Key takeaways

- Distressed investment opportunities have been limited during the last decade, but as debt defaults and insolvencies climb, deal flow is accelerating.

- Studies find that private ownership models deliver better outcomes for distressed assets than public ownership, and that distressed strategies outperform in periods of dislocation.

- Distressed investing requires specialist expertise. Firms experienced in navigating restructurings, bankruptcies and operational turnarounds are well-placed in the current market.

Over the last 12 months, companies have faced rising debt servicing costs and softening corporate earnings. In both the US¹ and Europe² interest rates are at the highest levels observed in more than two decades. The number of UK listed companies issuing profit warnings has increased for seven quarters in a row — the highest levels observed since 2008, per EY-Parthenon.³

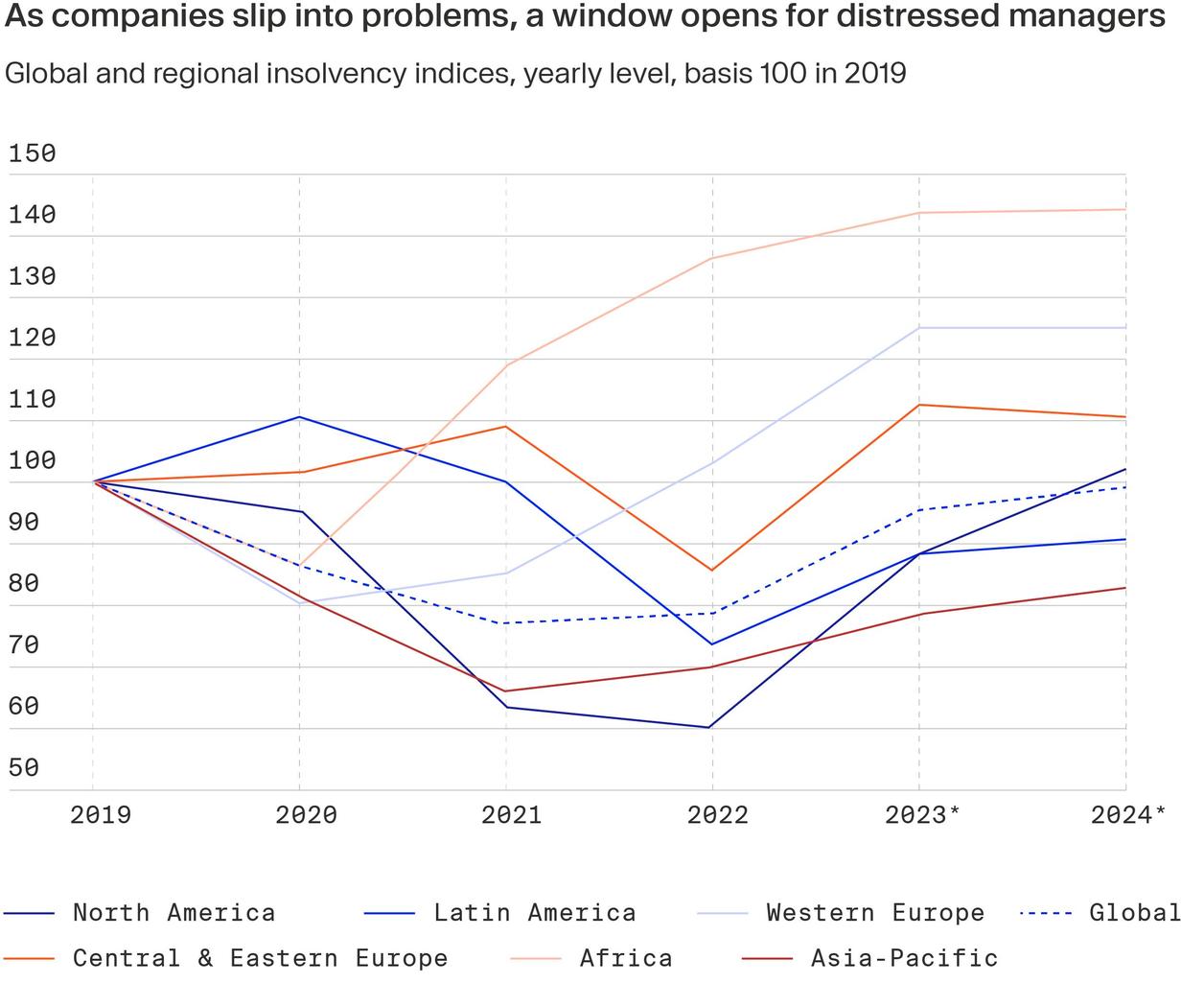

The deteriorating backdrop has seen rising debt defaults and insolvencies. According to Goldman Sachs forecasts based on Pitchbook data, 2023 is on pace to be the third-worst year for leveraged loan defaults, behind only the 2008/09 financial crisis and 2020 pandemic dislocation period⁴, while credit insurer Allianz Trade is forecasting global insolvencies to climb by 21% in 2023 and a further 4% in 2024.⁵

As increasing numbers of companies have slipped into distress, a window has opened for managers with turnaround expertise to secure transactions that would otherwise have been off the table in the bull markets of 2021, when companies were able to extend debt maturities and lower financing costs with relative ease.

Retrenching debt markets, however, mean businesses are no longer able to refinance their way out of difficulty, creating opportunities for distressed investors to step in and provide rescue options for companies under financial pressure.

Related article: Distressed Debt Investing: Definition & Strategies

The basics: types of distressed investments

The managers positioned to lean into the downturn come from a broad church and pursue a variety of investment strategies.

In volatile markets, distressed debt investors are primarily focused on buying up the debt of companies at discounts to par value with a view to either selling the debt on when prices in secondary debt markets recover, or to gain influence in restructuring and bankruptcy proceedings.

Loan-to-own distressed debt investors, meanwhile, purchase debt positions as a pathway to taking ownership of financially stressed companies via debt-for-equity swaps, and then make operational improvements to try to return assets to profitability.

