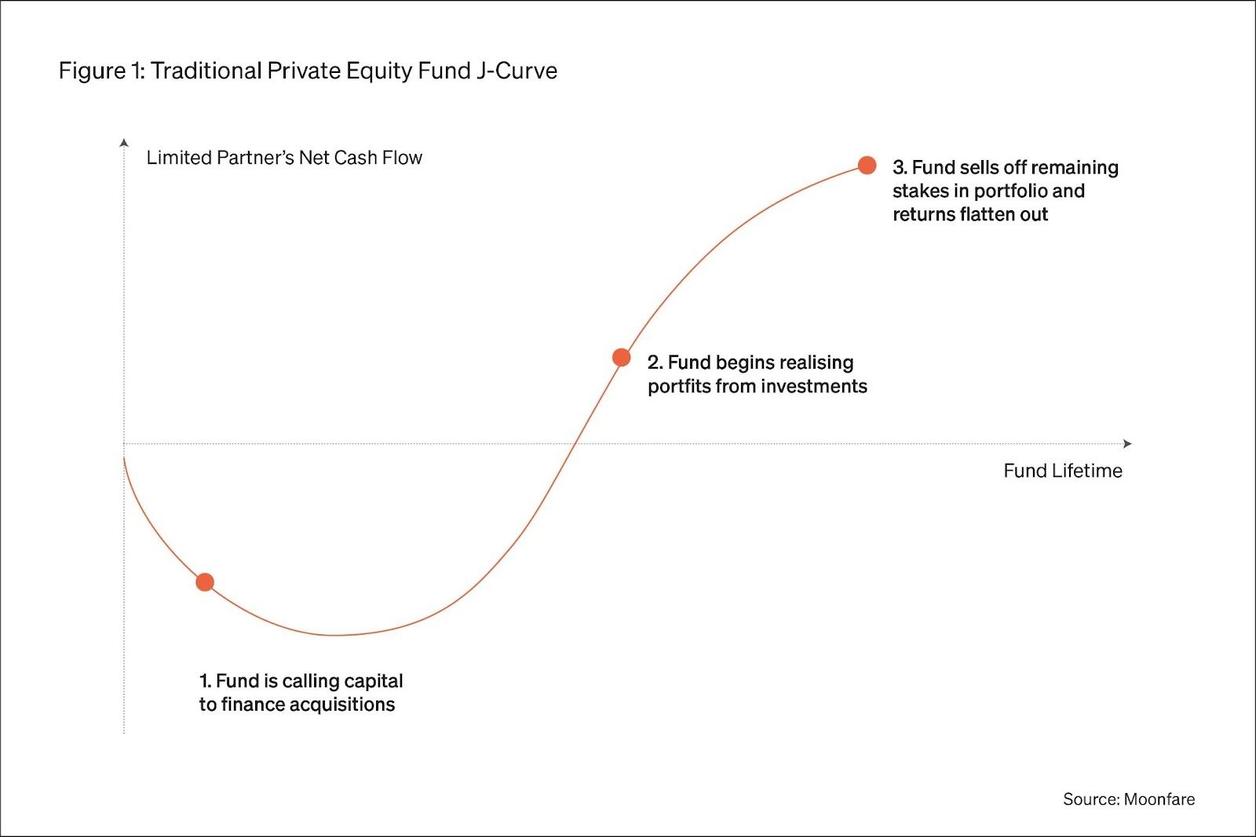

One powerful benefit of investing in existing private equity portfolios is the potential to better mitigate J-Curve effects. The J-Curve represents private equity’s investors net cash-flows over the fund’s lifetime (figure 1).

When investors or limited partners build a portfolio of private equity investments, they are setting up a collection of J-Curves that, taken together as a weighted average, represent the total net cash flow across the entire portfolio.

Each underlying fund has its own J-Curve. These distinct J-Curves will not be perfectly correlated, especially if different private equity funds are staggered over time. Capital calls across this diversified portfolio will happen more gradually and early distributions from some funds may even offset capital calls from later funds.

Hedge against organisational risks

In diversified portfolios, returns don’t hinge on a single manager or asset’s performance. Investors can benefit from a hedge against potential organizational risks (such as the loss of key personnel or information systems compromises) which are inherent to investing in a single asset or fund.

Friendlier entry into private equity

Finally, portfolios are often seen as a good starting point for investors into private equity. Moonfare portfolios, for example, have been constructed by a group of experienced private equity investment professionals who selected a handful of top-tier funds from a pool of hundreds.