The often-opaque nature of private markets has, to a degree, left many retail investors questioning whether adding these asset classes to their portfolio is right for them. However, this attitude could leave many investors potentially missing out on a key source of risk-adjusted returns. And more understanding of how it works could go a long way to giving investors and advisors more confidence when dealing with it.

With that in mind, let’s take a look at some key points within private equity (PE) that are often misunderstood, but are important to know.

Private equity is more than just buyouts

It is often assumed that PE covers only buyouts, where general partners (GPs) raise capital in order to purchase mature businesses outright, with a view to improving and selling the company at a profit later on. Recent examples of successful exits include Contabo, a cloud hosting platform acquired by Oakley Capital in 2019, which was sold in June to KKR for a 10x return.

Yet this understanding ignores the opportunity PE provides investors for access to smaller, fast-growing businesses which, while riskier investments, offer the potential for much higher returns.

As well as buyouts, PE also encompasses two other categories; venture capital and growth equity. Venture investing tends to focus on backing several early-stage companies looking to scale up and disrupt existing industries.

While a small percentage of these investments end up being successful, the rewards can be enormous. Sequoia Capital, for instance, netted $3 billion from the sale of WhatsApp to Facebook off an initial $60 million investment. Moonfare’s latest whitepaper dives further into what venture capital can offer.

Growth investments, meanwhile, sit in-between venture capital and buyouts, targeting minority investments in growing businesses that still have room to expand before an eventual exit.

GPs in these investments can also include larger institutions such as sovereign wealth funds who have the capacity and desire to pay large sums for access. Learn more about growth equity in our whitepaper.

Your commitment isn’t all due up front

Would-be investors can often be deterred by the relatively high minimums needed to invest in PE. Historically, this could be as much as $25 million. And while recent innovations have brought these down in some places to five-figure sums, handing over the equivalent of an annual salary to a closed-end fund can still feel prohibitive. However, PE firms don’t take that full amount at the start; instead they request committed cash when necessary during the fund’s investment period.

These capital calls, also known as drawdowns, take place as opportunities arise, usually spanning over the period of a few years. Therefore, it’s more accurate to think of your commitment spread out over that investment period, rather than due on signing.

This process is mitigated further given that the first distributions from the underlying funds usually occur a few years after the initial investment. Although this timing varies based on manager type and asset class, the likelihood for investors is that they won’t need to use 100% of their commitment, given part of their early distributions will be used to finance capital calls.

Over the typical horizon of a PE fund, the process of investors experiencing negative returns as capital is called from them, to increasingly positive returns as these investments mature and distributions occur, is known as the J-curve. For more on how an individual’s commitments and proceeds are managed through a PE fund’s lifecycle, read our J-curve explainer.

Leverage is no longer the name of the game

Public perceptions of PE often characterise the asset class as a debt-fueled casino focused on the profits of a select few at the expense of the wider business and its employees. This cartoonish representation, however, belies what a PE fund brings to the table and how it operates in the 21st century.

Relative debt levels, for example, have come down significantly in the last two decades, with research from the American Investment Council showing that the average loan-to-value ratio–a measure of the amount borrowed relative to the company’s underlying value–of new PE investments in 2020 was down 15 percentage points compared with deals in 2005¹.

At the same time, PE managers have become much more hands on with their investments, focusing on operational value creation rather than leverage to drive performance². As Pavel Ermoline, Investment Manager at Moonfare, explains: “In the 1990’s, private markets were highly inefficient and less competitive, with most managers using financial engineering in the form of leverage to generate returns. Now, the value creation strategy has progressively transitioned…to focus on operational improvements.” These strategies can include divesting non-core products, diversification or improving supply chain efficiency.

For more from Pavel on PE’s transformation, check out our article on PE’s resilience through recessions.

Performance is measured over the long term

For some, handing over capital to an investor without the knowledge of what they’ll invest in can be daunting. However, performing rigorous due diligence on a manager and its team can help investors find the partner that works best for them.

To do this, we need to understand a fund’s vintage—the year the vehicle first made investments—as well as its internal rate of return (IRR)—a measurement that allows potential investors to compare the relative performance of funds or deals across both vintages and asset classes. The IRR covers the fund’s lifecycle, not just the launch year.

