Key takeaways:

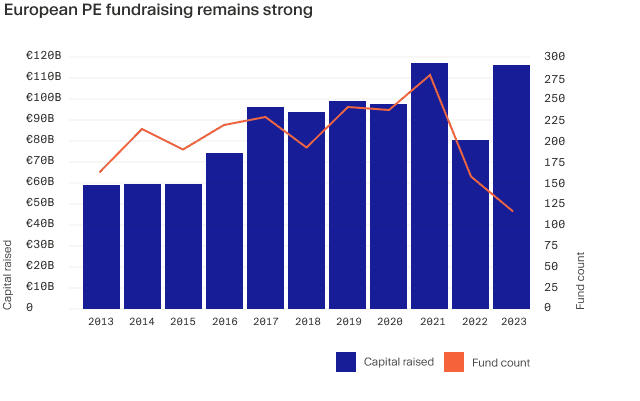

- Fundraising by European private equity firms hit €117.8 billion last year, just shy of the record €118.4 billion raised in 2021.¹

- Add-on acquisitions gained share as firms pursued buy-and-build strategies.²

- Take-privates accounted for nearly half of capital invested last year and sponsors continue to eye public markets for deals.³

The private equity industry felt the full brunt of rising rates, high inflation and economic uncertainty in 2023. Yet European PE fundraising proved astonishingly durable, rising 45% over 2022 to €117.8 billion, just €600 million short of the record capital raised in 2021.⁴

This feat was powered by a select group of high-profile managers, with the top five funds accounting for over half the total capital raised.

As limited partners (LPs) grew more risk-averse amid volatile conditions, they concentrated allocations in seasoned mega-funds from blue-chip houses like CVC, Permira and KKR. These firms tapped into their long-cultivated LP networks, who committed en masse on the prospect of outsized returns from market dislocations.

Mid-market managers weren't completely edged out though. For instance, UK-based ECI Partners raised £1 billion for its twelfth buyout fund, comfortably above its £900 million target.⁵ Nordic mid-cap firm Norvestor closed its ninth vehicle on €1.5 billion, almost doubling its previous fund size.⁶ Note that in both cases, these general partners (GPs) have extensive track records, demonstrating how LPs are being drawn to established names regardless of their strategy or market focus.

A shift to platform deals and add-ons

On the dealmaking front, European volume proved resilient despite worsening economic sentiment. Private equity deal value contracted 26.5% versus 2022, according to PitchBook, but estimated deal count inched up by 4.4% over the same period.⁷

With the pool of viable large-scale assets shrinking amid depressed valuations and costlier credit, activity shifted toward smaller platform deals and bolt-on acquisitions. In fact, add-ons made up almost 55% of transactions, the highest share in recent years, as sponsors doubled down on buy-and-build plays.⁸

For example, Xeinadin, a London-based accounting firm held by Exponent, acquired competitor McKeogh Gallagher Ryan in November, marking the portfolio company’s seventeenth add-on and ninth in 2023 alone.⁹

This spree of deals exemplifies how financial sponsors are banking on operational synergies and EBITDA multiple expansion to create value amid leverage constraints.

Carve-outs beckon

Corporate carve-outs are also expected to gain momentum in 2024 as organisations streamline their operations and hone their strategies. A recent study found that two-thirds of large corporates anticipate a significant increase in carve-out activity as transformation processes entail shedding assets unrelated to their primary strategic focus.¹⁰

In October, private equity firm Triton acquired Siemens Energy's high-voltage component business Trench, rationalising the vendor's portfolio and allowing it to focus on product quality issues at its wind turbine division Siemens Gamesa.¹¹ Carve-outs can be especially pressing in public markets. Activist hedge funds push companies to continually evaluate their business units and asset portfolio to identify low-returning or non-core divisions. They campaign for spin-offs of such units to eliminate resource drag, so that management attention and capital can be channelled into higher growth and return areas. Asset management firm Lazard reported a 7% year-over-year increase in new shareholder activism campaigns last year¹², marking an all-time high for Europe. This shift is partly due to the evolving relationship between companies’ management and their stakeholders, including local unions, governments and large investors.