Through the bull market of the last 10 years, distressed debt struggled to gain traction with investors, with Preqin figures showing a drop in distressed debt’s share of overall private debt assets from 42% in 2009 to 22% in 2021. During the last 12-18 months, however, as the market has moved back in favour of distressed debt strategies, investors have changed tack. A Preqin investor survey from 2023 found that 49% of respondents expected distressed debt to be among the best-performing private debt strategies.⁶

Managers have noted this shift in investor sentiment, bringing new distressed debt funds to market. Oaktree Capital Management is seeking more than $18 billion for its Oaktree Opportunities Fund XII.⁷ Strategic Value Partners, meanwhile, has reached a first close of $1.5 billion towards its $3.75 billion target for a fund that will target private debt restructuring deals and rescue financings.⁸

Further distressed debt fundraisings are anticipated in the coming months, with Preqin tracking 89 distressed debt vehicles currently in the market, the highest number in a decade.⁹

How turnarounds and special situations work

In addition to distressed debt strategies, turnarounds and special situations managers provide other options for investors seeking exposure to the stressed and distressed end of the market.

Rather than investing via debt structures, turnaround managers will invest in equity, usually just before a company falls into restructuring or insolvency proceedings. Turnaround players are typically called in when businesses are at risk of breaching banking covenants or running out of cash and are seeking investment but do not have the growth trajectory and profitability to secure interest from mainstream private equity and trade buyers.

Special situations is an overarching strategy that may include elements from turnaround and distressed debt playbooks, but can also target companies that remain profitable but are encountering low margins and stagnant growth. These deals typically arise from unique events such as corporate carve-outs, restructurings and spin-offs, and can encompass debt, equity or a combination of instruments.

As has been the case in the distressed space, fundraising momentum for turnaround and special situations fundraising has also been building. Bain Capital is targeting $4 billion for a global special situations fund that will target opportunities spanning equity, distressed assets, loan portfolios, corporate investments and real estate¹⁰, while special situations manager Diameter Capital closed its sophomore fund, which will invest in opportunities across the credit spectrum, at $2.2 billion, three times larger than its debut vehicle.¹¹

Delivering returns in volatile markets

Distressed investment strategies of all hues require specific skill sets and risk tolerances, and will regularly involve more heavy lifting than vanilla transactions, but in economic downturns provide opportunities to deliver market-beating returns.