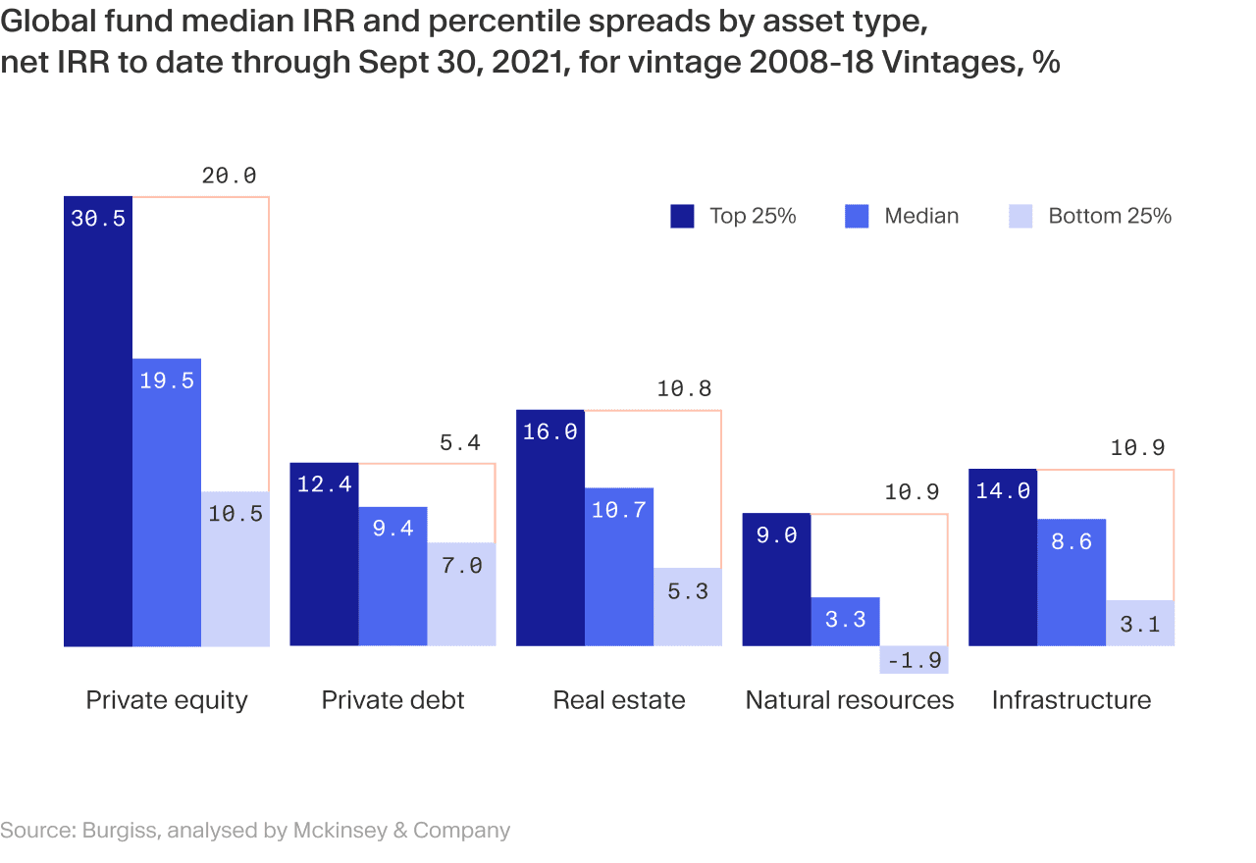

Assessing these metrics highlight the potential of PE in modern portfolios. According to McKinsey, the pooled IRR of the top 25% of PE funds with vintages from 2008-2018 topped 30%, way ahead of similar high performers in other asset classes.