As traditional barriers to activism erode, more traditional investors are joining the fray, adopting tactics once reserved for corporate agitators like Elliott Investment Management, one of the largest activist funds in the world.

This trend is highlighted by a notable increase in activism campaigns targeting mid-cap European companies and a growing willingness among active portfolio managers to apply pressure in Europe. With the right investment thesis and experience in executing these more complex transactions, private equity is poised to capitalise on the potential for corporate spinoffs.

Going private

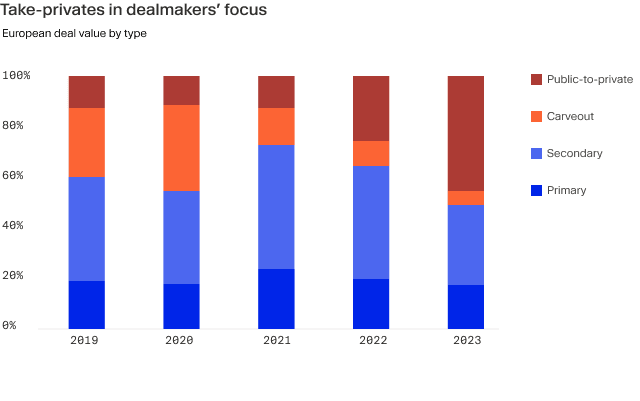

Public-to-private (P2P) deals have been another definitive theme of recent activity.

Take-privates accounted for a record 9% of European transaction count last year and an impressive 45% of value¹³, as dealmakers took advantage of relatively cheap European stock prices. The STOXX 600 index traded at a sizeable discount of around 30% to the S&P 500. Sponsors eager for undervalued targets centred much of their attention on the London Stock Exchange, which served up half of these deals in 2023. The largest of these saw EQT and Abu Dhabi Investment Authority subsidiary Luxinva purchase veterinary pharmaceuticals business Dechra for £4.5bn.¹⁴

Given the continued lag in European equities compared to the US, there are opportunities for PE to capitalise on the continent’s stock markets in 2024.

The forces shaping European PE

Looking ahead, a number of forces are providing catalysts for PE investment in Europe. Government incentives across the EU and UK aim to rapidly accelerate decarbonisation and energy efficiency in order to meet net-zero emissions targets by 2050.

Tax breaks for green projects and mandates around renewable energy sourcing are driving private equity interest in major wind and solar farms. New requirements for electric vehicle infrastructure and charging networks are also opening up opportunities within e-mobility. Separately, initiatives around upgrading technology and digitalising entire sectors are expected to fuel dealmaking in IT infrastructure and software capabilities across industries from manufacturing to healthcare. In pursuit of a fully digitised Europe by 2030, the European Commission unveiled Europe's Digital Decade strategy in 2021.

The plan sets specific goals for the region to meet within the next seven years. It spans critical technology infrastructure upgrades, business digital transformations, modernised public e-services and advanced professional skills development across the workforce.¹⁵

Regulatory changes are also enabling greater retail investor participation in previously restricted private market assets. Reforms to the European Long-Term Investment Fund (ELTIF), which took effect on 10 January, now permit features like fund of funds structures while strengthening retail investor protections. Industry estimates project retail inflows into European private equity could tally tens of billions in the coming years under the new ELTIF 2.0 rules.¹⁶ The region’s ageing population, especially of small business owners, is another important opportunity for sponsors. With around 60% of all European firms still family-owned, sponsors can buy out stakeholders looking to cash out and retire.¹⁷

Even in situations where owners wish to keep their business in the family, PE funds can support intergenerational transfers by taking minority stakes and providing growth financing to support relatives assuming control while founders step back. There is no shortage of opportunities on offer. With dry powder levels still hovering near record peaks, these enduring forces are set to drive dealmaking across Europe for years to come.

