Landlords in the Netherlands have suffered a double whammy in 2023 when it comes to getting the most from their investments. At the start of the year, the real estate transfer tax rate — a levy imposed on acquisitions of immovable property in the country — increased from 8% to 10.4%.

What’s more, the government has also announced plans to regulate mid-market rentals from 2024 onwards, limiting maximum rent per month at around €1,100 under a new points-based system. Property owners are facing the threat of fines should they breach these conditions.

In response, landlords are increasingly looking to move on from properties that are now becoming more of a burden than a potential pension pot. More than 90% of landlords surveyed by Vastoged Beland, for example, told the trade group they are forced to sell part of their real estate as a result of these policies and others.

These changes and others have therefore sidelined Dutch property investors looking for upside domestically, leaving them with a pool of capital and limited places to put it to work. However, this could also provide them the opportunity to access the world of private markets investing, for potentially less stress and higher risk-adjusted returns.

At a base level, private markets and real estate hold some common ground in an investment context. Both are asset classes that are usually held for the long-term, for example, and each are key pathways for investors to generate income. Indeed, a recent survey by BlackRock indicated that more than 80% of respondents identified income generation as a key factor in their private market allocation considerations.

Yet this broad parallel underestimates the advantages and variety that private markets can provide discerning investors with a wide range of return needs. Here are three key reasons why:

Higher potential returns

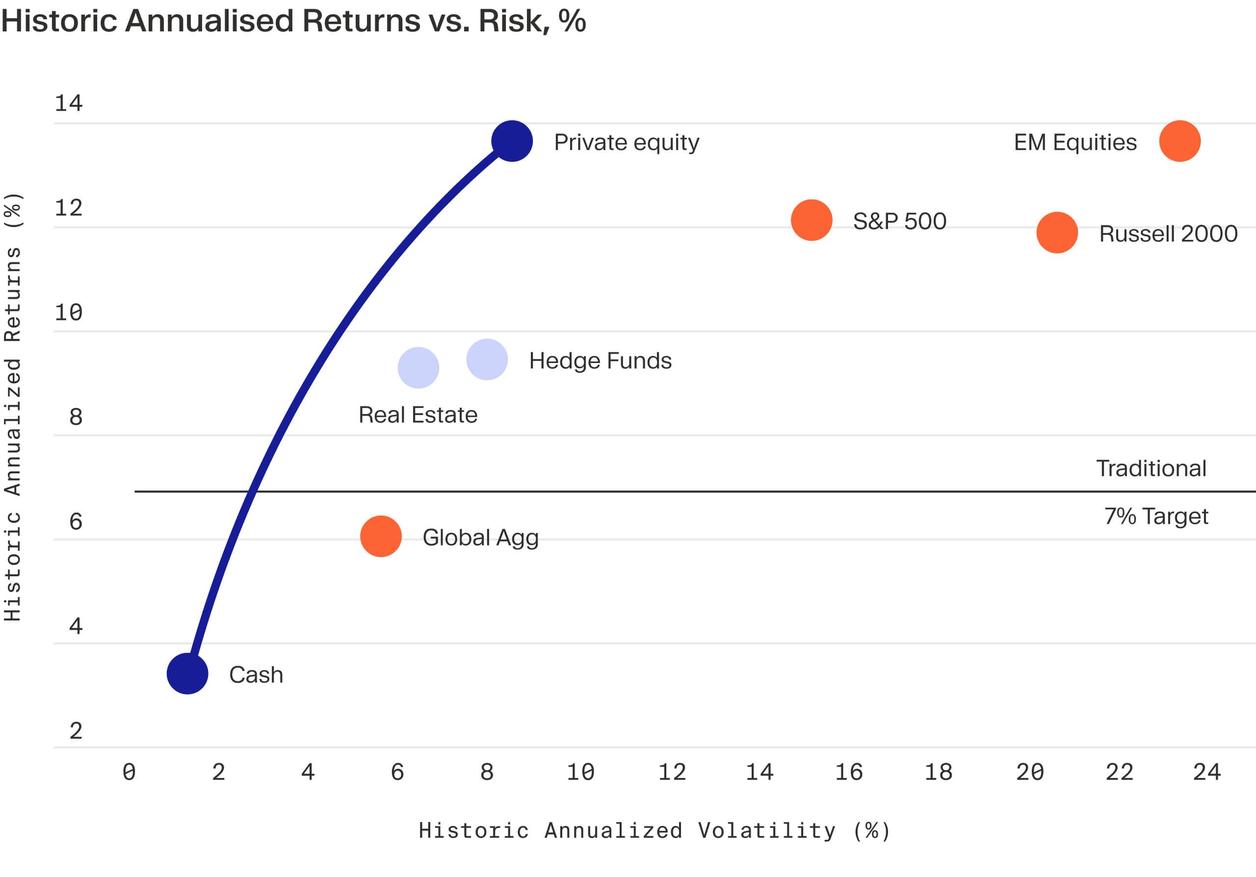

Certain areas of private markets have track records of outperforming many other asset classes, including real estate. Historical analysis by KKR, for example, found that private equity — the most common private markets strategy — generated annualised returns of nearly 14% over a more than 30-year period to 2020. What’s more, private equity was also found to generate less volatility over the same timeframe than a number of public market indices.

Peace of mind with top-tier managers

Investing, owning and managing a real estate portfolio is an incredibly hands-on endeavour. Of course, having this much involvement provides landlords with a hefty degree of active involvement that can lead to well-earned rewards, whether that is through leverage to maximise capital gains, or using local market knowledge to identify opportunities and outmanoeuvre other prospective buyers.

The level of personal involvement can also be incredibly high. Sourcing properties in person, managing renovations, dealing with tenants and running the risk of vacancy in the wrong market can all be resource-consuming and stressful. In addition the benefits of investing in a property market locally are mitigated by its concentrated nature; pooling your capital into a single property leaves it static and vulnerable to local movements that may not affect the wider market.

By contrast, private markets can take this burden away from investors who entrust their capital to leading managers with deep expertise in their fields and strong track records of delivering returns. Doing so, however, requires that investors can sure that these managers meet these requirement.

A variety of strategies for different risk appetites

While real estate can provide a path for income generation, private market asset classes can provide a wealth of options for investors with different return priorities.

Buyout for example, can provide access to investments in revenue-generating companies with a focus on downside protection, while those hunting for upside can look toward venture capital as a route to access investments in some of the potential giants of tomorrow. Industry leaders such as Uber, Slack and current OpenAI, for example, have been supported in their journeys through venture capital. There are even options for those who are more income focused, with private credit becoming an increasingly popular strategy in 2023.

- https://taxsummaries.pwc.com/netherlands/corporate/other-taxes#:~:text=Transfer%20tax%20on%20immovable%20property,as%20of%201%20January%202022

- https://www.vastgoedbelang.nl/actueel/nieuws/artikel.aspx?item=161

- https://www.businesswire.com/news/home/20230418005323/en/Income-Generation-to-Drive-Global-Private-Asset-Allocation-this-Year-BlackRock-Alternatives-Survey-Finds

- https://www.kkr.com/ja/node/3591