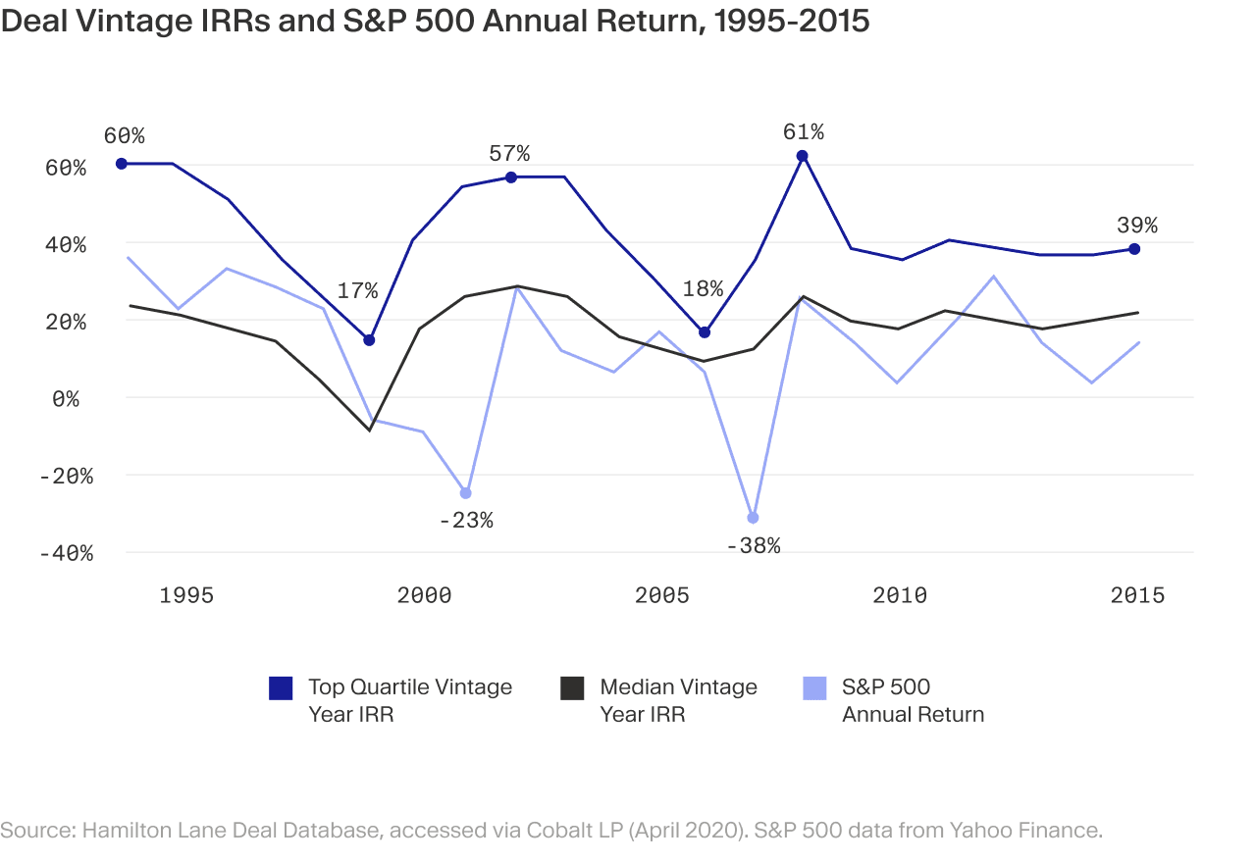

We can also compare PE with public market performance. Indeed, research from Hamilton Lane indicates that high-performing PE deal vintages in recessionary periods outperformed annual returns on the S&P 500 in the corresponding timeframe.

Read more about PE’s resilience in recessionary periods.

Private equity liquidity is increasing

In the current economic climate, being able to realise investments or rebalance portfolios quickly is top of mind for many individuals and even larger institutional players. It’s understandable, then, that PE may not come to mind first at this juncture, given that traditional PE investments involve handing over your capital to a GP for potentially a decade before seeing full returns.