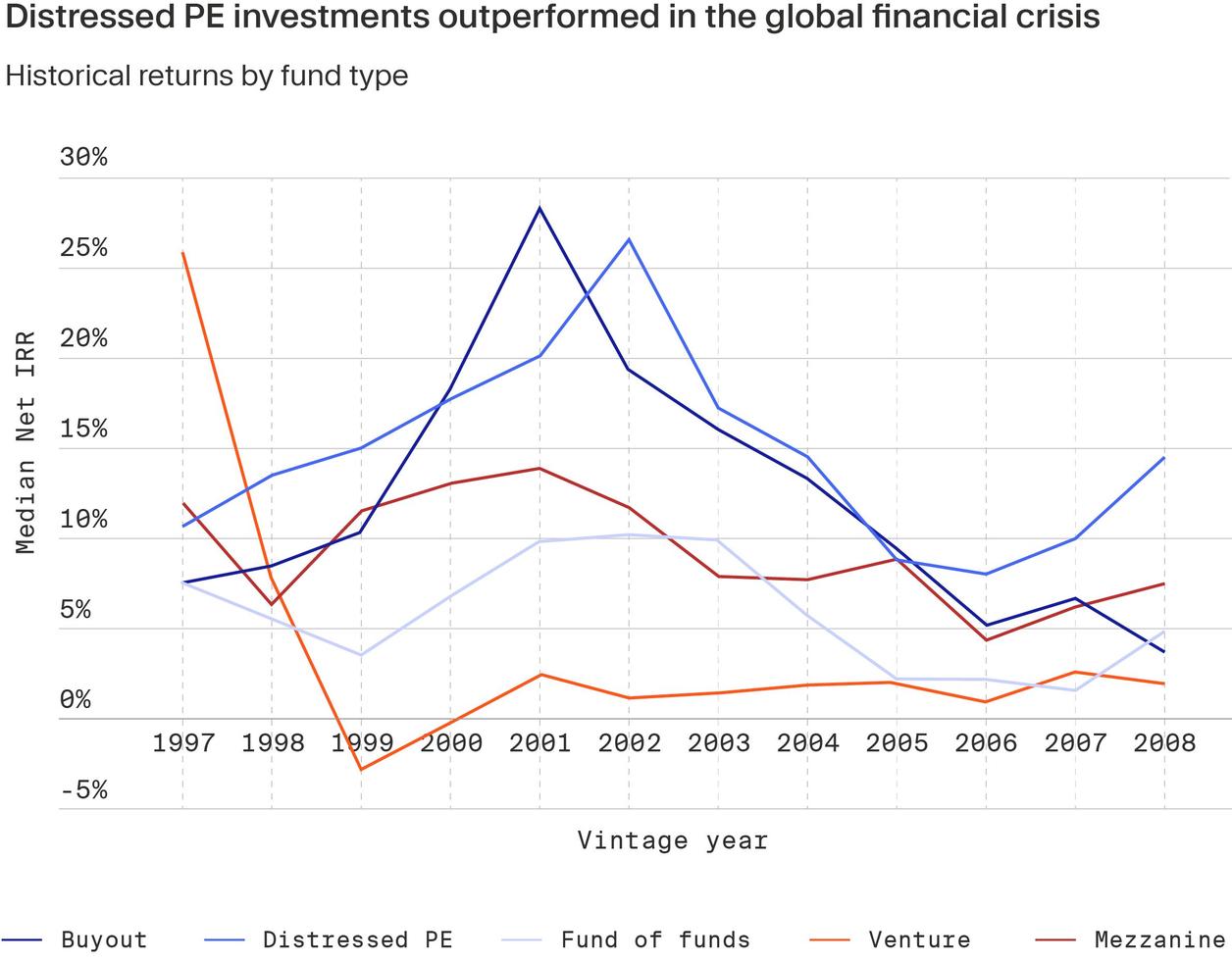

Research by students at Bocconi University in Milan found that between 2000 and 2010 distressed investment strategies matched buyout returns across the decade, but outperformed during the years of the global financial crisis.¹²

In periods of dislocation distressed investors have the experience and skills to lean into uncertainty and complexity, execute transactions when other buyers are sitting out and waiting for markets to stabilise, and invest in assets at discounts as a result.

The private equity ownership structure is a good fit for executing restructurings and turnarounds, with private control ownership allowing for fast decision making and the space to execute change away from the glare of public markets.