Spotlight: Private equity in DACH region

A pronounced economic deceleration in Germany did not significantly impact private equity momentum across the DACH region last year. Deal value is expected to have totalled €100bn, only 13.7% lower than 2022, which was itself an all-time record.

Mirroring the broader theme in Europe, sponsors have been zeroing in on bolt-ons, which accounted for 61.9% of buyouts by deal count.¹⁸ Culturally, there has been some resistance to private equity among German small and medium enterprises (SMEs) in the past. However, that sentiment could be softening amid mounting evidence that PE’s hands-on, active ownership has multiple benefits. A study by Munich Strategy Group found that among a sample of 820 mid-cap companies, those backed by financial sponsors ratcheted up sales by 7.5% a year, EBITDA by 11.8% and headcount by 8%. The control group managed 2.3%, 6.4% and 1.3% gains across these respective metrics.¹⁹ The growing acceptance of private equity among so-called Mittelstand companies is leading to a surge in the number of DACH PE and VC managers. It is estimated that the number of active GPs in the region more than doubled in the five years through October 2023, from 986 to 2,084.²⁰ There is still some way to go before it catches up with the rest of Europe. Germany’s PE industry still lags the likes of the UK, France and the Nordics which is, adjusted for the size of its GDP, the largest in the region.²¹

Meanwhile, Germany’s manufacturing and exports sectors face structural pressures from reconfiguring supply chains to energy policy overhauls. As such, private capital will likely play a key role in channelling growth financing to Mittelstand champions while steering the country's industrial base toward higher value-added domains.

¹ https://pitchbook.com/news/articles/europe-private-equity-growth-2023 ² https://files.pitchbook.com/website/files/pdf/2023_Annual_European_PE_Breakdown.pdf ³ https://files.pitchbook.com/website/files/pdf/2023_Annual_European_PE_Breakdown.pdf ⁴ https://pitchbook.com/news/articles/europe-private-equity-growth-2023 ⁵ https://www.ecipartners.com/news-and-insights/news/2023/eci-12-closes-at-1bn-hard-cap ⁶ https://realdeals.eu.com/article/fund-in-focus-norvestor-ix-closes-on-1.5bn-hard-cap ⁷ https://pitchbook.com/news/articles/europe-private-equity-growth-2023 ⁸ https://files.pitchbook.com/website/files/pdf/2023_Annual_European_PE_Breakdown.pdf ⁹ https://www.irishexaminer.com/business/companies/arid-41278750.html ¹⁰ https://www.nortonrosefulbright.com/en-gb/knowledge/publications/a9f73140/survey-on-carve-out-transactions ¹¹ https://www.reuters.com/markets/deals/triton-complete-acquisition-siemens-energys-trench-h1-2024-2023-10-12/ ¹² https://www.lazard.com/research-insights/shareholder-activism/ ¹³ https://www.rwbaird.com/corporations-and-institutions/investment-banking/insights/2024/01/top-ten-trends-in-european-pe-in-2023-and-implications-for-2024/ ¹⁴ https://www.bloomberg.com/news/articles/2023-06-01/eqt-said-to-near-deal-for-vet-drugmaker-dechra-pharmaceuticals ¹⁵ https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age/europes-digital-decade-digital-targets-2030_en ¹⁶ https://www.aima.org/article/elftif-2-0-reforms-set-to-drive-significant-growth-in-european-private-markets.html ¹⁷ https://single-market-economy.ec.europa.eu/smes/supporting-entrepreneurship/family-business_en ¹⁸ https://files.pitchbook.com/website/files/pdf/2023_DACH_Private_Capital_Breakdown.pdf ¹⁹ https://www.munich-strategy.com/studie-private-equity-im-mittelstand/ ²⁰ https://finance.yahoo.com/news/private-capital-dach-based-fund-080000266.html?guccounter=2 ²¹ https://www.statista.com/statistics/256655/private-equity-investments-in-europe-by-industry/