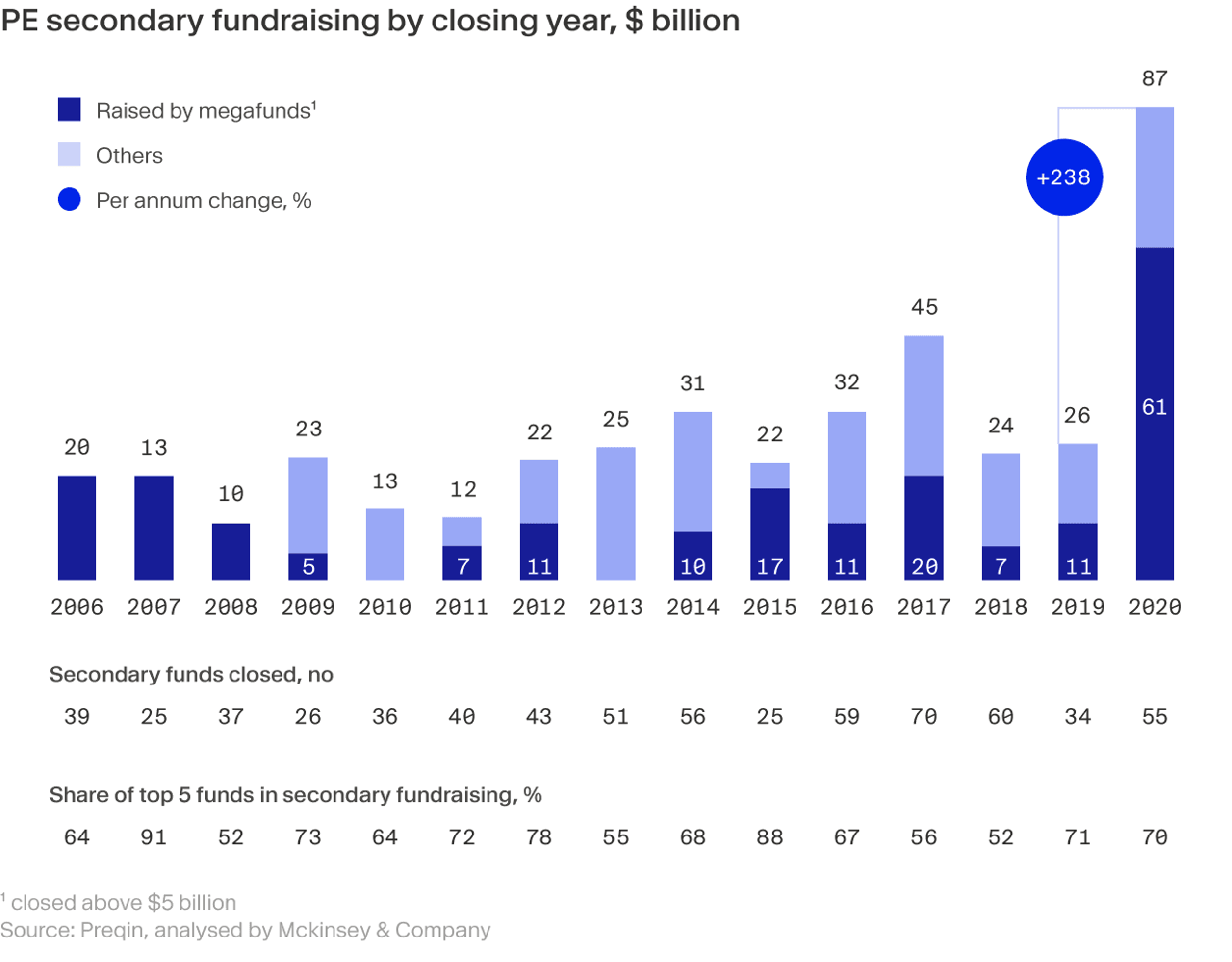

This picture is changing, however. Increasingly, firms are satisfying this demand for liquidity by offering secondary funds, vehicles designed to take existing stakes in companies from investors who would like to exit earlier than would traditionally be possible. This can be due to a variety of reasons, ranging from personal changes in circumstances or preferring to move capital elsewhere in the portfolio. According to McKinsey, PE secondaries funds raised almost $90 billion in 2020, almost three times 2019’s figure.

At Moonfare, we’re also helping our investors by providing opportunities to buy and sell through our biannual secondaries market. Through this, we are able to increase liquidity opportunities for individuals, aided in part by our partnership with Lexington Partners. Learn more about our secondaries platform.