A McKinsey study of 659 private equity-backed and publicly owned companies, for example, found that private equity-backed companies outperformed publicly owned peers when emerging from business distress, recovering EBITDA margins materially faster than their publicly held counterparts.¹³

What it takes to become a distressed investor

Not all buyout managers are equipped to deliver this level of outperformance from distressed investments. Mainstream manager skill sets are built on identifying market-leading assets in fast growing markets, and then differentiating their offers in highly competitive auction processes to win these deals. Due diligence exercises are extensive and the quality bar for investment is high.

Managers in the special situations and distressed deal segments, by contrast, are often looking at assets already in “intensive care” and making judgements on whether these assets can return value following complex operational and financial interventions. Deal processes can be truncated, as assets are typically on the brink, and managers often have to invest with limited windows for diligence.

Distressed investors require specialist restructuring and risk management skills, deep understanding of credit and capital structures, the bankruptcy code and legal process, as well as strong operational value creation capabilities.

Distressed investors in action: Sepura example

Kelso Place Asset Management’s investment in radio units business Sepura is an example of how distressed investors can deliver outsized returns by buying troubled assets at discounts and then drive upside through operational turnaround programmes.

Kelso Place bought the radio terminals business of Simoco Digital out of administration for only £1 in 2002. After renaming the business Sepura, bringing in new management and focusing on the development of secure radio communications platforms used by government and emergency services, sales climbed to more than £50 million, the company listed in London at a £225 million valuation, and generated a 183-times money return and a 225% IRR for the firm.¹⁴

end-sidebar

Distressed investing is not for faint-hearted

The potential upsides from distressed investment strategies do not come without risks. Target companies will typically be heavily indebted and on the verge of default or bankruptcy, and can fail to recover, even with the intervention of distressed investors.

Maintaining the support of key suppliers and customers is another challenge, with counterparties often nervous about maintaining trade with a stressed business that could run out of cash. While sustained macroeconomic headwinds can offer opportunities to buy up assets at discounts, they can also hamper efforts to turn companies around.

For managers targeting distressed debt deals to influence bankruptcy and restructuring proceedings, meanwhile, timelines to exit can be unpredictable and prolonged. According to Lowenstein Sandler the direct costs of a Chapter 11 bankruptcy process can be about one to two per cent of a debtor’s assets in larger cases.¹⁵ It can take up to five years to resolve large Chapter 11 cases, and even longer before payouts are made to debtors.¹⁶

Private equity managers pursuing distressed opportunities, however, are well-versed in identifying the troubled assets with the lowest downside risk and most promising upside potential.

Public markets provide limited scope to gain exposure to these investment strategies at a period when distressed assets present compelling return appeal. As the benign market conditions over the last ten years fade into the rear view, private markets distressed investors are ready to deliver.

¹ https://www.cnbc.com/2023/07/26/fed-meeting-july-2023-.html ² https://www.ft.com/content/440068b1-4c39-4ad9-94ee-2d54a1097fb2 ³ https://www.ft.com/content/44fbb18b-762c-4878-95ec-995da0cc02a7 ⁴ https://www.morningstar.com/news/marketwatch/20230617361/leveraged-loan-defaults-hit-25-billion-head-for-third-worst-year-in-history-says-goldman ⁵ https://www.allianz-trade.com/en_global/news-insights/news/allianz-trade-insolvency-report.html ⁶ https://tinyurl.com/2ya5sx6y ⁷ https://www.bloomberg.com/news/articles/2023-08-10/oaktree-targets-over-18-billion-for-record-private-credit-fund ⁸ https://news.bloomberglaw.com/private-equity/strategic-value-partners-raises-1-5-billion-for-new-fund ⁹ https://tinyurl.com/2ya5sx6y ¹⁰ https://www.reuters.com/business/finance/bain-capital-seeks-raise-4-bln-new-global-special-situations-fund-sources-2023-05-08/ ¹¹ https://www.preqin.com/news/diameter-capital-closes-2023-s-largest-special-situations-debt-fund-on-2-2bn ¹² https://www.bscapitalmarkets.com/uploads/7/0/5/5/70553335/from_the_brink-_private_equity_in_the_distressed_space.pdf ¹³ https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/how-private-equity-owners-lean-into-turnarounds ¹⁴ https://www.unquote.com/unquote/news/93269/uk-kelso-floats-sepura ¹⁵ https://news.bloomberglaw.com/bankruptcy-law/what-does-chapter-11-really-cost ¹⁶ https://www.x-claim.com/blog/5-reasons-why-it-takes-so-long-for-payout-recovery-in-ch-11-bankruptcy